MUSB acquisition deadline jitters

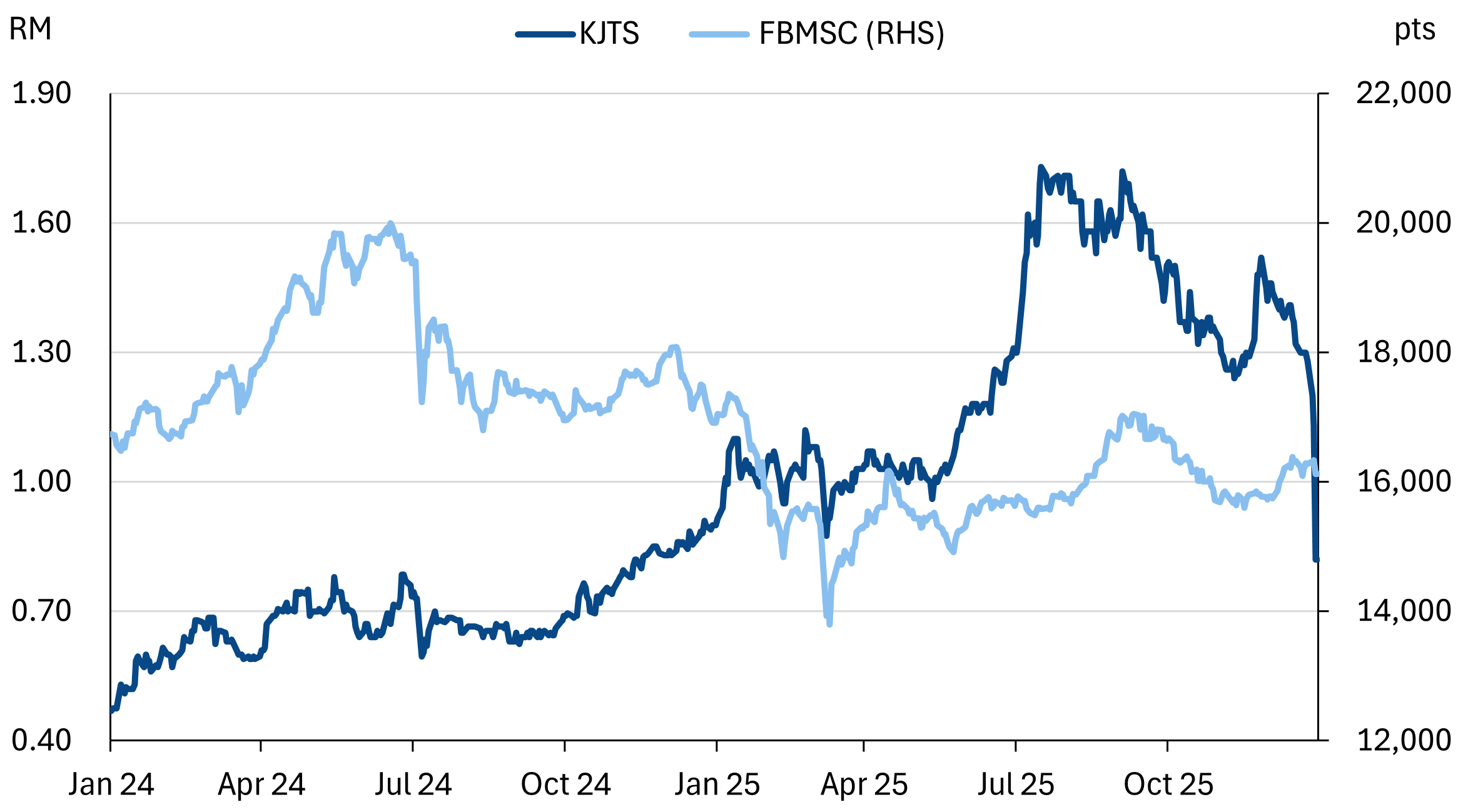

KJTS's share price fell 27% on worries the MUSB deal could fall through.

Stock information

KJTS

KJTS - 0293.KL

TRADING BUY

Target price: RM2.00

Last price: RM0.82

Market cap (RMm): RM566m

Shares out: 690m

52-week range: RM0.81 / RM1.81

3M ADV: RM1.2m

T12M returns: -9%

Disclaimer: By using this information, you hereby acknowledge that you are fully and solely responsible for evaluating the merits and risks of any investment decision and agree not to hold NewParadigm Research fully liable whatsoever for any actions, omissions and/or damages of any kind or matter arising from such decision.

Key takeaways

- The deadline to complete the MUSB acquisition from Malakoff is due next week but a key CP is still outstanding.

- We had imputed ~RM9m in earnings contribution from MUSB in our FY26E assumptions. Significant downside to our forecasts.

- Current share price implies 27x FY26E without MUSB contribution. We place KJTS under review pending the binary outcome next week.

Share price performance

Investment fundamentals

| RMm | FY24A | FY25E | FY26E | FY27E |

|---|---|---|---|---|

| Revenue | 138 | 186 | 222 | 280 |

| Revenue Growth | 15% | 35% | 20% | 26% |

| EBITDA | 12 | 28 | 35 | 44 |

| EBITDA margin | 9% | 15% | 16% | 16% |

| PATAMI | 15 | 21 | 30 | 42 |

| PATAMI margin | 11% | 11% | 13% | 15% |

| ROA | 10% | 12% | 13% | 15% |

| ROE | 13% | 16% | 19% | 23% |

| PER | 70 | 51 | 36 | 26 |

| P/BV | 9.2 | 8.2 | 7.0 | 5.9 |

| Yield | 0.0% | 1.0% | 1.0% | 2.0% |

Source: Company data, Bloomberg, NewParadigm Research, January 2026

Significant to earnings, more significant to sentiment

- Management hosted a call with investors yesterday to share updates on the Malakoff Utilities Sdn Bhd (MUSB) acquisition from Malakoff Corp Bhd (RM65.5m) that was first inked on 3 Feb 2025, almost one year ago. MUSB owns the large-scale cooling district for KL Sentral.

- According to management, a key condition precedent (CP) for the deal is still outstanding and the expiry of said CP is next week. We believe said CP could be tied to regulatory approvals. Note that the original long stop date for approvals was 120 days from the signing of the SPA.

- Despite protracted execution, management asserted that the acquisition is still in progress and additional information required of Malakoff has already been submitted. A follow-up meeting with Malakoff will also take place this week to address outstanding matters. In short, management intends to proceed with the deal.

- This looks like a binary risk event. Either the deal gets scrapped or it gets concluded, potentially with some extension of time.

- Impact to our earnings expectations in the worst-case scenario is ~RM9m. But also note we had assumed KJTS would be incurring an additional RM30-40m capex to enhance the MUSB cooling assets, so there will also be a corresponding cash savings of ~RM100m.

- While damaging, we think the hit to sentiment is potentially worse. KJTS has been trading on significant forward expectations of project acquisitions. While some collaborations have been signed, new deals have been scarce. This hiccup with MUSB undermines market confidence on execution and hurts multiples.

Binary outcome; under review

- We place KJTS under review pending the outcome of the CP’s next week. An extension is possible, but that would still push out earnings contributions from MUSB.

- KJTS also has other prospects in the pipeline, but the aforementioned hit to sentiment could linger. In short, if the deal is called-off there could be a further 10-15% downside from current valuations.