Not just a Sabah tourism play

Life Water is the dominant bottled water player in Sabah.

LIFE WATER BHD

LWSABAH | 5328.KL

NOT RATED

Fair value: RM1.90

Last price: RM1.57

Market cap (RMm): RM743m

Shares out: 473m

52-week range: RM0.75 / RM1.69

3M ADV: RM3.7m

T12M returns: 89%

Disclaimer: By using this information, you acknowledge that you are solely responsible for evaluating the merits and risks of any investment decision and agree not to hold NewParadigm Research liable for any damages arising from such decisions.

Key takeaways:

- Life Water’s dominant bottled water market share in Sabah makes it state-focused tourism proxy, with direct comparisons to Spritzer.

- While smaller (~25% vs SPZ’s revenue), Life Water has a potentially higher ceiling to grow outside of its core Sabah market as well as expanding into mineral water.

- Valuations have begun to closely track SPZ. Against a similar 20x PER multiple, Life Water’s fair value is RM1.90.

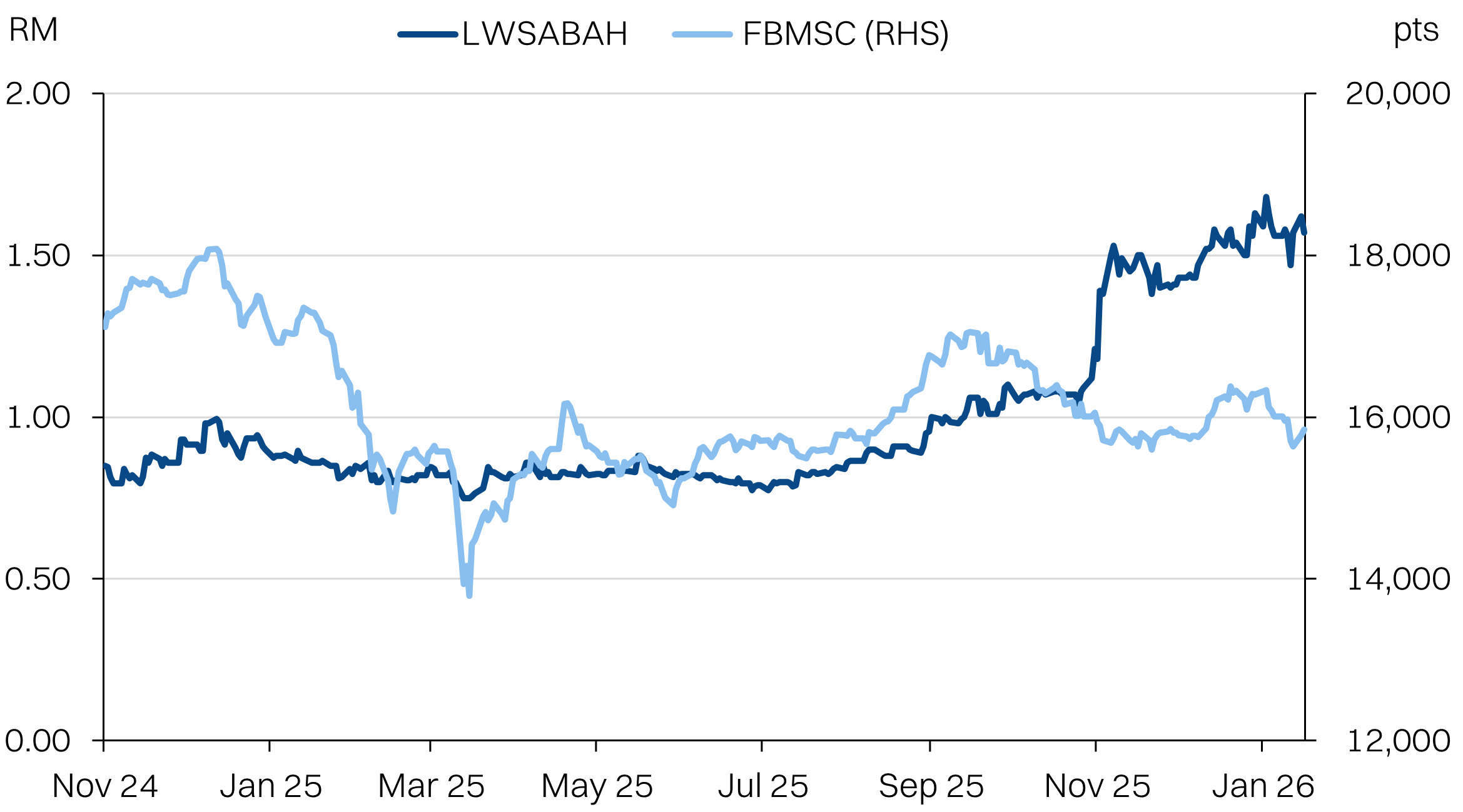

Share price performance

Investment fundamentals

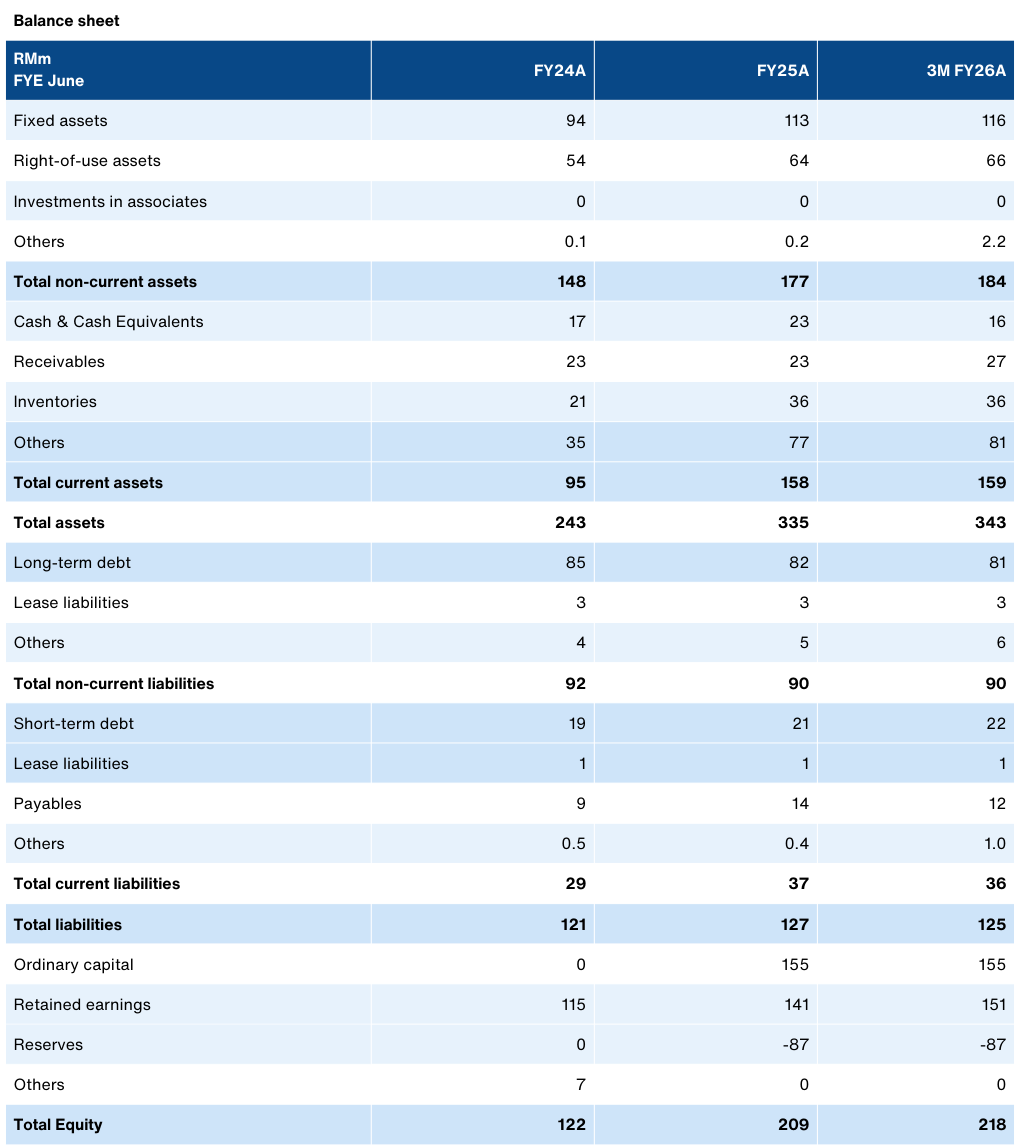

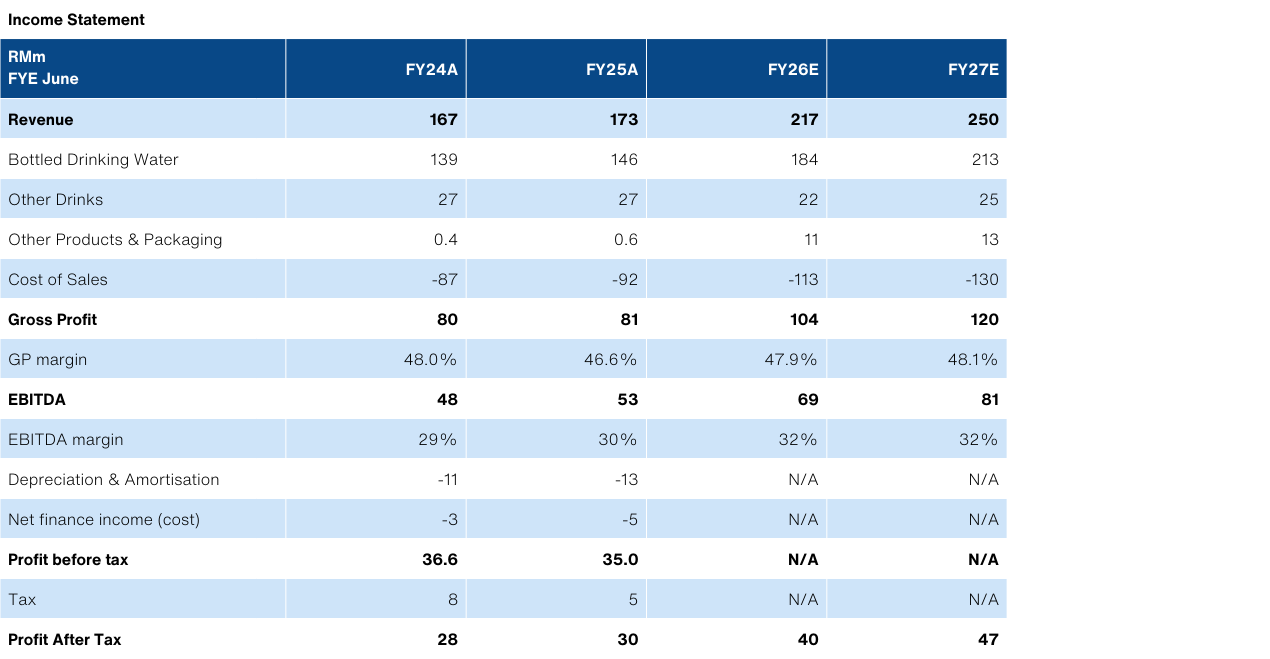

| RMm (FYE JUNE) | FY24A | FY25A | FY26E | FY27E |

|---|---|---|---|---|

| Revenue | 167 | 173 | 217 | 250 |

| Growth YoY | 10.30% | 3.6% | 25.4% | 15.2% |

| EBITDA | 48 | 53 | 69 | 81 |

| Margins | 29% | 30% | 32% | 32% |

| Adj NP | 28 | 30 | 40 | 47 |

| Margins | 16.7% | 17.3% | 18.4% | 18.8% |

| Net Debt | 53.4 | 7.2 | N/A | N/A |

| ROA | 12% | 9% | N/A | N/A |

| PER(X) | 26.5 | 24.8 | 18.6 | 15.8 |

Source: Company data, Bloomberg, February 2026

A mini-Spritzer with more headroom to grow

- Life Water is the dominant bottled water player in Sabah with a total market share nationally of 11% compared with Spritzer’s 40-45% share. Life Water’s revenue base for bottled water is only about 25% of Spritzer’s.

- We anticipate Life Water will benefit from the Visit Malaysia 2026 tourism thematic, similar to Spritzer. Sabah makes up about 6% of foreign visitors (compared with ~11% of the population). However, Sabah also has strong domestic tourism potential, especially if low-cost carriers like AirAsia ramp up capacity and drive down domestic fares.

- Still this upside looks to be well-captured in consensus expectations of +26%/+30% YoY revenue/NP growth for CY26 (Life Water has a June year-end). This is better than Spritzer’s +14%/+20% estimates that we have.

- Supporting the growth outlook is Life Water’s expansion outside of Sabah, targeting Sarawak and Brunei, for now. We anticipate Life Water will have to build up manufacturing capacity in Peninsula Malaysia if it intends to expand into that market in the future, to be cost-competitive.

- Additionally, Life Water has shown more appetite for inorganic growth with the recent acquisition of a sauces/condiments subsidiary that will add another ~RM10m to revenues.

- Life Water also has one major difference with Spritzer. The former does not have mineral water offerings, only focused on drinking water. This is a niche that management is looking to expand into which could further support long-term growth.

- To summarize, Life Water may be smaller than Spritzer but has higher ST growth and a potentially higher growth ceiling for the aforementioned reasons.

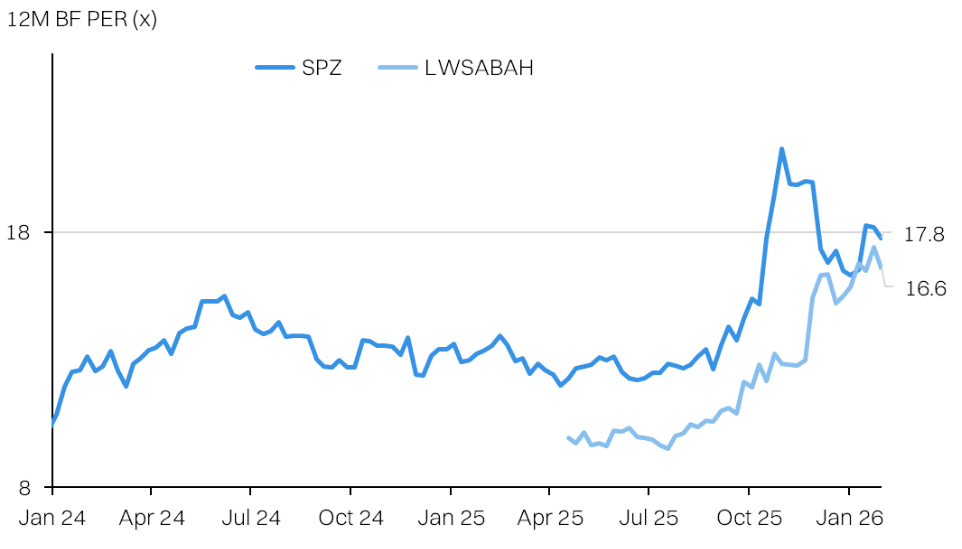

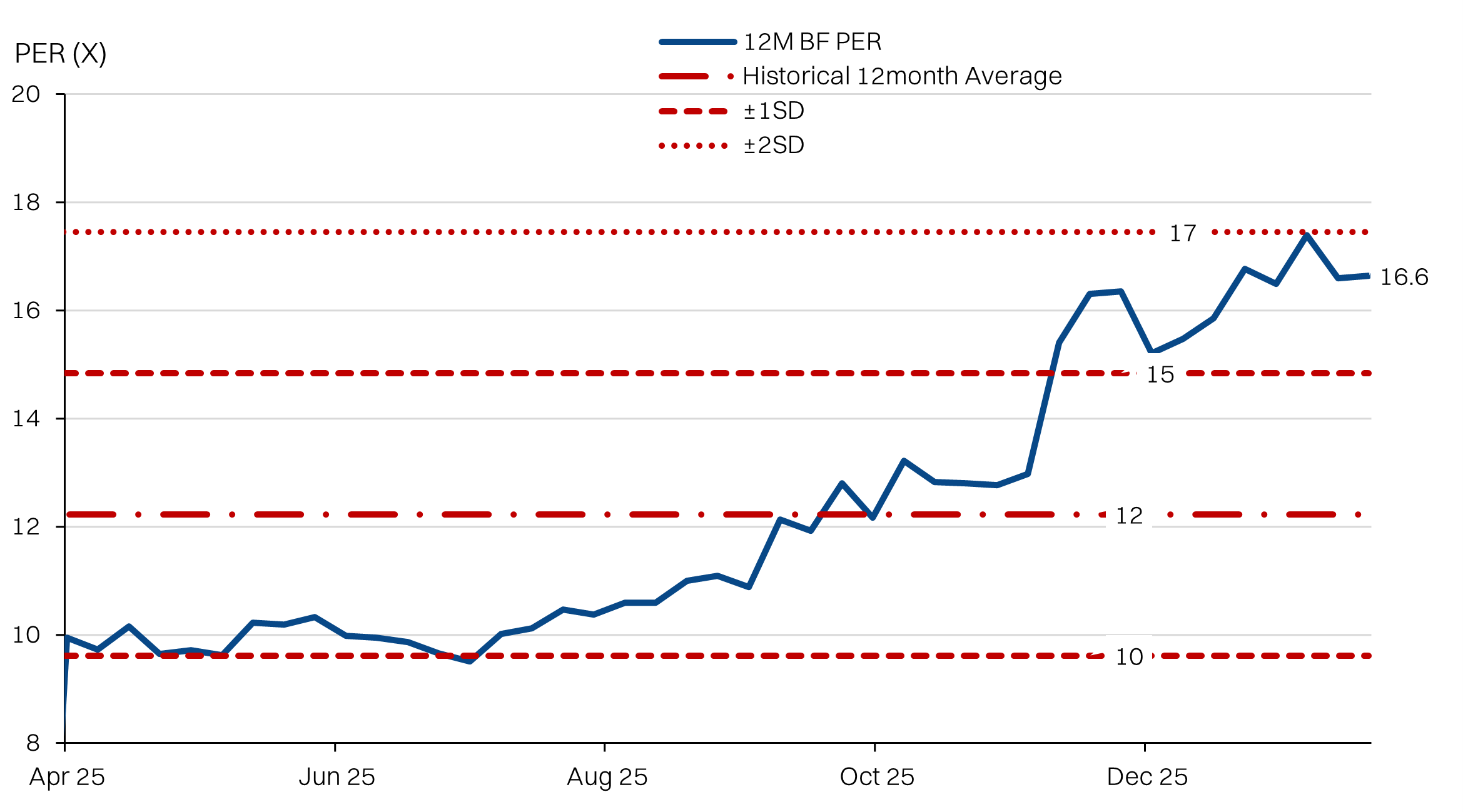

Valuations should track Spritzer

- Having just listed in 2024, Life Water does not have a long valuation track record and has been enjoying relatively sharp growth. Thus, we benchmark the stock to Spritzer and apply the same 20x PER multiple (+2SD vs 1yr historic average), to arrive at a fair value of 20x.

- This is reasonable, given the combination of higher growth ceiling and higher ST growth potential.

About the Company

Life Water is a Sabah-based beverage manufacturer, primarily in bottled water complemented with a small portfolio of carbonated and flavored beverages. Within bottled water, Life Water has ~11% market share nationally. But with sales almost entirely in Sabah, it has dominant market share in the state. Life Water’s brands include K2, Sasa, Sabah Water, 2more and TRITONiC.

Life Water is vertically integrated, with four production plants include water processing, in-house PET preform, bottle manufacturing and a proprietary logistics and distribution network. They also have an exposure in markets such as Sarawak and Brunei with ~2% share of sales.

Life Water recently completed the acquisition of Twinine Sdn Bhd in July 2025, which is a diversification into sauces and condiments.

About the Stock

Life Water Berhad was founded in 2001 in Sabah. The Group was listed on the Main Market of Bursa Malaysia in November 2024 following its initial public offering (IPO), priced at RM0.65 per share.

Life Water remains founder-led, with the founding management team retaining significant ownership. Founders Liaw Hen Kong and his wife, Chin Lee Ling are the largest shareholders via Scarecrow Holdings, which holds approximately 36.2% of the group.

This is followed by co-founders Lim Young Piau and Tan Hwong Kuen, each holding approximately 18% stakes respectively. The Company is classified as a Shariah-compliant stock under the screening methodology of the Shariah Advisory Council of the Securities Commission Malaysia.

Investment Idea

While smaller than Spritzer (SPZ), Life Water should be able to deliver similar earnings growth in CY26E, supported by the same tourism tailwinds (albeit, focused to Sabah). Additionally, Life Water has been more proactive with inorganic growth and has the headroom to diversify into mineral water as well as selling into more states outside of Sabah (including Brunei).

With the higher ceiling for growth over the medium term and the same fundamental drivers, we think pegging Life Water to the same multiple as SPZ makes sense - 20x PER on CY26E, as opposed to being limited to Life Water’s own historic PER range.

Key Risks

- Operations and revenue base remain highly concentrated in Sabah. Slower-than-expected market penetration into Sarawak, Brunei or Peninsular Malaysia could cap long-term volume growth and limit earnings scalability.

- Delays in commissioning new production lines or a slower utilisation ramp-up could defer the realization of operating leverage embedded in FY26–FY27 earnings assumptions.

- Expansion into new SKUs and non-core beverages may entail execution risks. Poor execution could result in lower-than-expected margins and dilute overall earnings contribution.

- Exposure to fluctuations in resin, plastic preforms and other packaging material prices, which are largely USD-denominated. Adverse foreign exchange movements or a sharp rebound in resin prices could quickly compress margins.

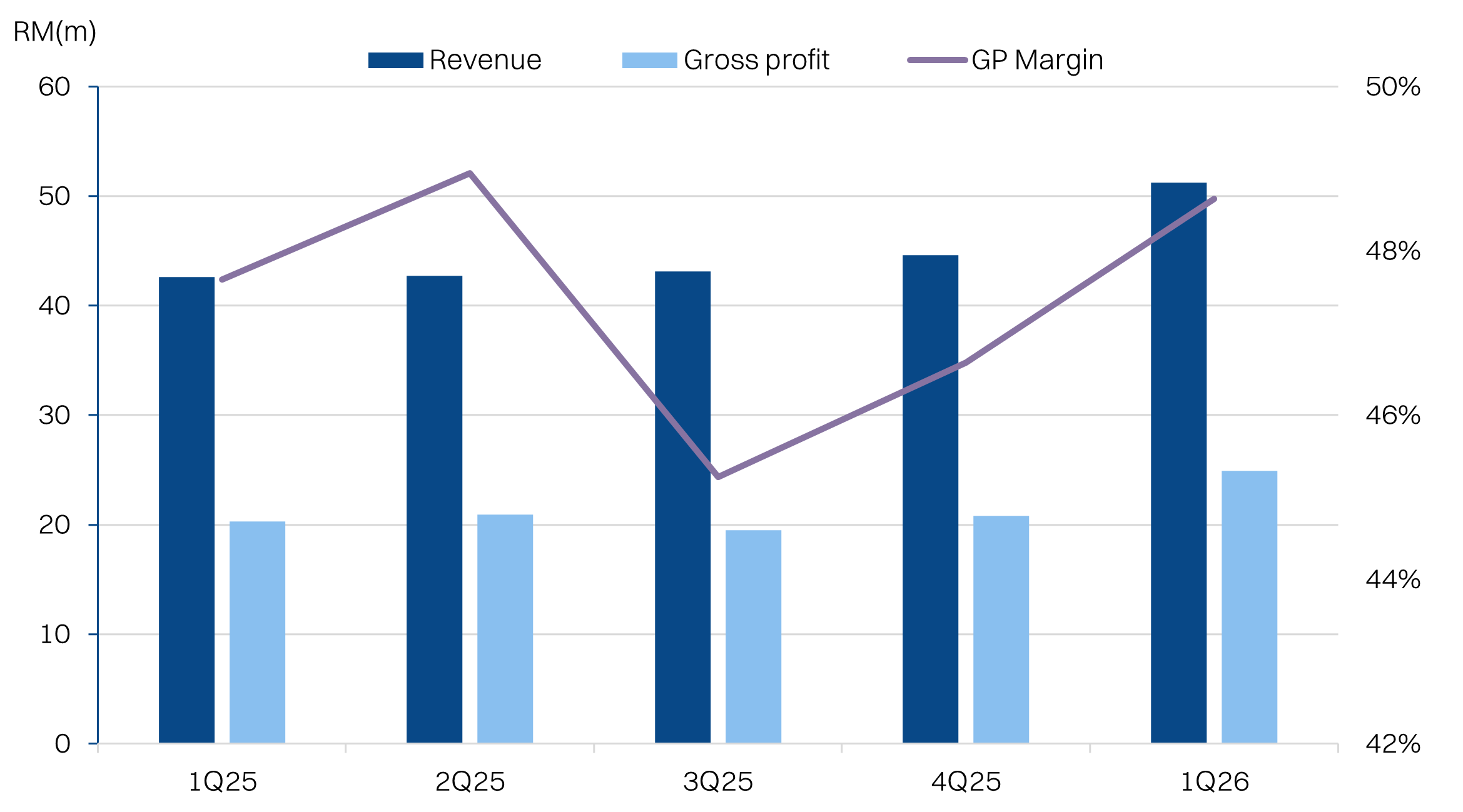

Earnings expansion

Life Water reported 1QFY26 revenue of RM51.2m (+20% YoY), marking a clear step-change from the RM44.6m run-rate recorded in 1QFY25. Annualising the 1QFY26 performance implies a revenue run-rate of RM205m, already covering 95% of FY26 consensus revenue expectations of RM217m, providing strong early-year earnings visibility.

The revenue uplift was underpinned by two key drivers. First, the commissioning of the new Sandakan Sibuga Plant 1 line in mid-2025 has materially expanded the Group’s effective production capacity. Prior to the expansion, effective drinking water capacity stood at approximately 470–500m liters per annum. Post-expansion, installed capacity increased to 626m liters per annum, representing a 25–30% uplift. This translated into higher drinking water segment revenue, which rose to RM43.43m from RM38.09m in the prior year period.

Life Water announced on May 2025 that it had entered into a Share Sale Agreement to acquire Twinine Sdn Bhd. The acquisition of the Sabah-based sauces and condiments manufacturer for a total cash consideration of RM10.5m.

The first-time consolidation of Twinine in 1QFY26 contributed RM2.08m in quarterly revenue, a meaningful increase compared with RM0.55m (0.4% of Group revenue) from other products and packaging in FY25. While Group PAT grew a more modest +3.6% QoQ, this reflects Twinine’s lower initial margin profile and early-stage integration costs rather than any deterioration in core bottled water operations

Despite Twinine’s consolidation, Group gross profit margin expanded to 48.5% in 1QFY26 from 46.6% in FY25. We view this outcome positively, as it demonstrates the resilience of core margins. While Twinine may exert modest margin dilution in the near term, it broadens the earnings base and introduces medium-term margin upside through scale benefits. As integration progresses and utilisation continues to ramp over FY26–FY27, we expect the margin impact to normalise.

GP trend

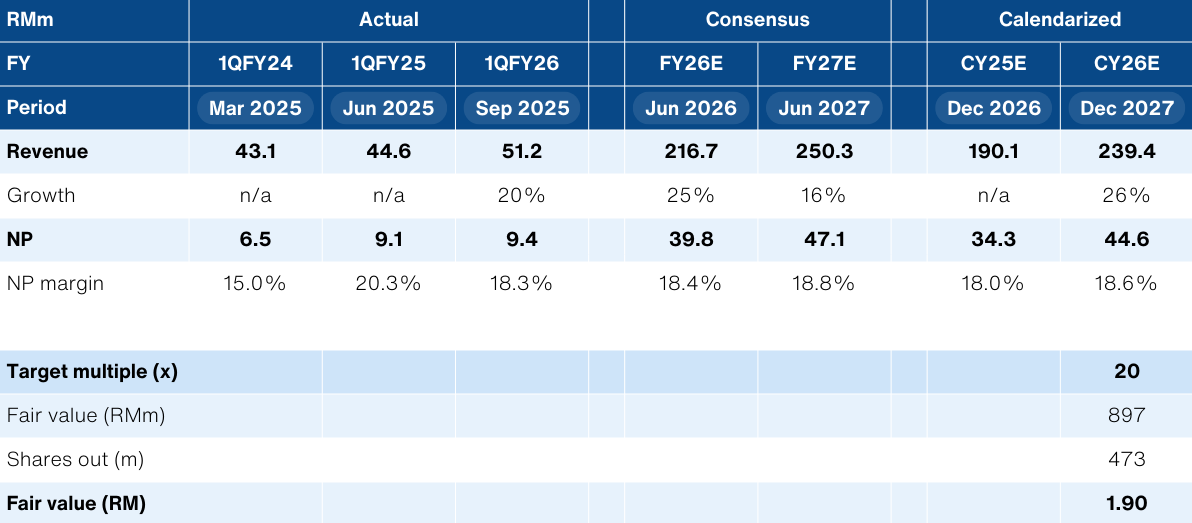

Fair value of RM1.90

Our own earnings estimates for Life Water are in-line with consensus expectations, which points to a healthy 32%/18% NP growth for FY26E/27E. Calendarizing these expectations, we have RM44.6m NP for CY26 or +26% growth. For contrast, we estimate Spritzer will grow by about +20% YoY in CY26.

We think Life Water should be able to trade on similar multiples to that of SPZ, especially since it has the potential to grow at a faster pace for the aforementioned reasons. At the same multiple we ascribed to SPZ of 20x CY26E (+2SD vs SPZ 1yr average PER). While this is significantly above Life Water’s own historic PER range, we flag that Life Water has had a relatively short valuation track record having only listed in 2014. Additionally, with similar ST growth expectations, we think that a valuation convergence with SPZ is reasonable. Our fair value for Life Water is RM1.90.

Note, Life Water also has some sensitivity to resin prices, which is prices in US dollars. We estimate that a 10% decline in resin costs will translate to ~4% upside to earnings.

Fair value: RM1.90

Valuations - tracking Spritzer closely

Valuation expansion reflected in re-rating

Selected financials

Source: Bloomberg, NewParadigm Research, February 2026