Despite tailwinds, expectations are low

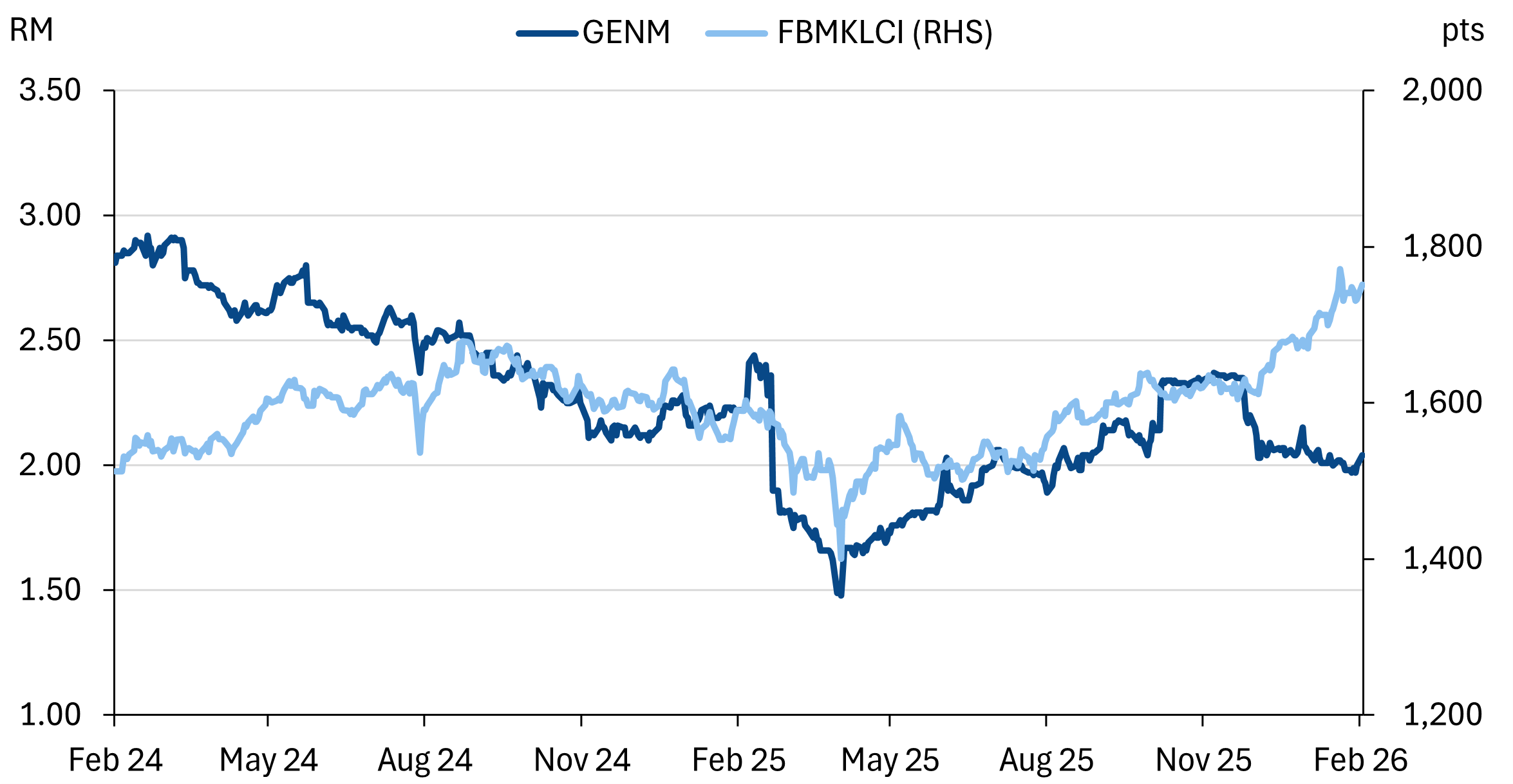

GENM has lost -15% since the GO failed with little value placed on the tourism upside nor the NYC casino license.

GENTING MALAYSIA

GENM | 4715.KL

NOT RATED

Fair Value: RM2.20

Last price: RM2.00

Market cap (RMm): RM11,562m

Shares out: 5,668m

52-week range: RM1.46 / RM2.48

3M ADV: RM25.5m

T12M returns: -7%

Disclaimer: By using this information, you acknowledge that you are solely responsible for evaluating the merits and risks of any investment decision and agree not to hold NewParadigm Research liable for any damages arising from such decisions.

Key takeaways

- Since the voluntary GO failed, GENM has been sold down -15%, and is generally overlooked by institutional funds.

- Between VM26 tailwinds this year and NYC Casino in coming years, this is an interesting stock to track, especially if valuations correct further.

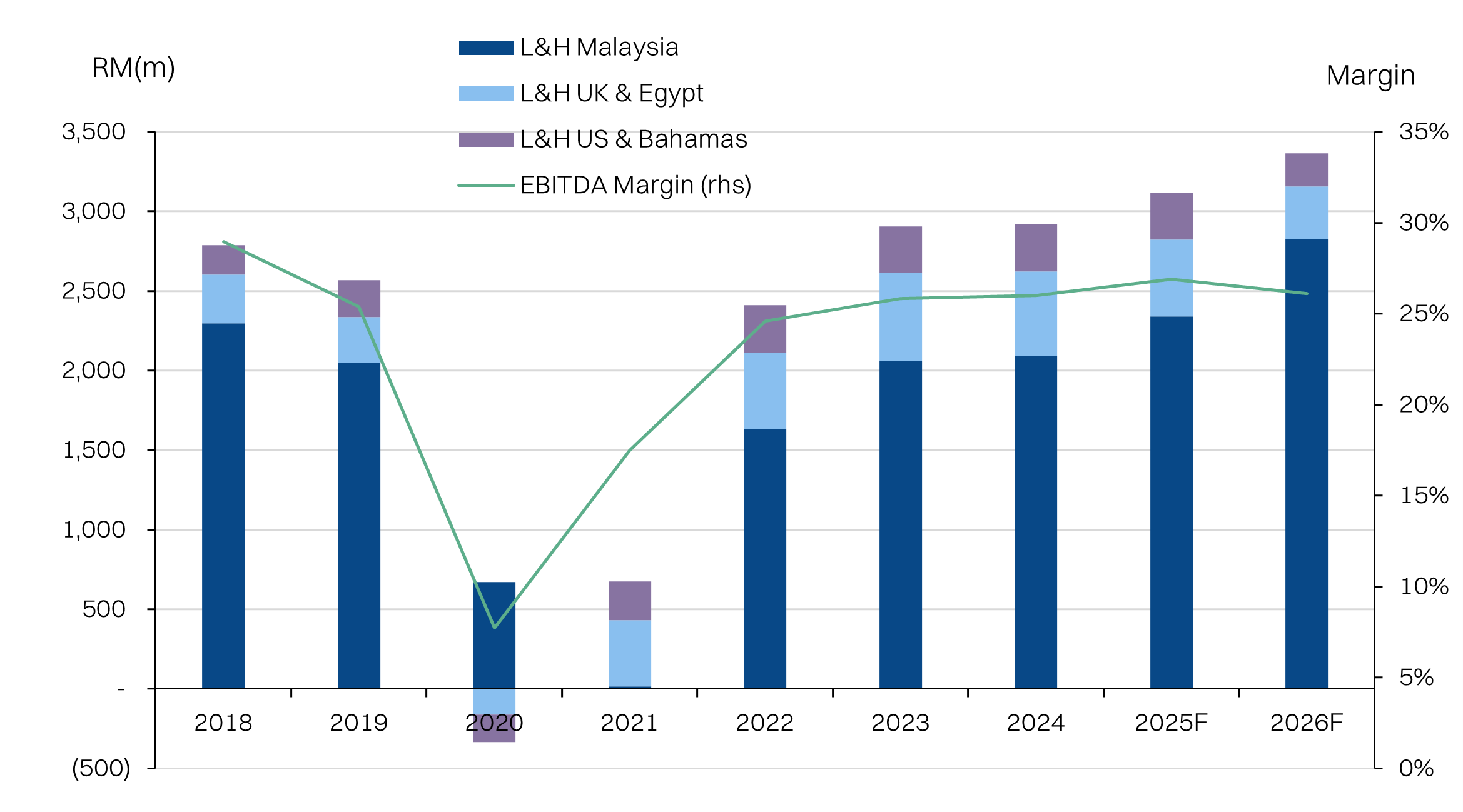

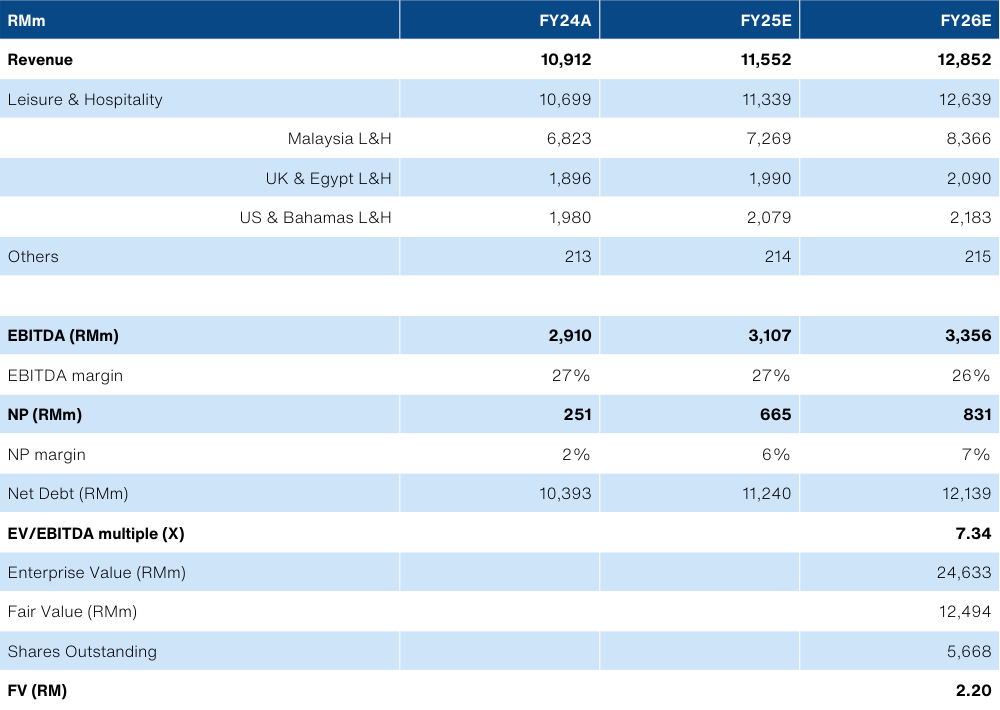

- We estimate FY26E adj. EBITDA can top street’s estimates by +4% on higher ARR (+10% YoY) and higher footfall (+10% YoY). At the 3yr average EV/EBITDA of 7.3x, the implied FV is RM2.20.

- See also: our VM26 thematic report.

Share price performance

Investment fundamentals

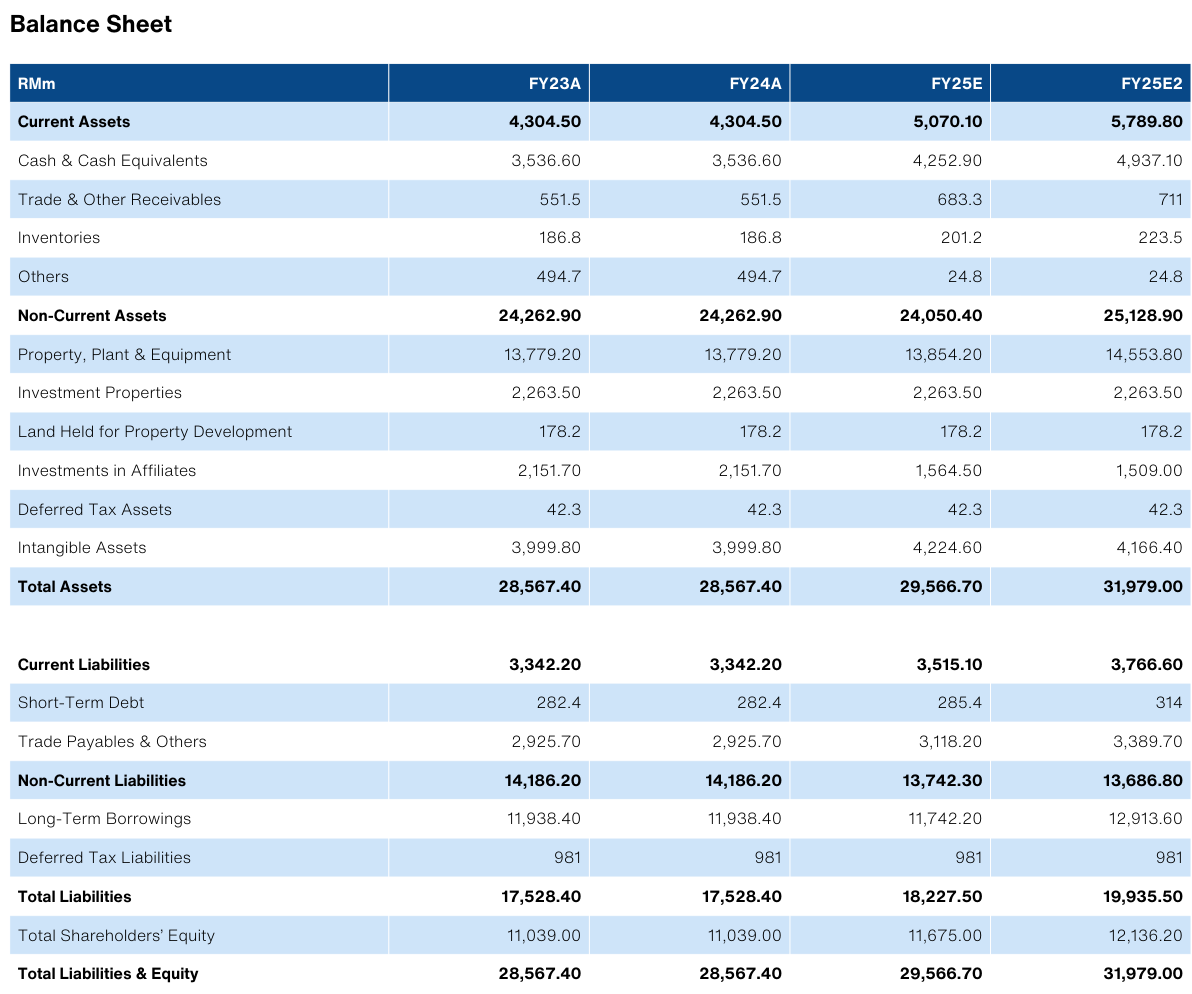

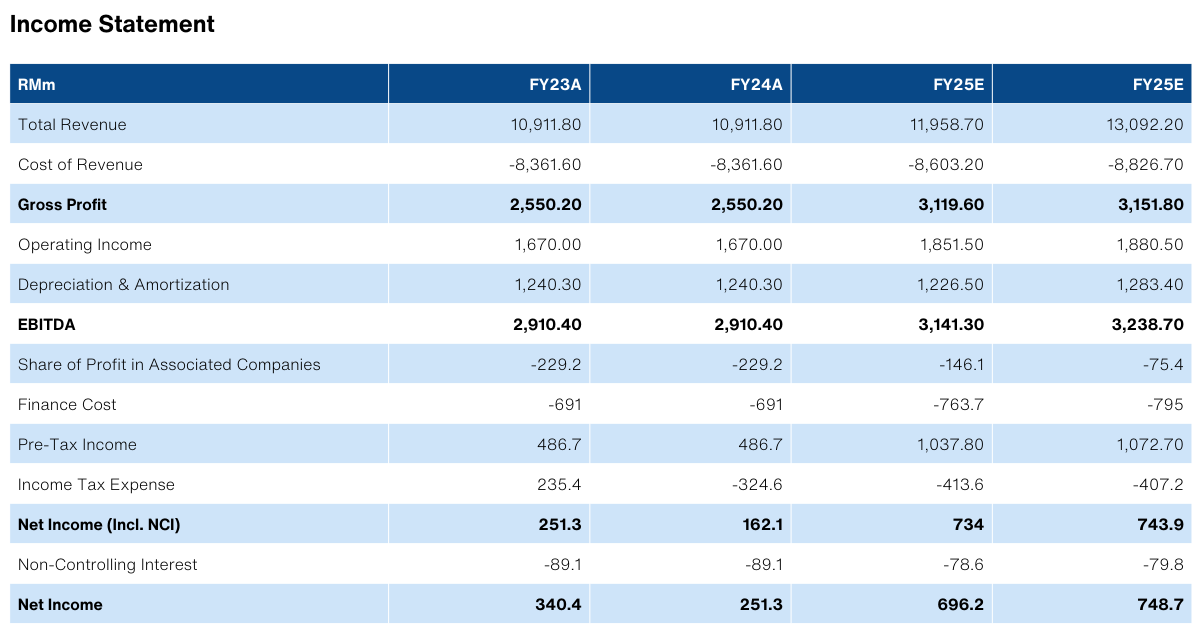

| RMbn (FYE DEC) | FY24A | FY25E | FY26E |

|---|---|---|---|

| Revenue | 10,912 | 11,553 | 12,854 |

| Growth YoY | 7.0% | 6.0% | 9.0% |

| EBITDA | 2,910 | 3,107 | 3,356 |

| EBITDA margin | 26.7% | 26.9% | 26.6% |

| Adj NP | 251 | 665 | 831 |

| NP Margin | 2.0% | 6.0% | 8.0% |

| Net debt | 10,393 | 11,240 | 12,139 |

| Depreciation | 1,240 | 1,177 | 1,121 |

| PER (X) | 49.7 | 18.7 | 15 |

Source: Company data, NewParadigm Research, February 2026

KIV for value

- Investor interest and confidence in GENM is relatively low. In turn, GENM has been overlooked despite the thematic tailwinds. The share price has quickly fallen from the voluntary general offer of RM2.35 (rejected by minorities), despite securing one of three casino licenses in NYC.

- A patchy earnings track record is part of the problem. GENM’s skidded to a historic low of RM1.48 following the poor 4Q24 results (reported end-Feb) last year. The market has not been enthused by the various corporate exercises undertake by the group either.

- But with some of the key negatives out of the way, we’d be remiss to publish a series on tourism without touching on GENM. After all, following the privatisation of Malaysia Airports, GENM is the de-facto big-cap tourism stock, even if it does have a bigger skew to domestic visitors. The stabilization of AirAsia X (see link) does offer an alternative, but GENM is less risky, despite its 103% net gearing.

- In the short term, the primary catalyst for GENM would be to make the most of Visit Malaysia 2026 tailwinds. Given Resorts World Genting (RW Genting) is operating near-full capacity, our assumed +10% visitor numbers should easily drive a further +10% average room rate (ARR). Critically, this should be a tailwind for margins and support our EBITDA expectation that is +4% above consensus.

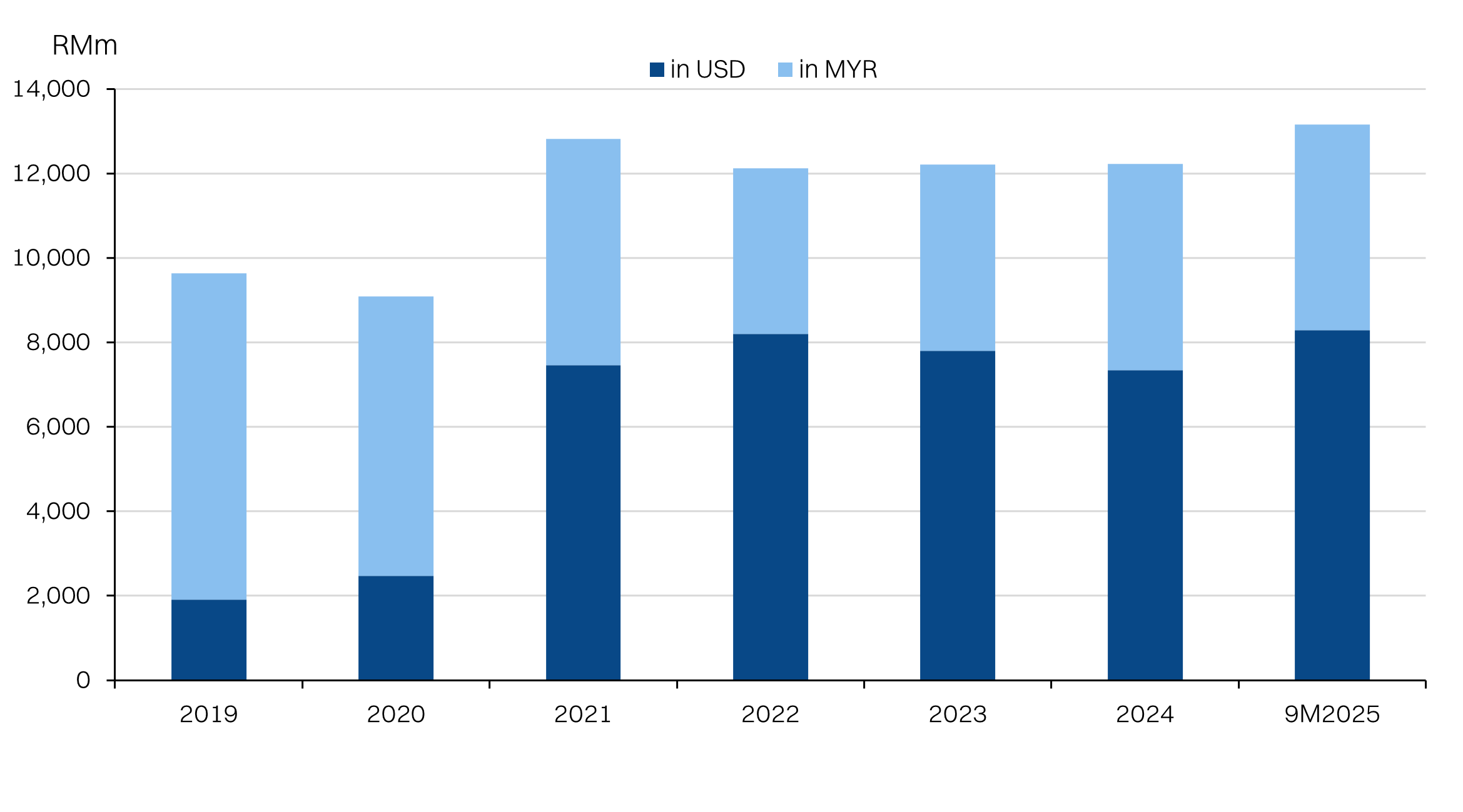

- Separately, the high dollar denominated debt (US$2bn) will act as a natural currency hedge - if the ringgit strengthens further and diverts tourists away.

- Lastly, the longer-term catalyst for the group will ride on execution of the newly awarded NYC casino license that the market appears to be completely pricing out.

Limited upside, but interesting on further de-rating

- At a 3yr average EV/EBITDA multiple of 7.3x, we estimate a FV of RM2.20 on FY26E EBITDA.

- Given the stock is under-owned, we anticipate upside re-rating could be relatively rapid, but timing and entry levels are key. The key hurdle to clear will be the upcoming 4Q25 results (announced end-Feb). Any selloff on disappointment could provide better entry levels, as most other negatives appear priced in already.

About the Company

Genting Malaysia Berhad (GENM) operates the sole land-based casino gaming license in Malaysia, located in its namesake Genting Highlands. It is more than gaming, with a complete offering that includes hotels, theme parks, entertainment and shopping, that gives it a broad catchment. We estimate about 80-85% of the visitors are domestic with a large volume made up of day-trippers.

GENM also operates casinos internationally. The largest overseas base is UK with over 30 casino licenses. However, the future growth is expected to be driven by US following the award of a casino license in New York City. Genting also operates two other gaming outlets in New York State, that includes live tables and sports betting. Additionally, the group owns other hotels internationally including the Bahamas, Miami and Egypt.

About the Stock

GENM was listed on the Main Market in 1989 and is the key subsidiary of the Genting Group, which controls 73.8% equity interest in GENM via Genting Bhd. The Group is led by Tan Sri Lim Kok Thay, who serves as the Chairman and Chief Executive. GENM is not Shariah compliant.

A recent key development was the failed voluntary takeover bid to privatize GENM at RM2.35 per share, by its parent, Genting Bhd. Following the rejection by minorities the share price has derated below the offer price.

GENM’s shareholding composition has shifted over the years. GENM used to be one of the top holdings among foreign funds, but today it is <10%. The rising proportion in Shariah AUM onshore also means valuations for GENM (like other non-Shariah stocks) face continued pressure. Broadly, institutional holdings in the group have fallen over the years, down by ~14ppts compared with 2019, and channel checks suggest muted institutional interest in the stock.

Investment Idea

GENM is probably trading close to FV, in our view. But it is worth keeping tabs on this tourism thematic stock, that has been discounted and overlooked due to its patchy track-record.

For this report, we are focusing on the Malaysian tourism thematic. However, we note that the development of the recently awarded casino license in New York City will be a key re-rating catalyst beyond 2026.

While high international tourist arrivals would be a big boost for GENM, it is worth noting that the group is significantly dependent on domestic tourism - about 80-85% of visitors. Of course, foreign tourists have much higher average spend (~10x, we estimate). In short, GENM should benefit from Visit Malaysia 2026.

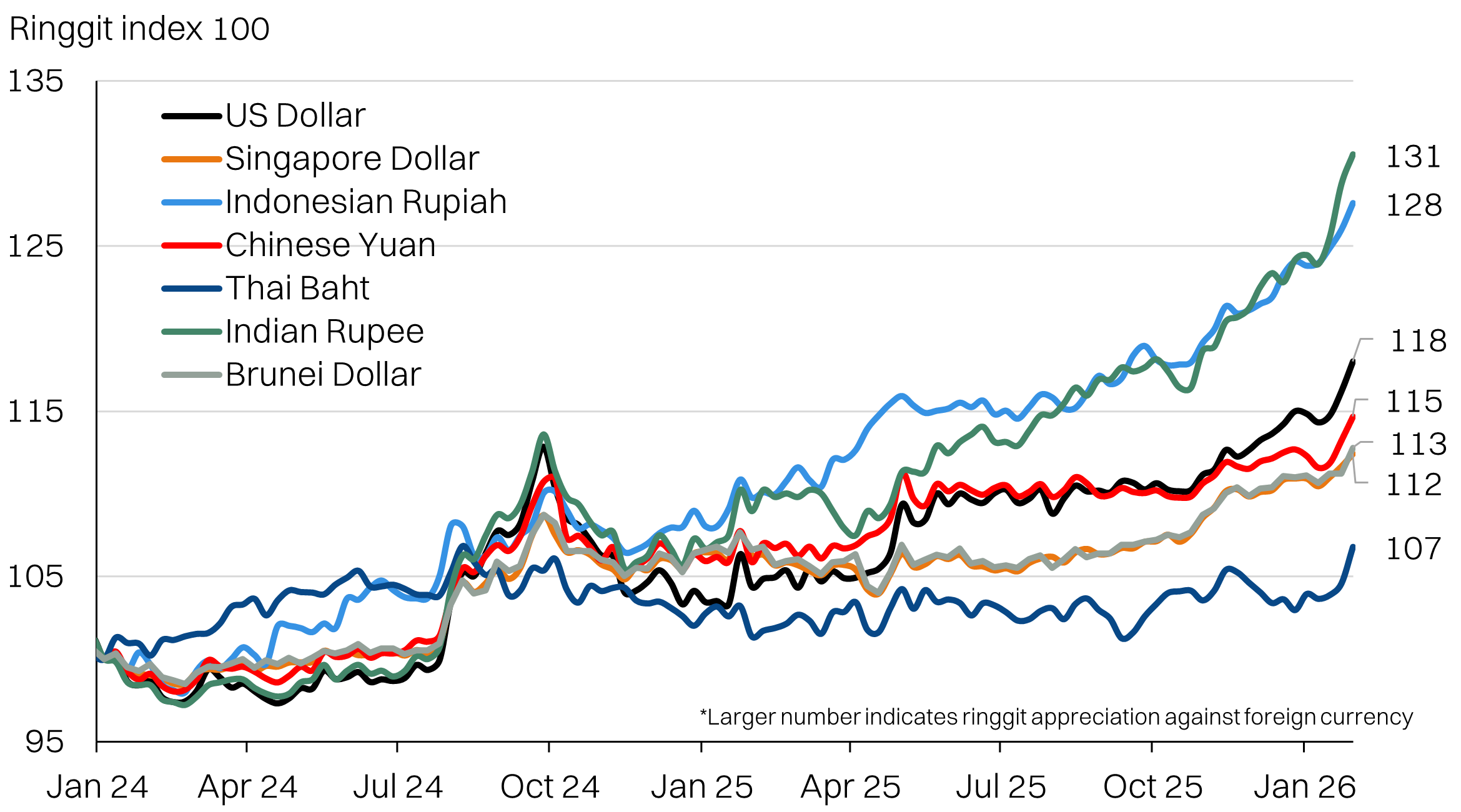

Additionally, GENM has ~US$2bn in dollar-denominated debt, ramping up for the NYC casino investments (~US$5.5bn). Every 10% appreciation in the Ringgit could generate ~RM60m in finance costs savings but offset by ~RM40m in lower dollar denominated EBITDA contributions.

Key Risks:

- A stronger Ringgit could lead domestic visitors to opt for overseas holidays and divert foreign tourists (Singaporean, Chinese, and Indian) away from Malaysia.

- Unfavorable/unpopular corporate exercise by management.

Visit Malaysia 2026 - tailwind for GENM

GENM should benefit from higher international tourist arrivals, even if the bulk of its visitor base are domestic day-trippers. This is because international tourists have much higher spend (est 10x vs excursionists).

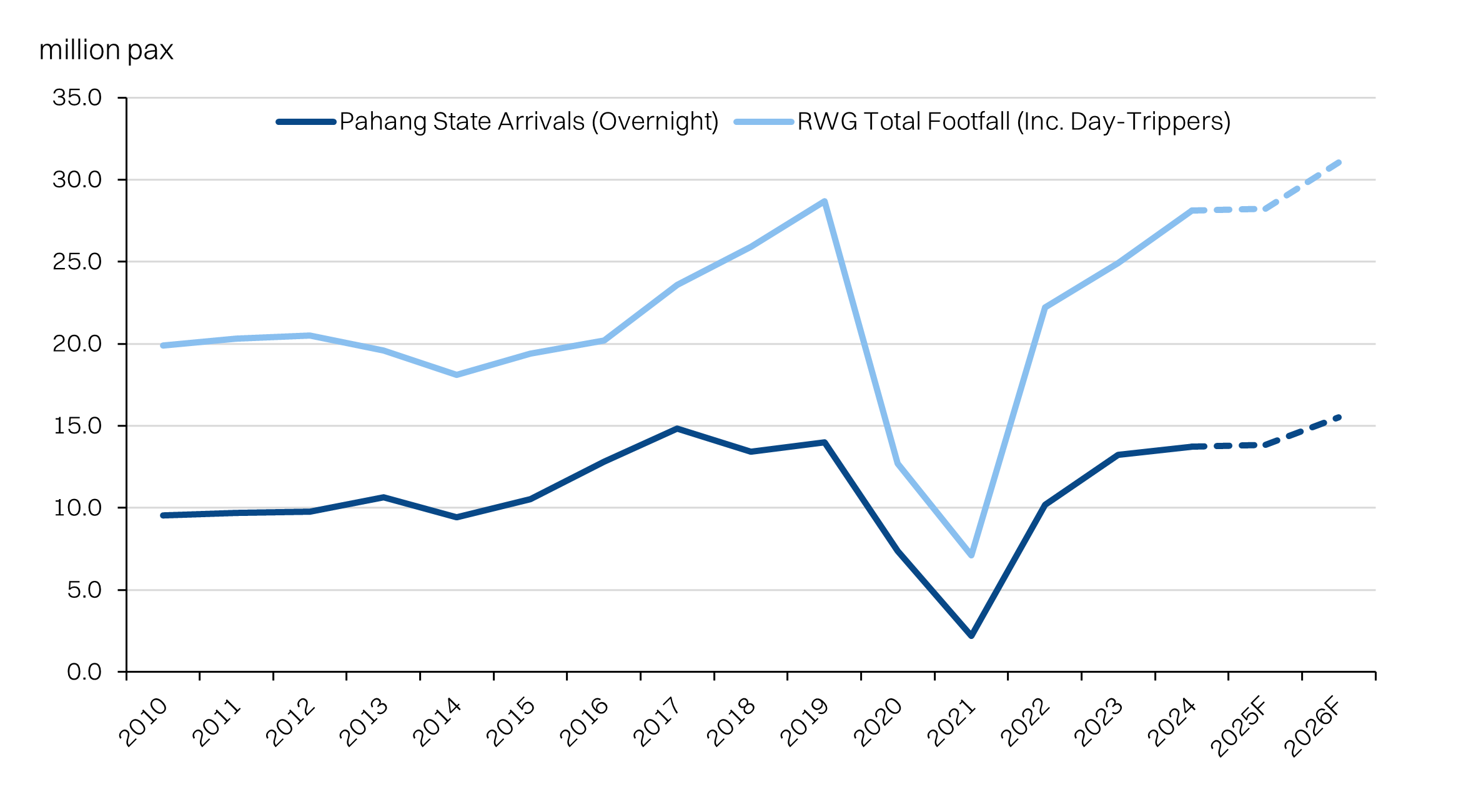

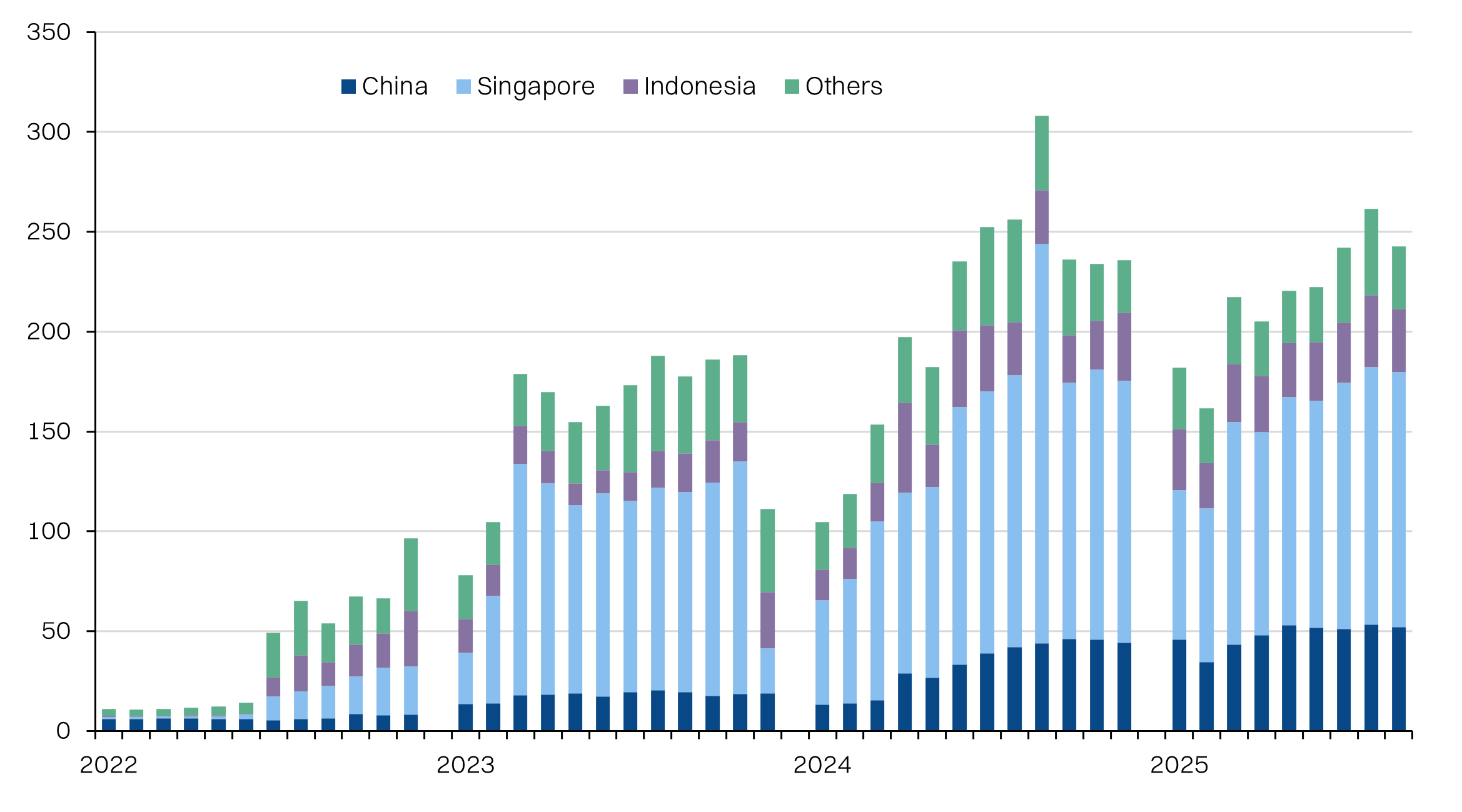

Visitor counts have already recovered to pre-pandemic levels in 2025 and should exceed these numbers in 2026. Both VM26 and Pahang State visitor targets point to ~12% growth this year. A key demographic to watch will be Chinese tourists, which we believe are attracted by Genting’s gaming offerings. Monthly tourist counts (based on Pahang state data) are up +69% YoY).

Operationally, the resort has reached full readiness with all facilities, including both gaming floors. A strategic MOU with MoTAC focused on edu-tourism and eco-tourism further aligns the group with the national tourism agenda. We believe the combination of a fully operational asset base and strong policy alignment will ensure the resort maximizes its visitor capture rate during this peak period.

We estimate total arrivals to RWG will reach a new peak, surpassing FY19 levels.

China Tourist Arrivals to Pahang Continue to Rise, Up 69% YoY in 9M2025

High occupancy should drive higher yields

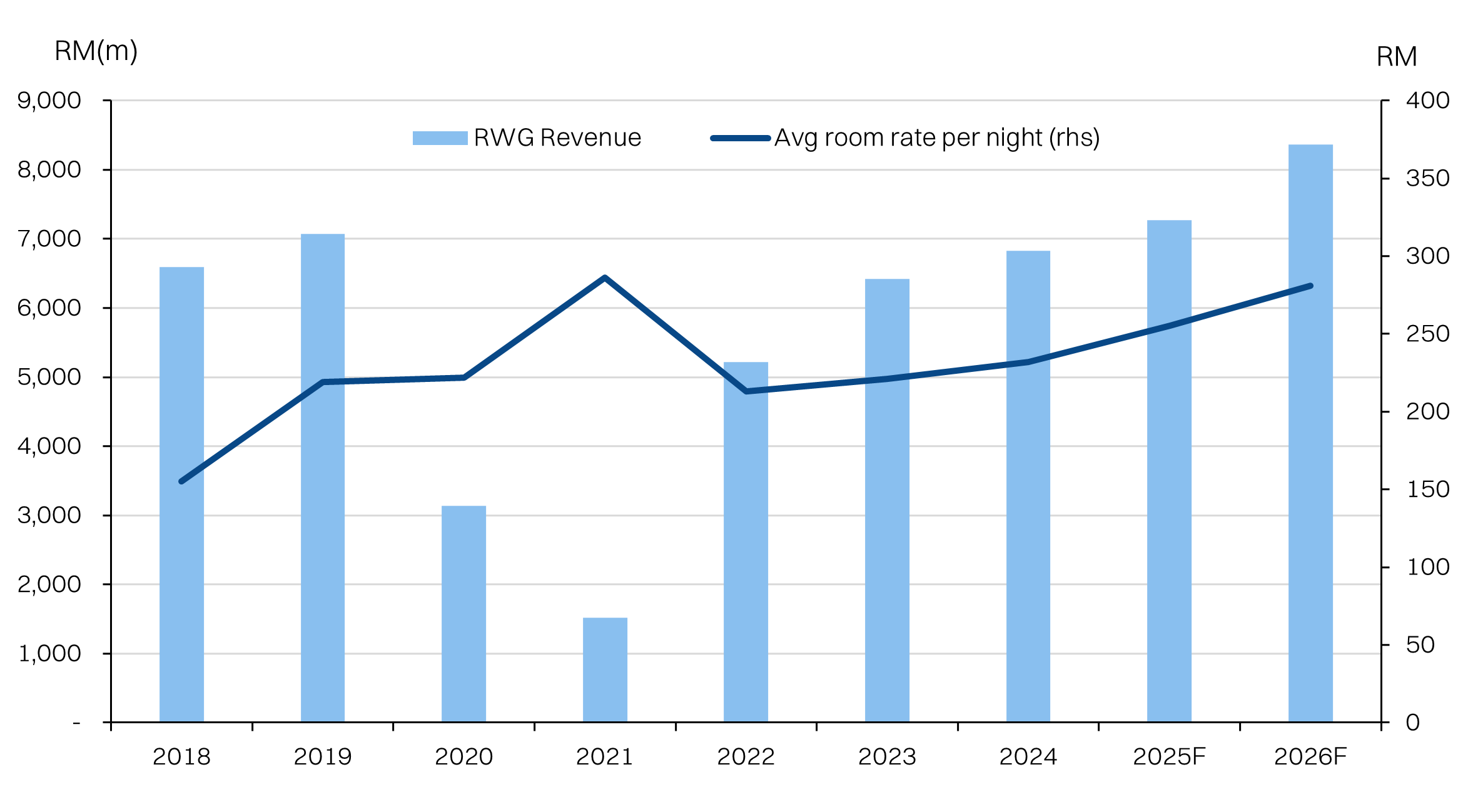

GENM has historically enjoyed +4.3% CAGR in average room-rates post-pandemic. But with occupancy already at 99% for RW Genting, we foresee more room for ARR upside this year if the tourist volumes continue to rise. This could result in higher occupancy at the nearby hotels like Arwana as well, which is not at full occupancy.

Against this backdrop, and given limited room supply, we project Malaysia’s leisure and hospitality segmental revenue to reach RM8,673.20m in FY26E, supported by management’s ability to price up ARR. Critically, the higher ARR should also be supportive of group gross profit margins this year.

99% Occupancy to Drive Higher Room Rates as Demand Rises

Malaysia EBITDA to Surpass Pre-COVID Levels While Margins Stabilise

Currency hedge

Beyond yield expansion, the strengthening Ringgit as a natural hedge for GENM. The key risk to the VM26 thesis is the currency strength driving away potential foreign visitors as well as catalyzing more domestic tourists to travel abroad.

However, with ~US$2bn in debt, GENM will enjoy substantial ~RM60m in finance costs savings for every 10% appreciation in the ringgit. While this is somewhat offset by lower US$ EBITDA (~RM40m), the estimated net impact of RM20m will be about +2.5% uplift to earnings expectations. This excludes the one-off unrealized forex gains. Note that GENM uses forward contracts for its upcoming 12 months of interest payments.

The Ringgit has appreciated against all major countries of origin for tourists

USD Continues to Dominate GENM’s Borrowing Mix

Fair value of RM2.20

We estimate there could be ~4% upside to consensus EBITDA assumptions for FY26, driven by a 10% upside to ARR this year on +10% visitors. Note that this excludes any forex upside. GENM is currently trading at RM1.99, which is also below the proposed takeover offer of RM2.35 that shareholders rejected.

Against a target EV/EBITDA multiple of 7.3x (3yr average), our FV for GENM would be RM2.20. Note that we included lease liabilities in our enterprise value calculations. To achieve this valuation, GENM simply has to stop disappointing the market (earnings, corporate exercise) and capture the VM26 upside in the ST. Over the LT, execution of the NYC license would also be another catalyst.

Immediate upside is thin, but we think the trajectory of the 4Q25 earnings (due late-Feb) could give more clarity to take a position. Or at least, better entry levels if the results disappoint.

Fair value: RM2.20

EV/EBITDA Below –1SD of 3-Year Average

Selected financials

Source: Bloomberg, Company data, NewParadigm Research, February 2026