A Rail Turnaround

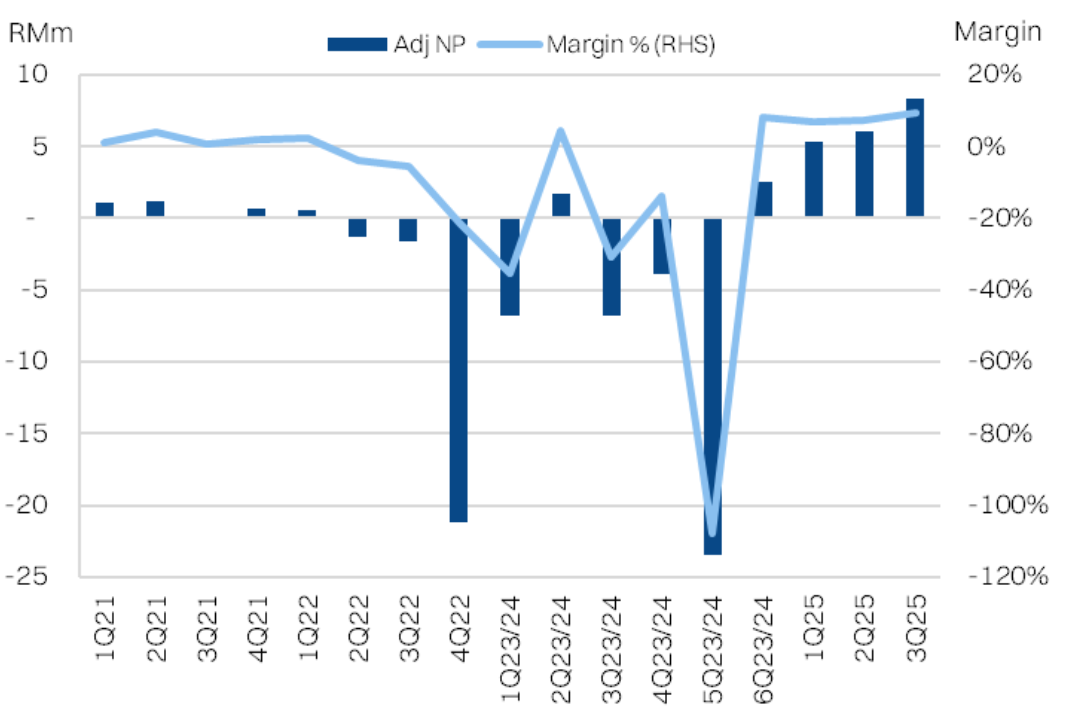

Destini has already delivered 3 quarters in the black after aggressively kitchen sinking i18M24 (ended June), that saw heavy impairments and exit/disposal from problematic segments/subsidiaries.

Stock information

Destini Berhad

DESTINI - 7212.KL

BUY

Target price: RM0.65

Last price: RM0.40

Market cap: RM220m

Shares out: 549m

52w range: RM0.20 / RM0.42

3M ADV: RM0m

T12M returns: 33%

Source: Bloomberg

Disclaimer: By using this information, you hereby acknowledge that you are fully and solely responsible for evaluating the merits and risks of any investment decision and agree not to hold NewParadigm Research fully liable whatsoever for any actions, omissions and/or damages of any kind or matter arising from such decision.

Key points

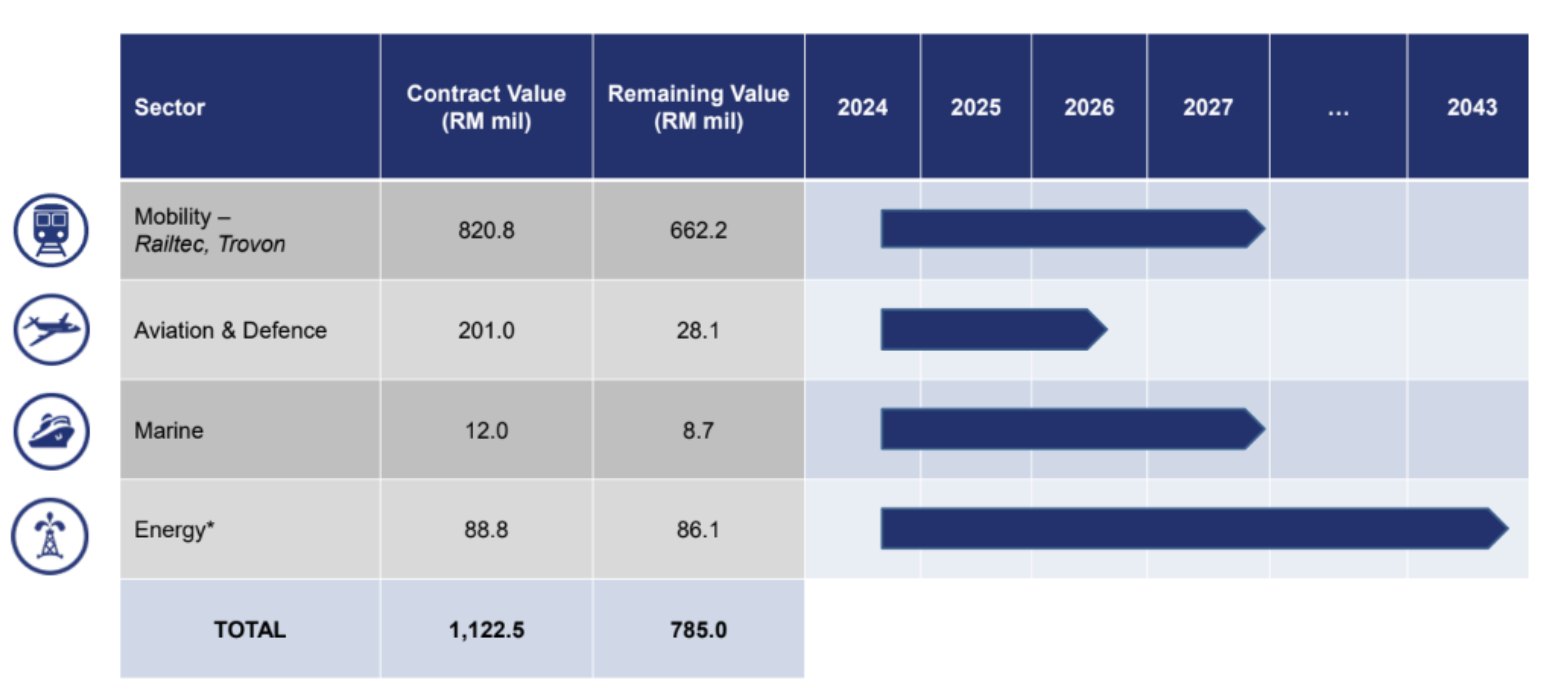

- 785m orderbook driving +32% YoY upside to FY26E NP,underpinned by a major MRO job for KTMB.

- Tenderbook of RM3.2bn, with estimated ~RM430m

≥70%probability of winning; ~RM100m of potential contract awards in thecoming 1-2months. - Long shot: aiming for a 25-year refurbishment and leasing contractworth RM5bn; RM200m revenue per year.

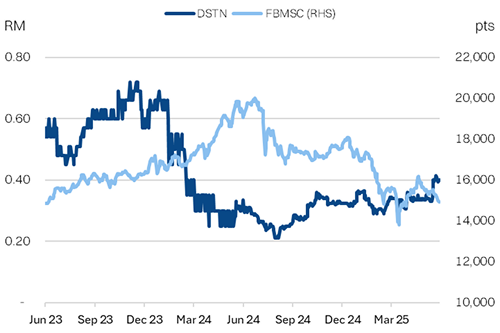

Share price performance

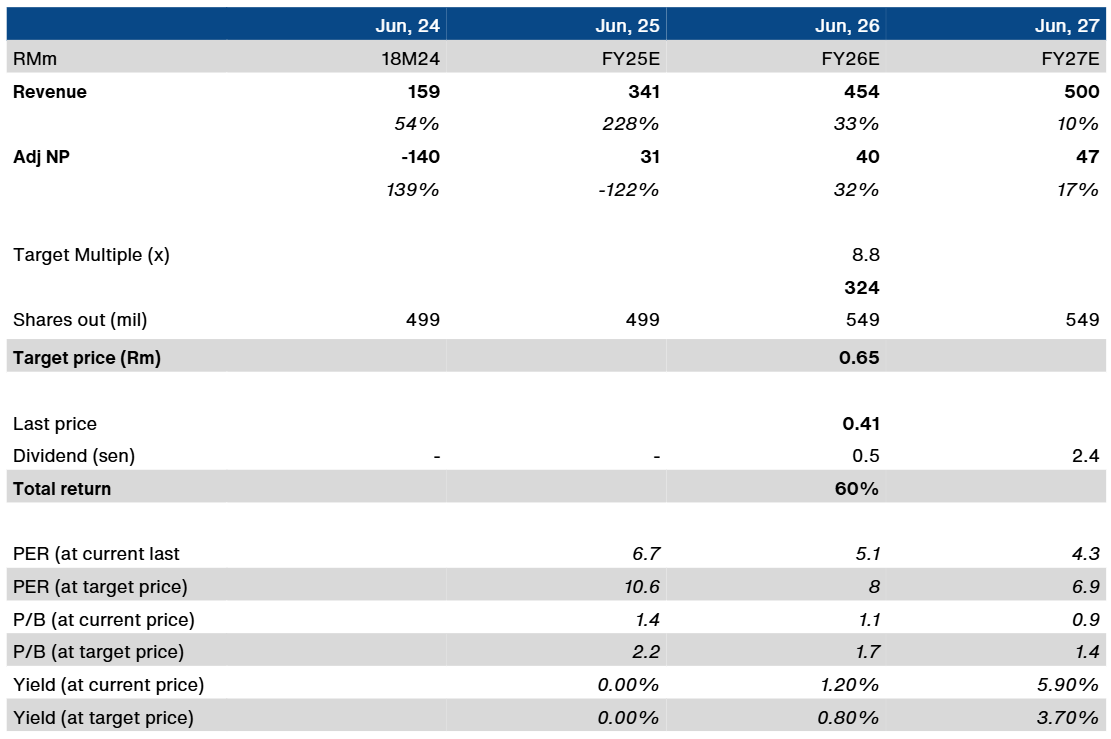

Investment fundamentals

| RMm | 18M24A | FY25E | FY26E2 | FY27E3 |

|---|---|---|---|---|

| Revenue | 159.3 | 340.5 | 454.4 | 499.8 |

| Revenue growth | 54% | 114% | 33% | 10% |

| EBITDA | -119.1 | 47.6 | 61.3 | 71.2 |

| EBITDA margin | -75% | 14% | 13% | 14% |

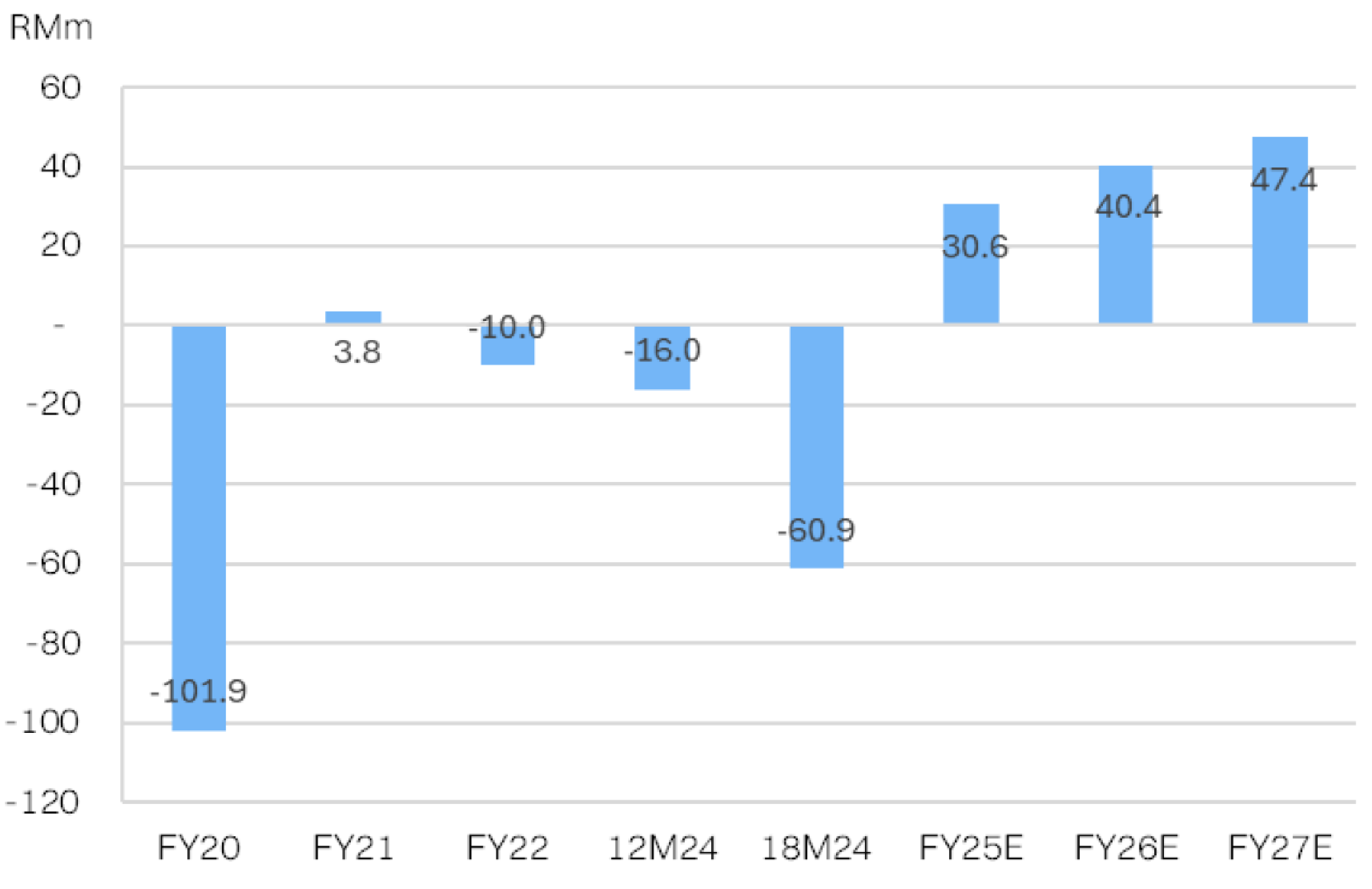

| PATAMI | -140.1 | 30.6 | 40.4 | 47.4 |

| Adj PATAMI | -60.9 | 30.6 | 40.4 | 47.4 |

| EPS reported (sen) | -70.4 | 6.1 | 8.1 | 9.5 |

| DPS (sen) | - | 0.5 | 2.4 | 2.8 |

| ROA | -23% | 10% | 8% | 9% |

| ROE | -53% | 20% | 21% | 20% |

| PER | - | 6.7 | 5.1 | 4.3 |

| P/BV | - | 1.4 | 1.1 | 0.9 |

| Yield | 0% | 0% | 1% | 6% |

| Net debt/Equity | -26% | -27% | -42% | -41% |

Source: Bloomberg, NewParadigm Research, 2025

We initiate coverage on Destini Bhd with a BUY and target price of RM0.65, which implies a 64% upside. Even without any multiple expansion, Destini’s ~32% YoY earnings growth for FY26 should drivet he fair value of the stock to RM0.54. However, we anticipate further contract wins coupled with a gradual dispelling of negative legacy perception, justifies a moderate re-rating to at least 8.8x PER.

- Quality earnings growth: We forecast a step up in earnings to RM40m for FY26E (+32% YoY), underpinned by steady execution of the MRO contract for KTM (RM570m outstanding). We anticipate upside potential to our assumptions, pending variation orders to scope ofwork. Note, management is guiding for FY26E earnings of ~RM50m.

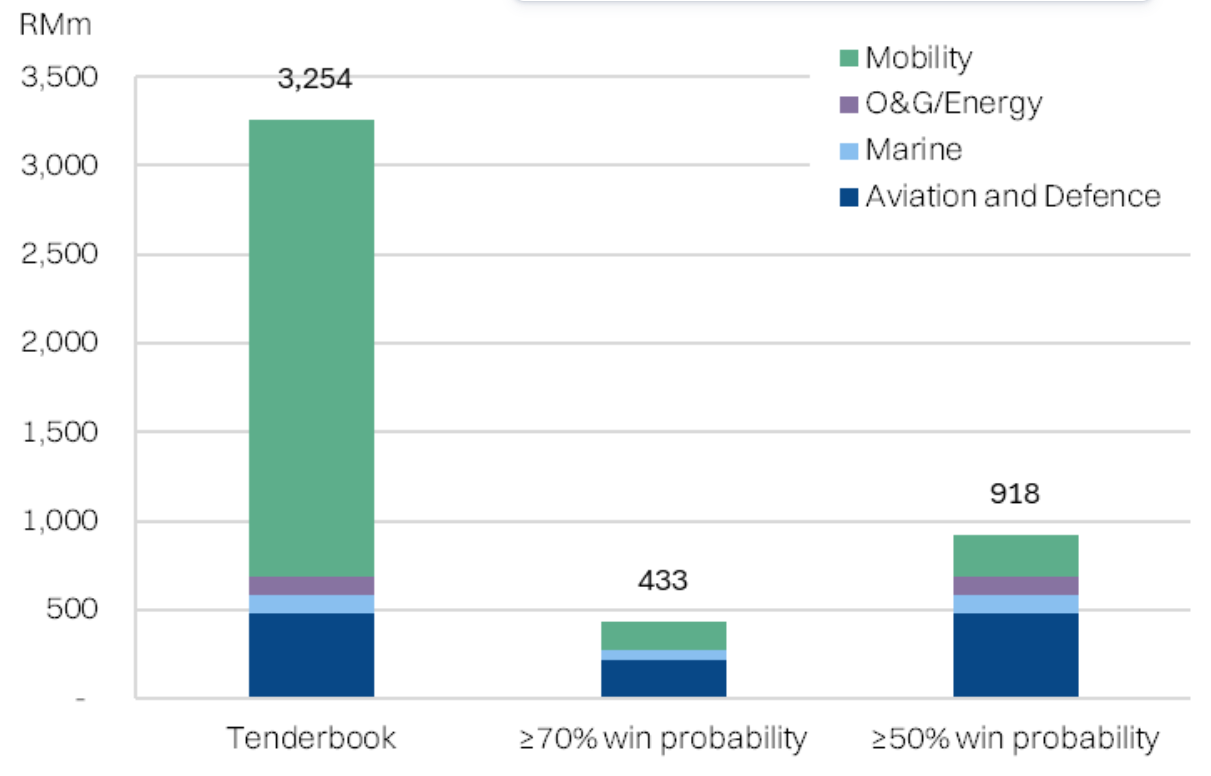

- New contract wins: We believe Destini should trade like a construction stock going forward and enjoy re-rating in valuations in line with new contract wins. The group has a bid book of RM3.2bn, of which at least RM433m is high probability (≥70% chance of winning) and another RM485m with 50%-70% chance. Management is guiding for~RM100m in contract awards to be decided in the next 1-2 months that will be a ST catalyst for the share price.

- Long shot: Destini is also pursuing a high upside but low-probability leasing contract from KTMB worth potentially RM4-5bn over 25years. MoT has pivoted strategically towards a leasing model for rolling stock assets, creating the opportunity for Destini to acquire old rolling stock, refurbish it, and lease it back. The key challenge for Destini, is the up-front capex heavy nature of a leasing business.

Destini has already delivered 3 quarters in the black after aggressively kitchen sinking in 18M24 (ended June), that saw heavy impairments and exit/disposal from problematic segments/subsidiaries. The group has also recapitalised substantially (led by an RM60m injection by the major shareholder/chairman) and should be able to fund further growth without another cash call on shareholders. To underscore this point, management is guiding for a 0.5 sen dividend per share for FY25 and potentially introducing a dividend payout policy of at least 30% going forward.

Valuation

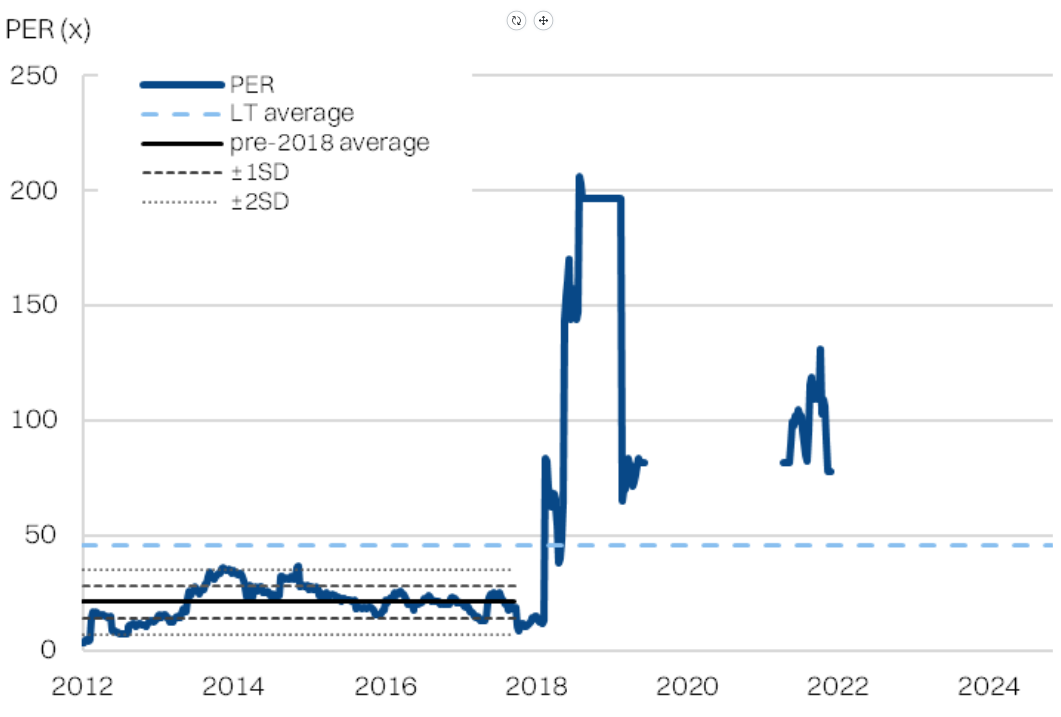

We value Destini at an undemanding 8.8x FY26E PER. This compares favourably at -1.7xStd Dev against the pre-2018 average PER of 21x. Initiate coverage with a BUY.

About the company

Destini Bhd offers engineering services in mobility (mostly rail), aviation and defence (primarily for the military), marine (for O&G) and energy (predominantly solar. The bulk of Destini’s operations are based in Malaysia, but it has a small footprint in Singapore, China. Australia and UAE. The bulk of Destini’s orderbook today relates to the maintenance, repair and overhaul (MRO) of KTMB rolling stock.

About the Stock

Destini Bhd’s controlling shareholder is Datuk Aziz with a 11.6% stake. The stock otherwise is mostly held by retailers with almost no institutional participation. This reflects the perceived political risk associated with the companies operations. Destini has seen two major corporate exercises in 2024 – a 2 for 1 rights issuance as well as a 1 for 10 stock split.

Investment thesis

Destini is a turnaround story, that is still building credibility. As the profitability track-record continues and the group continues to build its orderbook, the market should reward the company with a smaller discount on valuations. Critically, the stock has virtually no institutional ownership, for now. Destini’s profits for the next 2-3 years are underpinned by its Level 4 MRO contract with KTMB (RM695m), and new contract wins are supported by a sizable RM3.2bn bid book funnel.

Key risks

Political risk – Destini primarily contracts with the government or government linked entities. Changes to the political establishment can be disruptive to contract flows and payments, as seen in 2018.

Cash flow risk – Despite turning profitable, Destini’s bloating receivables has translated persisting cash flow drag and remains reliant on debt.

Cyclical risk – Destini has enjoyed lumpy level 4 MRO contracts, but such overhaul/refurbishment cycles are irregular and infrequent – likely more so as RAC moves towards a leasing model.

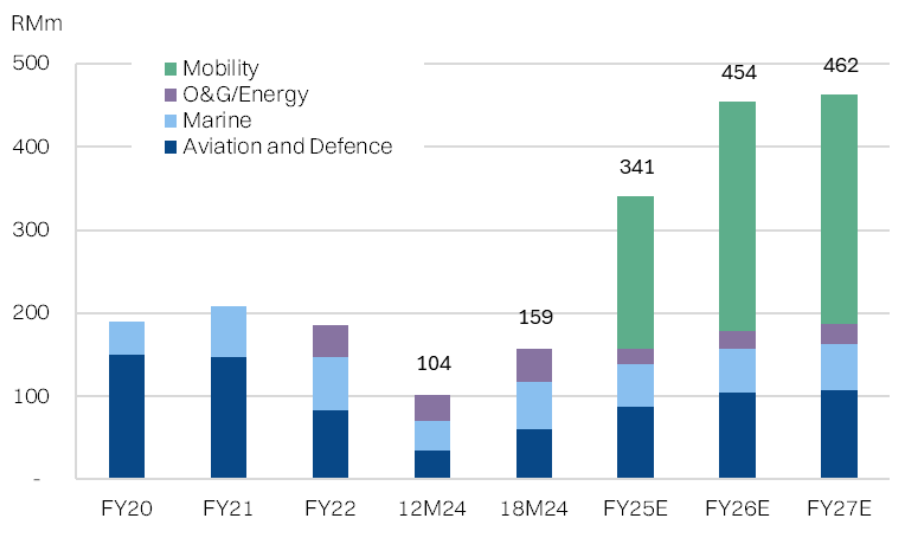

Chart 1: Adjusted PATAMI outlook

Getting Destini back on track

Initiate with BUY; RM 0.65 target price

Destini has been off investors’ radar for some time, and for good reason. The group has been struggling to break even since Pakatan Harapan took over the government in 2018, which precipitating significant disruption to Destini’s defence contracts.

But we think Destini is worth revisiting. The group has been profitable for the past 3 consecutive quarters, as the turnaround plan implemented by Datuk Abd Aziz Haji Sheikh Fadzir (Chairman, major shareholder) is beginning to take shape.

The key change, has been the recapitalization of the group (with RM60m from Datuk Aziz himself), shedding of problematic subsidiaries, and some cost-rationalization. This included almost ~RM150m in provisions and impairments in the extended 18M24 (ended-June; change in FYE).

The stronger balance sheet is allowing Destini to execute the RM695m in maintenance, repair and overhaul (MRO) projects for 45 total trainsets via its 70%-controlled subsidiary M Rail Technics S/B. (RAILTEC; balance 30% by KTM Bhd):

May 2022: RM531m MRO contract for 35 six-car-sets: (Link)

Sept 2022: RM164m MRO contract for 10 electric train sets: (Link)

Notably, Destini’s valuations did not re-rate on the news of the aforementioned contract awards, perhaps overshadowed by the group’s weak balance sheet and persistent losses. However, with Destini now turning a profit, we think markets should begin reflecting the turnaround going forward, especially if there are more contract wins.

The MRO projects in hand are contributing ~RM4m/qtr to Destini’s PATAMI or about 50% of the mix over the past nine months, bringing Destini’s 9MFY25 PATAMI to RM19.7m. This implies the group is trading at an a mere 7.8x trailing annualised PER. However, management is guiding for RM30m in PATAMI for FY25E, which then implies a mere 6.7x trailing PER.

Looking ahead, we think Destini should be able to accelerate earnings to RM40m for FY26E, which implies a forward multiple that is only 5.1x. By any measure, cheap. Note, that management’s own forecasts are more bullish – aiming for RM50m earnings for FY26E. This will hinge on timely execution (MRO contracts only payable on delivery of rolling stock, including passing certification) as well as securing variation orders on out-of-scope work.

Even holding the current trailing multiple unchanged. Destini should be valued at

RM0.54. But we believe the company can trade at a less discounted multiple of at least 8.8x forward PER, on the basis that it should have a stream of new contract awards to announce.

In turn, we initiate coverage on with a BUY recommendation and a target price of

RM0.65 based on a target multiple of 8.8x FY26E PER.

The catalysts

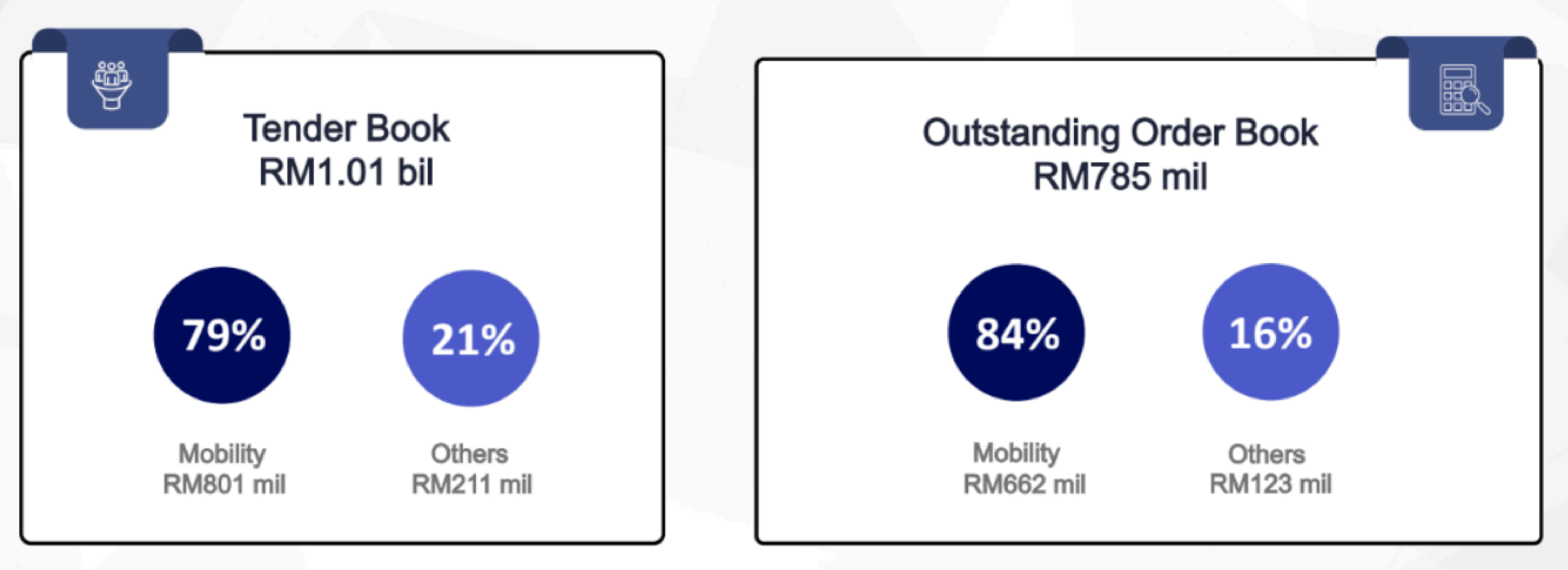

With a healthier balance sheet and a growing profitability track-record, we anticipate that Destini’s share price should be more reactive to new contract wins going forward – not unlike a construction stock. To this end, Destini has a bid funnel of RM3.2bn. Management advertises a tenderbook of RM1bn, with an implied win rate of ~34%. Note that bid figures in this section are gross, not adjusted for minority stakes.

Of the funnel, the most immediate catalysts could materialize in the next 1-2 months with management is guiding that an estimated RM100m worth of its active bids should be awarded – both for rail sector related contracts – for which management has indicated a high-degree of confidence in securing.

- Estimated RM60-70m Level 3 MRO contract for 9 ETS; from MOT (Link).

- Estimated RM20-30m MRT related MRO contracts.

Looking ahead, we think it is worthwhile scrutinizing Destini’s tenderbook. Management

is guiding for a tenderbook of that is roughly 79% mobility-driven:

Chart 2: Destini’s tenderbook and orderbook.

However, it is worth noting that the tenderbook is heavily skewed by a large rail project with a low-probability of success. We think a more accurate depiction of the tenderbook profile by probability of success. In this approach we find Destini has ~RM433m worth of high- probability bids (>70% chance of success) and RM485m worth of moderate probability bids (50-70% chance of success).

Chart 3: Destini’s tenderbook breakdown

It is also worth noting that the aforementioned tenderbook does not include a leasing project that could be worth in the region of RM4-5bn (over 25 years), based on management guidance. Management has indicated that it is exploring the potential to buy old rolling stock, refurbish it, and leasing it back to KTM. This follows a similar approach undertaken by SMH Rail, which has purchased 44 locomotives to be refurbished and leased-back to KTMB for 25 years (Link).

The Ministry of Transport has been exploring leasing as a major financing option for rolling stock, entering into a 62 train deal with China’s CRRC (China Railway and Rolling Stock Corporations, worth an estimated RM10.7bn.

We see this as a balance sheet intensive project, that will require more capital (or debt) to fund. The acquisition of old rolling stock and the refurbishment will incur significant up-front costs on Destini and leasing incomes will only kick in once the refurbished trains are delivered. In turn, we categorize this leasing project as high upside but low probability for now.

Key risks:

Destini still needs to a longer profitability track-record to substantiate a more sustainable re-rating. Another key metric that keen-eyed investors will be monitoring will be the group’s cash flows.

Understandably, Destini has been aggressively ramping up its revenues as it executes its MRO contracts. In turn, there has been a significant ballooning in working capital. However, it is worth noting that for the 9MFY25, Destini is still running a net operating cash flow deficit of RM85.2m. This is against a positive inflow of RM33.7m operating cash flow before working capital adjustments.

This has largely boiled down to a spike in receivables to RM166.2m. Destini has covered this deficit with an issuance of RM68.8m in debt over the past 9 months (as of 3QFY25 ended-March) as well as raising RM17m via a private placement last month:(49.9 million shares or 10% of outstanding shares at RM0.35/share, taken up by Mohamad Najib Mohd Ali via his vehicle Kismet Array S/B (link).

Nonetheless, management has indicated that some key outstanding amounts due will be collected in 4Q25, including RM17m outstanding from the Ministry of Defence. Additionally, the bulk of the receivables are from MoT, and management asserted high confidence in collection.

In fact, management is guiding for a modest half-sen dividend for FY25E, only a ~1.2% yield at the current share price. However, management plans to put in place a dividend policy of at least 30%. We would see this a positive signal to shareholders, and aligns naturally with the major shareholders interests, following his personal investment of RM60m into the company.

Looking ahead, we note that the last major change in government in 2018 was not kind to Destini. The next major risk event on this front would be the 16th general elections, due some time in late 2027. Investors should be cognizant of this risk event, but we take comfort in the fact that it is over two years out.

Warrants Attention

| Warrant details | |

|---|---|

| Name | Destini Warrants B |

| Last price | RM0.10 |

| Pricing date | Jun 23, 2024 |

| Strike price | RM 0.54 |

| Conversion ratio | 1:1 |

| Implied premium | 60% |

| Issue amount | 166.35 million |

| Issue date | Jul 3, 2024 |

| Expiry date | Jun 3, 2029 |

Source: Bloomberg

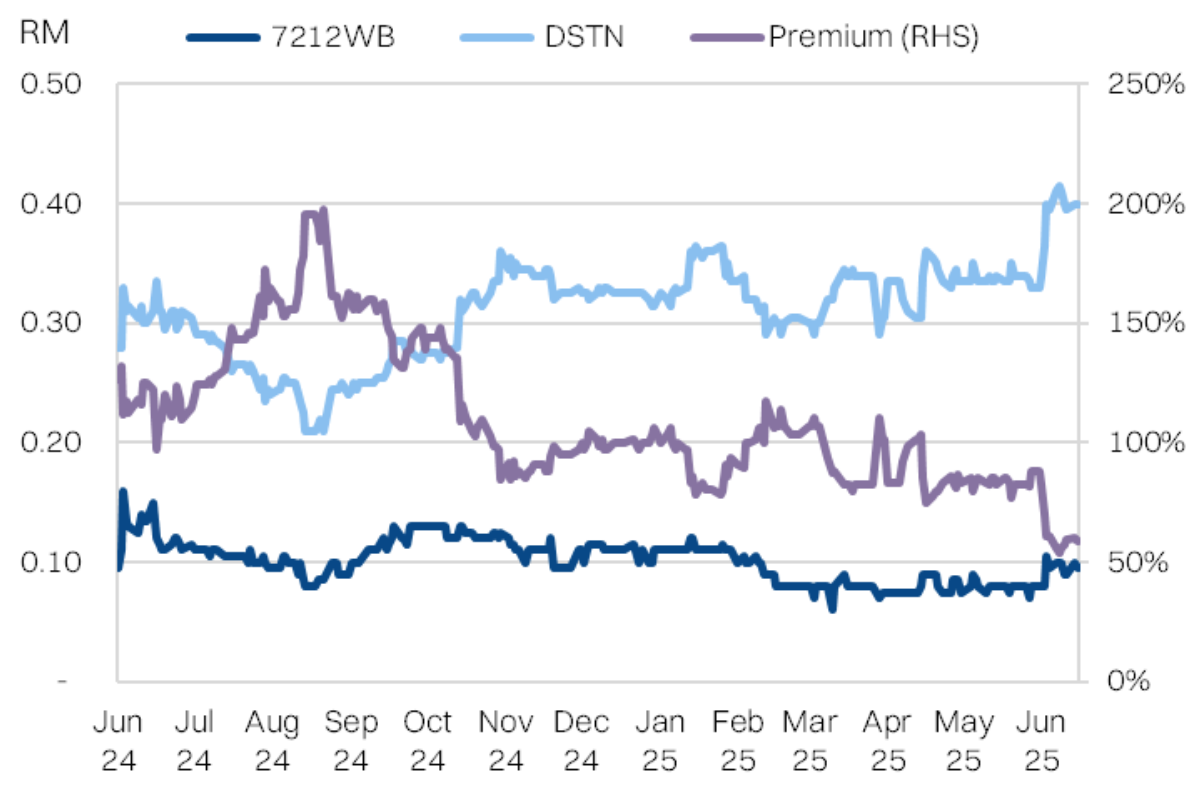

It is worth noting that Destini Bhd has 166 million call warrants issued on the stock, 7212WB. The warrants are currently trading at an implied premium of 60% to the stock, based on the last close of 10sen per warrant. So while there is a potential dilution of 30% to the stock, it is unlikely to be exercised in the short term.

However, we flag that our target price of RM0.65 would put the warrants marginally in the money. Investors should be mindful of potential dilution if there is a strong performance in the share price.

We do not make a recommendation on the warrants of the company.

Chart 4: Warrant vs Underlying Stock

Earnings

Destini’s medium term earnings outlook is underpinned by the mobility segment; in particular the sizable RM695m orderbook for the Level 4 MRO for KTMB (70% controlled).

Management is guiding for RM300m/RM500m revenue and RM30m/50m NP for FY25E/26E respectively. Our own forecasts are a little more conservative for FY26: 9% lower at the topline and 19% lower at the bottomline. We anticipate this provides some headroom to upgrade numbers, pending execution by Destini.

The earnings outlook is anchored by a steady flow of 3 trainset MRO’s per quarter (or 12 per year) at an average value of RM22m/train. This has potential revenue upside as well, due to additional out of scope work.

Chart 5: Revenue projections

Chart 6: Destini’s orderbook profile

At the same time, we anticipate net margins should be fairly stable at 9-10% going forward, but with potential for upside pending out-of-scope work from the MRO contracts.

The improved profitability should also be attributed to some cost rationalisation (admin expenses down -15% vs CY24 to RM59m for FY25E. This was aided in part by the exit from several troubled business units – Destini Avia Technique (commercial aviation MRO), Destini Ship Building, Safeair (ground handling services), AMS (marine equipment), and Destini Marine Solutions.

The sizable impairments/write-offs of RM146m in 18M24 also saw significant reduction in unhealthy assets on the balance sheet like receivables, intangibles and goodwill. Destini is now only about RM4m in depreciation per year.

Chart 7: Destini’s PATAMI and margins

Valuations: Narrowing discount

We value Destini on 8.8x FY26E PER, which implies a valuation of RM0.65.

We think the PER valuation methodology will be the most appropriate for Destini, as the contract-driven nature of its business should allow it to trade similar to construction stocks.

Chart 8: Valuation methodology

It is worth noting that valuation benchmarks for Destini are limited, due to the protracted run of losses since 2018 as well as the lack of analyst coverage. Destini does not have a useful historic PER benchmark since 2018. However, we can use the pre-2018 reference. From 2012 to early 2018 (pre-GE14), Destini traded at an average PER of 21x trailing earnings. Our 8.8x PER target is -1.7Std Dev below the pre-2018 average PER.

Chart 9: Destini PER bands

As a sanity check, we can refer to price to book valuations. Destini has averaged a price to book ratio of 1.3x over the long run (1.4x pre-2018). Our target price of RM0.65 implies a P/B of 1.6x FY26E net assets, which is +0.2StdDev above the trailing 5-yr average of 1.5x P/B.

However, we also flag that P/B may not be as appropriate given the aggressive impairments, write-offs and disposals in 2023-2024 (as part of the turnaround exercise) has changed the composition of the company’s assets quite drastically.

Chart 10: Destini P/B bands

What Went Wrong?

Destini’s decline into the red began in 2018, following a change in government in from the 14th general elections that disrupted defence contracts. Delays in payments put a strain on cashflows and new contract awards were either delayed or more challenging to secure.

Destini’s two flagship programmes—a trio of offshore patrol vessels for the Malaysian Maritime Enforcement Agency and six MD 530G helicopters for the Army—were caught in this recalibration. The patrol-vessel venture was effectively wound down when Destini divested its shipyard stake in April 2021, removing a crucial revenue pillar for the Marine segment. Meanwhile, the helicopter project completed only in June 2022, but unbudgeted costs for air-worthiness upgrades, pilot training, spares, and warranty support pushed the Aviation and Defence division to a segment loss of RM 22.1 million in FY22. Coupled with a RM 7.8 million Marine shortfall due to idle overheads, these overruns explained virtually the entire FY22 group loss of RM 30.2 million.

Destini began its pivot into mobility (rail) with the formation of M Rail Technics S/B – a 70:30 JV with KTMB. This was followed by RM695m in MRO contract wins in 2021. However, the ongoing drag from the aforementioned problematic contracts, coupled with elevated overheads and a cash-strapped balance sheet, meant that the group remained loss-making.

Ultimately, more drastic changes were required. In 2023, Datuk Aziz assumed controlled and leadership of the company, kicking off a five-year turnaround plan. This included injecting RM60million of his own capital, as well as the departure of executive chairman and major shareholder, Datuk Rozabil Abdul Rahman, after 12 years at the company.

Destini recapitalized with an RM133 million renounceable rights issue with free warrants that restored liquidity to mobilise rail contracts secured in 2022 and trimmed bank borrowings. A ten-into-one share consolidation followed on 12 June 2024, lifting the consolidated share price above institutional trading thresholds and tightening the free float.

Meanwhile, twenty dormant subsidiaries were removed, six operating entities were reassigned to more logical parents, and Oracle NetSuite was installed to give management real-time control of working capital and procurement. The board composition was also improved with three new independent directors.

Key figures

Dato' Abdul Aziz bin Haji Sheikh Fadzir. Chairman, Major Shareholder

Board profile: (Link)

Dato’ Abdul Aziz bin Haji Sheikh Fadzir is no stranger to Destini, as he has been a

passive investor in the company alongside Datuk Rozabil since 2011. However, he tooka step up in 2023 with an RM133 million equity infusion and seasoned government-industry network have repositioned Destini from a balance-sheet casualty to a credible turnaround story centered on its long-stalled rail-overhaul contracts.

Since re-joining the board in July 2023 and assuming the chair on 11 March 2024, the 62-year-old accounting graduate from Indiana University–Purdue University

Indianapolis has marshalled the financial, operational and political levers needed to reboot growth. Through his private vehicle, Dayanine Equity, Dato’ Aziz underwrote the September 2023 rights issue and supported the 10-for-1 share consolidation, eliminating working-capital bottlenecks that had frozen two KTMB Level-4 maintenance jobs worth RM695 million. Mobilisation began in December 2023, and management now expects Destini’s Mobility division to swing from a RM13.2 million loss in the FY2024 transitional period to positive operating cash flow from FY2025 onward, providing the clearest multi-year earnings visibility within the group.

Operational credibility stems from three decades of P&L responsibility as Executive Director of Gold Bridge Engineering & Construction Bhd, where he oversaw large-scale property and infrastructure projects. Governance depth is underpinned by past directorships at Kretam Holdings, Safeguard Corporation, Utusan (Melayu) Malaysia and TH Heavy Engineering, complemented by board roles at Universiti Utara Malaysia and Tourism Malaysia. Politically, his tenure as UMNO Vice Youth Chief and former MP for Kulim-Bandar Baharu—plus cabinet-level family ties—facilitate stakeholder access at the Ministries of Defence and Transport, bolstering tender pipelines and lender confidence. The five-thrust turnaround he initiated—subsidiary rationalisation, stakeholder outreach, financial restructuring, ERP-driven cost discipline and order-book rebuilding—has

already pruned 20 dormant units and installed Oracle NetSuite for real-time visibility. It is worth noting that Datuk Aziz was temporarily declared bankrupt in 2014 (Link) but has since rectified the matter. He has no regulatory sanctions on his record.

Encik Ismail bin Mustaffa. Executive Director, CEO

Board profile: (Link)

Destini’s execution is led by Encik Ismail bin Mustaffa who brings over 30 years of

experience in audit-and-finance as well as executing turnarounds.

Appointed Executive Director on 28 August 2023, the 61-year-old Singaporean is no stranger to Destini’s moving parts. As Chief Executive Officer of Destini Armada Group he previously ran international marine operations spanning Singapore, Australia, China, the UAE and the UK, shouldering P&L responsibility for fleet availability, dry-dock discipline and asset-turnover targets. That frontline exposure gives him a granular view of contract risk, banker expectations and cross-border compliance—skills he now deploys to kick-start two KTMB Level-4 overhaul jobs worth RM695 million and to normalise working-capital cycles after years of under-investment.

Ismail’s holds a B.Sc. (Hons) in Finance & Accounting (University of Salford) and a

Diploma in Business Studies (Ngee Ann Polytechnic), sharpened by the National

University of Singapore’s General Management Programme. Early stints in Big-Four audit and corporate treasury built fluency with covenant negotiation and cost

benchmarking, competencies which he later applied in restructuring TH Heavy Engineering alongside Aziz. Board evaluations cite his “extensive experience in the

businesses of the Group” and “due care in managing operations”.

Ismail holds no other public-listed directorships, has no family ties to Destini insiders and carries no regulatory blemishes. His remit now spans ERP roll-out (Oracle NetSuite), KPI-linked incentive design and lender engagement—pillars of the five-thrust turnaround plan.