High-leverage tourism proxy

AAX will be reactivating the entire AirAsia fleet by 2Q26

AirAsia X

AAX - MYX 5238

Not Rated

Fair value: RM3.15

Last price: RM2.06

Market cap (RMm): RM6,923m

Shares out: 3,361m

52-week range: RM1.23 / RM2.33

3M ADV: RM13.0m

T12M returns: 17%

Disclaimer: By using this information, you acknowledge that you are solely responsible for evaluating the merits and risks of any investment decision and agree not to hold NewParadigm Research liable for any damages arising from such decisions.

Key takeaways:

- Post-restructuring, AAX is a high-leverage play on tourism, both in and outbound. Estimated ~15% capacity addition for Malaysia in FY26.

- Strong ringgit and low oil prices underpin profitability, as it reduces finance/leasing costs and fuel costs.

- We estimate AAX can deliver EBITDA of ~RM4.6bn for FY26E on the aforementioned drivers. At a conservative 6.5X EV/EBITDA, the fair value for the stock would be RM3.15.

- See also: our VM26 thematic report.

Share price performance

Investment fundamentals

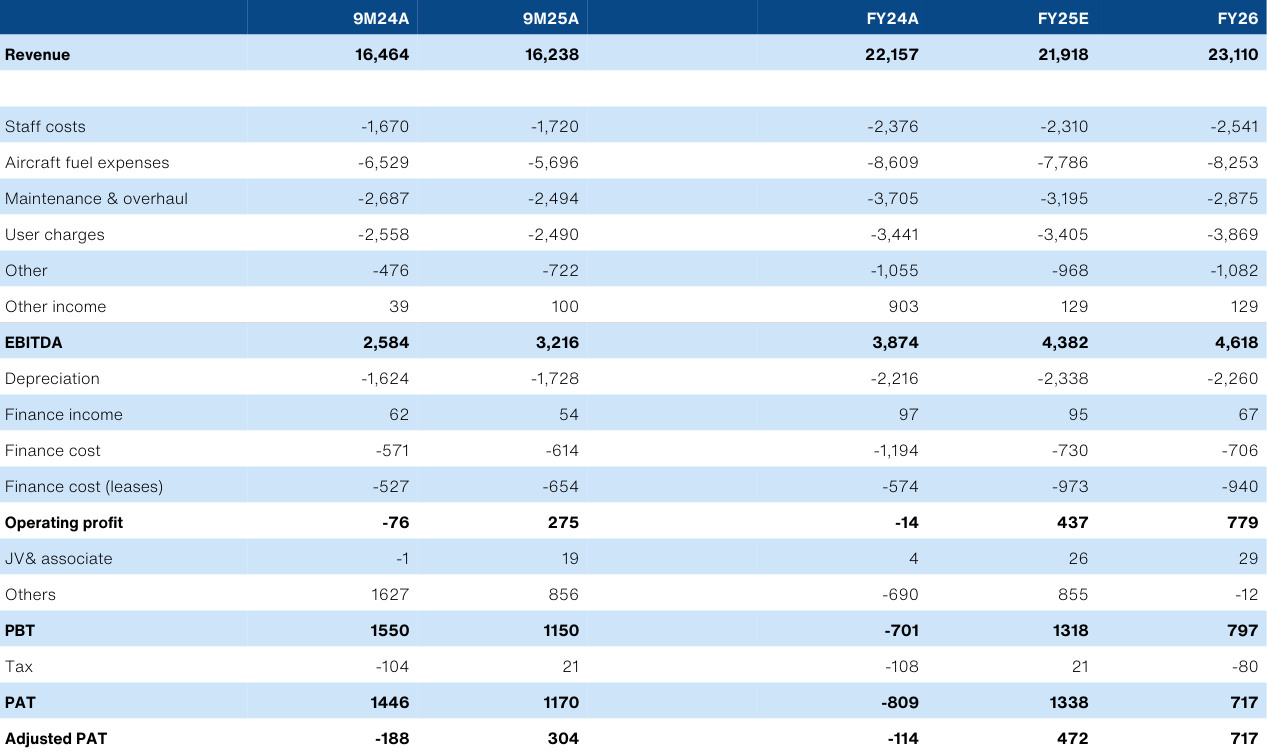

| RMbn | FY24A | FY25E | FY26E |

|---|---|---|---|

| Revenue | 22.2 | 21.9 | 23.1 |

| Revenue Growth | n/a | -1.0% | 5.0% |

| EBITDA | 3.9 | 4.4 | 4.6 |

| EBITDA margin | 17% | 20% | 20% |

| Adj PATAMI | -0.11 | 0.47 | 0.72 |

| PATAMI margin | -1.0% | 2.0% | 3.0% |

| Net Debt | -22.6 | -20.1 | -19.7 |

| ROA | -0.4% | 1.4% | 2.2% |

| PER | n/a | 14.7 | 9.7 |

Source: Company data, Bloomberg, January 2026

Flights, fares, fuel, Forex

- Flights - AirAsia has been operating below capacity post-pandemic due to limitation in parts as well as financial resources to reactivate the entire fleet. As of 2025, AirAsia was only operating about 190 of its 225 aircraft but carrying most of the finance/lease costs associated with the planes. Looking ahead, the group intends to have virtually all aircraft operational by the end of 1Q26. For Malaysia alone, there will be an additional ~15% capacity added.

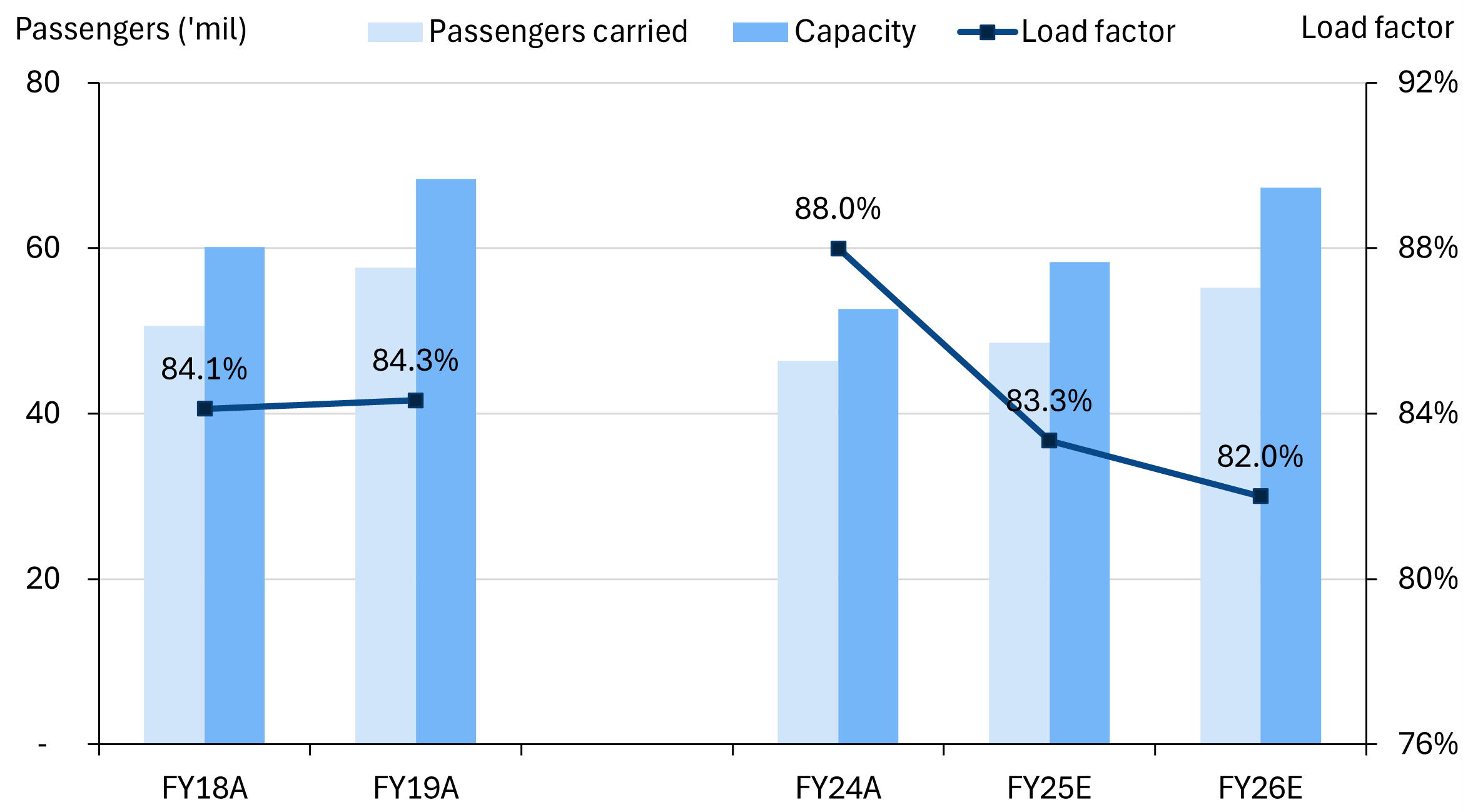

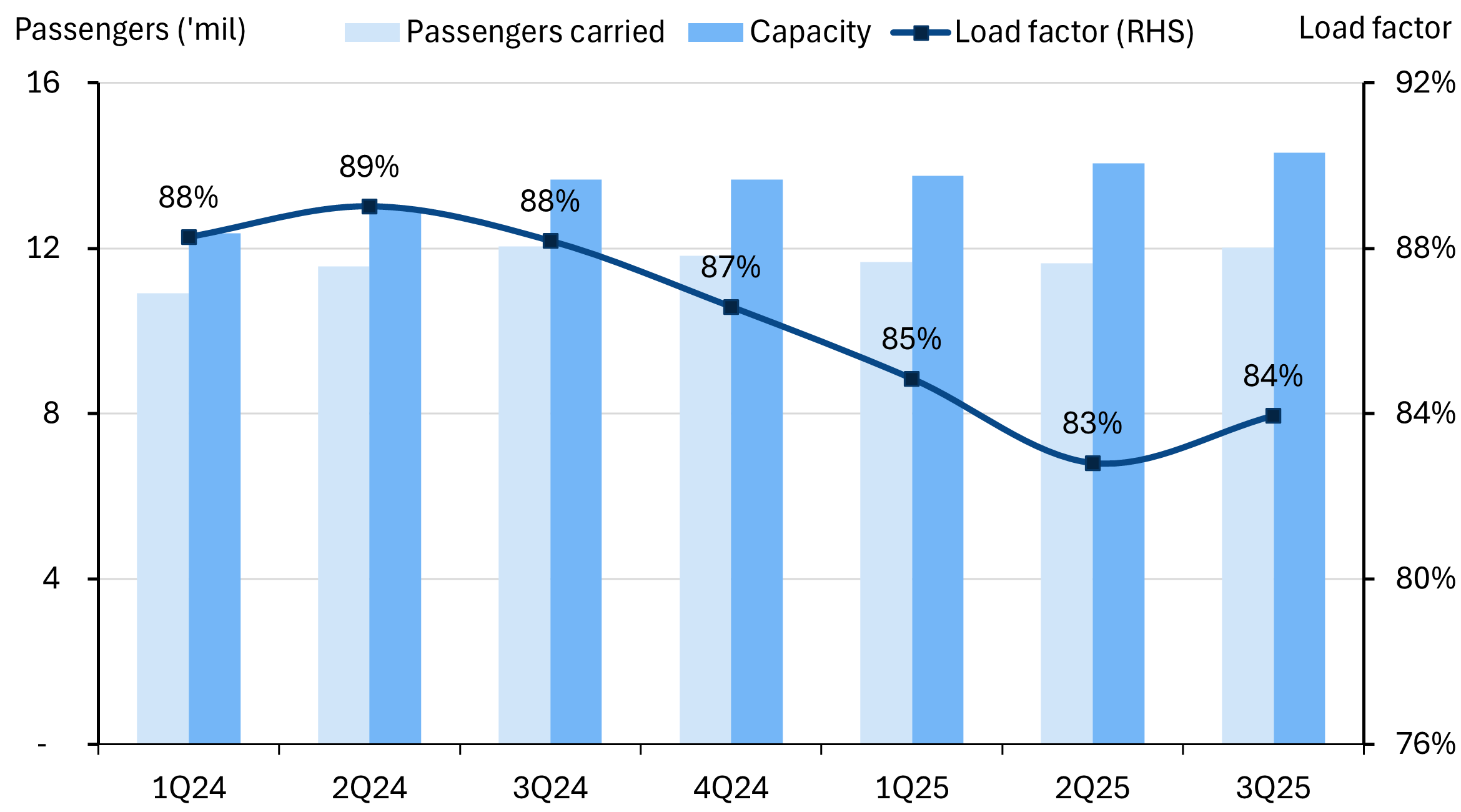

- Fares - We anticipate this will come at the expense of lower yields (average revenue per passenger), as additional supply will need to be supported by promotional activity. Keep in mind that AirAsia has been operating at relatively high load factors (89%/84% in FY24A/25E) on constrained capacity. However, given the previously idle aircraft still carry leasing overheads, the net impact of reactivation should be profit accretive.

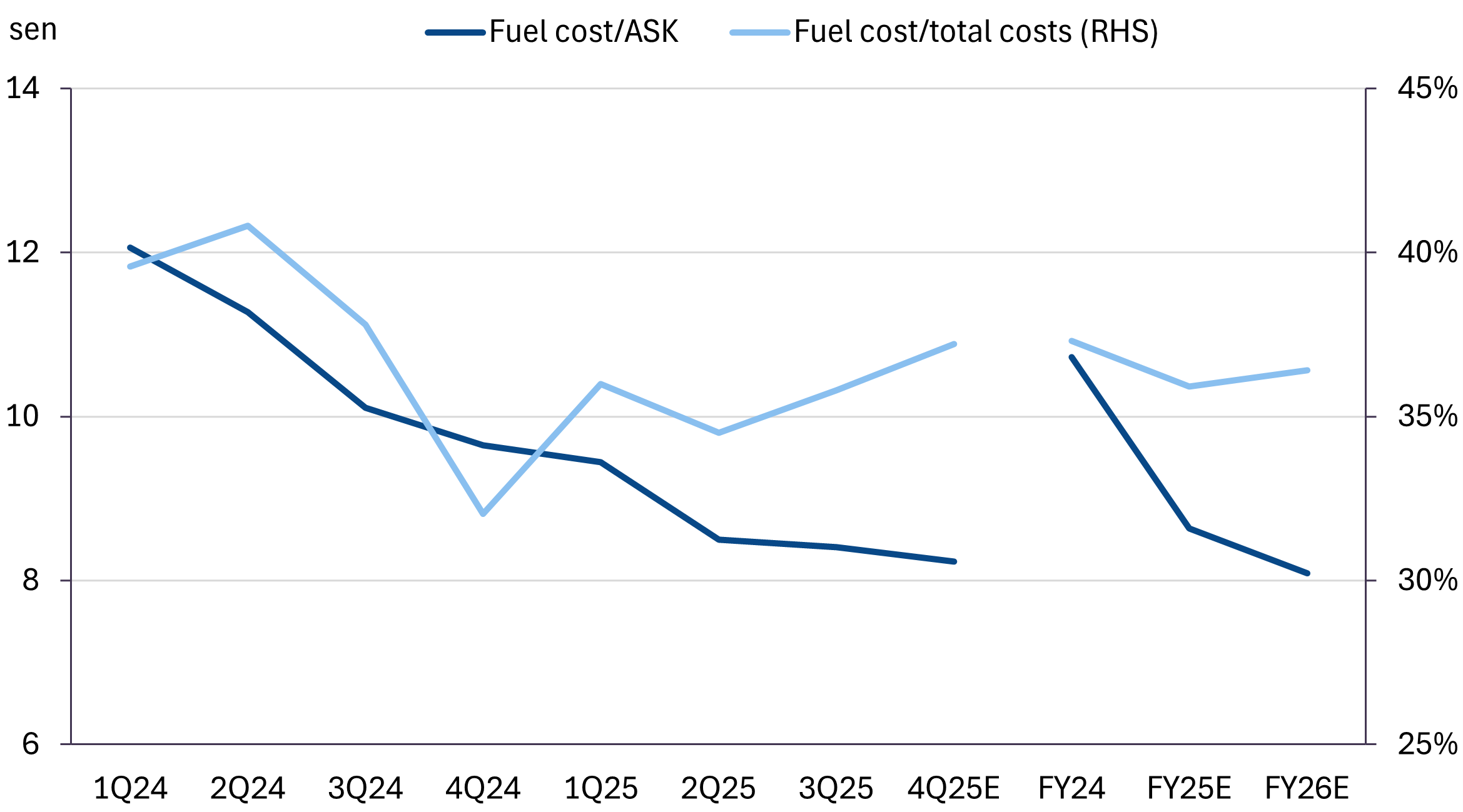

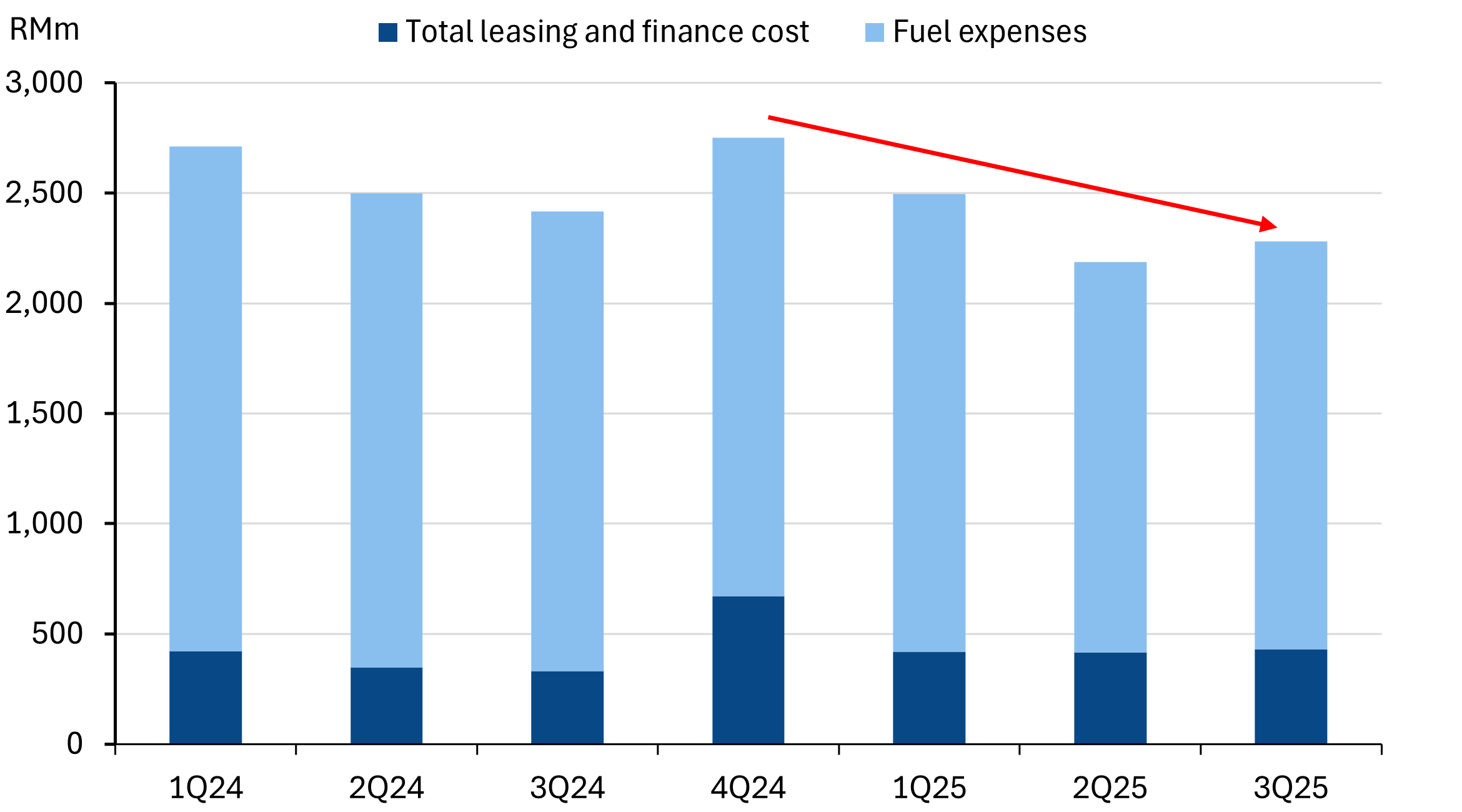

- Fuel - The single largest cost component for an airline is fuel. For a low-cost carrier like AirAsia, it is 35-40% of total costs. Jet fuel prices have fallen by about 9% in the past one year and is down -17% in Ringgit terms. It is worth noting that fuel prices have not fallen as quickly as oil prices as Jet crack spreads remain elevated due to tight refinery capacity and relatively healthy demand. Note that AAX is completely unhedged to fuel prices and is fully exposed to price movements.

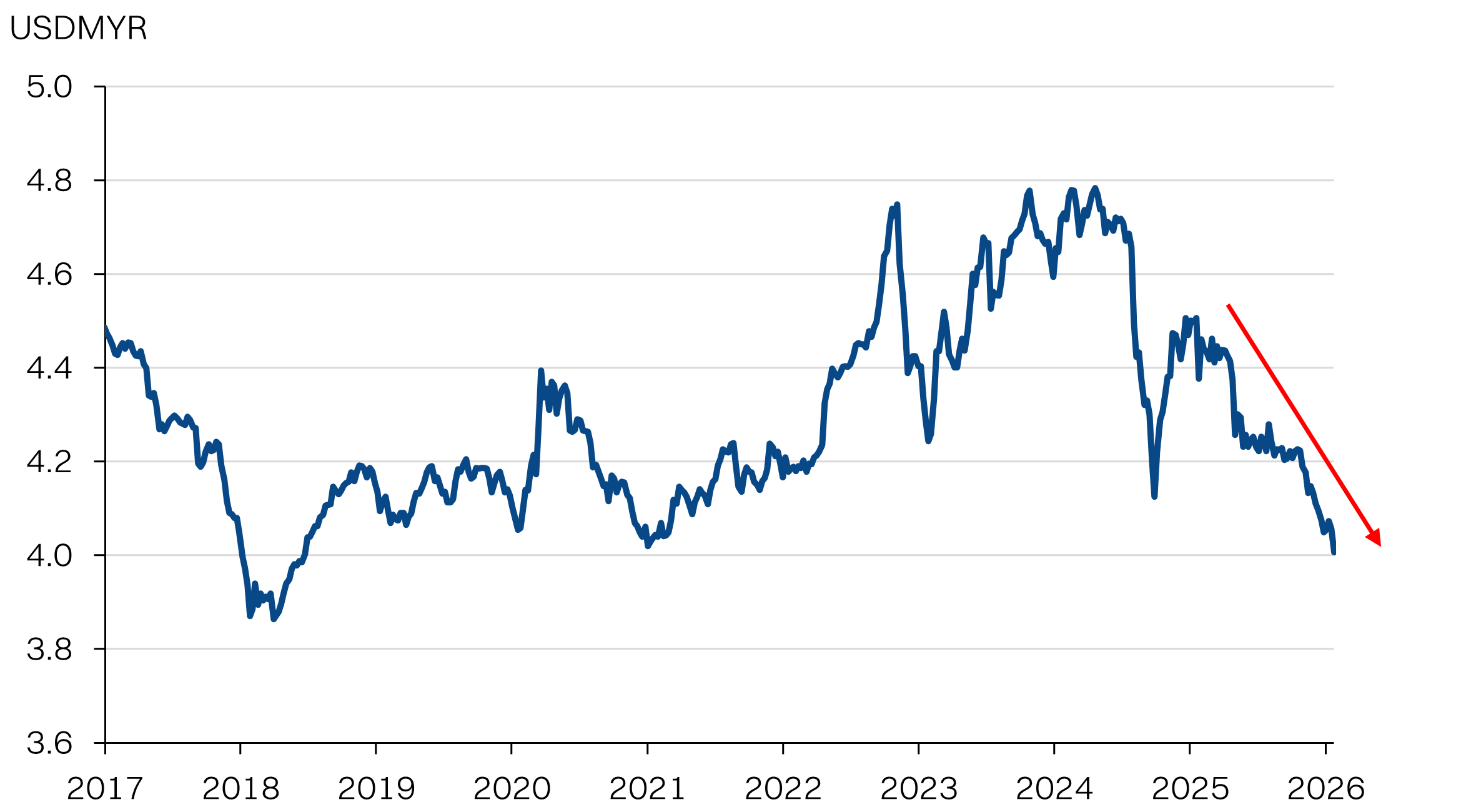

- Forex - The ringgit’s strength not only helps with lowering fuel costs, but also finance and leasing charges. AAX has roughly RM20bn in debt and leases denominated in US$, with an estimated annual cost of ~RM1.5bn. Every 1% strengthening of the ringgit could translate to ~RM100m in lower costs annually.

Fair value of RM3.15

- We estimate that AAX could achieve an EBITDA of ~RM4.6bn (+5% YoY), on the back of +5% revenue growth from +14% passenger growth. Assuming an EV/EBITDA multiple of 6.5x (-1SD vs the sector average of 7.2x), AAX’s potential fair value would be RM3.15.

- We think a more conservative multiple should be applied, given the high gearing on the balance sheet as well as the dilution to yields from the incoming capacity. That said, AAX shifts back to expansion in FY27 and beyond, there would be room for multiple re-rating.

About the company

AAX has acquired the aviation operations from CAPITALA, but will continue to pay a brand licensing fee of ~1% to the latter. In turn, AAX now operates the largest low-cost carrier airline in Asia with operations in Malaysia, Thailand, Philippines, Indonesia and Cambodia.

AAX is still carrying significant lease and debt burden from the pandemic totalling ~RM20bn. Critically, most of the aircraft leases have been extended up to 18 years with an average fleet age of 13 years, potentially leaving AirAsia with a relatively older fleet in the coming years.

Post-restructuring, management is guiding that AAX will have shareholders funds of ~RM600-700m. Debt restructuring is still ongoing and de-leveraging the balance sheet will be key going forward.

About the stock

AAX used to be the long-haul unit of AirAsia Group Bhd (since renamed CAPITALA). It is controlled by Tan Sri Tony Fernandez who holds 32% of the stock.

Warrants - AAX has 223.5m warrants in circulation that expire in Dec 2030. This is roughly a 7% dilution to the underlying stock. The warrants have a 1:1 conversion ratio with a strike price of RM1.64. The warrants are currently trading at a ~20% premium to the underlying stock.

Investment idea

AAX is likely the stock with the highest leverage to the visit Malaysia 2026 thematic, now that Malaysia Airports has been privatized and the consolidation of the AirAsia aviation operations from Capital A Bhd last month.

AAX will be returning its full fleet into action by 2Q26, adding ~15% more capacity. Keep in mind that AirAsia has been carrying the leasing cost of the grounded aircraft. While we anticipate some pressure on yields, we expect this will easily drive +5% topline and EBITDA growth. In turn, this translates to +52% Adj. PAT growth, given the improving operating leverage.

Assuming a modest re-rating in multiples to 6.5x EV/EBITDA, the potential fair value of AAX would be around RM3.15.

Key risks:

- AAX carries ~RM20bn in debt and lease liabilities. Unfavourable movement in forex and/or any operational headwinds could result in significant losses if operating leverage unwinds.

- Fuel costs are a significant portion of total costs - about 35-40%. AAX does not currently undertake any hedging. Unfavourable movements in forex or fuel prices could translate to a large swing in profitability. In particular, we flag geopolitical tensions in the Middle East as a potential trigger for a spike in oil prices.

- AAX is operating a relatively old fleet with an average age of 13 years, and is committed to lease said aircraft until 18 years old. This could result in higher maintenance costs due to age and/or lower aircraft availability. It could also result in a relatively uncompetitive offering vs peers.

Getting off the ground

The completion of the transfer of Capital A’s aviation assets into AirAsiaX (AAX) creates an excellent tourism proxy for investors (Note: Thai AirAsia remains an associate). Timing could not be better as AAX will see its entire fleet return to service by 2Q26. The fleet’s reactivation since the pandemic has taken a long time, held back by limitations in finances and spare parts.

In Malaysia alone, AirAsia will be adding ~14% more capacity in 2026, as refurbished aircraft are returned to service. Overall, we estimate a 15.5% increase in capacity across the network. AAX has also been carrying the leasing costs of the grounded aircraft as well as the one-off costs of aircraft reactivation. Putting these aircraft back to work should be earnings accretive and improve operating leverage.

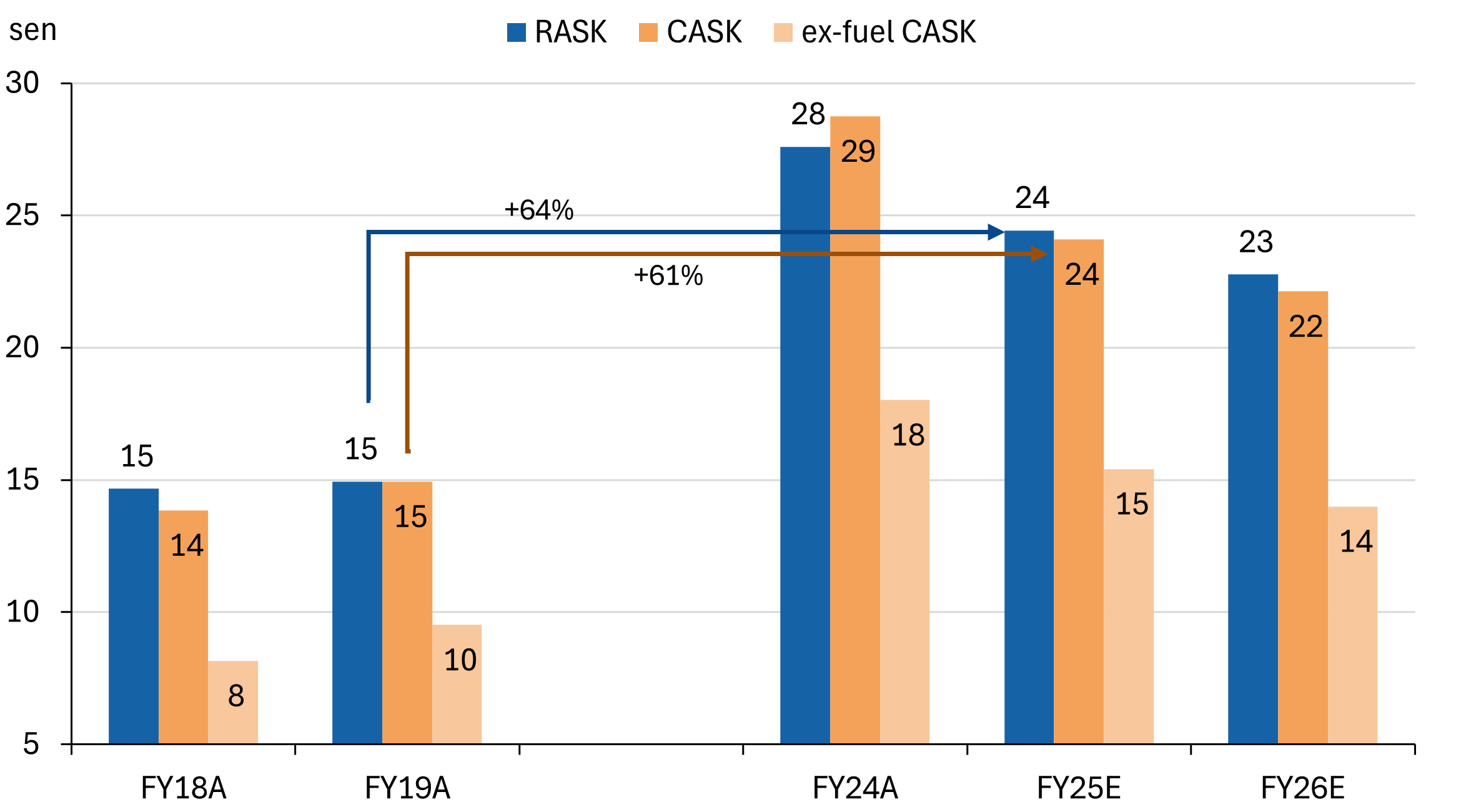

The operating environment has also been better for low-cost carriers (LCC’s), as AAX has been able to charge higher fares with fewer discounts to limitations on overall supply. This has allowed AAX to manage overall revenue per average seat kilometer (RASK) at a slight premium to its highly elevated cost per average seat kilometer (CASK).

AirAsia (excl. TAA) operating stats - ASK, RPK, load factor

RASK, Fuel/RASK, EBITDA

2025 was a tough year

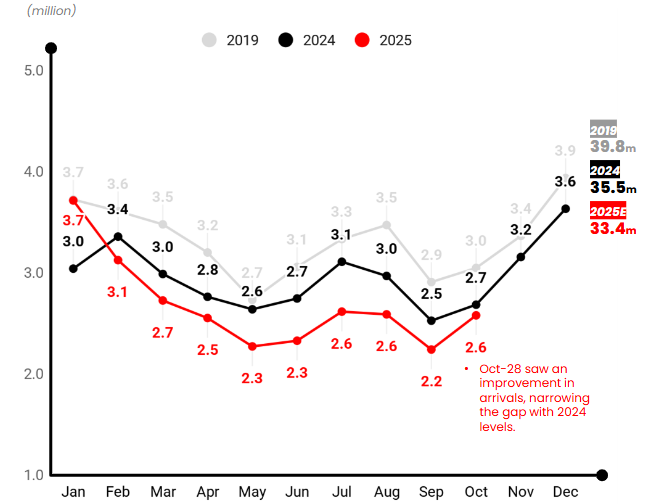

Operationally, AAX is also bouncing back from a challenging 2025. Demand in key markets like Thailand and Philippines saw soft tourism demand. Thailand was hurt by negative sentiment from Chinese tourists and the armed conflict with Cambodia. Both Thailand and Philippines also dealt with some natural disasters last year.

AAX was pushed to pivot towards more domestic flights in Thailand, with 40% of capacity now domestic and lower yield.

Looking ahead, there are some signs of recovery, coming from a low base. Load factors (ex-TAA) are already improving in 3Q25 to 84% after a four quarter slide as AAX continued to add capacity. The stronger ringgit should be supportive of outbound tourism from Malaysia, where AAX will be adding the most capacity. Overall, the resilient demand should help absorb some of AAX’s incoming supply.

AirAsia (excl. TAA) operating stats - ASK, RPK, load factor

Thailand tourist arrivals fell in 2025

Rebuilding trust

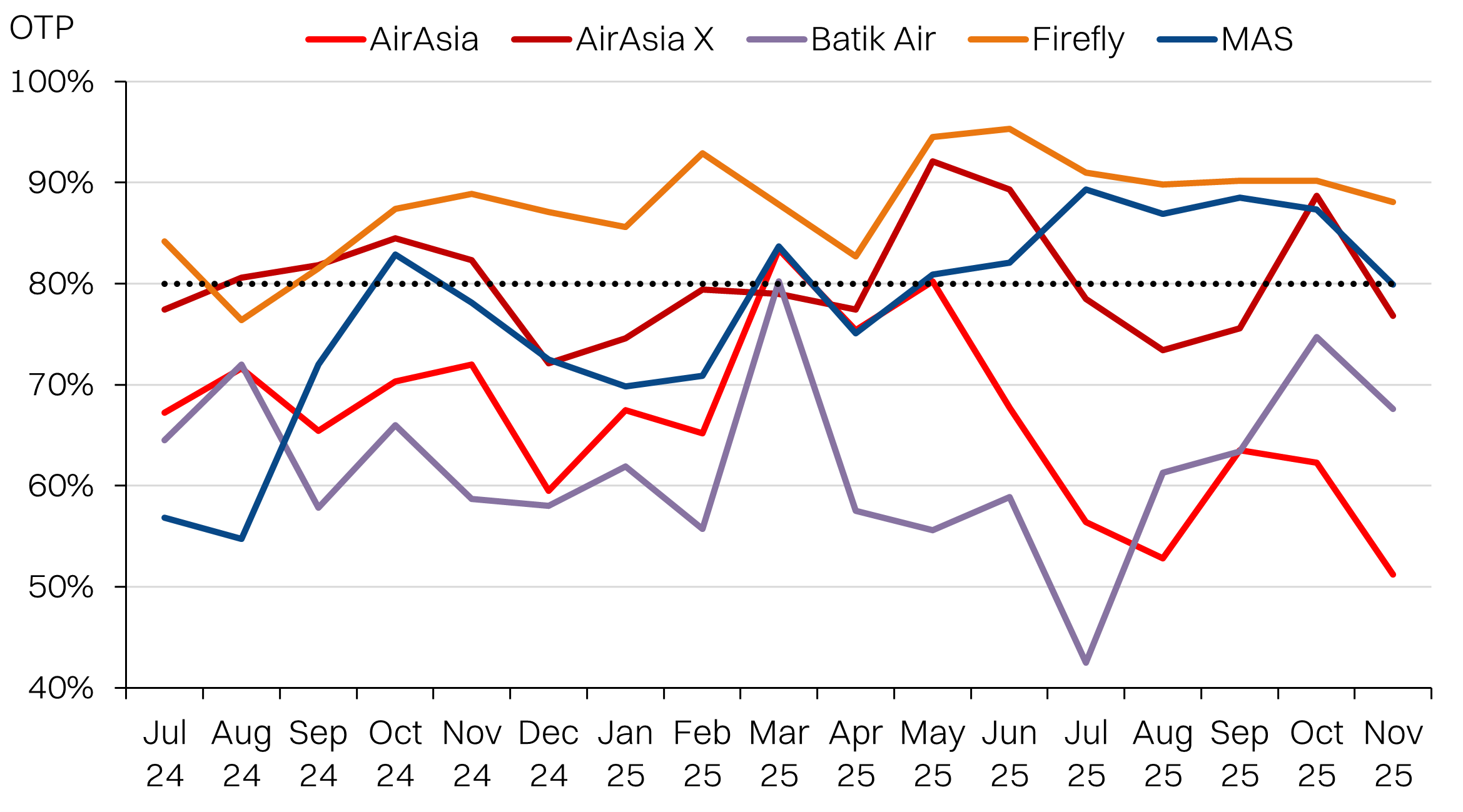

in 2026, with AirAsia returning to full capacity, the airline’s focus will be on improving customers’ experience and rebuild trust, particularly in the home market of Malaysia. As a result of the fleet limitation, AirAsia has struggled to achieve an on-time performance of 80%. Additionally, almost 20% of AirAsia flights have been cancelled, albeit at least one month before the flight, due to shortages of aircraft.

While headline performance is not far off from the most direct competitor, Batik Air, it has likely resulted in a loss of confidence by passengers that value punctuality and predictability. In particular, we suspect this has hurt AirAsia’s business fliers. Rebuilding confidence with this segment will be key to improving yields going forward.

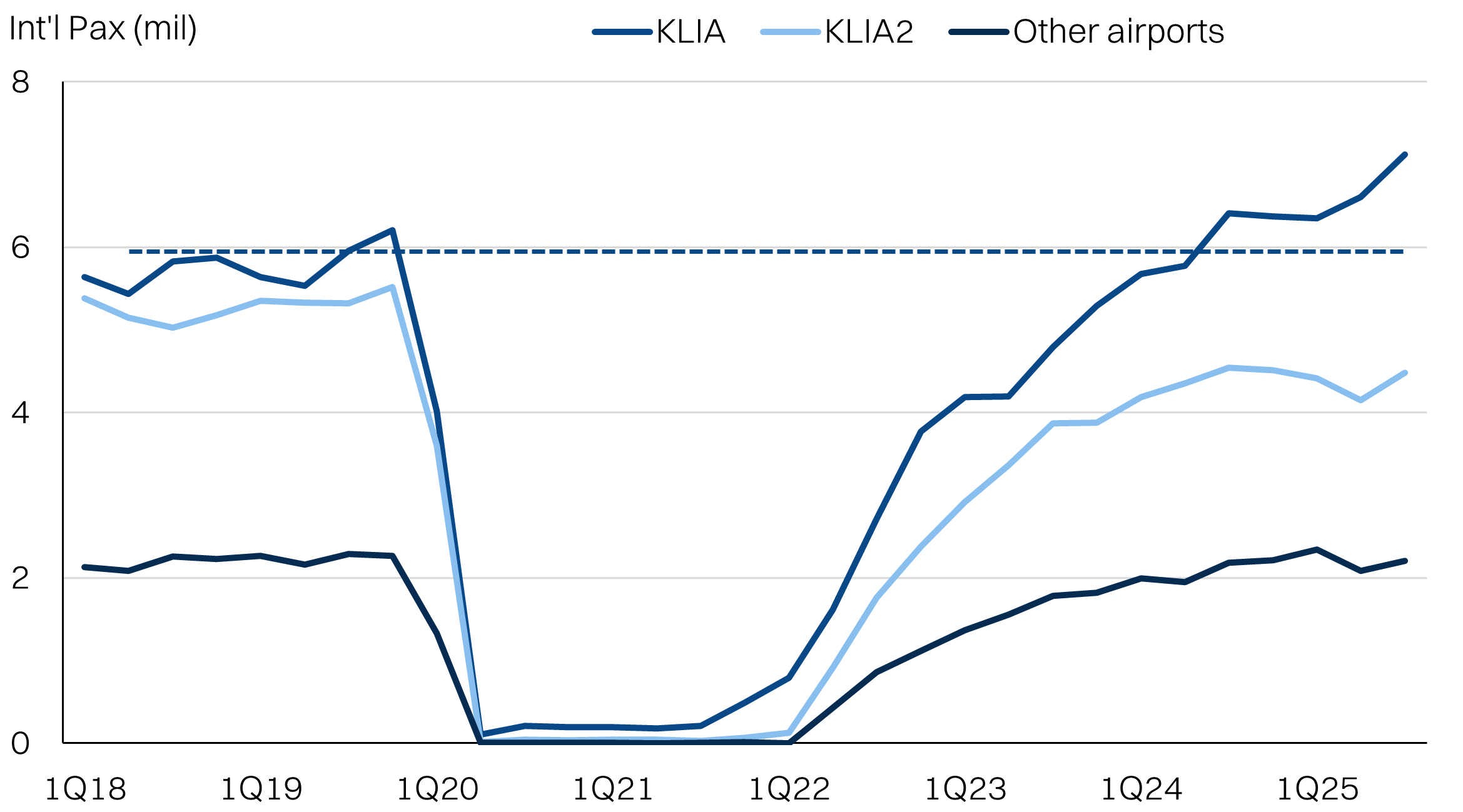

It is also interesting to note that KLIA has outpaced KLIA2 in terms of post-pandemic recovery, indicating underlying demand from fliers with a high willingness to pay has been strong. Unfortunately, AirAsia has not been able to capitalize.

The Civil Aviation Authority of Malaysia publishes airlines’ performance here.

International passenger movements - KLIA2 has lagged the recovery at KLIA

International flights on-time performance: AirAsia has lagged

Fuel

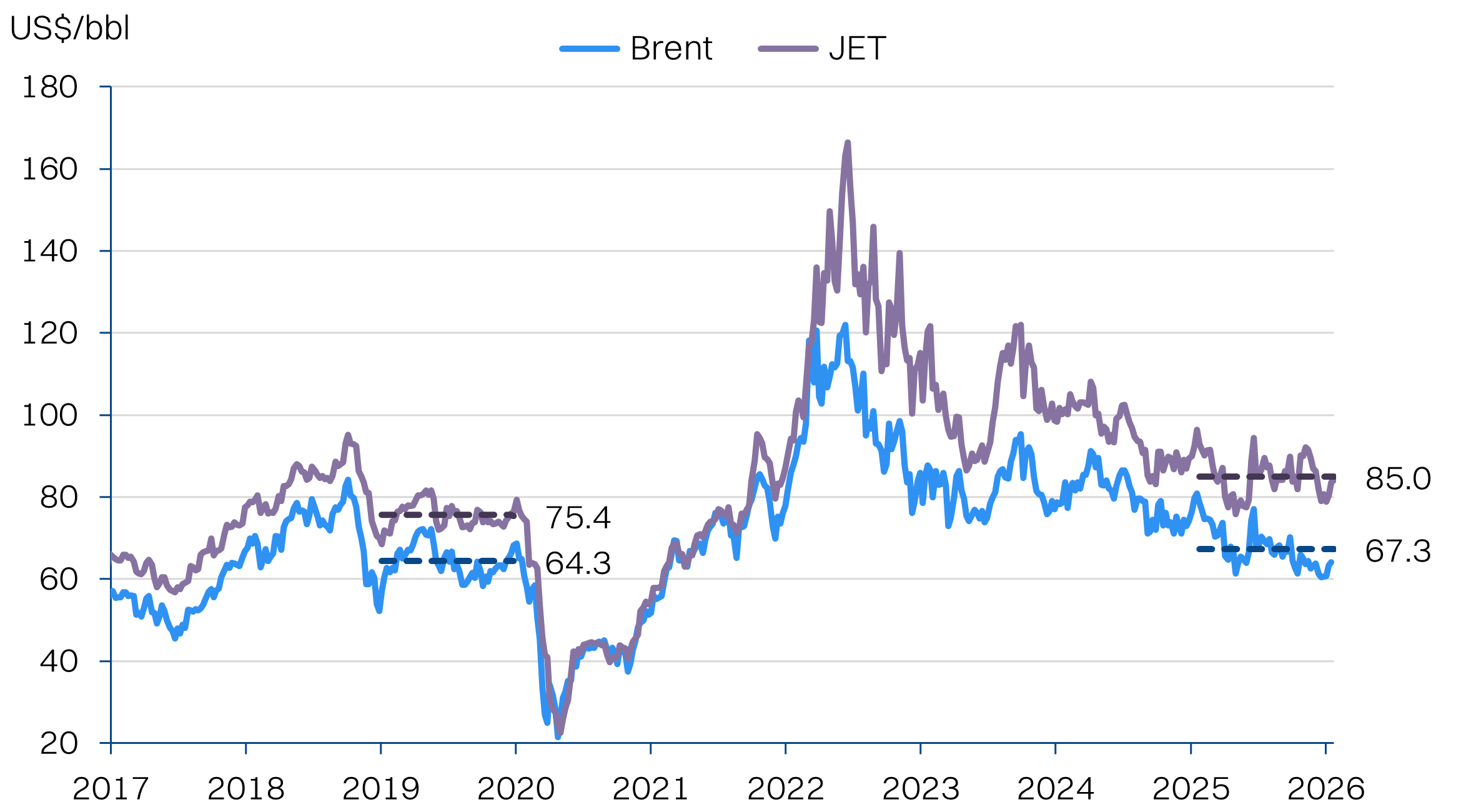

While the ramp up in capacity will drive topline growth, the big swing factor for earnings will be fuel costs. AAX’s fuel costs range between 35%-40% of total expenses and jet fuel prices have fallen by -9% over the past 12 months and appears to be relatively stable at around US$85/bbl.

We estimate that every 1% reduction in realised fuel costs translates to ~RM70m in cost savings.

It is worth noting that jet fuel prices are still above the pre-pandemic average of ~US$75/bbl, despite similar oil prices (US$67/bbl vs US$63/bbl). The reason for the higher jet fuel crack spreads due to limited capacity at refineries and relatively robust demand from airlines.

We have assumed fuel costs will be ~7% cheaper than FY25, which is in turn a substantial driver of our earnings assumptions. Note that AAX has no forward hedges on fuel prices and will be highly exposed to sudden movements in oil prices.

Brent has fallen -21% in the past one year, JET is down -9%

AAX fuel costs - falling in-line with JET prices

Forex

AAX is also highly exposed to currency movements, given fuel, leasing and finance costs are denominated in dollars while revenues are denominated in local currencies. A large portion of maintenance and overhaul costs are also in dollars.

Critically, AAX is carrying about RM20bn in debt and leases denominated in dollars. Movements in the currency will result in a substantial unrealised forex gain/loss from quarter to quarter. However, the realized interest savings can be substantial.

We estimate that every 10bps movement in the ringgit translates to ~RM11m in cost savings for AAX on a full-year basis. We have assumed an average of 4.00 for the USDMYR for FY26E in our assumptions.

Note that AAX does not have any currency hedges either.

The ringgit is trading at its strongest level since 2018

Costs denominated in dollars

Fair value of RM3.15

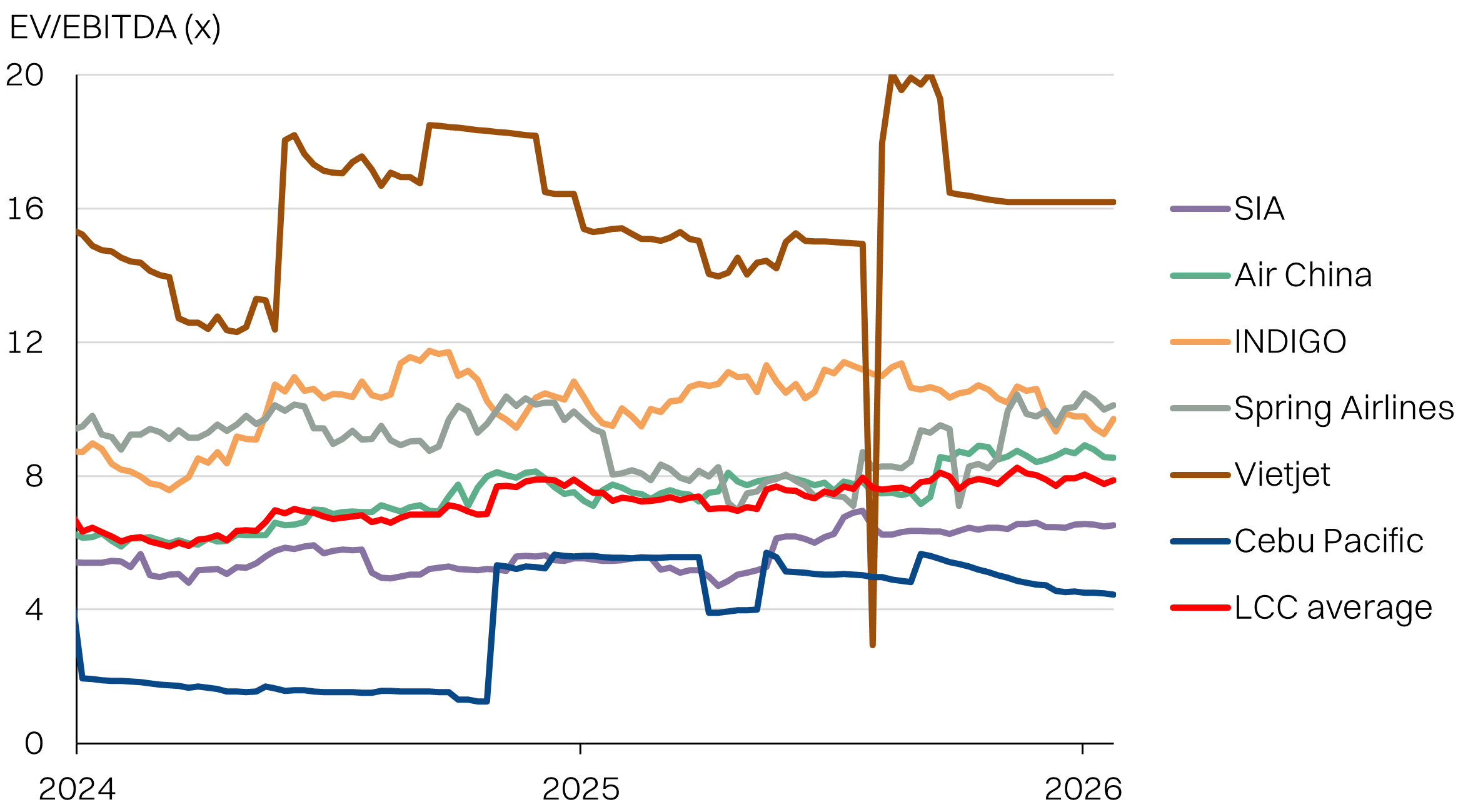

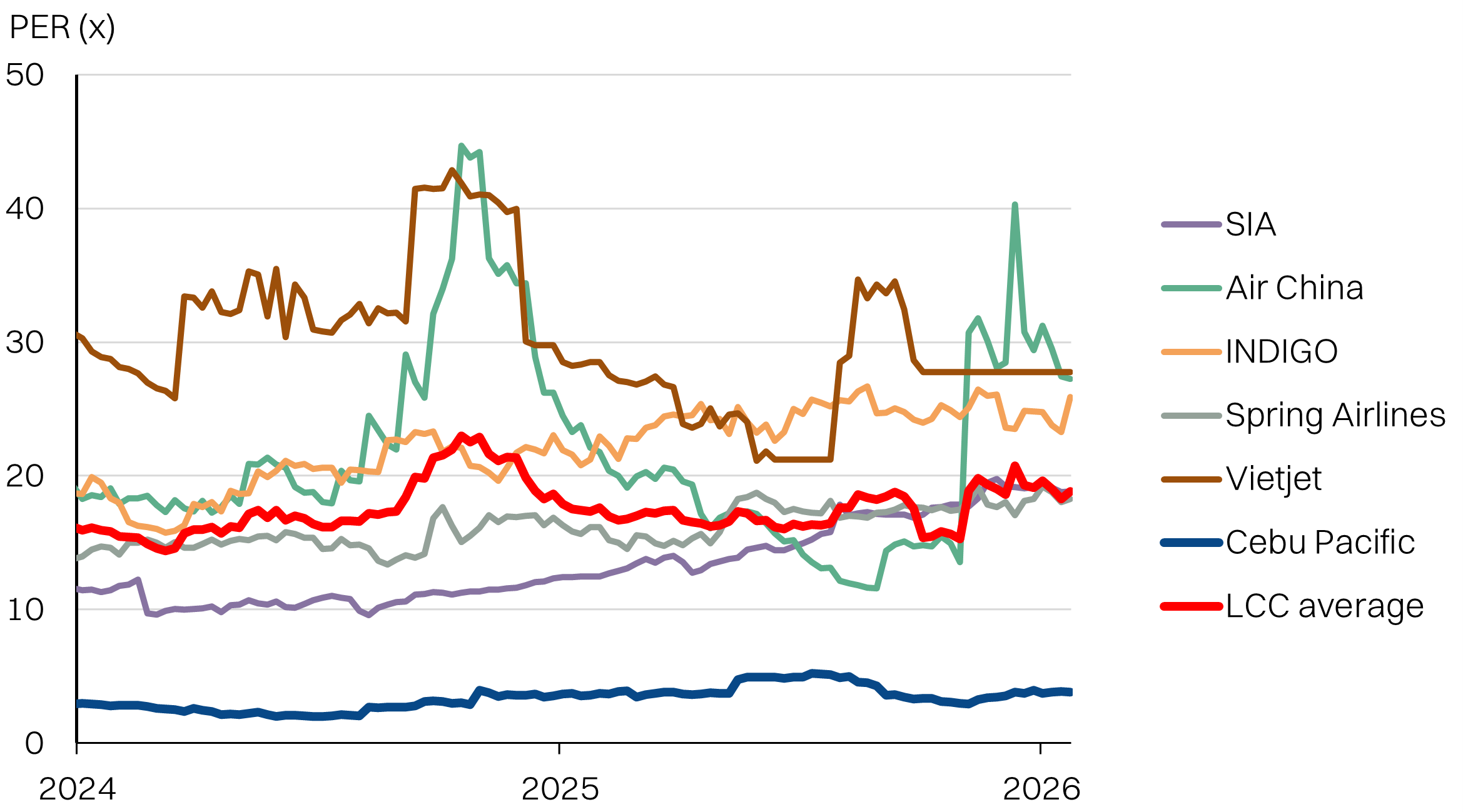

Since Capital A and AAX historic valuations do not represent well its current balance sheet and outlook, we think using regional peers as a valuation benchmark might make sense. Airlines mostly trade at around 4-12x EV/EBITDA, with the LCC’s average at 8x. Note, we have excluded Vietjet as it was a significant outlier.

Against the post-pandemic average EV/EBITDA average for LCC’s of 7.2x, we think the -1SD of 6.5x is a fair benchmark for AAX given the highly-leveraged balance sheet. At an EV/EBITDA of 6.5x FY26E EBITDA of RM4.6bn, the implied fair value for AAX is RM3.15. It also implies a PER of 15x FY26E which is also around -1SD vs the same peer comp PER average (but including Vietjet).

AAX probably has more room for re-rating, as long as it can demonstrate stable yields, operational profitability and lower gearing going forward.

Peer valuations average 8x EV/EBITDA

Peer comp

Selected financials