Politics, policy, profits - v1

Bersatu's departure from PN is kicking off a period of increased political uncertainty ahead of GE16 in late-2027.

Stranger bedfellows

Disclaimer: By using this information, you hereby acknowledge that you are fully and solely responsible for evaluating the merits and risks of any investment decision and agree not to hold NewParadigm Research fully liable whatsoever for any actions, omissions and/or damages of any kind or matter arising from such decision.

Key takeaways:

- Bersatu’s breakup with PN marks a turning point in the political status quo. Expect more uncertainty ahead of the GE16 election cycle.

- The BN-PH pact is being tested. The deferment of e-invoicing rollout points to populism overriding tough reforms going forward.

- But market knows what to expect this time, even if another hung parliament is likely. We like consumer staples, PPP plays, O&G, and potential beneficiaries among Sabahan/Sarawakian companies.

KLCI vs Elections | Sectoral index vs GE15 | Swing seats

Source: SPRM, Bloomberg, NewParadigm Research, January 2026

We’ve seen this show before

- Like Stranger Things Season 5, it is getting harder to surprise the audience and the plot is getting repetitive. While we anticipate more political uncertainty heading into the next election cycle, we think market reaction should be more muted this time around. The real issue will be the loss of political appetite to stomach tough policy reforms.

- Bersatu’s departure from the Perikatan Nasional (PN) coalition with PAS opens the door for a major bout of political merry-go-round for the major coalitions. There are many permutations. But the two extreme ends of the barbell could see a BN-PAS alliance or a return to the multi-cornered fight for Malay voters.

- In either case, we anticipate a renewed push in populist promises headed into the election cycle that will continue to limit further fiscal reforms. Ironically, the depression in oil prices will undercut the efficacy of the retail fuel subsidy reforms. The broad risk to corporates will be higher taxes but offset by consumer-friendly handouts and a propensity to cap inflation. However, infrastructure spending is likely to remain constrained or shifting more emphasis to the PPP model.

- In turn, we like consumer stocks that can benefit from cash handouts (99SM, NESTLE). Given the limited fiscal headroom, we like companies with a public-private partnership angle like LSH over the usual mega infrastructure players (GAM, SUNCON).

Another hung parliament is likely

- The fragmentation of the Malay vote between PKR, BN, Bersatu, and PAS is likely to result in another hung parliament in GE16, which we loosely define as one where the Peninsula-based coalitions are unable to secure a simple majority.

- We expect a relatively smooth transition towards the formation of a unity government, with lessons learnt from the GE15.

- The likely fragmentation of political consensus in Peninsula is also likely to hand more negotiating leverage for the increasingly cohesive Sarawakian and Sabahan state governments. In turn, putting more pressure on the tight fiscal resources.

- Politically, the relatively reform-oriented PH is likely to lose seats if the ‘23 state elections are anything to go by. That said, PAS, Bersatu and UMNO have the highest exposure to swing seats, which will keep things interesting till the polls are tallied.

Election cycle noise comes early

Since forming the unity government in November 2022, Prime Minister Anwar Ibrahim has enjoyed a period of relative political stability that has allowed for some challenging policy reforms. Ideally, the unity government would have another year to put the finishing touches on its policy plans before heading into the election cycle proper.

But with the break-up of Bersatu and PAS, formerly under the Perikatan Nasional (PN) banner, we anticipate a ramp up in political uncertainty over the next two years ahead of the 16th General Elections that are slated for late-2027. To be clear, we see very low risk of the unity government unraveling prematurely and/or triggering an early election. Instead, we see the PN split as a catalyst for the four major Peninsula blocks - Pakatan Harapan (PH), Barisan Nasional (BN), PN and Bersatu, to begin negotiating potential pacts for GE16.

We don’t have any special insight that would help us predict the numerous political permutations this could take ahead of GE16. But do not miss the forest for the trees. The big picture takeaway is that the tenuous pact between BN and PH becomes less necessary with a fracture in PN.

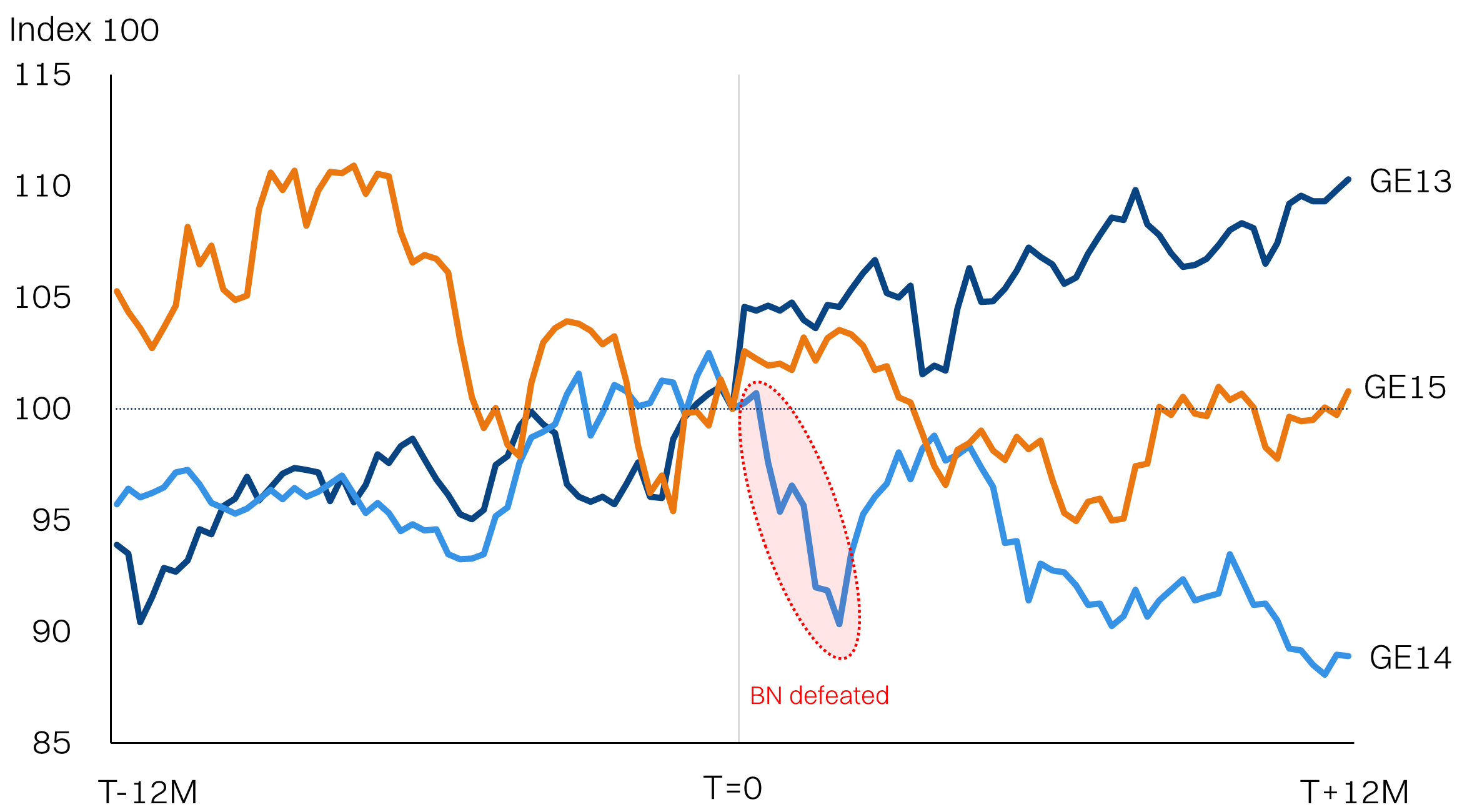

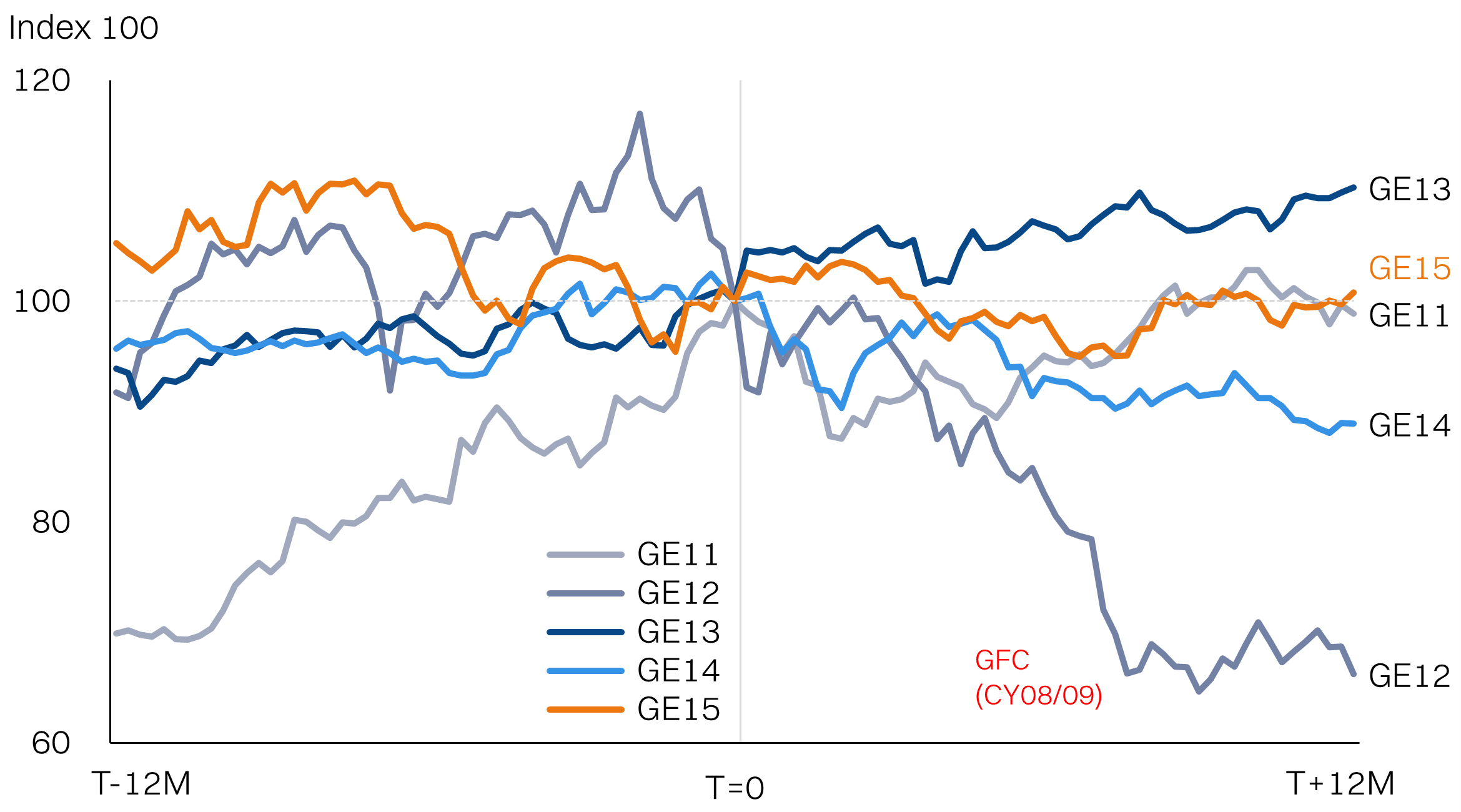

Looking back at the market’s reaction to prior elections, we can see that the run-up to GE15 was particularly volatile, with a ~15% swing in the KLCI index with the risk tilted to the downside. In contrast, both GE13 and GE14 saw more steady appreciation. The key difference with the lead up to GE15, was that the outcome of the election was more unpredictable given the shuffle in political coalitions ahead of polling and the high number of candidates contesting each seat. And of course, the prospect of a hung parliament and more political stalemate.

However, most of the concerns quickly evaporated. Despite a hung parliament, PH and BN were able to come together and anchor a unity government in relatively short order - only 5 days. The efficacy of the union could be debated, but the market has enjoyed relative political stability post-GE15, especially compared to the volatility of 2018-2022. Recall, the KLCI was volatile ahead of GE15 with a ~15% swing in the lead up. But with the experience of GE15 in hand, we anticipate market could be less reactive to the political noise this time around.

In summary, we expect an earlier ramp up in political uncertainty ahead of the GE16 election cycle. Market sentiment should also be less reactive, even if re-rating is more likely post-election.

KLCI vs election cycle: pre-GE15 saw ~15% swing in the KLCI

Beyond the broader sentiment drag, we anticipate the rising political uncertainty could affect the market in two main ways.

Populism paralyses policy reforms:

- It might be pure coincidence, but the government earlier this week announced a one-year extension for e-invoicing (for businesses between RM1m and RM5m revenue) as well as the reduction service tax for rentals among micro, small and medium enterprises. Even if the potential collections are relatively small, both moves will hurt tax collection and hints at waning resolve for unpopular broad-based revenue measures. In short, 2025 could be the peak year for fiscal reforms.

- Ironically, the continued pressure on oil prices (Brent now hovering at US$60/bbl) has undercut the efficacy of the fuel subsidy reforms - reducing the savings on subsidies while petroleum revenues cool.

- With limited fiscal headroom to navigate and rising need to repeat populist cash transfers, we anticipate upside surprise from government spending on infrastructure projects could be underwhelming. We anticipate infrastructure projects will underwhelm as a catalyst for the construction sector.

- Conversely, we see more upside for public-private partnership opportunities, and flag LSH as a potential beneficiary. LSH is already proposing several PPP highway alignments in Selangor together with partner IJM.

- On the other hand, we see consumer staples as a beneficiary of any cash handouts. In particular, we flag 99Speedmart as well as Nestle given the exposure to basket of goods eligible for the RM100 SARA distribution.

Sabah & Sarawak gain more leverage:

- Both Sabah and Sarawak state governments are proving increasingly cohesive, even as a hung parliament remains a likely outcome of GE16 (which we define as core Peninsula coalitions not being able to secure simple majority in Parliament.

- In fact, a key feature of the current unity government is the ability for BN and PH to marginally form a unity government with a simple majority (112 seats combined) on their own. But based on the poor results of the 2023 state elections, this will likely be tested in GE16. Even a marginal loss of seats would make the coalition with Sabah and Sarawak a requirement to control parliament.

- With more bargaining power, we anticipate incremental fiscal allocation to the aforementioned states, but typically these moves are not significant for stocks. However, a more rapid resolution of the Petronas-Petros negotiations could be a catalyst for the broader upstream O&G investments, which could be a boost for the beaten-up O&G offshore services sector.

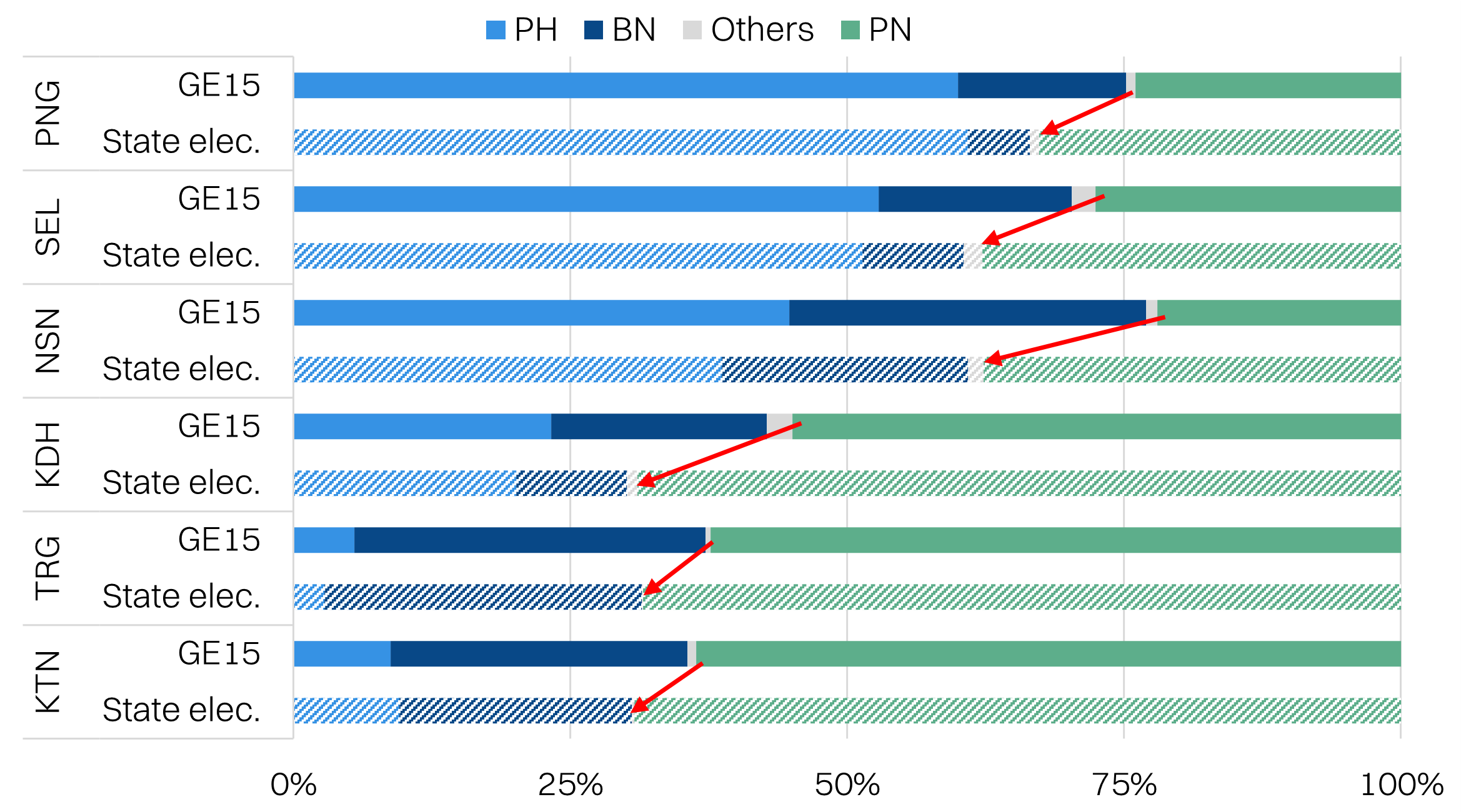

Share of votes, GE15 vs 2023 state elections: PN gained +10ppt vote share

Sectoral performance

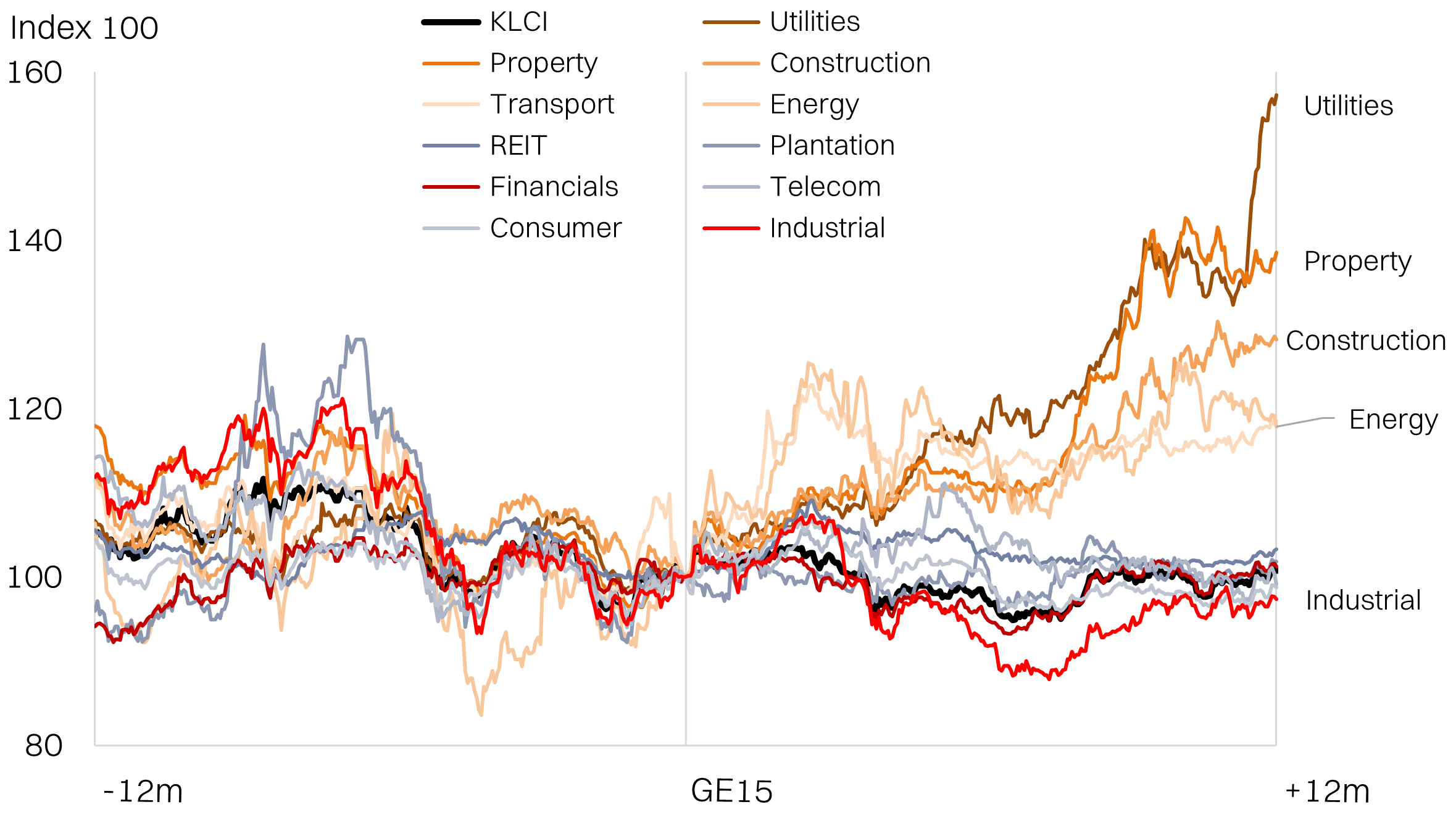

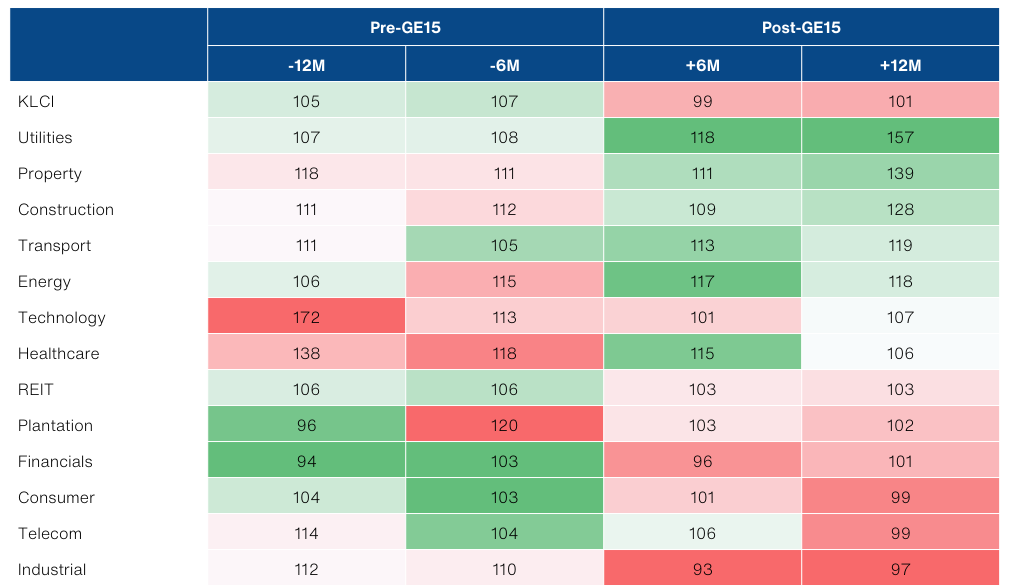

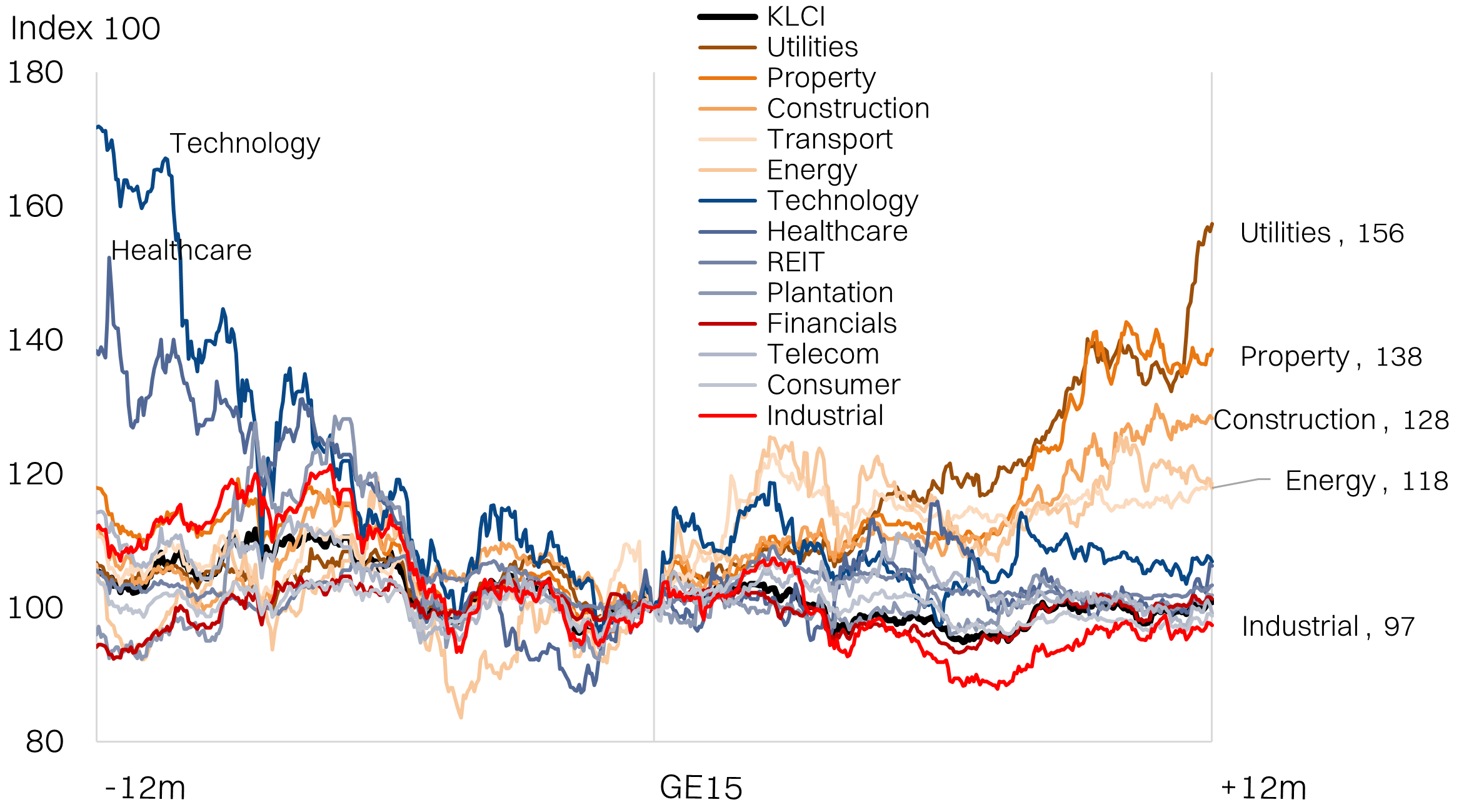

Overall, it appears the more significant rerating only took place after GE15, across selected sectors.

- The best performing sectors post-GE15 were utilities, property, construction, transport and energy. Broadly, most of the major index movements were driven by idiosyncratic drivers behind a few high-weightage stocks. For example, the outperformance of utilities was driven by YTL/YTLP. This rally was triggered by YTLP’s tentative foray into AI DC that was formally announced in Oct 2023 - the partnership with NVIDIA. The property sector outperformance was one that enjoyed a broad-based support from its constituents, underpinned by continued post-pandemic recovery in launches and sales.

- The worst performing sectors were industrials, telecoms, consumer and financials. Aside from telcos which had to contend with the policy uncertainty around the Digital Nasional Bhd deployment of 5G, broad-based macro-dependent sectors were laggards. Also worth noting that tech’s underperformance pre-election was due to the cyclical post-pandemic slowdown in demand for consumer electronics.

Bursa sectoral indices performance; GE15 = Index 100

Bursa sectoral indices performance; GE15 = Index 100

Key stocks:

Within our coverage, we like LSH for its exposure to PPP projects. In an environment where fiscal resources are stretched, private sector-funding is more critical to get infrastructure projects going. IJM is also a key partner for LSH to develop such highways in Selangor.

Leaning on government populism (cash handouts), we expect to see continued support for consumer staples but note that valuations are elevated.

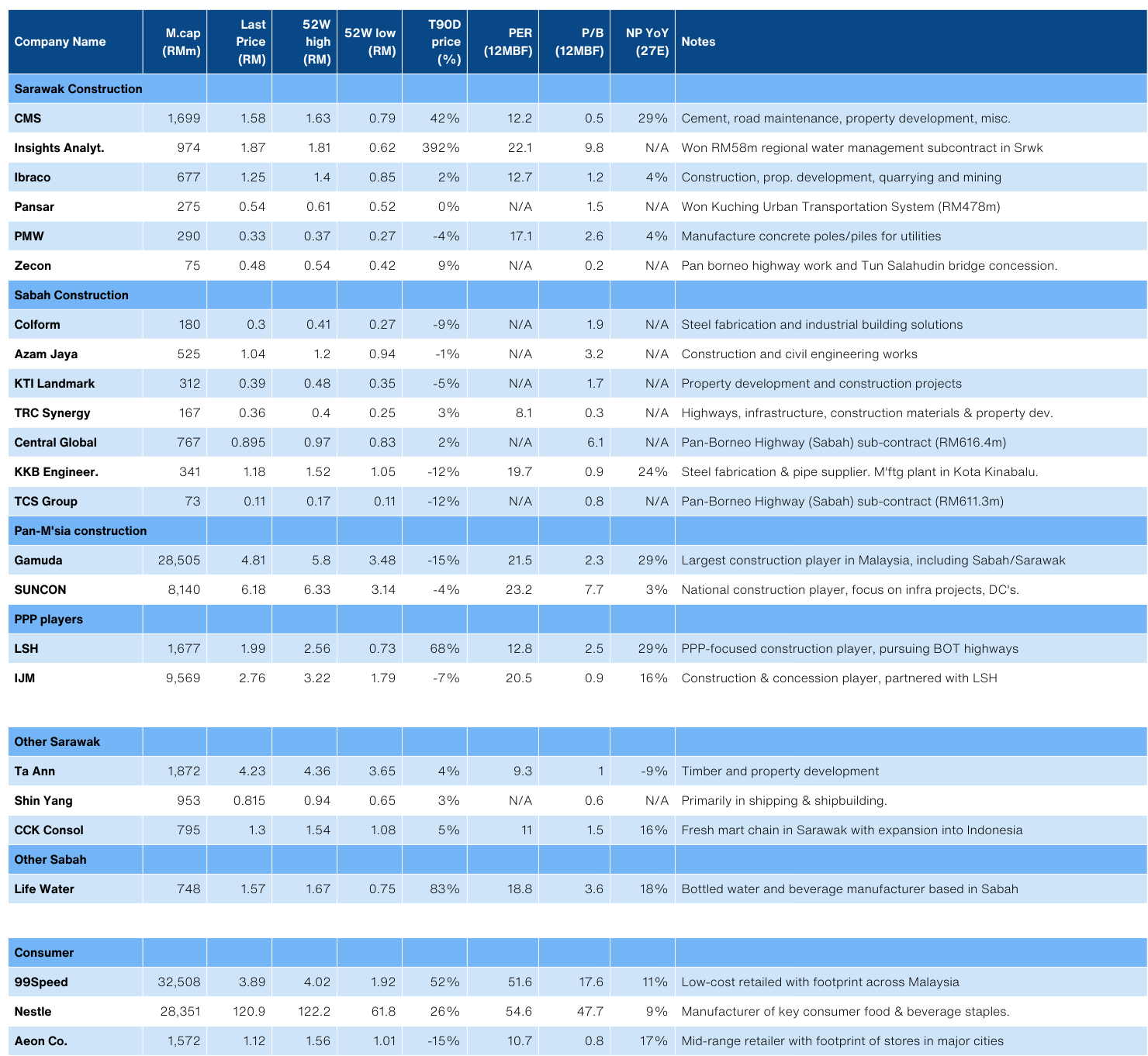

From the names compiled below, we can see the Sabah/Sarawakian construction companies are trading at relative discounts to the Pan-Malaysian giants like Gamuda and Suncon. This suggests there could be more room for sentiment-led re-rating. Some names have already moved on news flow of new contract awards, like Insights Analytics.

Stocks in focus

A recap on the state of politics in Malaysia

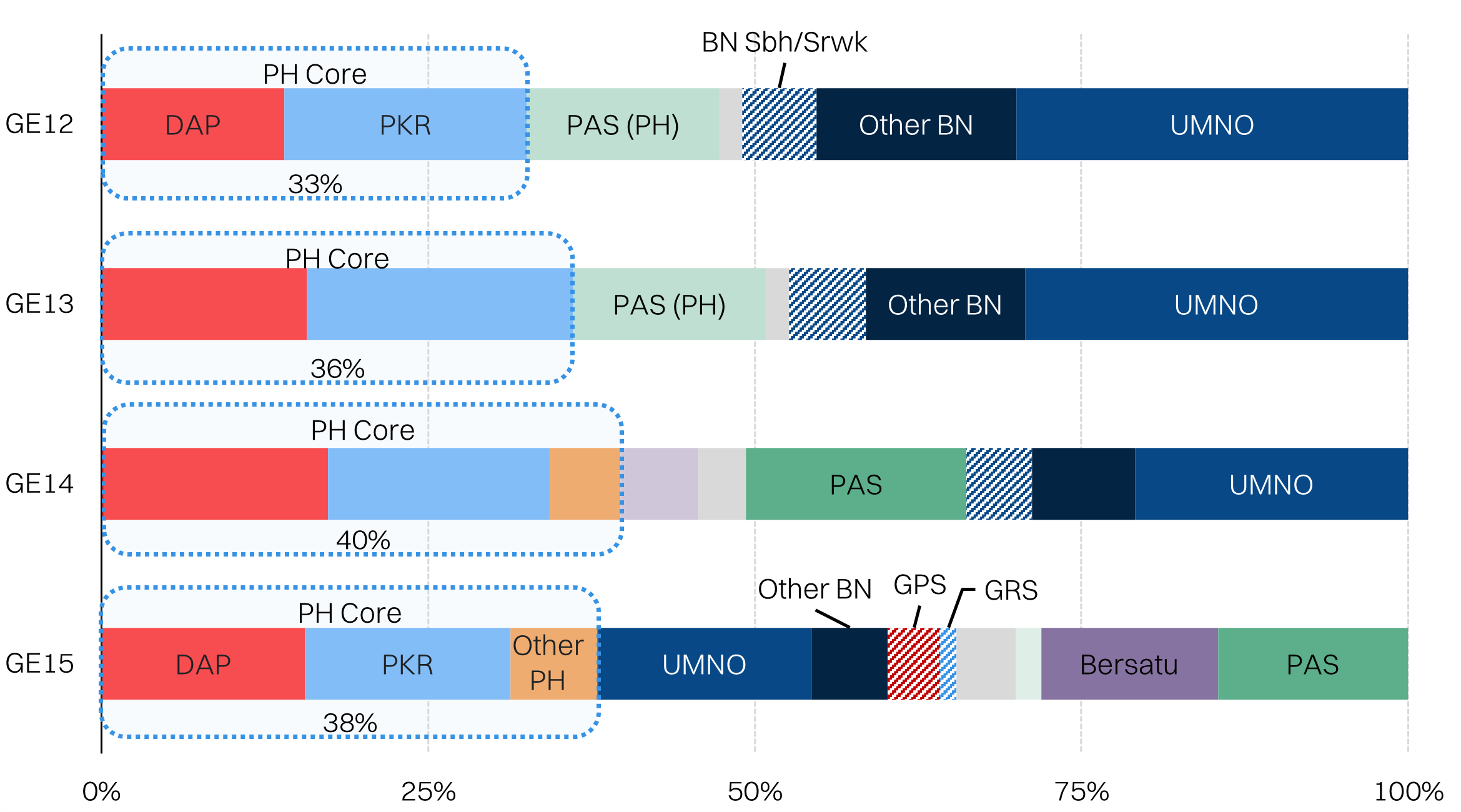

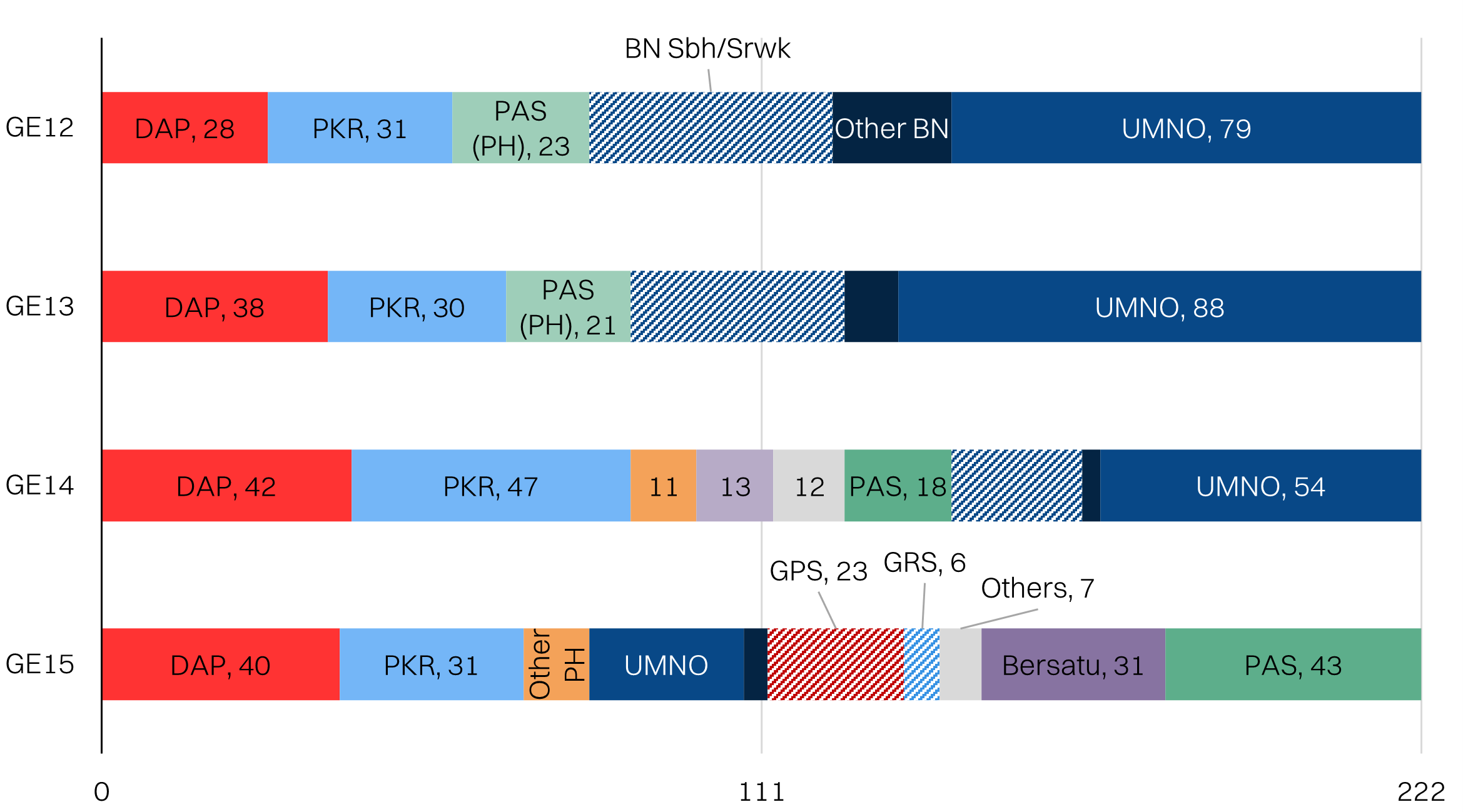

GE15 marked a significant shift in Malaysia politics when it resulted in a hung parliament. PH saw a drop in vote share for the first time since GE11 and PAS under the PN banner bagged the single largest block of seats at 43.

Looking back: GE11-14 could be characterized as the gradual consolidation of the opposition chipping away at the once dominant incumbents, BN. We’d distill this era of politics by the oppositions mostly pro-reform and anti-BN rhetoric that culminated in a vote against the 1MDB corruption scandal that finally toppled BN in 2018. Another key trend during this period that weakened BN was the fragmentation of the ethnic Malay vote that had 3 or more candidates contesting.

What changed: GE15 saw a consolidation of the Malay vote with PAS and Bersatu working together under the PN banner, which drove the huge losses by UMNO and PKR. Without a clear establishment to rally against, political rhetoric became more polarized and charged along nationalist and racial issues. Interestingly, PAS’ gain in parliamentary seats (+11ppt) disproportionately outperformed the -2ppt drop in vote share compared with GE14.

Share of votes cast: PH lost vote share in GE15

Share of parliamentary seats: PAS and Bersatu gained the most ground

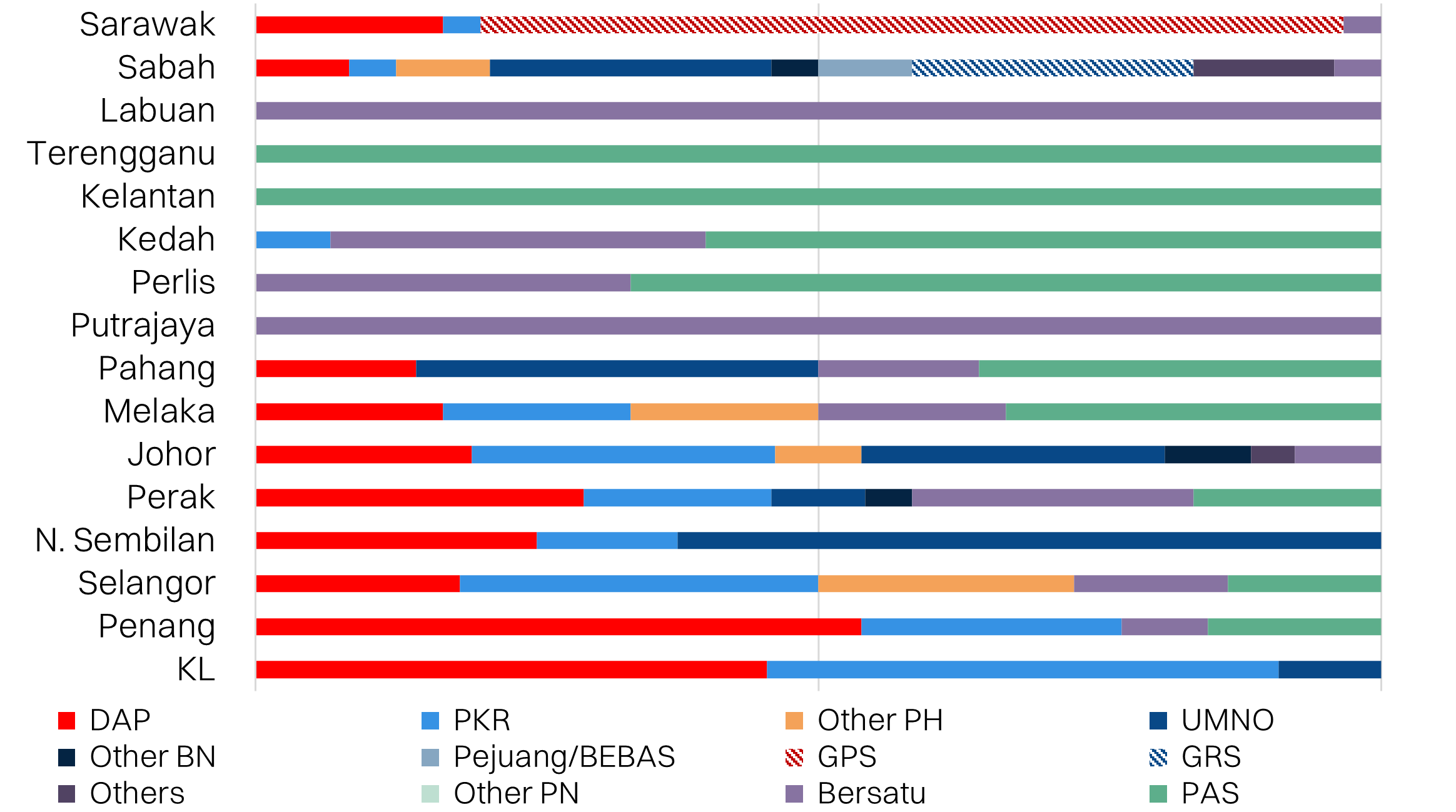

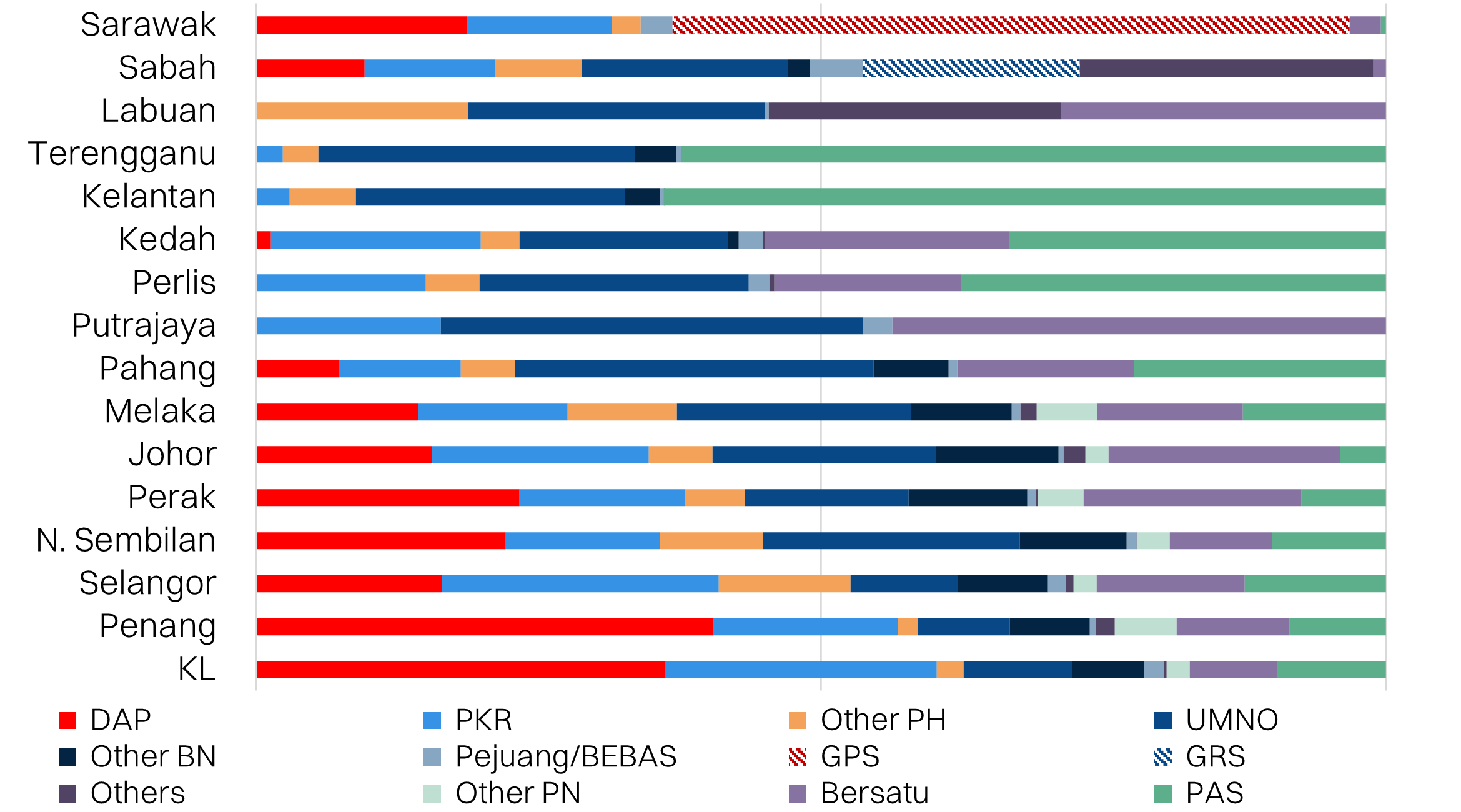

GE15 recap: Election outcome by state

The big swing in parliamentary seats in Terengganu, Kelantan, Kedah and Perlis is also solidifying PAS’s position in the northern states. Meanwhile, PH remains highly entrenched in the more urbanized states with larger non-Malay demographics. In turn, this leaves Pahang, Perak, Melaka and Johor as the key battleground states.

At the same time, both Sabah and Sarawak should continue to see the trend of Borneorization develop. DAP’s big loss in the Sabah state election likely a taste of things to come, as Peninsula-based parties lose relevance in the Borneo states.

Parliamentary seats by state: Demographic divide

Share of parliamentary votes: PAS and Bersatu gained the most ground

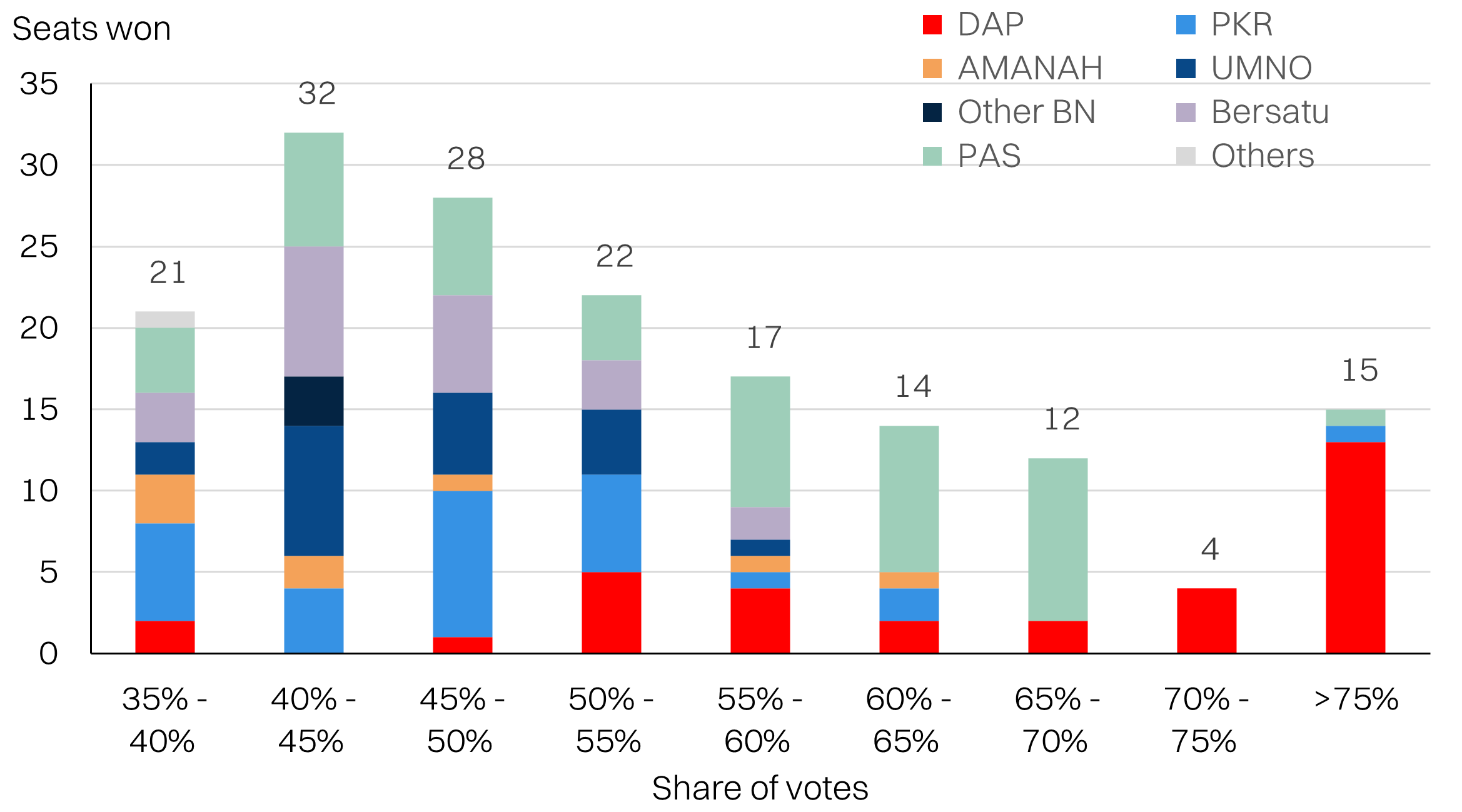

GE15 recap: Narrow margins

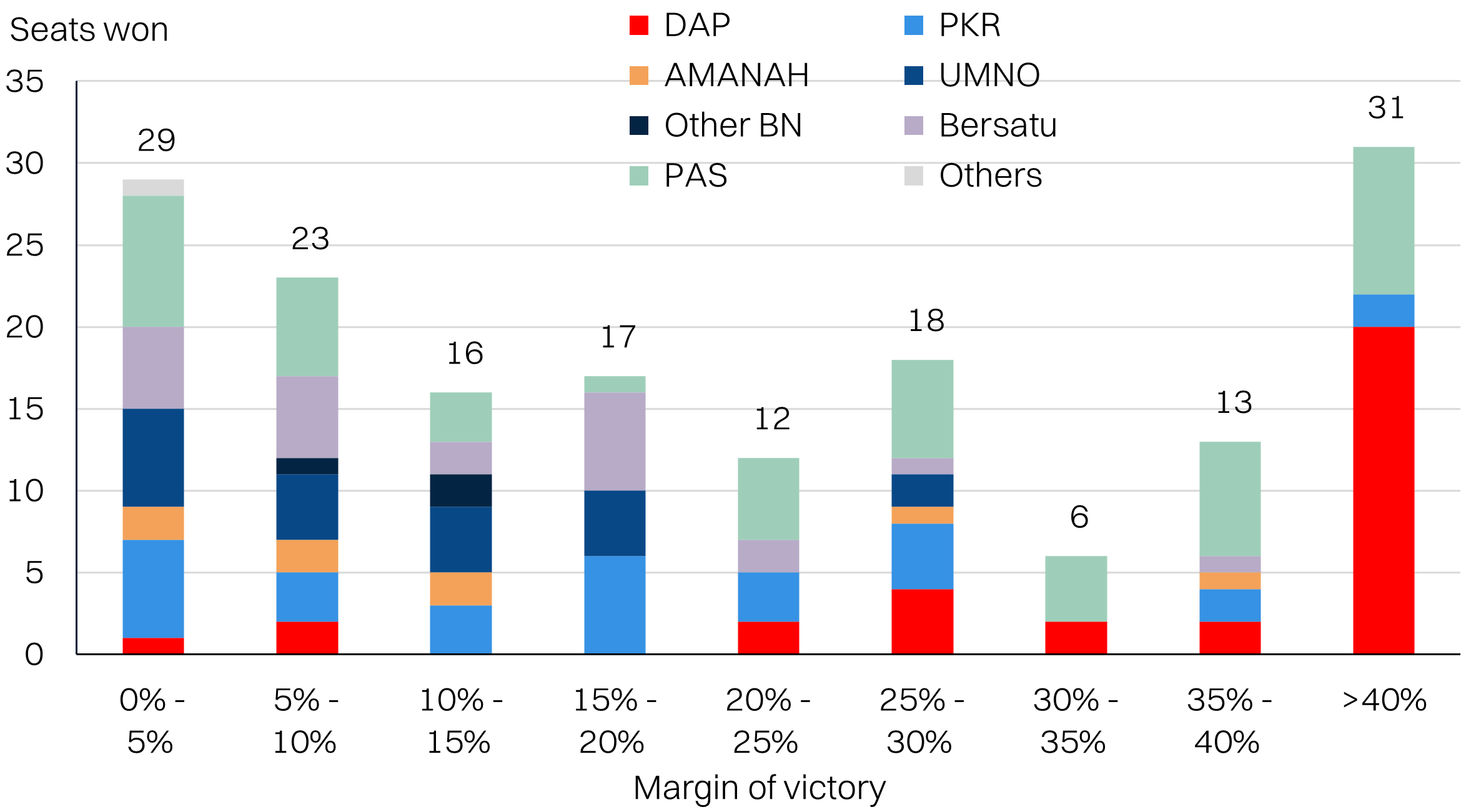

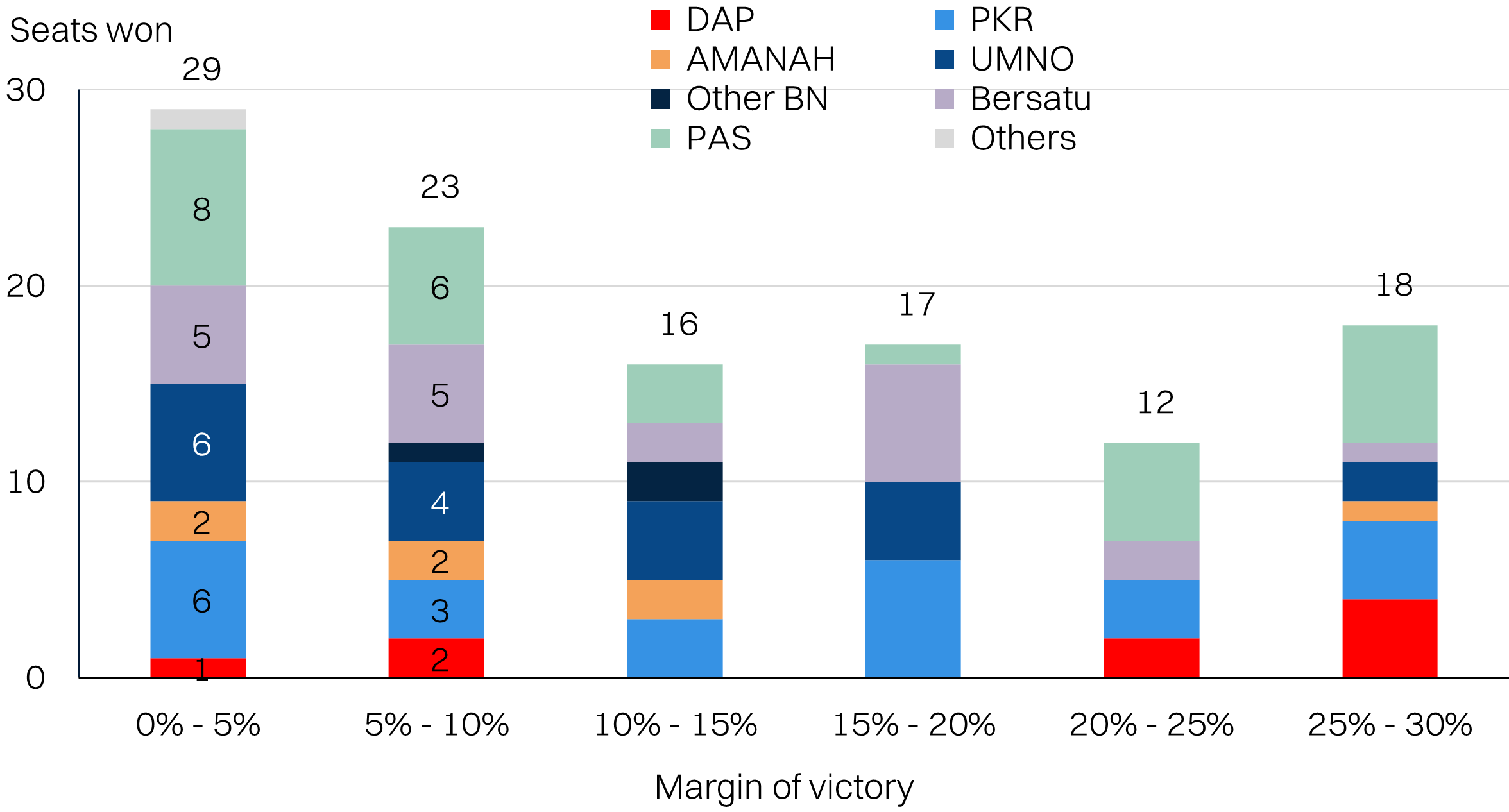

There are approximately 50-60 swing seats in Peninsula Malaysia that will be the key battleground for GE16. Overall, it looks like UMNO and Bersatu face the most pressure to defend swing seats, followed by PAS and PKR.

GE15 saw a whopping 53 seats won with less than 45% of the votes due to multi-cornered fights splitting the votes. These are seats that could swing dramatically if the number of parties contesting is reduced. Interestingly, the bulk of the swing seats won in GE15 were by PN - roughly 40% of said seats. But proportional to the total seats won, only 22% of PAS’ seats are marginal. In contrast, 50% of Bersatu’s seats are marginal, 63% for AMANAH, 34% for PKR and 50% for DAP. DAP has relatively low exposure at 6%.

Another way to measure swing seats are those that were won by <10% margin. Again, PAS and Bersatu have the most marginal seats combined, followed by UMNO and PKR. However, as a proportion of total seats won, 50% of UMNO’s and AMANAH’s seats are marginal by this measure.

Share of votes (Peninsula): 53 seats won with <45% of votes

Margin of victory (Peninsula): 52 seats won with <10% margin of victory