Resetting Expectations

Loss of the MUSB contract will hurt KJTS' earnings outlook.

Stock information

KJTS

KJTS | 0293.KL

BUY

Target price: RM0.80

Last price: RM0.70

Market cap (RMm): RM483m

Shares out: 690m

52-week range: RM0.67 / RM1.81

3M ADV: RM1.4m

T12M returns: -23%

Disclaimer: By using this information, you acknowledge that you are solely responsible for evaluating the merits and risks of any investment decision and agree not to hold NewParadigm Research liable for any damages arising from such decisions.

Key takeaways

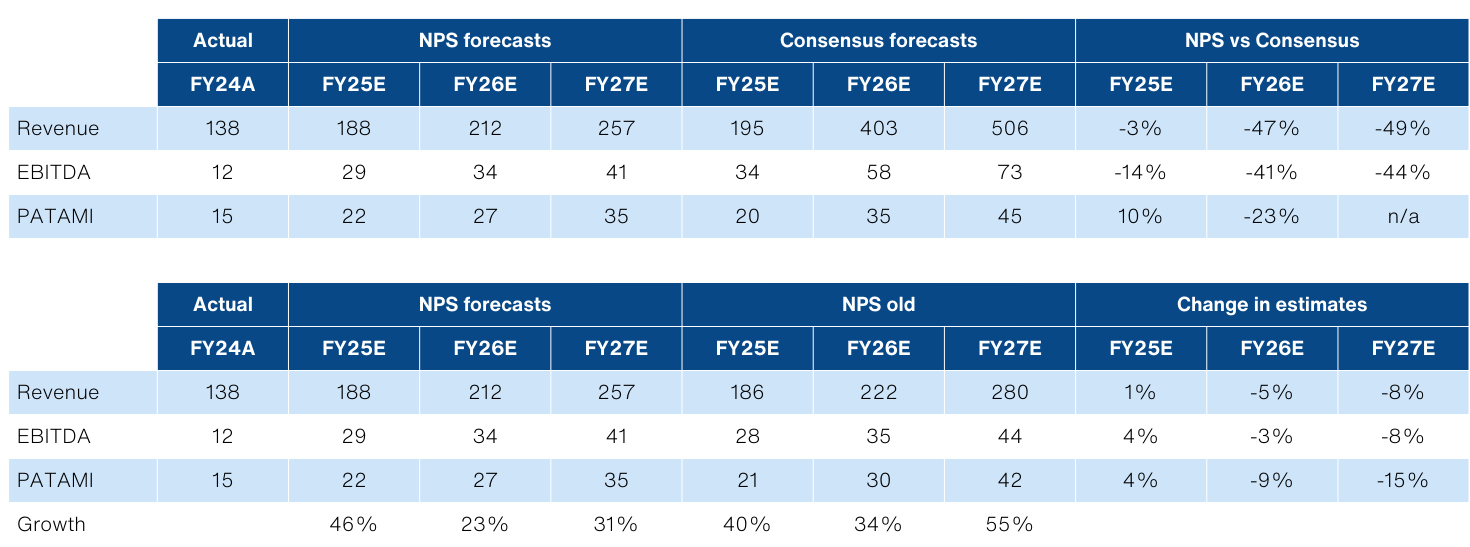

- The acquisition of MUSB has been mutually terminated. We cut our FY26/27 numbers by -9%/-15% to reflect this.

- However, KJTS is still on track to deliver almost >40% YoY growth in FY25E, even without MUSB. We think the market has oversold the stock on the negative news flow.

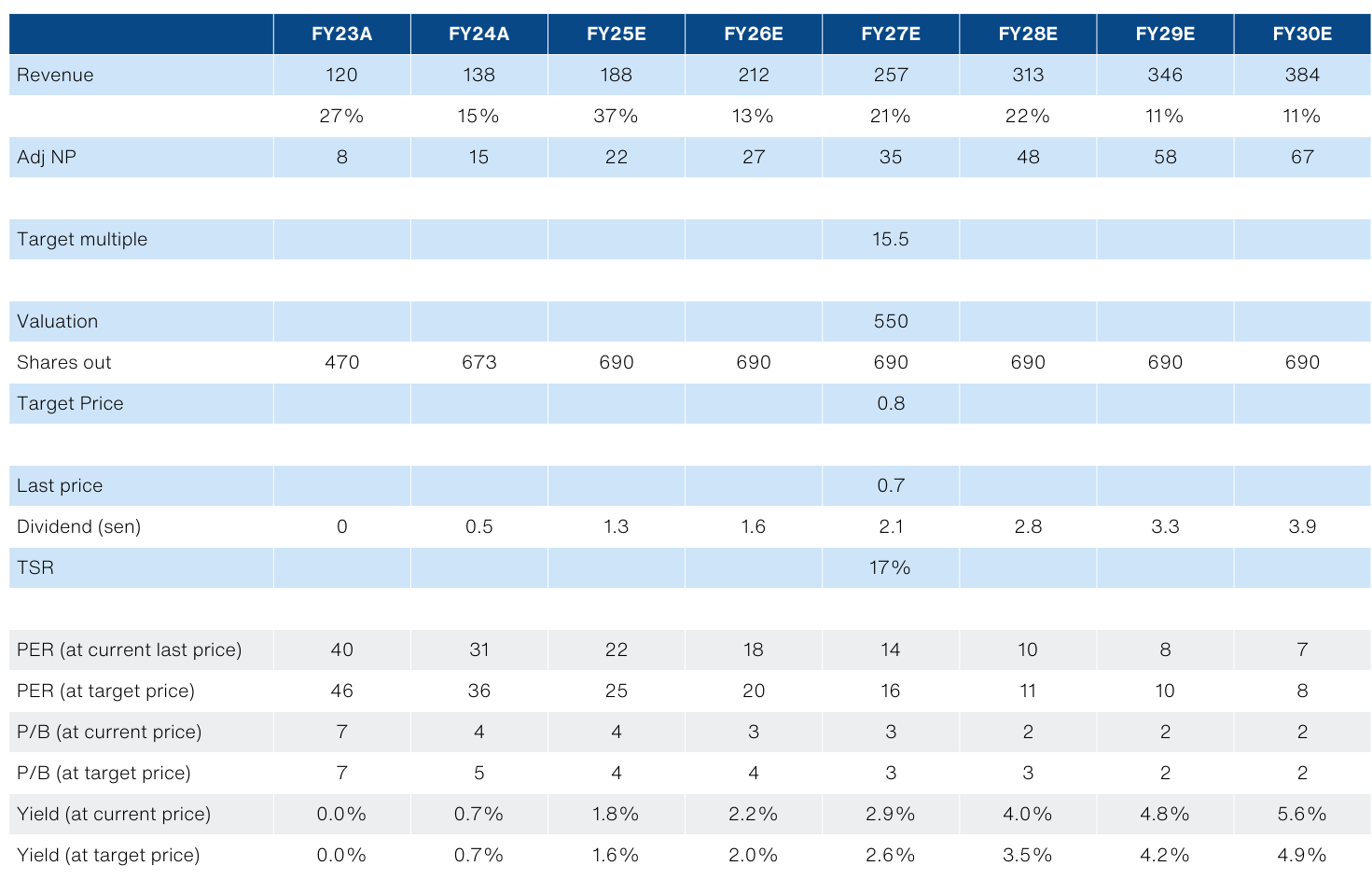

- We cut our TP to RM0.80 on the lower NP and lower target multiple of 15.5x FY27E PER. We revise our recommendation to BUY.

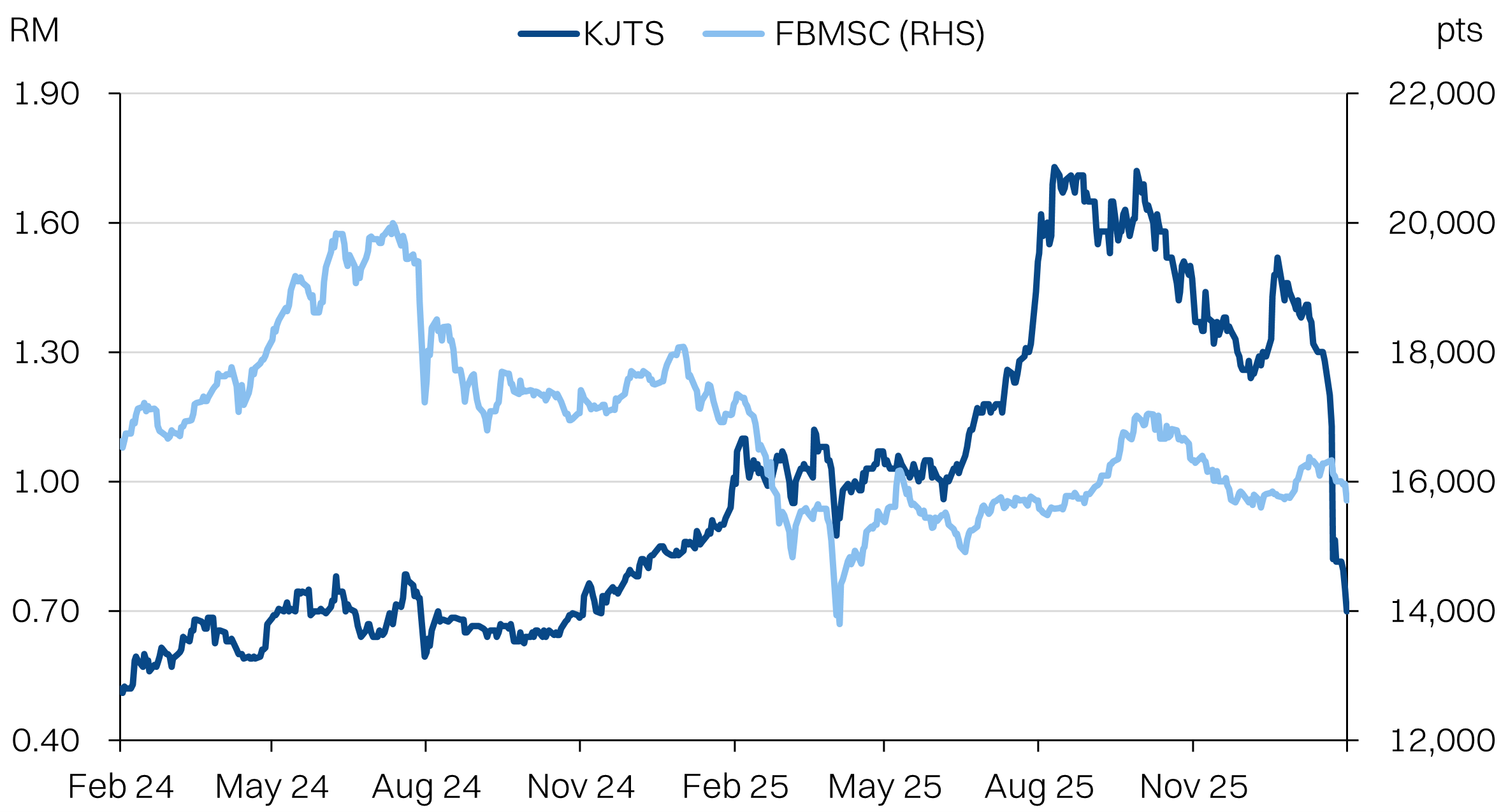

Share price performance

Investment fundamentals

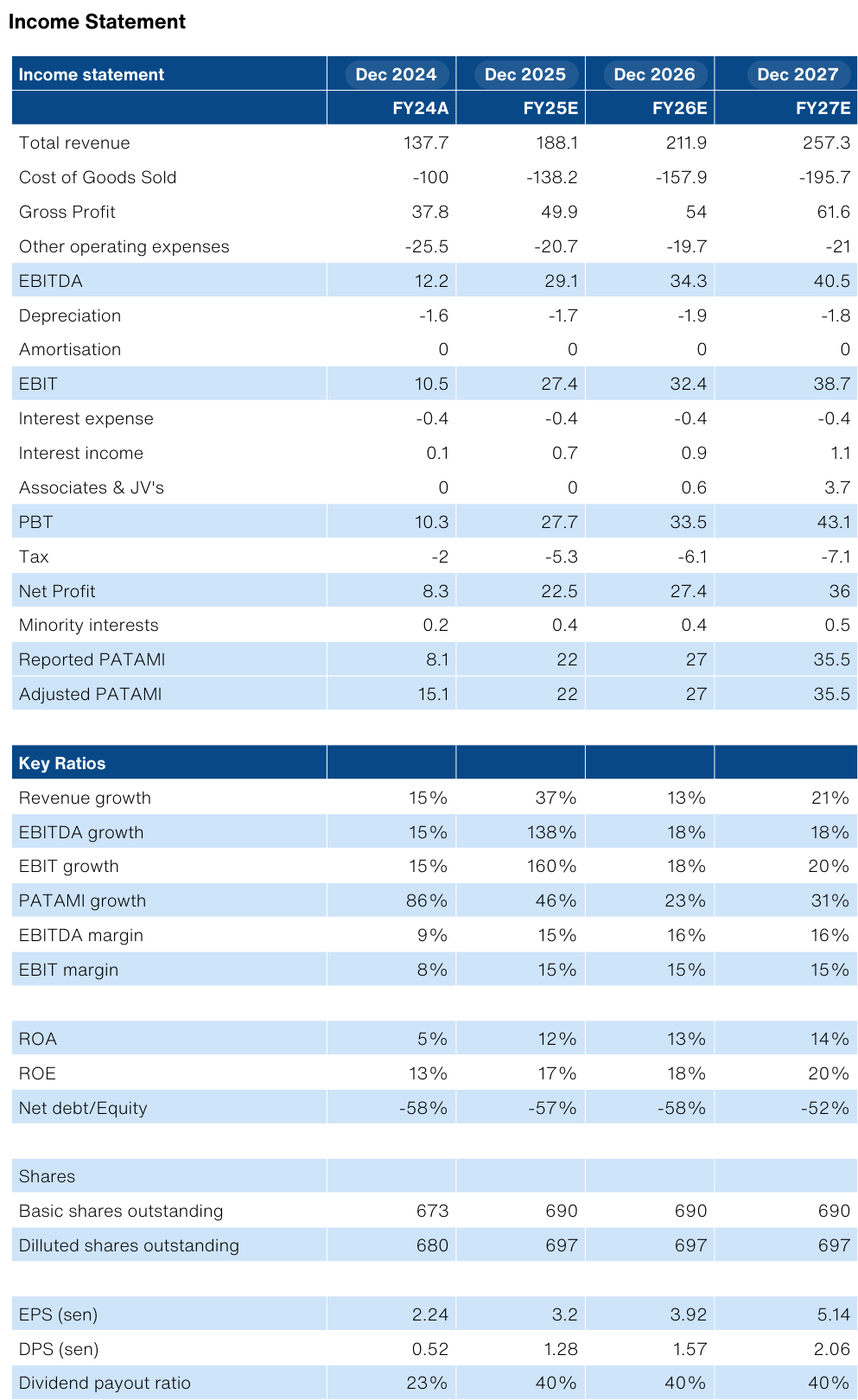

| RMm | FY24A | FY25E | FY26E | FY27E |

|---|---|---|---|---|

| Revenue | 138 | 188 | 212 | 257 |

| Revenue Growth | 15% | 37% | 13% | 21% |

| EBITDA | 12.2 | 29.1 | 34.3 | 40.5 |

| EBITDA margin | 9% | 15% | 16% | 16% |

| Adj PATAMI | 15.1 | 22 | 27 | 35.5 |

| PATAMI margin | 11% | 12% | 13% | 14% |

| ROA | 10% | 12% | 13% | 14% |

| ROE | 13% | 17% | 18% | 20% |

| PER | 31.2 | 21.9 | 17.8 | 13.6 |

| P/BV | 4.1 | 3.6 | 3.2 | 2.7 |

| Yield | 1% | 2% | 2% | 3% |

Source: Company data, Bloomberg, NewParadigm Research, February 2026

Disappointing development

- KJTS has announced the mutual termination of the Malakoff Utilities Sdn Bhd acquisition from Malakoff Corp Bhd. Recall that the deal was first announced on 3 Feb 2025 with a value of RM65.5m. The reason the deal fell through was due to failure to complete several CP’s.

- We had previously imputed ~RM8-9m earnings contribution from MUSB, assuming a ~RM30-40m worth of capex enhancement for the assets.

- In turn, we cut out FY26/27 NP assumptions by -9%/-15%, deflecting the loss of MUSB as well as delays to subsequent acquisitions.

What next?

- It is still “business as usual” according to management, with several other prospects still in play. Timing of news flow is difficult to predict, but we have built into our expectations that KJTS can secure deals of similar value (cumulative acquisition and capex) to MUSB within the next 12 months.

- Additionally, we think the long-awaited announcement of the GLIC partner in Lestari Cooling Energy (LCE), should also be a welcome catalyst for the stock.

Revised recommendation to buy with lower TP

- The latest development explains the recent share price weakness. However, we anticipate the share price will remain under selling pressure in the short term, as several large institutional funds appear to be clearing their positions.

- This is a good entry level for investors that have little previous exposure to the stock, as we think the overall disappointment is priced in at this level - implied 18x FY26PER.

- We roll forward our valuations to FY27E and lower our target multiple to 15.5x (-1.2SD vs historic average PER of 25x). The lower multiple reflects diminished confidence in new acquisitions, given the recent slippage.

- In turn, this translates to a target price of RM0.80. We revise our recommendation to Buy from Trading Buy previously.

Earnings revisions

Valuations

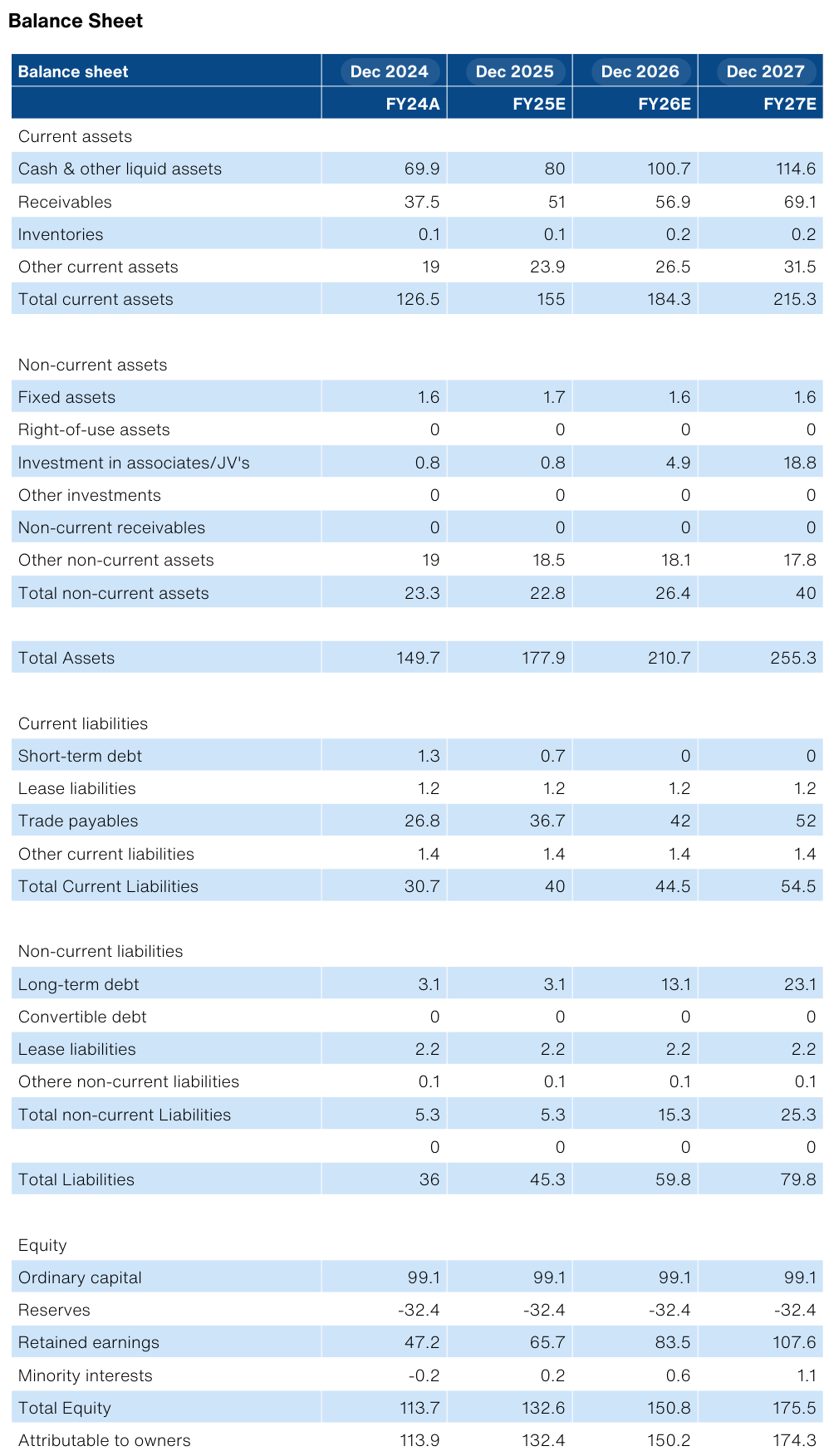

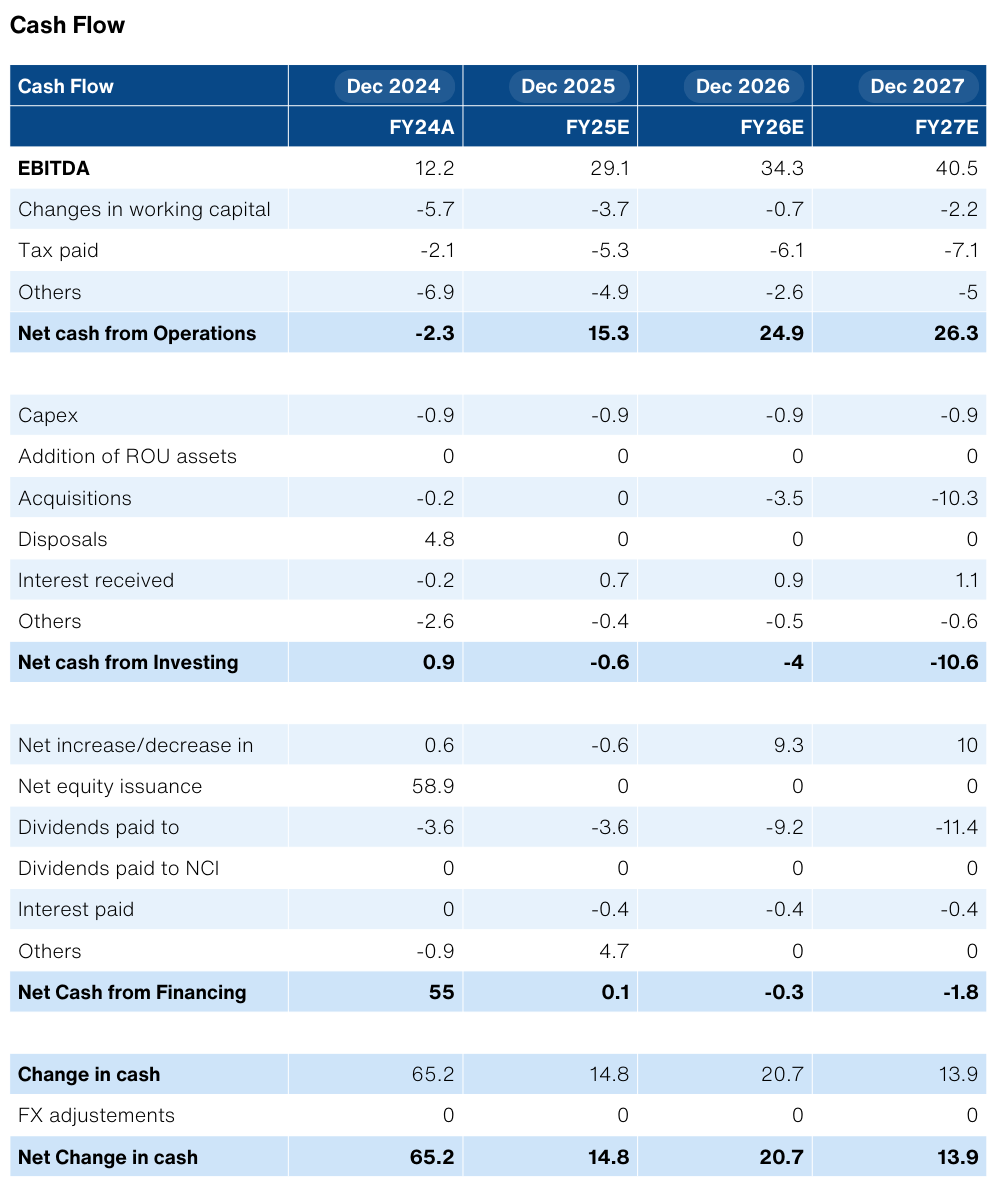

Selected Financials

Source: Company data, NewParadigm Research, February 2026