Milking opportunities in US and Cambodia

Able could deliver double digit growth - a potential catalyst to return to pre-MACC valuations.

Able Global

ABLE - KL.7167

NOT RATED

Fair value: RM2.20

Last price: RM1.60

Market cap (RMm): RM483m

Shares out: 308m

52-week range: RM1.26 / RM1.89

3M ADV: RM0.19m

T12M returns: -11%

Disclaimer: By using this information, you acknowledge that you are solely responsible for evaluating the merits and risks of any investment decision and agree not to hold NewParadigm Research liable for any damages arising from such decisions.

Key takeaways

- Addition of two major US retailer clients could contribute ~RM13.2mil in earnings in FY26E, we estimate.

- Able is benefitting from the Thai-Cambodian conflict. Two distributors have been secured; we estimate ~RM5m NP contribution for FY26E.

- Low-to-mid teens NP growth looks reasonable. And if the stock rerates to -2SD of the pre-MACC average (8.5x PER), the implied FV would be RM2.20.

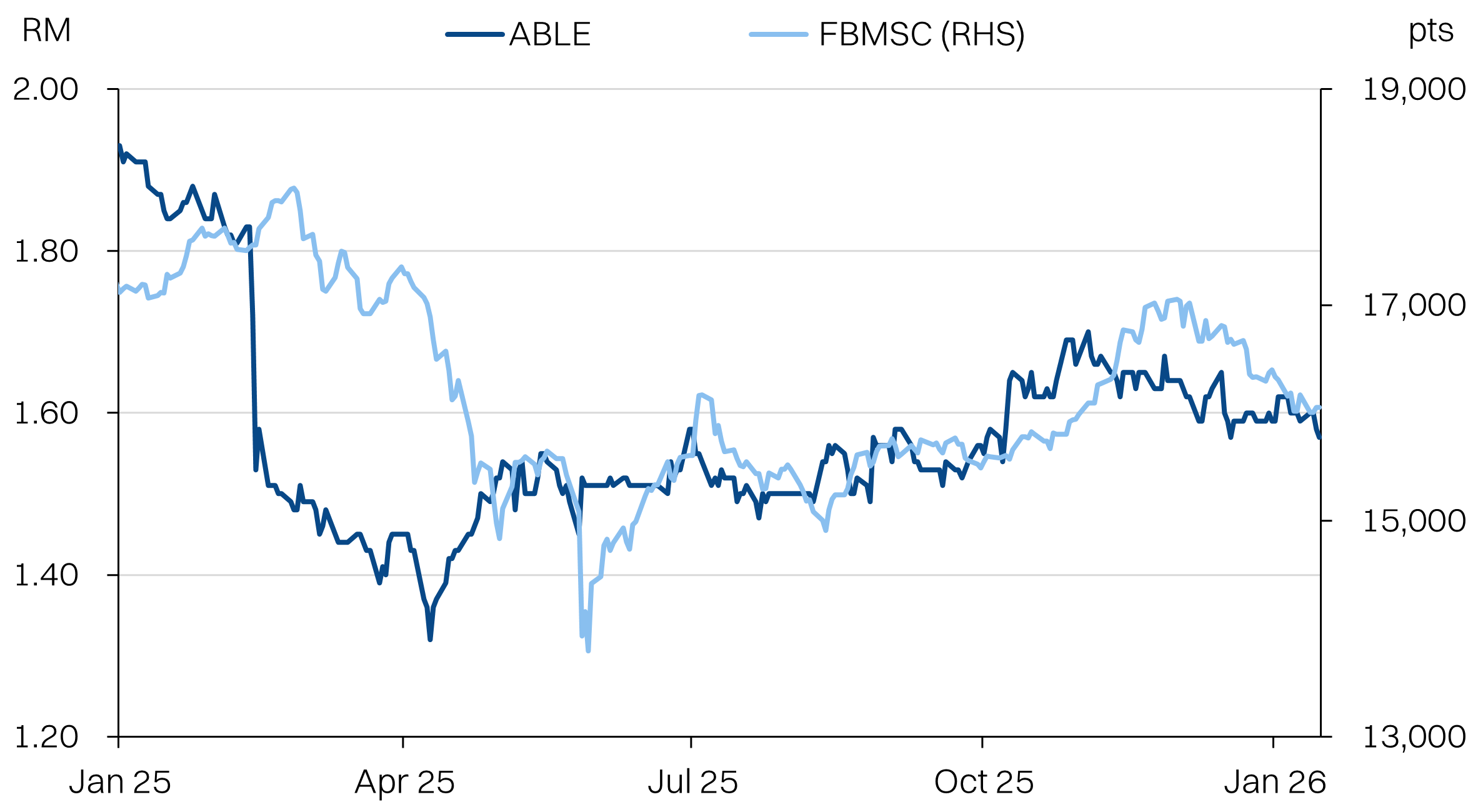

Share price performance

Investment fundamentals

| RMm | FY24A | T12M | FY25E | FY26E |

|---|---|---|---|---|

| Revenue | 729 | 681 | 692 | 758 |

| Revenue Growth | 13% | -10% | -5% | 10% |

| EBITDA | 114 | 109 | 104 | 120 |

| EBITDA margin | 16% | 16% | 15% | 16% |

| Adj PATAMI | 69 | 70 | 71 | 81 |

| PATAMI margin | 9% | 11% | 10% | 11% |

| ROA | 8% | 9% | 8% | 10% |

| ROE | 14% | 14% | 13% | 15% |

| PER | 9.6 | 7.2 | 6.8 | 6.6 |

Source: Company data, Bloomberg, January 2026

Expansion into US market

- Able has secured two major US-based retailers as clients for its Mexico plant, for both condensed and evaporated milk, due to start operations in 1Q26/2Q26.

- Management appears confident in volume upside and is adding +60% capacity to 8,000MT/month, even though the plant is currently operating at 43% utilisation.

- Assuming utilisation averages 50% in FY26 due to a gradual ramp up through the year, we estimate this will translate to ~RM13.2m NP contribution for the 43%-held associate. At a stable utilisation of 75% full-year, this would be ~RM20m NP contribution.

Displacing Thai suppliers in Cambodia

- Able is positioned to benefit from the Thai-Cambodian conflict (began in June 2025), even if the current ceasefire holds. Prior to the conflict, Thailand was the largest supplier of dairy to Cambodia. But the war saw a steep curtailment of fresh milk supplies that created shortages in Cambodia as well as a shift to shelf-stable products like condensed and evaporated milk as alternatives.

- Able has secured two large distributors in Cambodia and began exports in 4Q25 and is looking to secure more as Cambodian distributors seek to diversify away from Thai suppliers.

- Thailand is the largest exporter of dairy products in ASEAN, where they supplied total of USD32.5mil of US42.6mil to Cambodia before border closure.

- Management is guiding for Cambodian contribution to rise to RM4.8m, from RM2.1m previously.

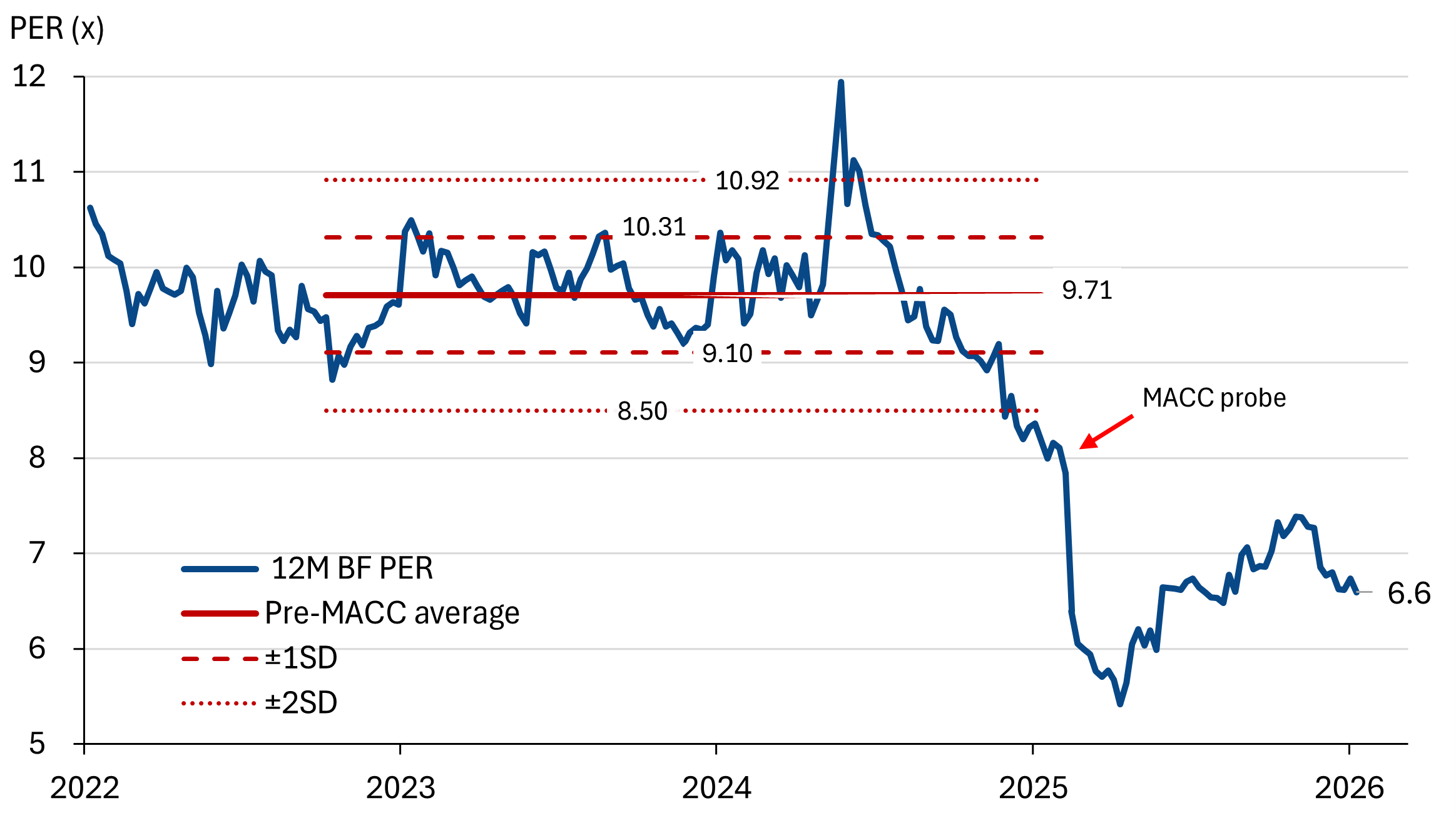

Potential Re-rating to pre-MACC levels

- The aforementioned catalysts can drive at least ~10% NP growth, with room to surprise on the upside on better operating leverage.

- Meanwhile, Able’s valuations remain depressed since tanking in February 2025 following the MACC probe into the company and management. Able used to trade at an average of 9.7x PER (BF 12M).

- With the investigation closed and earnings growth, we think a re-rating to at least 8.5x PER is reasonable - only -2SD vs the pre-MACC average. This implies a fair value of RM2.20.

About the Company

Able Global Berhad (AGB) manufactures condensed milk, evaporated milk, milk powder, as well as tin cans for domestic and export markets. Able has production facilities in Malaysia as well as Mexico (43% associate). Tin can manufacturing was historically the group’s core business, but it now contributes only about 16% of total revenue, with the dairy and food segments forming the main earnings base.

About the stock

Able Global Berhad (formerly Johore Tin Berhad) is a syariah compliant stock listed on the main market. The stock controlled by management, led by CEO Edward Goh (19.4%) and chairman, Ng Keng Hoe (11.4%).

The stock saw valuations drop following probes by the anti-corruption agency into the company and management. But even though all the investigations have been dropped, the stock continues to trade at 6-7x PER, well below its historic pre-MACC average of 9.7x.

Investment Idea

Able’s share price and valuations have not recovered despite the conclusion of the MACC probe in April 2025 and August 2025 against the company/CEO and Chairman respectively. This is despite business operating as usual. In fact, earnings have been gradually improving on better plant utilisation.

Meanwhile, the group has two growth catalysts:

- US demand: Able has secured two major US retailers as clients for its plant in Mexico.

- Thai-Cambodia conflict: Able has the opportunity to displace Thai dairy suppliers to Cambodia following the conflict. Able has already secured two distributors there with more potentially pending.

Key Risks

- Expansion of domestic Cambodian milk production could decrease market access. Reliance on Thai raw milk could also pose a risk of product boycotts.

- High exposure to two US clients for Mexico operations (est. >60% of production by FY27). Could have weaker negotiating power on ASPs that could soften margins.

- Management intends to venture into industrial park development. We see little carry-over expertise from the existing business or intrinsic endowments that give Able an advantage here. Venture due to begin in 2027.

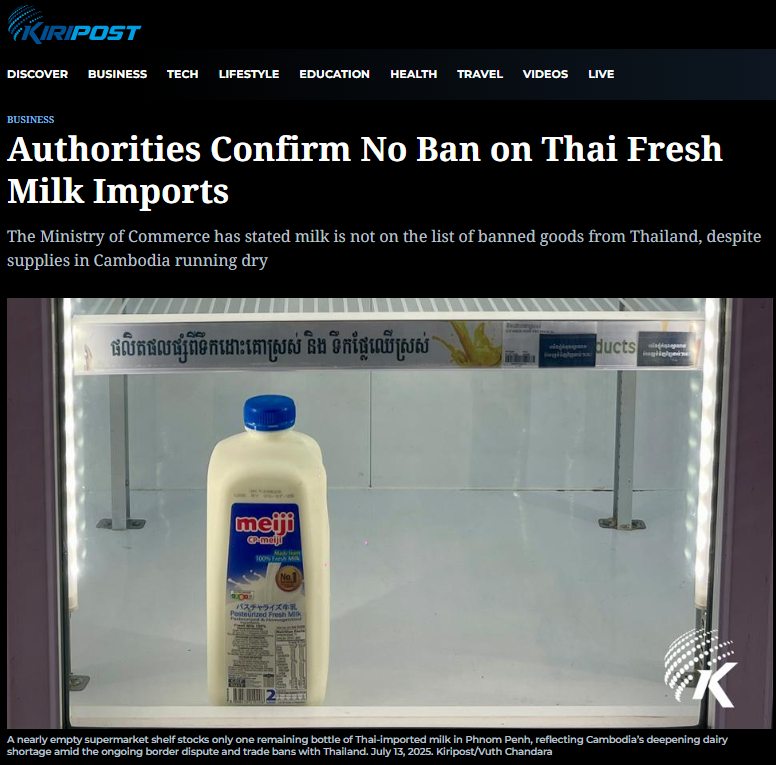

Thai-Cambodian conflict opens door for market access; +4% NP

Prior to the military conflict along the Thai-Cambodian border in 2025, Thailand was the largest supplier of milk products to Cambodia. According to OEC data, Thailand made up 76% of Cambodian milk products imported by value. Border closures and disruptions to supply chains resulted in severe shortages, especially for raw milk.

Even though the ceasefire has been put in place, ongoing tensions will likely continue to support Able’s opportunity to gain a foothold in the country. Able has already ramped up supply of condensed and evaporated milk to the country - going from non-existent exposure to almost 3% of revenue for FY25E, based on management guidance. This is roughly RM21m in sales in the 2H25 alone (when operations started). For FY26, management is aiming for 7% of sales to come from Cambodia.

This implies ~20% volume growth against the 2H25 exit run rate and translates to incremental sales of ~RM30m for the full year. If margins hold at ~10%, incremental profits of RM3m for FY26E. In turn, this translates to roughly 4% earnings upside vs FY25E.

While not a perfect substitute, shortages in raw milk droive consumers towards shelf-stable reconstituted alternatives. This driver is likely to unwind as Cambodia moves to ramp up domestic production and reduce reliance on Thailand. Currently, Cambodia is only capable of producing about 20% of its domestic fresh milk demand, based reports citing the country’s largest domestic milk producer - Kirisu.

Additionally, the broader shift by Cambodians away from Thai brands should continue to support Able’s market penetration. However, it is worth noting that Able sources the bulk of its raw milk from Thailand. Other Malaysian companies are also jumping on the opportunity, like Farm Fresh Bhd (FFB), which has an MoU with Cambodia’s Alpha Group and local authorities to help develop the country’s dairy infrastructure.

Looking ahead, there could be more upside for Able if the current ceasefire (since 27 December 2025) were to breakdown, resulting in a new round of supply disruptions. The current ceasefire is the third major one in 2025.

News reporting during the peak of the shortage in 2025

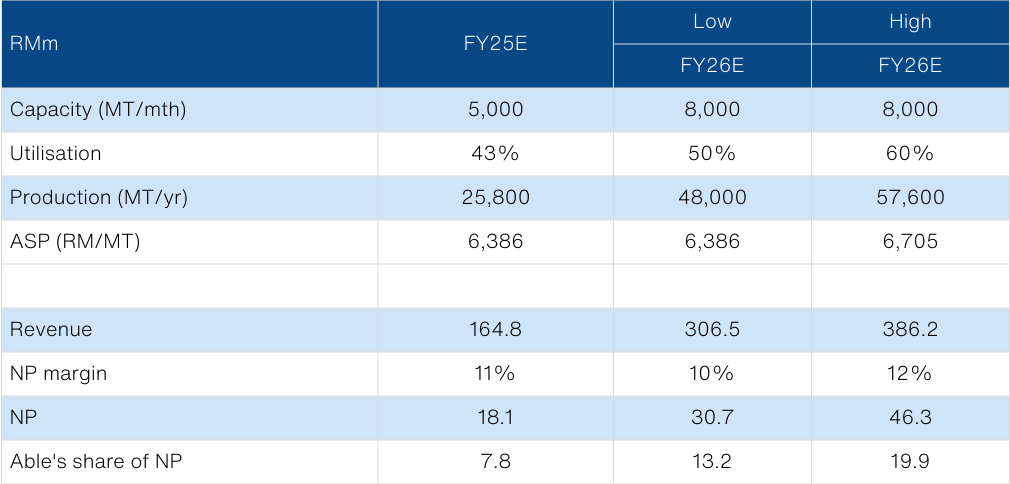

Major US retailers to drive Mexico production volumes

Another well‑reported catalyst for Able, which we believe is not yet fully reflected in the share price, is the addition of two major U.S. retailers as customers for its Mexico plant. Based on management’s description of the clients, we believe these to be US-based nationwide retail chains. Able will manufacture both condensed and evaporated milk under the retailers’ own brands.

Currently, the 43%-held Mexico joint venture contributed only RM5.4m to NP in 9M25 and is on-track to deliver ~RM7.8m for FY25E. However, we anticipate contributions could almost double to RM13m for FY26E, or an incremental +8% NP vs FY25E.

By adding another 60% production capacity this year (from 5,000MT/month to 8,000MT/month), management has shown strong confidence in the demand coming from said US clients. Keep in mind that Mexico is currently running at a relatively low utilisation of 43%.

Against the higher production capacity base, management is also guiding for higher utilisation of 50-60%. This implies potential revenue lift of +86% to +136% YoY. The more conservative end of that assumption translates to aforementioned RM13m NP contribution. However, more bullish assumptions would translate to RM20m NP contribution (60% utilisation) or +18% NP upside vs FY25.

Keep in mind that these utilisation assumptions are based on a gradual ramp-up in production through the year and calculated against exit capacity figures. Assuming the plant can achieve 75% utilisation in FY27 on stable volume loading through the year, this would translate to ~RM25m NP contribution from this operation alone.

Mexico plant: potential +70%-150% NP upside

The condensed/evaporated milk industry in the US

The underlying demand for condensed/evaporated milk products in the US tends to be driven by commercial demand in food production. For example, bakeries. For the most part, consumer preference in the US is for fresh milk, which is relatively cheap and abundant. One market study by IndexBox estimated the size of this market at ~US$1.8bn or ~994k MT/year. However, LT growth trends are subdued at only +0.1% CAGR.

In turn, this implies that Able will have roughly >3% market share in US, assuming all incremental production volumes are for the US clients.

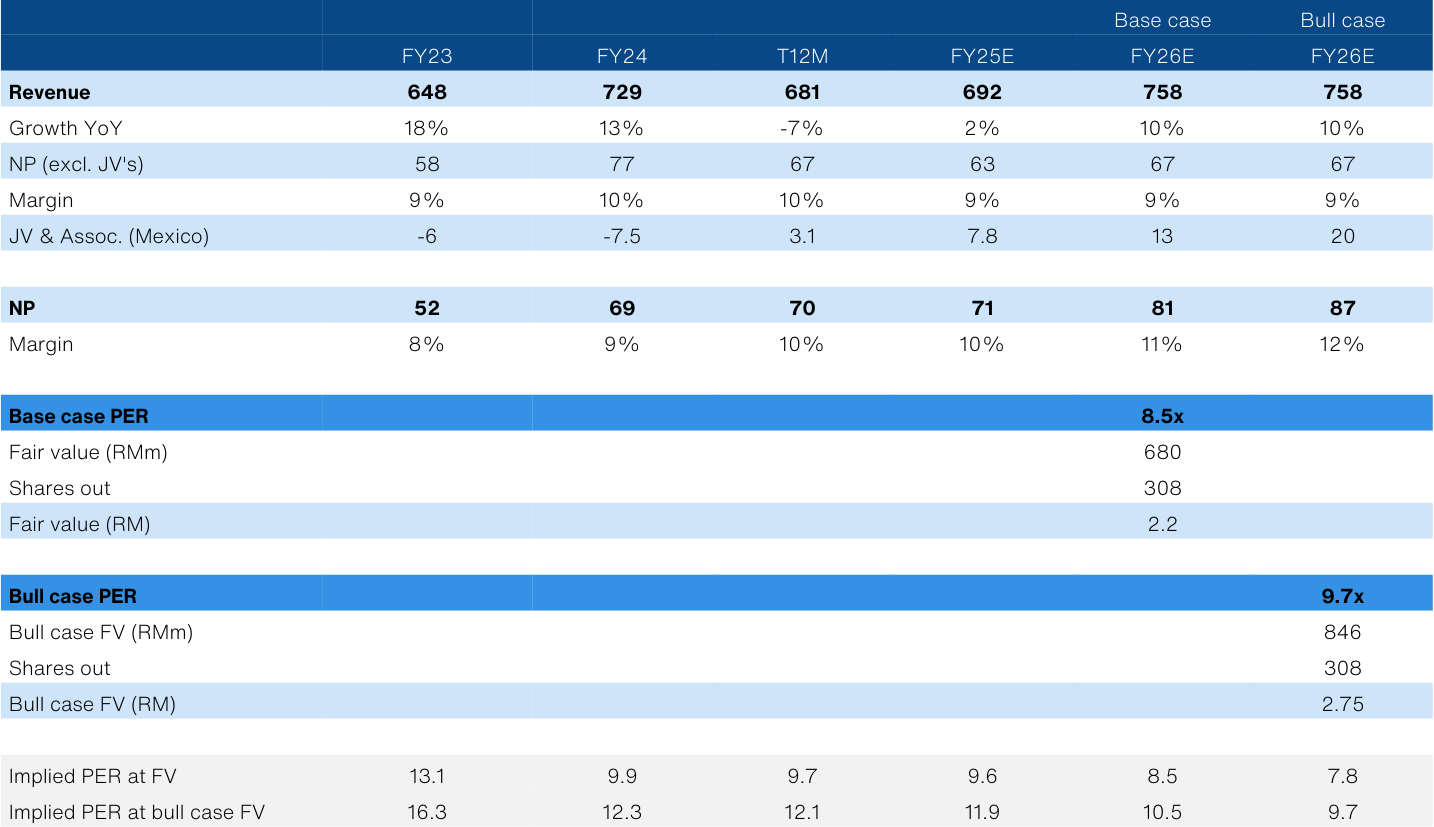

High ceiling for re-rating if earnings materialize

We estimate a fair value of RM2.20 for Able. This is based on 14% NP growth and a conservative PER multiple of 8.5x FY26E which is still -2SD vs its pre-MACC average.

The catalyst for the re-rating will be the delivery of earnings growth. Meanwhile, the earnings outlook is well-supported by both the aforementioned Cambodian and US expansion opportunities that will contribute RM3m and RM5m respectively to NP.

Our bull case scenario suggests a FV of RM2.75 - based on a further +RM7m NP upside from Mexico operations coupled with a re-rating back to the pre-MACC average PER of 9.7x.

Pre-MACC investigation, Able traded at 9.7x PER on average

Valuation table: Fair value: RM2.20

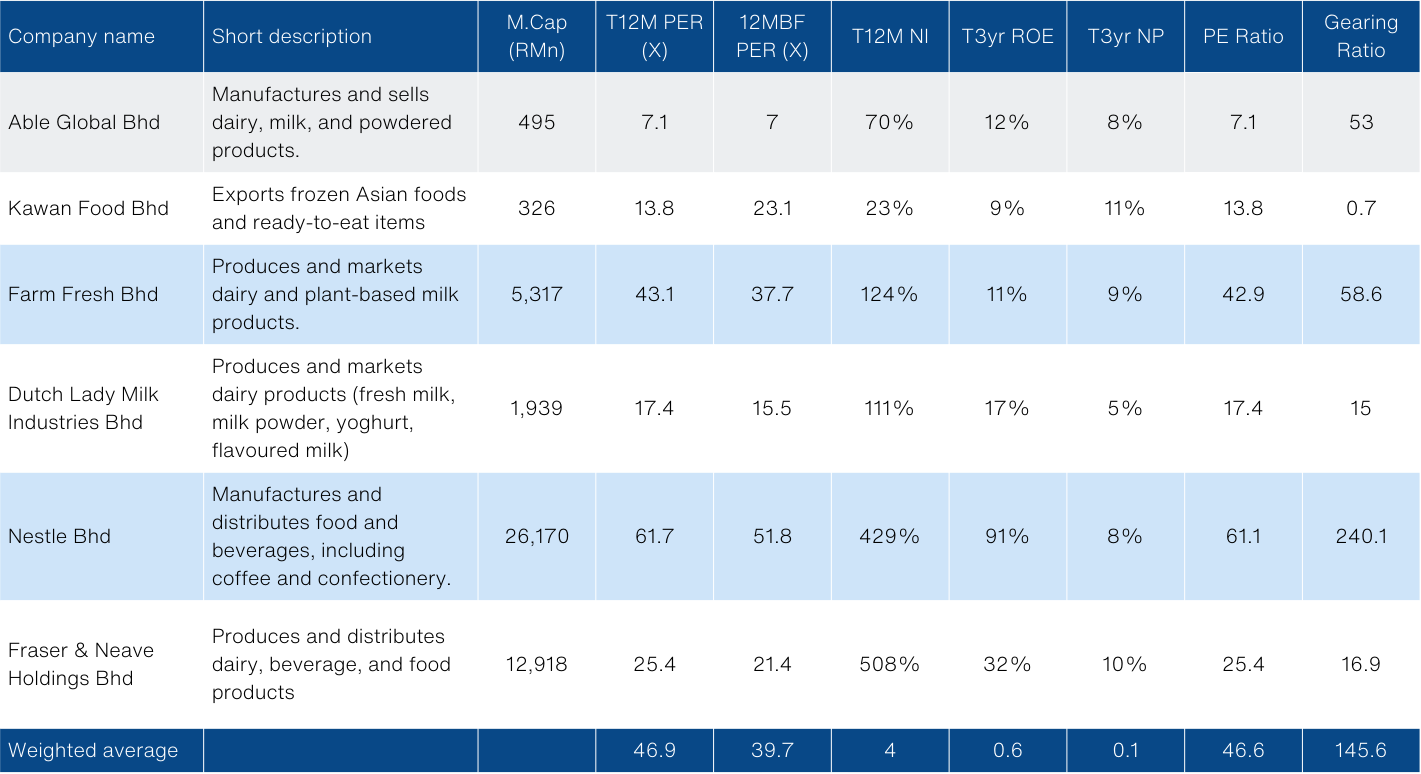

Peer Comparison

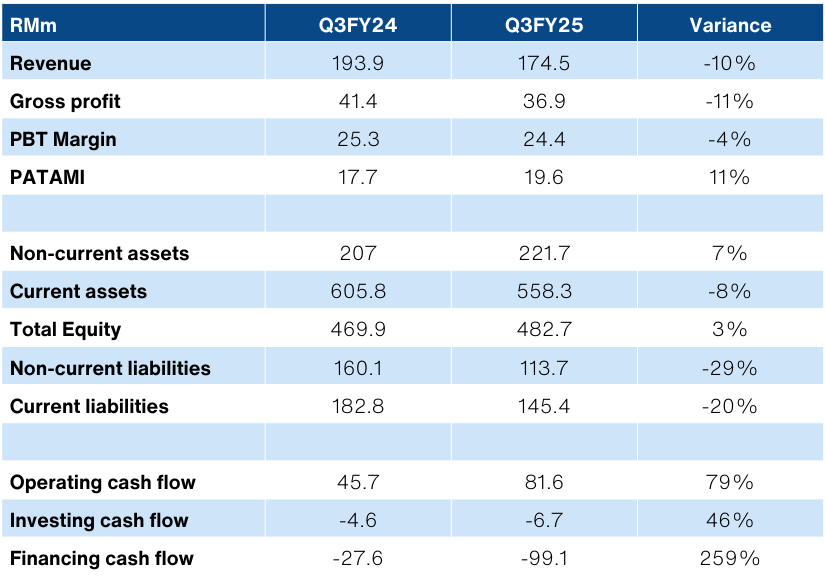

3Q25 financial performance

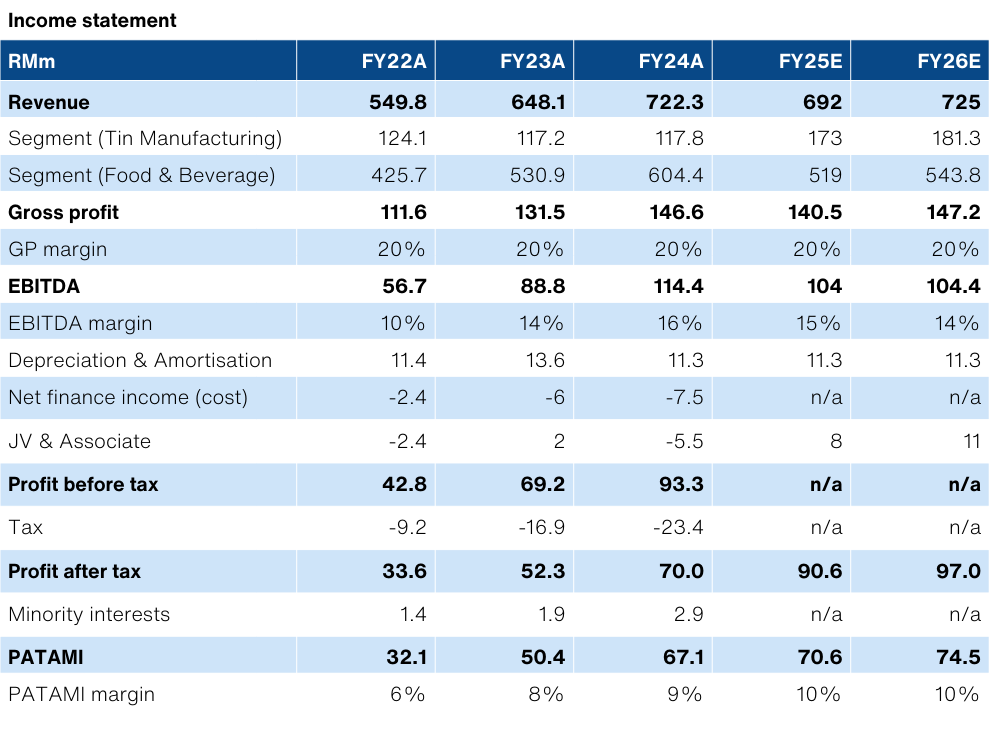

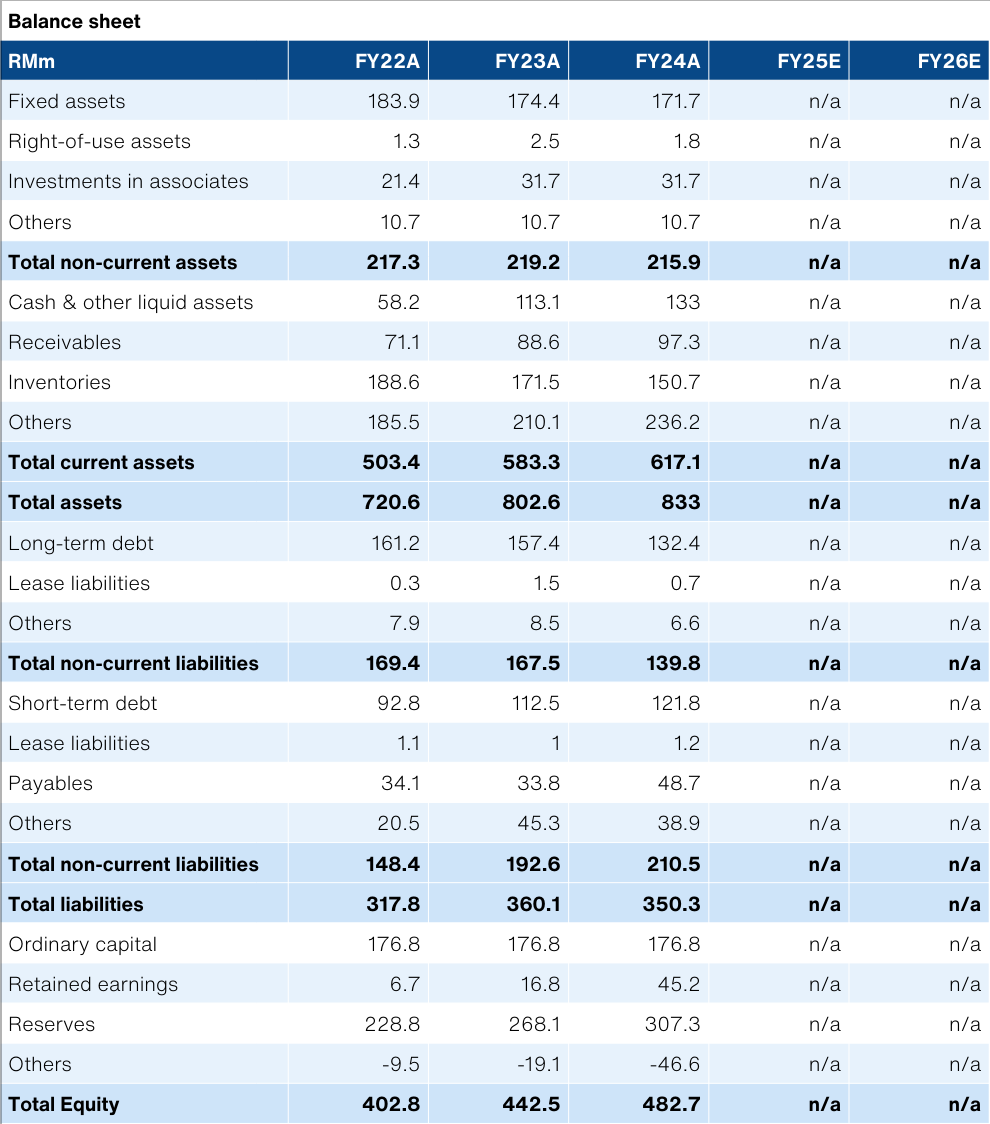

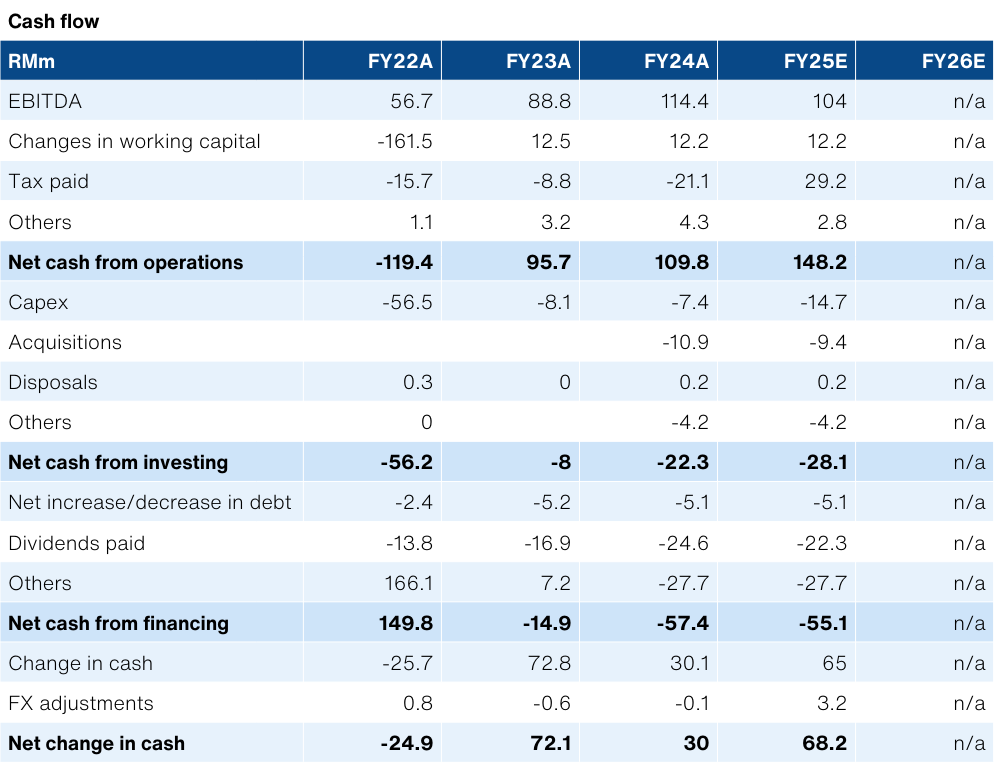

Financials

Source: Company data, NewParadigm Research, January 2026; Forecasts based on Bloomberg consensus