4Q25 - Meeting expectations

4Q25 results were in-line with ours/consensus expectations

Wasco Greenergy

GENERGY MK | 5343.KL

BUY

Target price: RM1.10

Last price: RM0.64

Market cap (RMm): RM323m

Shares out: 500m

52-week range: RM0.61 / RM0.98

3M ADV: N/A

T12M returns: -36%

Disclaimer: By using this information, you acknowledge that you are solely responsible for evaluating the merits and risks of any investment decision and agree not to hold NewParadigm Research liable for any damages arising from such decisions.

Key points

- 4Q25 Adj NP of RM9.8m (+16.7% YoY) was in-line with ours/consensus expectations. Full year Adj NP up +5.6% YoY.

- Orderbook remains stable at RM241m, marginally lower by RM9m YoY.

- We trim our FY26E Adj NP by -2% and lower our TP to RM1.10 (from RM1.30) on a lower target multiple of 12x.

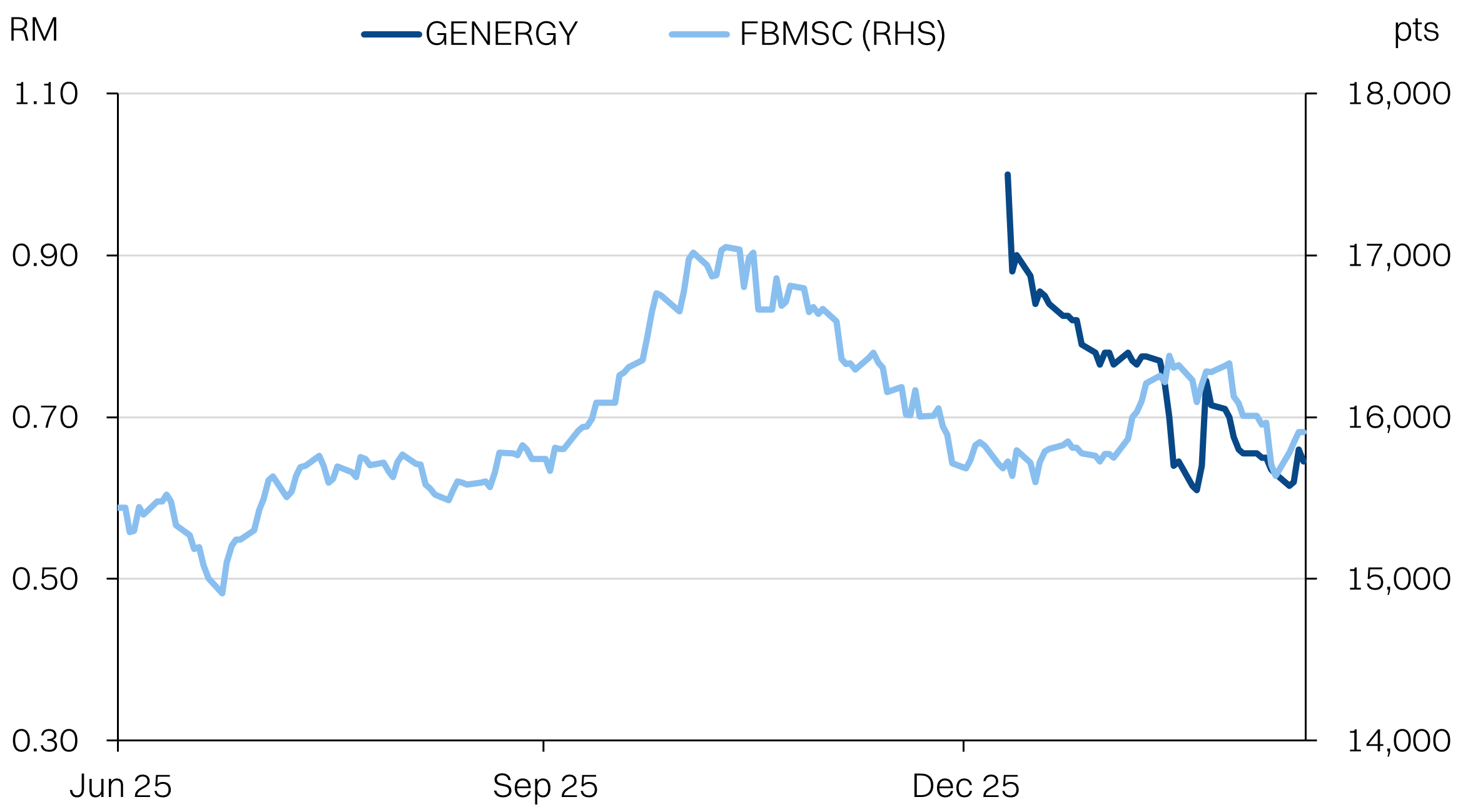

Share price performance

Investment fundamentals

| RMm (end-dec) | FY25A | FY26E | FY27E | FY28E |

|---|---|---|---|---|

| Revenue | 267 | 303 | 341 | 359 |

| Revenue (YoY) | -4% | 14% | 13% | 5% |

| Adj PATAMI | 28.6 | 34.7 | 40.1 | 41.5 |

| Adj PATAMI margin | 11% | 11% | 12% | 12% |

| DPS (sen) | 2 | 2.4 | 2.8 | 2.9 |

| ROA | 7% | 8% | 8% | 8% |

| ROE | 11% | 12% | 12% | 11% |

| PER | 8.5 | 9.2 | 8.0 | 7.7 |

| P/BV | 0.9 | 1.1 | 1.0 | 0.9 |

| Yield | 3% | 4% | 4% | 4% |

| Net debt/Equity | 16% | 15% | 17% | 18% |

Source: Company data, NPS Research, February 2026

Newsflow needed to reverse derating

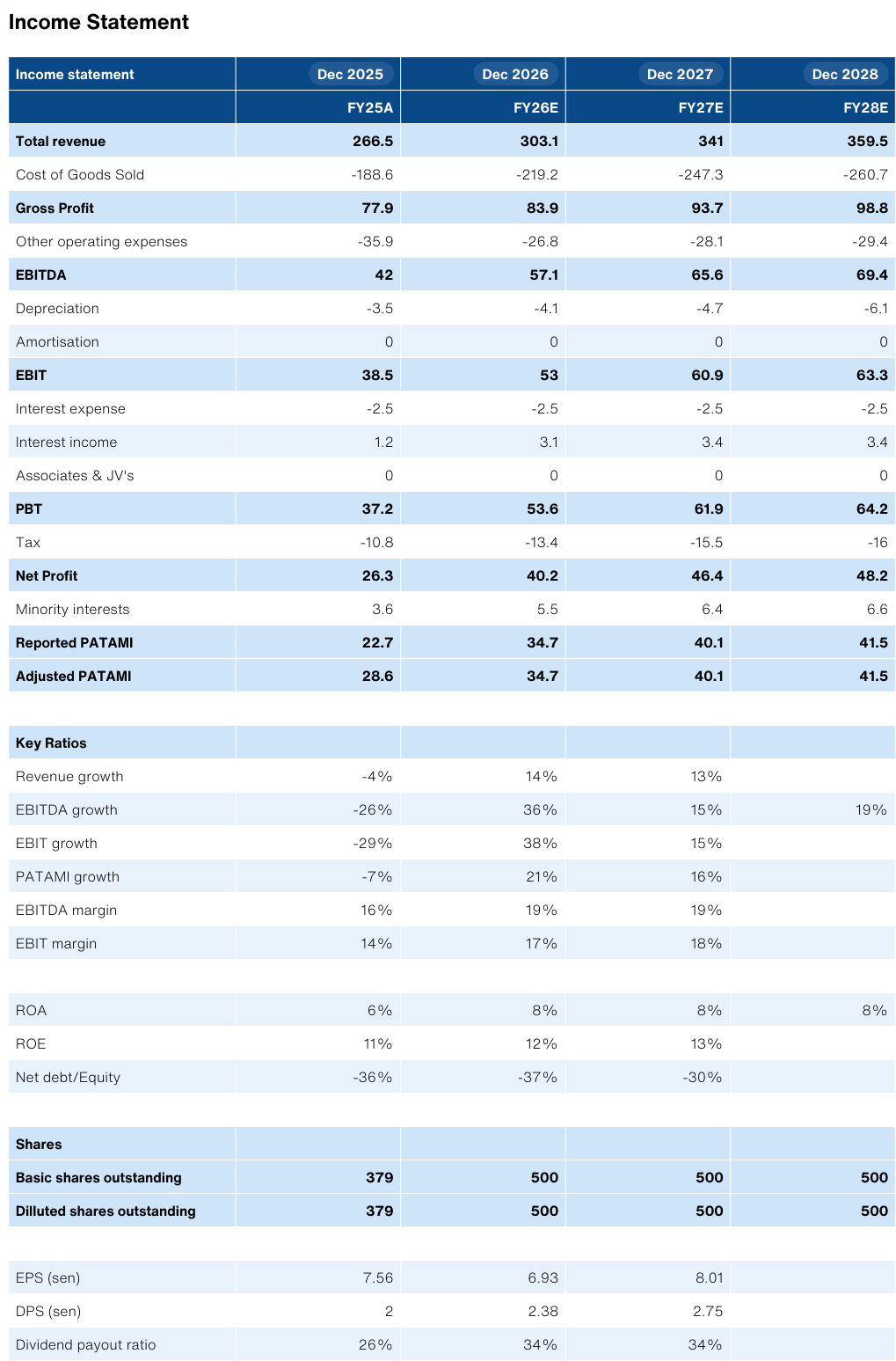

- GENERGY’s 4Q25 earnings were broadly in-line with expectations, with a full-year Adj NP of RM32.3m (+5.6% YoY). Revenue of RM266.5m was a little softer than expected (-3.7% YoY) but offset by better margins.

- Management shared that orderbook remained stable at RM241.3m, with ~89% in renewable energy and another 11% in industrial energy and equipment. Almost all the orderbook is due to be recognized in FY26. The current trajectory of the orderbook points to a potentially flatter FY26. Nonetheless we maintain our expectation of RM303m (+14% YoY), as we expect securing new projects will drive growth.

- On that note, there were not meaningful updates on prospective brownfield/greenfield projects for the build-own-operate (BOO) and build-own-transfer (BOT) segment that management is trying to build. The timeline for the brownfield project is the clearest, with management expecting a decision within 1Q26. However, the tender process on the greenfield project sounded less certain and could take longer to come to a decision.

- A dividend of 2sen/share was declared (34% payout), which was in-line with expectations.

Oversold, but catalyst needed

- Since listing, GENERGY’s share price has fallen ~36%, despite no material downgrades in outlook. One potential reason for the derating, could be the corresponding weakness in other renewable stocks (solar in particular), that have seen a sharp correction in the same period. While having very different drivers, we appreciate the weaker market sentiment will have a tack-on impact on GENERGY as well.

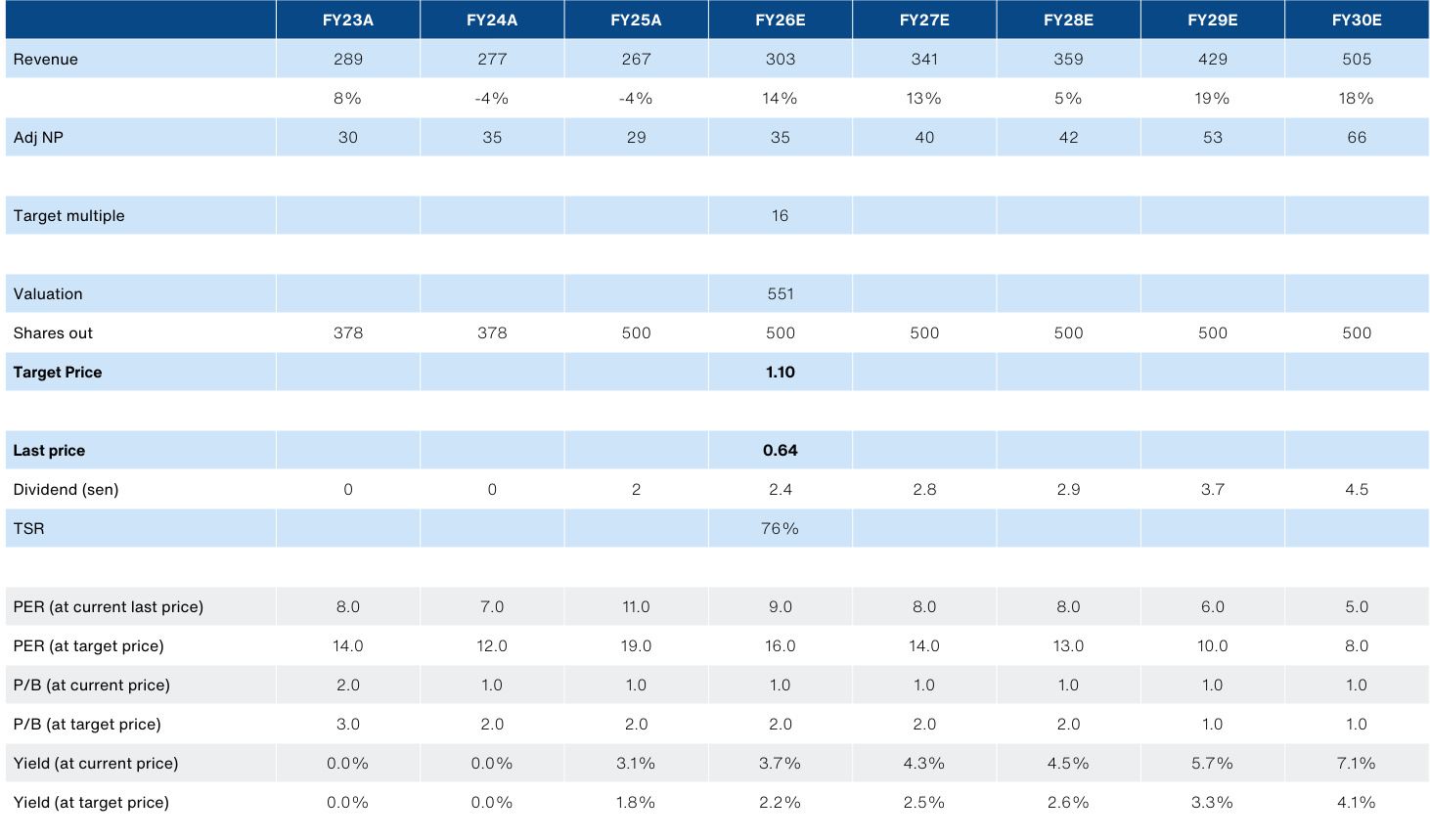

- GENERGY is now trading at an implied 8x FY26E PER, which we see as heavily depressed. We lower our target multiple to 15.9x FY26E for a target price of RM1.10.

- The key for GENERGY’s rerating hinges on newsflow of new BOO/BOT projects. The good news, is that the aforementioned brownfield project is likely to crystalize within the next 2-3 months.

- Maintain BUY.

About the Company

Wasco Greenergy Bhd (GENERGY) is one of the top biomass power equipment EPCC companies in Malaysia and Indonesia. This encompasses boilers that are fabricated in-house and the distribution of Shinko steam turbines. GENERGY differentiates itself from its direct competitor, BM Greentech, by providing engineering for customized solutions. It will further differentiate itself by venturing into asset ownership of biomass-to-steam systems for industrial customers.

About the Stock

GENERGY is listing on the main board of Bursa Malaysia and will be a Shariah compliant stock. It is a renewable energy spin-off from its listed O&G-focused parent, Wasco Bhd, which retains a 62.5% stake. GENERGY is a professionally-managed company with a majority independent board.

Investment Thesis

GENERGY is an early-stage opportunity to invest in a high-growth renewable niche of biomass-for-steam power. Not just as an EPCC, but as an asset owner. Between the abundant and under-utilized biomass supply and the estimated 30% cost savings compared with natural gas-powered steam, which we estimate to be an RM2-3bn market. Thematically, GENERGY will be a strong ESG play as it helps customers decarbonize while decoupling from global energy commodity prices.

Key Risks

- Execution risk: By far the biggest hurdle will be securing the first greenfield biomass-to-steam contract and subsequently delivering on the expected payback period of 5 years. GENERGY has no track record with asset-ownership.

- Competition: GENERGY has sizable EPCC competitors in the space. While some lack direct engineering capability, they have the resources and balance sheet to close the gap and compete for the same assets.

- Feedstock: The business model counts on biomass remaining at least cheaper than conventional fuels. Competing use for biomass that threatens feedstock prices would upend the business model.

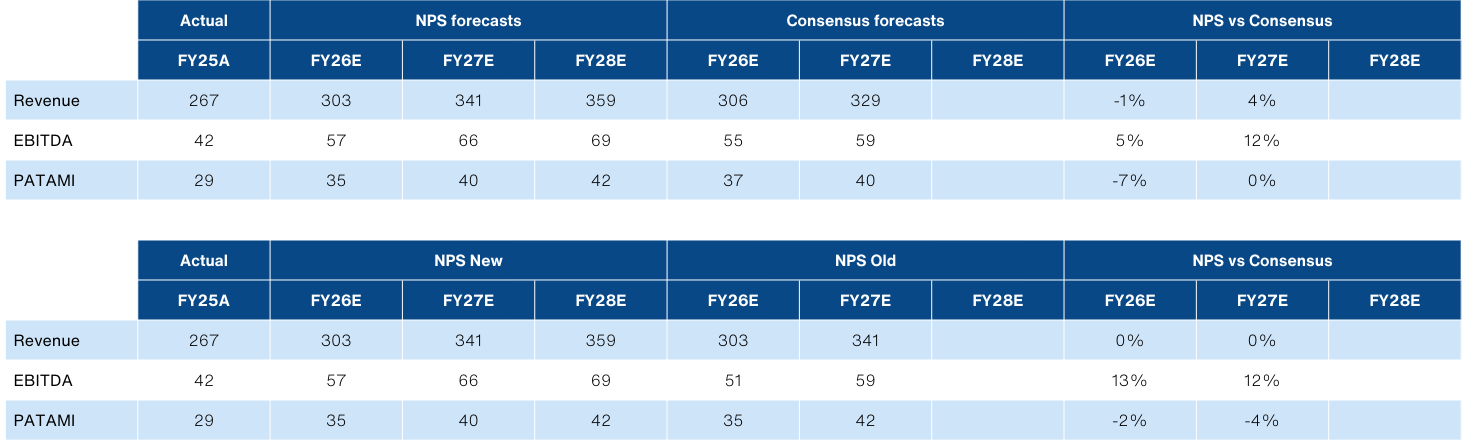

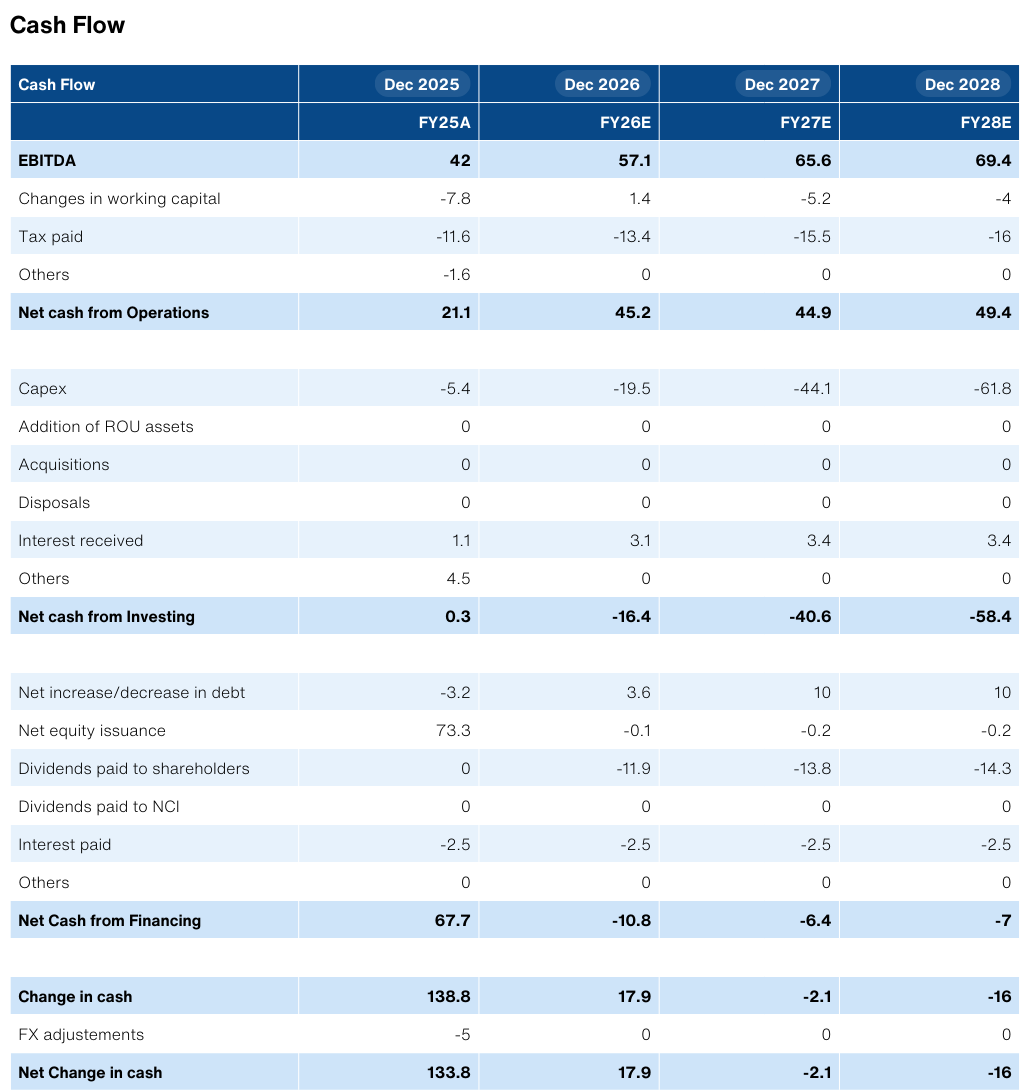

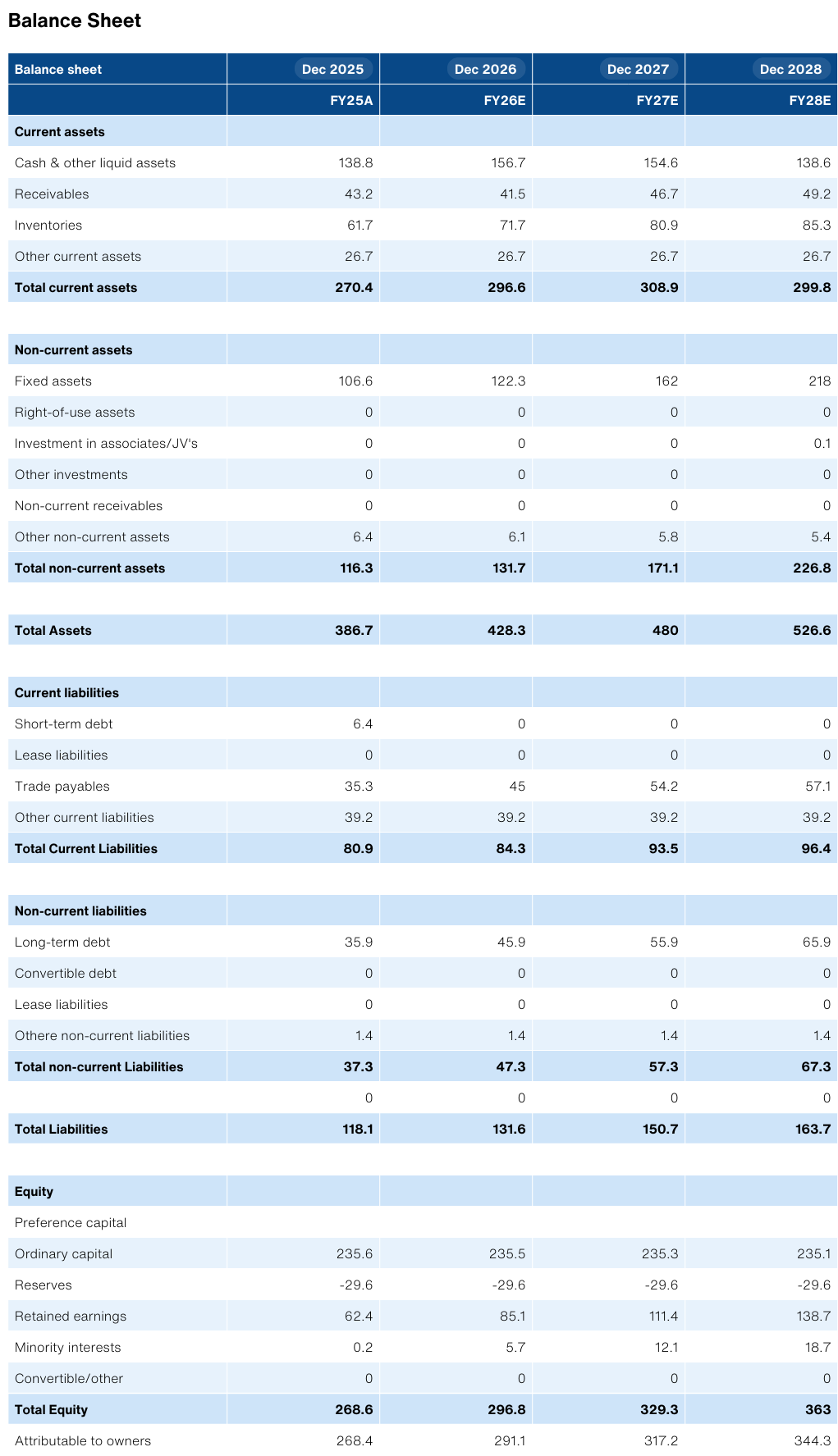

Changes to forecasts

Lower TP to RM1.10

Selected financials

Source: Company Data, Bloomberg, NewParadigm Research, February 2026