Low-risk tourism catch-all

PETD benefits from increased flights without any load factor or yield risk, unlike airlines.

Petronas Dagangan

PETD - 5681.KL

Not Rated

Fair value: RM24.00

Last price: RM20.32

Market cap (RMm): RM20,187m

Shares out: 993m

52-week range: RM16.10 / RM23.80

3M ADV: RM13.0m

T12M returns: 14%

Disclaimer: By using this information, you acknowledge that you are solely responsible for evaluating the merits and risks of any investment decision and agree not to hold NewParadigm Research liable for any damages arising from such decisions.

Key takeaways:

- More flights means more fuel sales for PETD, capturing both in/outbound tourism. PETD also benefits from stronger domestic tourism, that will be supported by relatively cheap RON95.

- Subsidy rationalization was not as bad as anticipated and EV penetration concerns priced-in already.

- Volume growth should surprise on the upside, supported by Jet demand as well stabilized retail demand post-subsidy rationalization.

- See also: our VM26 thematic report.

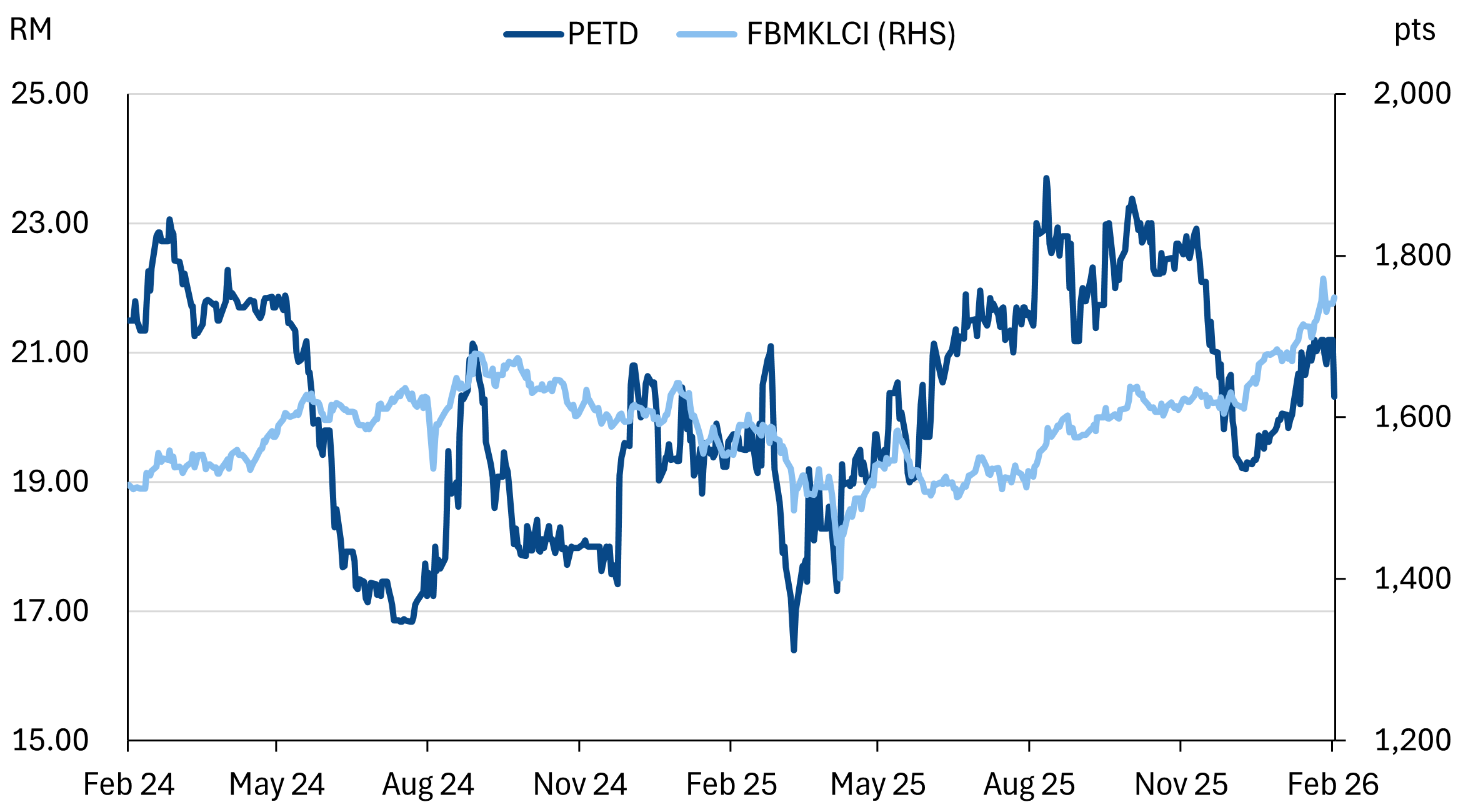

Share price performance

Investment fundamentals

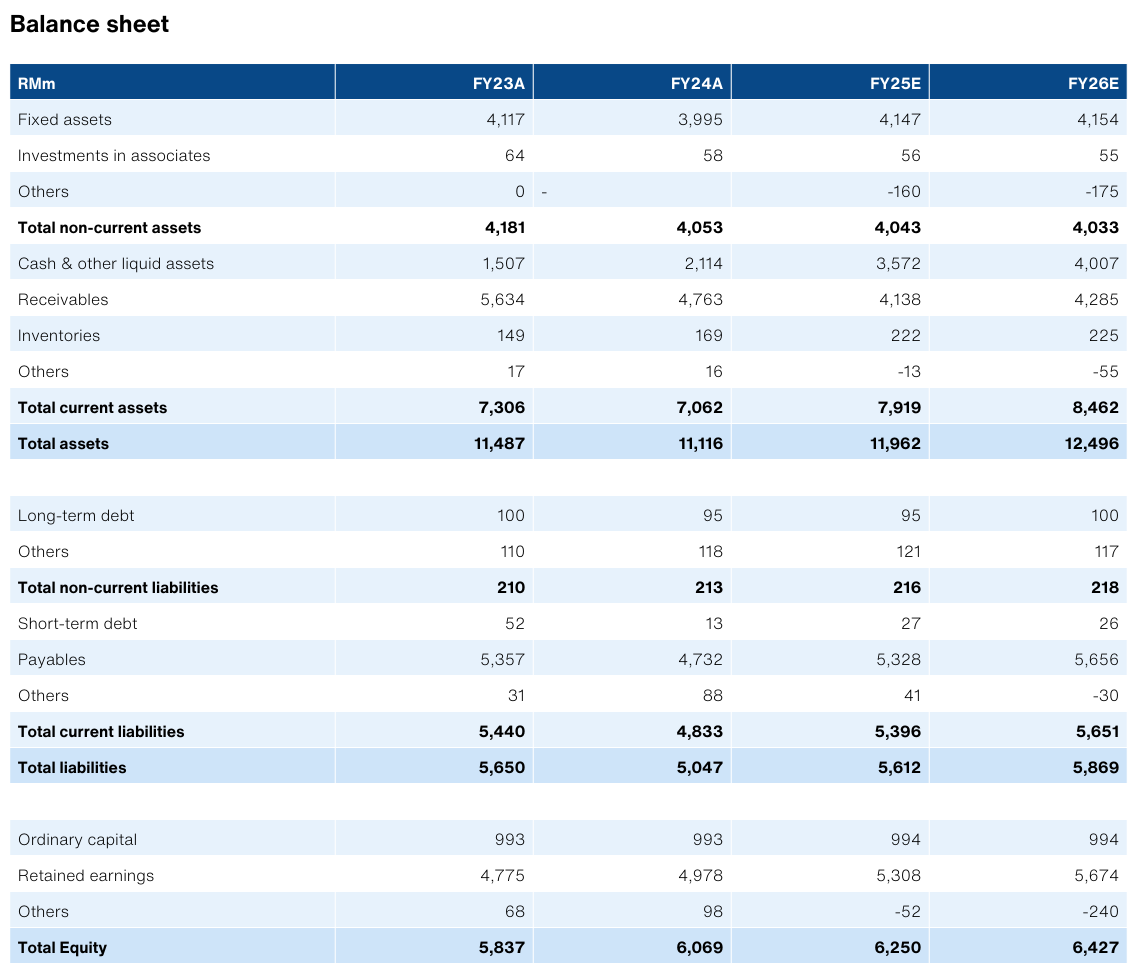

| RMbn | FY24A | FY25E | FY26E | FY26E |

|---|---|---|---|---|

| Revenue | 37.5 | 38 | 37.7 | 39.7 |

| Revenue Growth | 2.0% | 1.0% | -1.0% | 5.0% |

| EBITDA | 1.8 | 2 | 2 | 2.1 |

| EBITDA margin | 4.8% | 5.3% | 5.3% | 5.2% |

| Adj PATAMI | 0.9 | 1.1 | 1.1 | 1.2 |

| PATAMI margin | 2.5% | 2.9% | 3.0% | 3.0% |

| ROA | 8% | 10% | 9% | 9% |

| PER(x) | 21.4 | 18.6 | 18.1 | 17.3 |

| Yield | 3.9% | 4.3% | 5.1% | 5.4% |

Source: Company data, Bloomberg, February 2026

Negatives priced-in, room to re-rate

- We see PETD as a potentially overlooked tourism proxy that can benefit from Visit Malaysia 2026. Airlines are boosting capacity this year, including AirAsia with ~14% additional capacity. Overall we anticipate airlines will add low-to-mid teens capacity in Malaysia this year, based on indicative data from OAG.

- PETD is also uniquely positioned, as it will benefit from outbound tourism as well, similar to the airlines. With the ringgit up +10% against the dollar, we foresee this as a catalyst for outbound tourism in 2026.

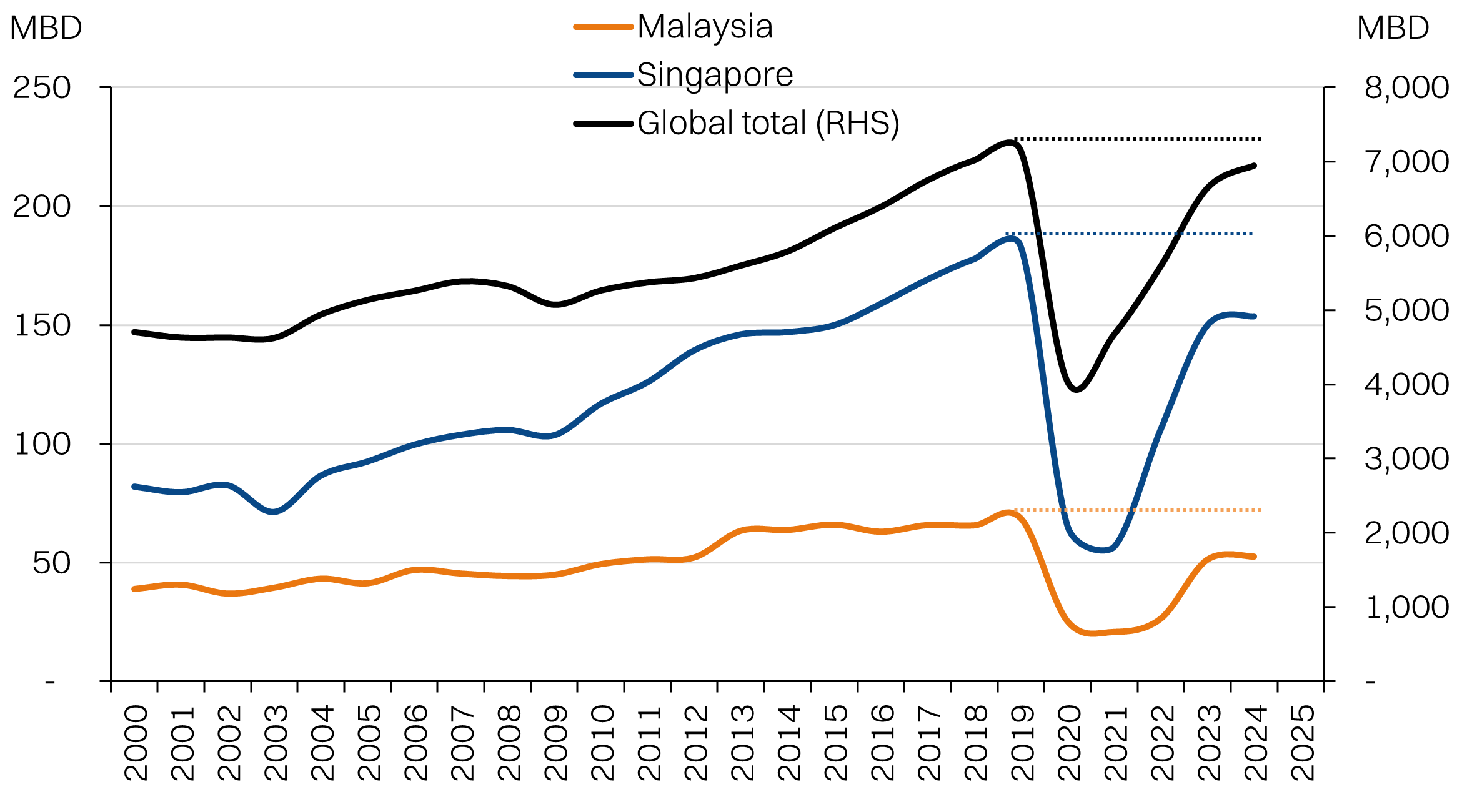

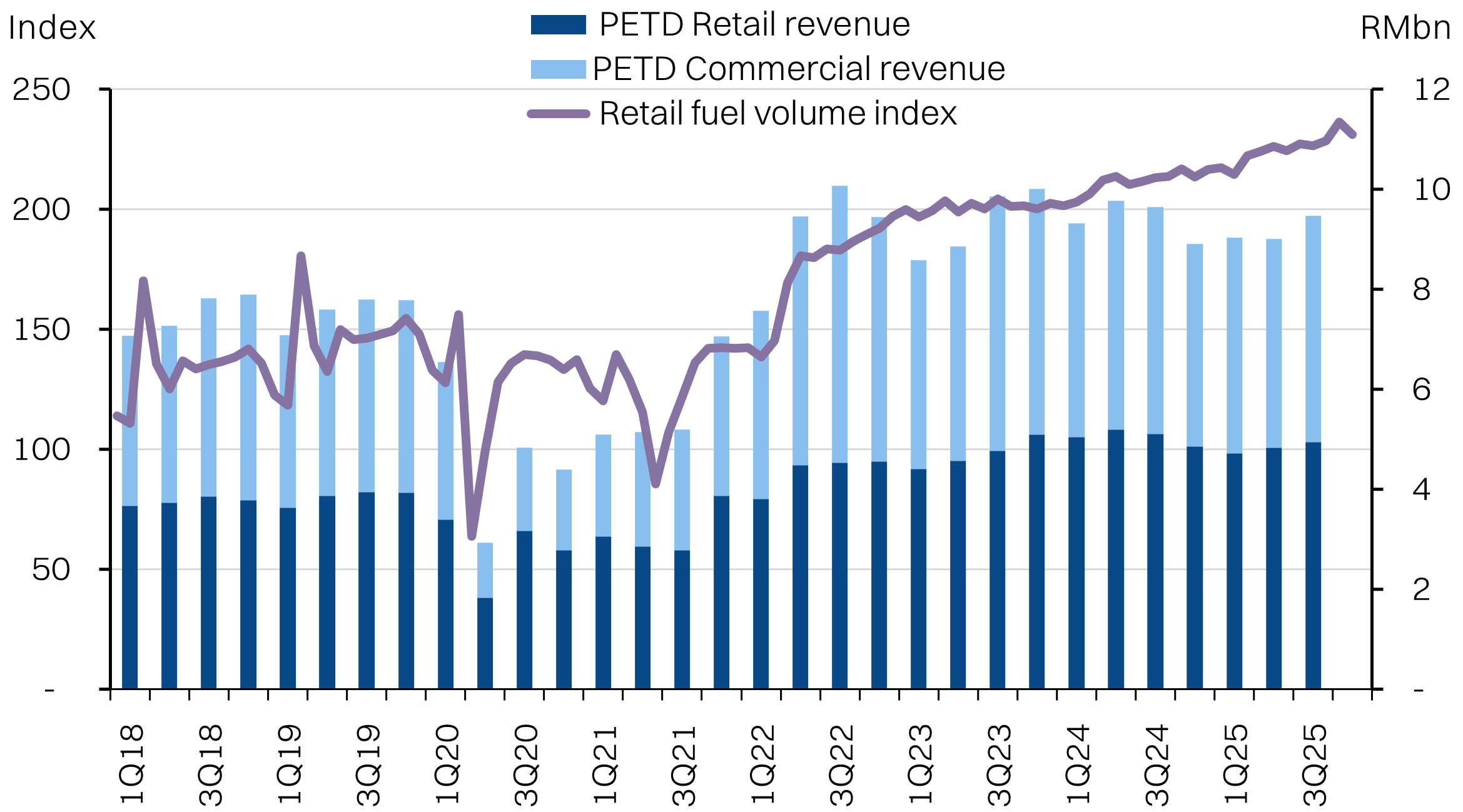

- PETD derives about 15-20% of its revenue from commercial aviation fuel and for 9M25, volume growth for the segment has been in the “high double-digits” according to management. According to PETD, it is one of the largest aviation fuel providers, with substantial market share with the two domestic carriers - Malaysia Airlines and AirAsia.

- The primary limitation on further growth will be availability of capacity within the multi-product pipeline (MPP) that supplies the Klang Valley Distribution Terminal (KVDT).

- Notably, PETD does not have much exposure to currency movements or oil prices, as the inventory float is less than 7 days.

Low expectations can be beat

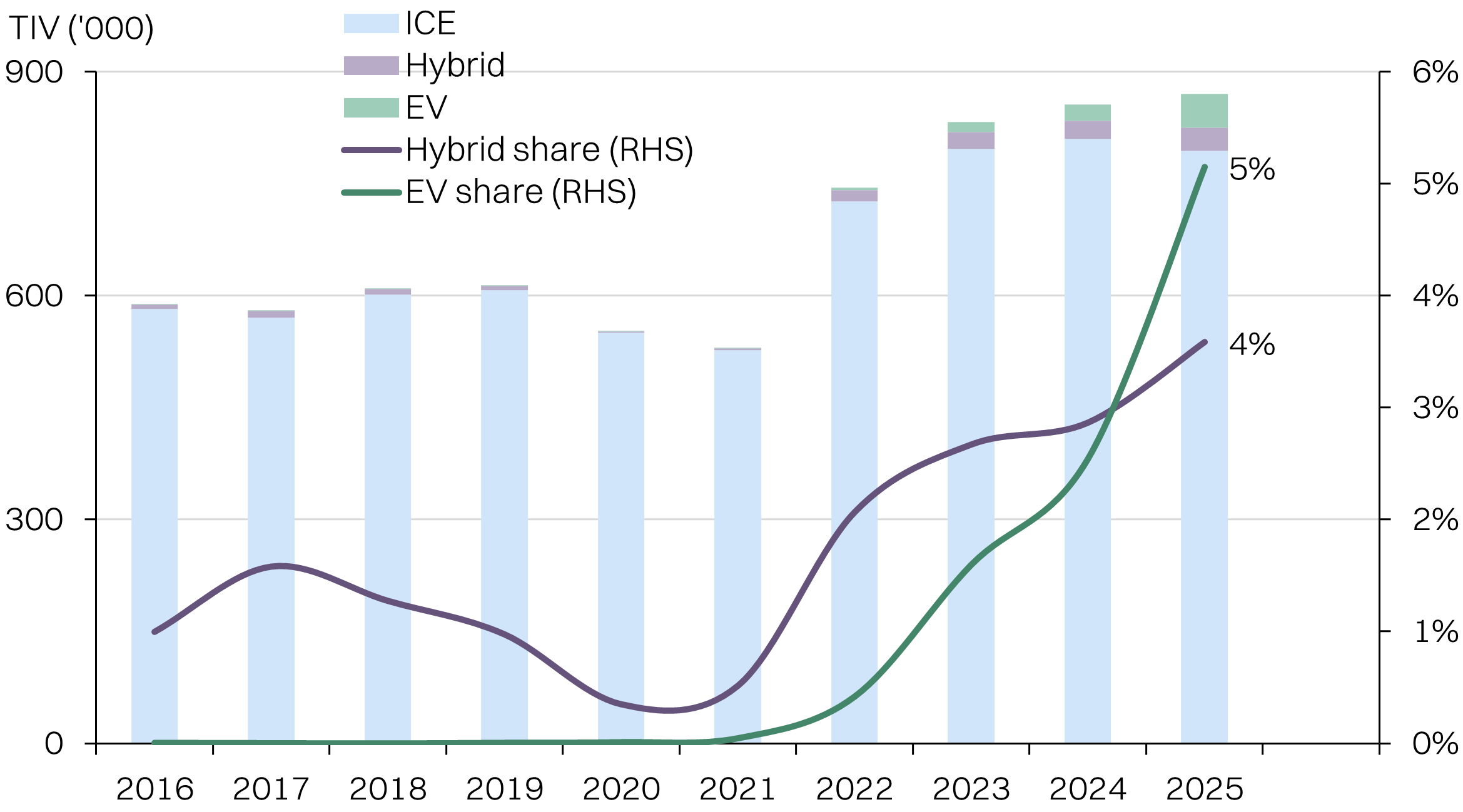

- Consensus is only pricing in +1% YoY NP growth for FY26E and +2% topline growth. We think this is highly conservative, given retail fuel sales should be normalizing from the Budi95 implementation. Do not overlook the fact that ICE sales are still at record highs of 790k in 2025, spurred by affordable Chinese marques. Additionally, we expect to see mid-teens volume growth for commercial aviation. Overall, we think a 5.2% revenue target would be fairly achievable, translating to ~5% PATAMI growth as well on unchanged margins.

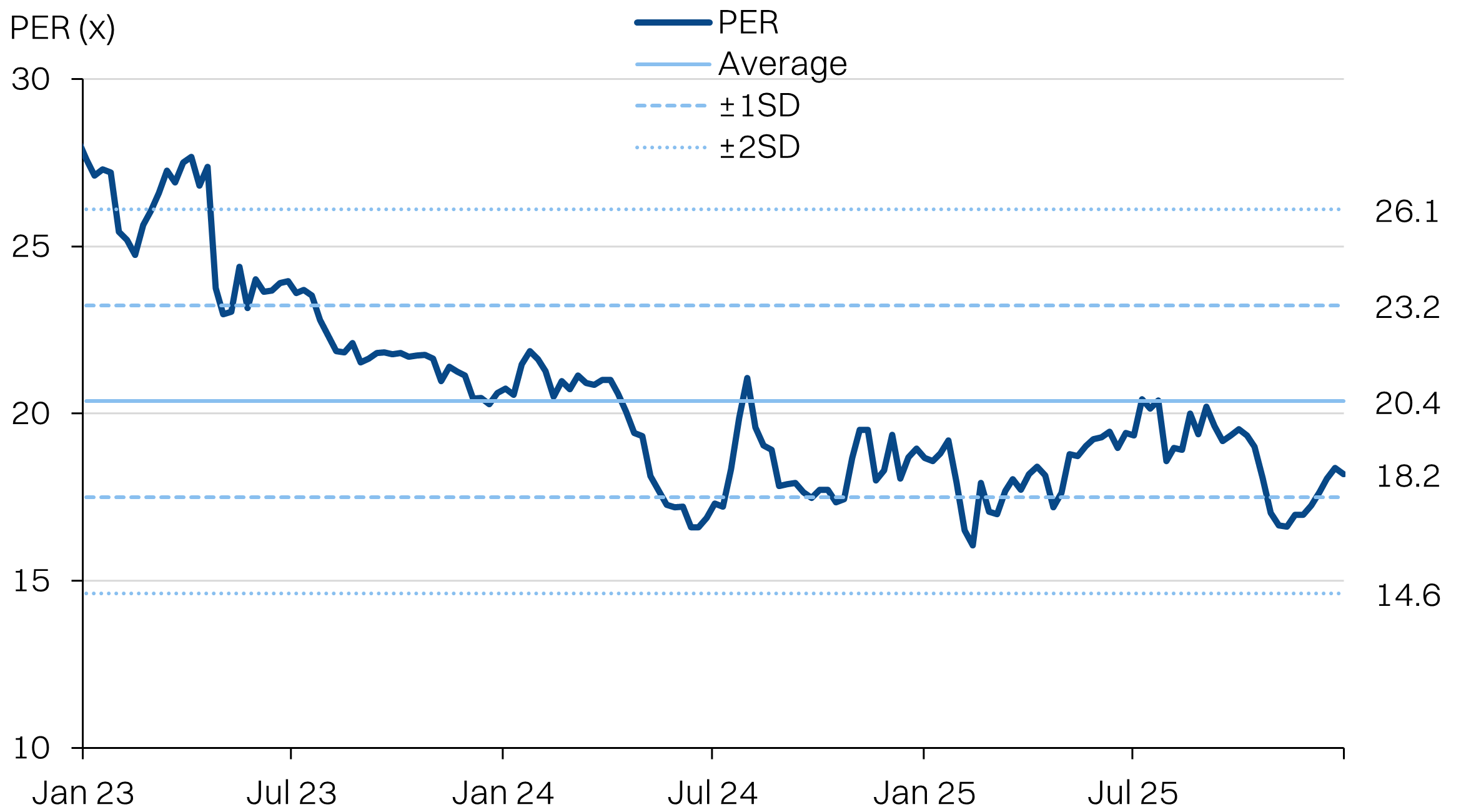

- Against this backdrop, PETD is trading at -0.7SD vs the 3yr average of 20.4x. Between a modest re-rating to the average PER of 20.4x as well as stronger earnings growth, PETD has a potential fair value of RM24.00.

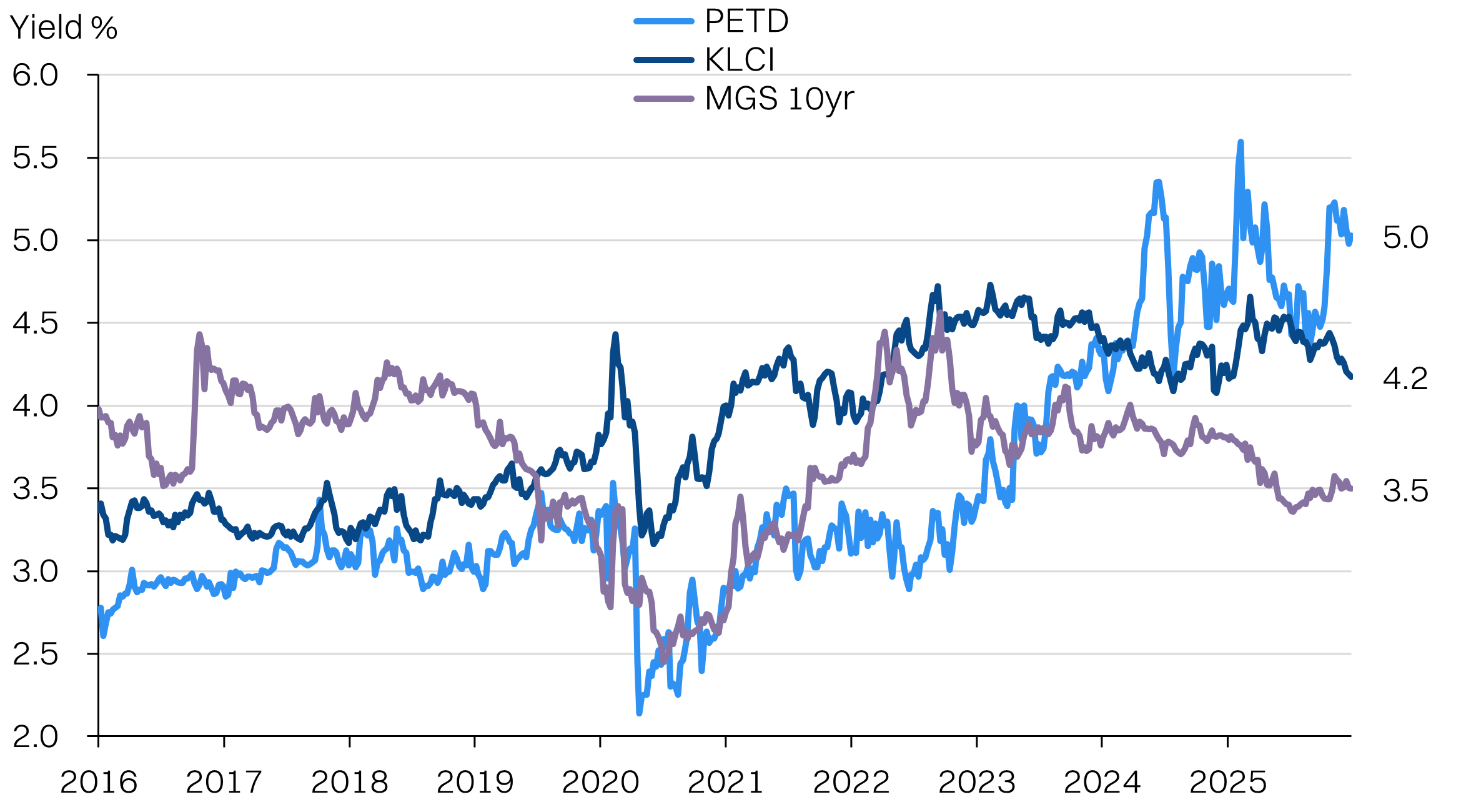

- PETD’s high implied yields are also supportive of valuations. Current yields of 5.2% are at a 100bps premium to the KLCI yields. Historically, PETD trades in-line or at a discount to market yields.

About the Company

Petronas Dagangan runs the largest retail fuel network in Malaysia with over 1,000 stations and 800 Mesra convenience stores. The group derives 60% of sales from the retail business and another 40% from commercial. Within commercial, roughly 40-50% stems from jet fuel.

PETD also has the Setel digital wallet app that collects loyalty rewards for users as well as facilitating redemption of the Budi95 fuel subsidy quotas.

About the Stock

PETD is part of the Petronas stable of listed companies and is 63.9% owned by the latter. The next largest shareholder is EPF with a 13.19% stake. PETD is a syariah compliant stock that is also a constituent of the FBMKLCI Index.

A key characteristic of PETD, is that many ESG-minded funds may opt to avoid holding the stock due to its high exposure to fossil fuels and challenge in pivoting to electric vehicles.

Coupled with the policy risk from subsidy rationalization, PETD’s valuations have been under pressure in recent years.

Investment Idea

PETD is a low-risk catch all that will benefit from stronger tourism activity - both inbound, outbound and domestic. PETD is one of the top suppliers of jet fuel, particularly with the two major domestic carriers - Malaysia Airlines and AirAsia. Additionally, higher domestic tourism in the form of more interstate travel will also boost retail fuel consumption. The ample 300l Budi95 subsidized retail fuel quotas at a low price of RM1.99/l should be supportive of domestic travel.

At the same time, PETD is coming from a relatively low base of expectations, following a de-rating in the share price over the past two years that has seen its valuations fall and yields rise to 5.2% - now at a 100bps premium to the KLCI.

Key Risks:

- EV adoption accelerates: This is a long-term risk to PETD’s earnings. But faster than expected adoption is likely to weigh heavy on sentiment of the stock as investors price in a more rapid adoption of EV’s. The end of CBU EV excise duty exemption should curtail some EV sales this year, but the ramp up in CKD offerings at lower price points should translate to EV penetration into the premium mass market segments. For now, the generally low price of RON95 should help to dissuade more rapid EV adoption.

- Change in government policy: There are two broad policy risks that PETD faces. The first would be a further narrowing of the current fuel subsidies. Indirectly, this would catalyze further EV adoption. The second policy risk, would be additional incentives for EV adoption, especially for more affordable models.

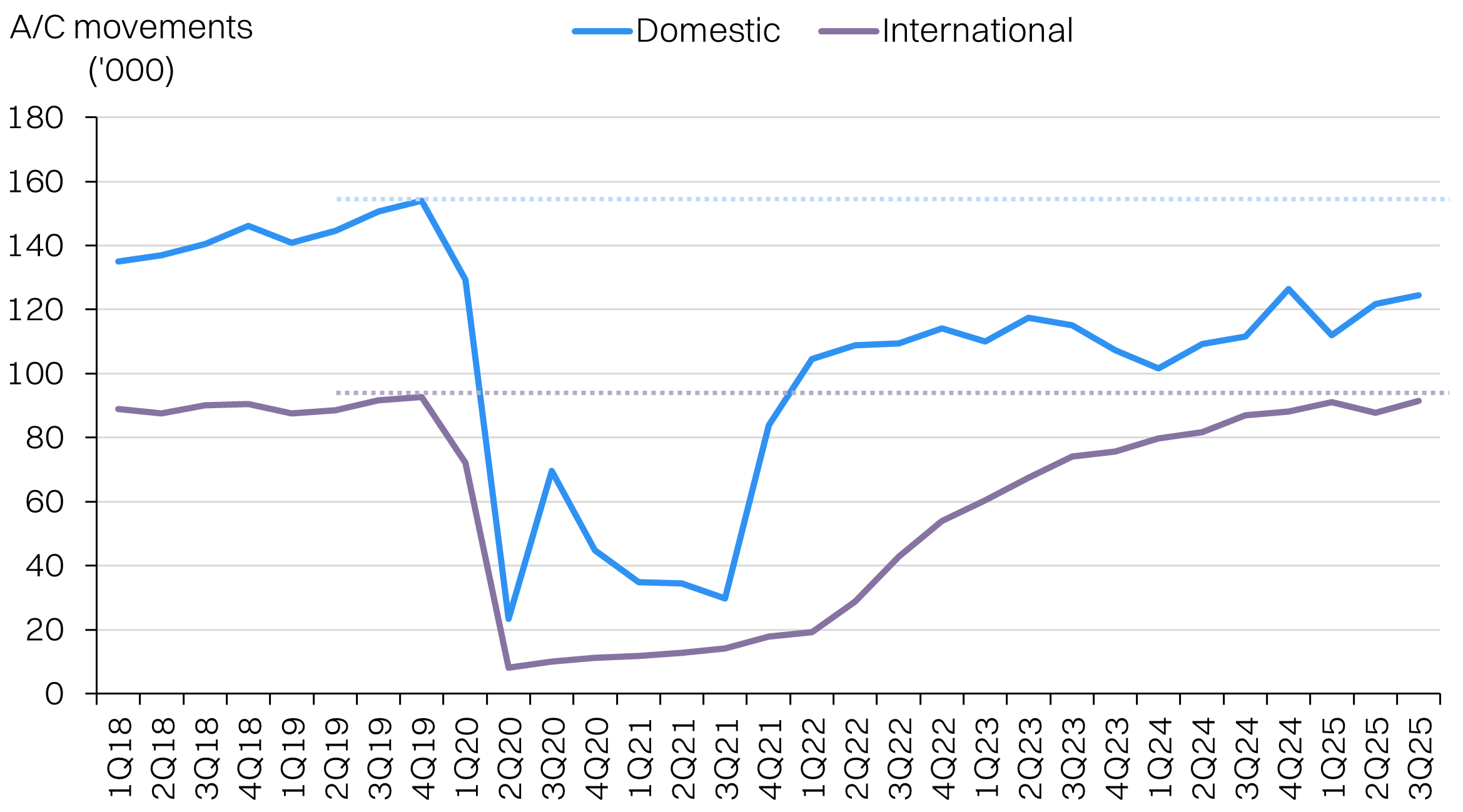

Follow the aircraft movements

Passenger movements alone are not the best indicator of aviation fuel consumption, and in turn, commercial Jet sales for PETD. Instead, aircraft movements are a better indicator. As more aircraft return to service, especially under airlines like AirAsia that have been operating below potential, we expect Jet volumes for PETD could outpace relative passenger growth. In short, even if load factors fall on higher aircraft supply PETD will sell fuel in proportion to the increased number of flights.

In particular we note the laggard recovery in KLIA2 flights as well as domestic flights in Malaysia. We suspect the elevated operating costs for low-cost carriers like AirAsia have reduced the volume of low-fare seats available as well, as airlines are forced to prioritize yield and load factors over maximizing seats.

All said, we anticipate that total Jet consumption is probably 5-10% below 2019 levels and will have significant room to normalize this year as new aircraft supply is introduced. For context, PETD indicated “high double-digit growth” for commercial Jet in 9M25. Critically for PETD, it does not have to worry about yields or load factors, making it a low-risk play on both inbound and outbound airborne tourists.

Aircraft movements - domestic movements still lag pre-pandemic volumes

Jet fuel consumption - Malaysia is still below 2019 levels

Muted subsidy rationalization and strong ICE sales

Subsidy rationalization under Budi95 has been much tamer than previously anticipated. PETD management has indicated a stabilization and recovery in retail fuel consumption post-implementation, returning to low single-digit growth.

At the same time, EV sales have been a dark cloud hanging over fuel retailers, with EV/hybrid penetration up to 9% in 2025. However, we anticipate the pace of EV penetration will moderate in 2026 as the excise duty exemptions on CBUs ended in Dec 2025. At the same time, the highly attractive cost of fuel of RM1.99/l for RON95 for most Malaysians under Budi95, remains a strong disincentive for EV adoption, even if more CKD models are launched.

Ultimately, ICE sales are still very high in absolute terms with ~790k units sold in 2025, which should not be overshadowed by the modest -2% YoY contraction. For reference, China’s retail fuel volumes only peaked in 2023 as EV sales penetration hit over 40%. A lot more policy support would be needed for that kind of penetration rate in Malaysia, and the limited fiscal headroom remains a substantial constraint.

In short, we think the market is sufficiently bearish on the impact of EV’s on PETD.

TIV - ICE car sales fell -2% in 2025 as EV/hybrid sales hit 9% share

Retail fuel sales

Solid yields underpin valuations; FV of RM24

We think consensus earnings expectations for FY26E are a little too conservative - at 1% YoY only against a +2% revenue growth. We think a topline growth of +5% is achievable, with volumes in retail and commercial growing at 4.5% and 6% respectively. Retail fuel sales should normalize after Budi95 implementation. After all, annual ICE TIV is still very strong at 790k in FY25. On the commercial front, we expect strong double-digit growth in aviation fuel volumes to persist into FY26, supporting ~6% growth for the segment.

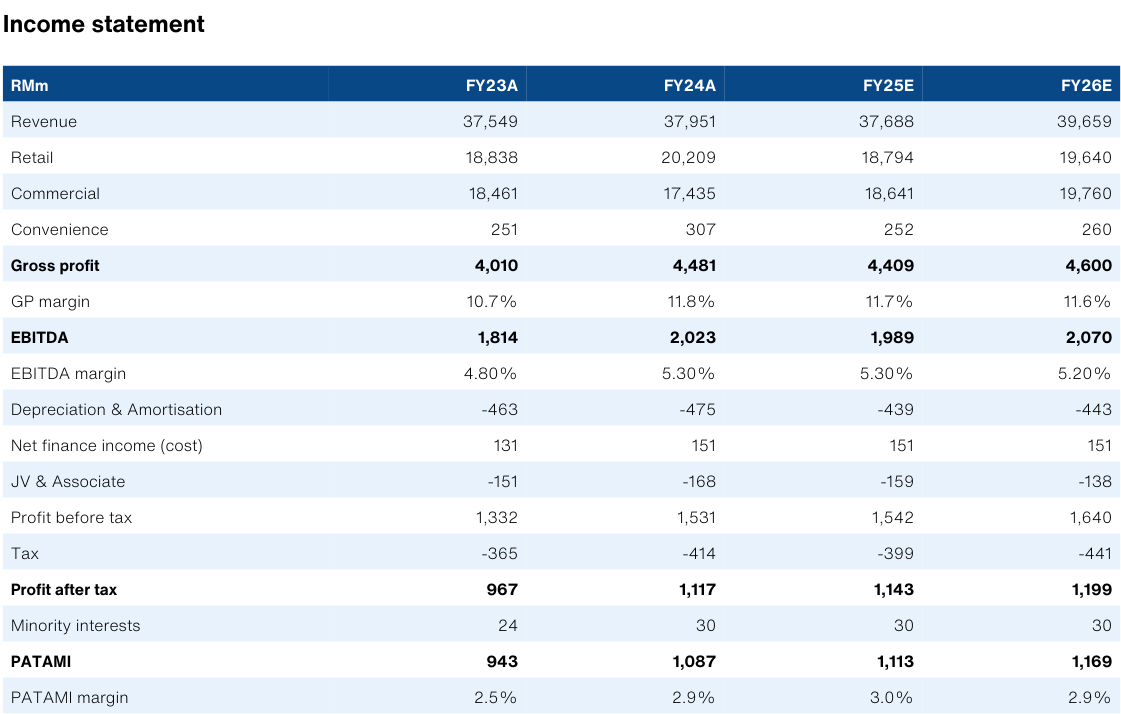

Overall, we anticipate this will translate to 4.1% EBITDA growth and +5.1% PATAMI growth for FY26E to RM1.17bn. Based on the 3yr historic PER of 20.4x, this points to a fair value of RM24.

PETD’s yields also provide substantial comfort to the valuations. Our fair value implies a yield of 4.6% which is still above the KLCI’s current 4.2% forward yield. Not that PETD has historically traded at a yield discount to both the KLCI and the 10yr MGS. At the last close, PETD’s forward yields are at an implied 5.2%.

PETD is trading at -0.8SD vs its 3yr average PER

PETD yields are now at a healthy premium to the KLCI

Selected financials

Source: Bloomberg, NewParadigm Research, February 2026