Regional datacenters on the horizon

KJTS is partnering with a China State Construction Engineering subsidiary to pursue cooling projects in the region.

Stock information

KJTS

KJTS - 0293.KL

TRADING BUY

Target price: RM2.00

Last price: RM1.20

Market cap (RMm): RM828m

Shares out: 690m

52-week range: RM0.87 / RM1.81

3M ADV: RM1.1m

T12M returns: 34%

Disclaimer: By using this information, you hereby acknowledge that you are fully and solely responsible for evaluating the merits and risks of any investment decision and agree not to hold NewParadigm Research fully liable whatsoever for any actions, omissions and/or damages of any kind or matter arising from such decision.

Key takeaways

- KJTS has signed a collaboration agreement with China Construction Third Engineering Bureau to pursue regional datacenter projects.

- We estimate several prospects are being pursued regionally with a combination of EPCC and/or project ownership.

- Securing a sizable project outside of Malaysia would be a re-rating catalyst for KJTS. Maintain Trading Buy.

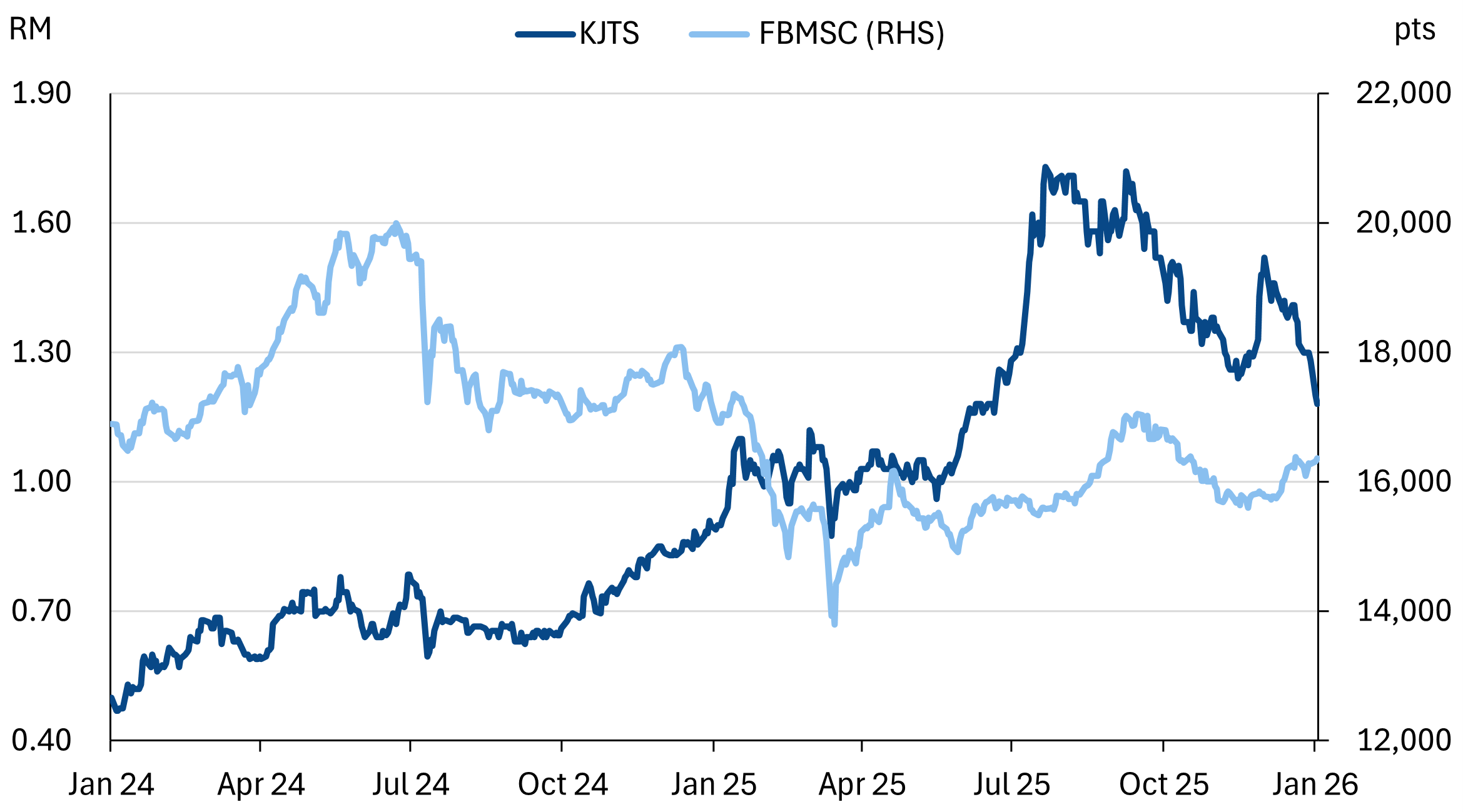

Share price performance

Investment fundamentals

| RMm | FY24A | FY25E | FY26E | FY27E |

|---|---|---|---|---|

| Revenue | 138 | 186 | 222 | 280 |

| Revenue Growth | 15% | 35% | 20% | 26% |

| EBITDA | 12 | 28 | 35 | 44 |

| EBITDA margin | 9% | 15% | 16% | 16% |

| PATAMI | 15 | 21 | 30 | 42 |

| PATAMI margin | 11% | 11% | 13% | 15% |

| ROA | 10% | 12% | 13% | 15% |

| ROE | 13% | 16% | 19% | 23% |

| PER | 70 | 51 | 36 | 26 |

| P/BV | 9.2 | 8.2 | 7.0 | 5.9 |

| Yield | 0.0% | 1.0% | 1.0% | 2.0% |

Source: Company data, Bloomberg, NewParadigm Research, January 2026

Looking at regional opportunities

- KJTS’s collaboration agreement with China Construction Yangtze River (Malaysia) Sdn Bhd (CCYR) paves the way for KJTS to break into regional datacentre projects, particularly in Thailand, Singapore and Turkey. The deal will tie up both parties to exclusively work with one another on selected projects.

- CCYR is a wholly-owned subsidiary of China Construction Third Engineering Bureau Co. Ltd. (CCTEB) that in turn a wholly-owned subsidiary of China State Construction Engineering Corp Ltd (601668 CH) - a RMB209bn market cap company.

- CCYR’s scope will be for the civil and structural works related to cooling and building services, architectural and construction works, and integration of other systems.

- KJTS’s scope will be on the EPCC of cooling/heating systems, energy management systems and potentially facilities management as well.

- We anticipate this MOU paves the way for KJTS to expand its funnel of prospective cooling projects, particular overseas and in the datacenter segment. Currently, KJTS does have some DC work, but nothing recurring.

- Details are scarce, but management has indicated that the scale of projects being pursued will be sizable. Furthermore, there is potential for projects with an asset ownership structure to be rolled into the Lestari Cooling Energy (LCE) associate.

Still waiting for newsflow

- Lack of constructive newsflow has weighed on KJTS stock and hurt our thesis. This is primarily due to delays in finalizing the additional anchor investors for LCE as well as new contract wins.

- We continue to position KJTS as a newsflow-driven stock first but one that is underpinned by a solid recurring cash flow operations.

- Key catalysts for the stock include the aforementioned signing of the anchor investor for LCE as well as new contract wins. Additionally, securing new projects regionally via the new collaboration with CCTEB should be a further re-rating catalyst. It would demonstrate KJTS’ ability to expand outside of Malaysia as well as into the datacenter space

- Maintain Trading Buy with a target price of RM2.00.