Short-term stay with long-term growth

EXSIM HOSPITALITY

EXSIMHB | 1287.KL

NOT RATED

Fair value: RM0.33

Last price: RM0.275

Market cap (RMm): RM604m

Shares out: 2,322m

52-week range: RM0.22 / RM0.29

3M ADV: RM0.4m

T12M returns: 13%

Disclaimer: By using this information, you acknowledge that you are solely responsible for evaluating the merits and risks of any investment decision and agree not to hold NewParadigm Research liable for any damages arising from such decisions.

Key takeaways

- Mana Mana is scaling from ~1,500 rooms currently to ~6,000 be end-FY27 as well as another ~900 rooms across 3 key hotel/resorts.

- We estimate earnings will grow by ~20% to RM41.6m by FY27E, albeit still anchored by the design and fit-out arm.

- The transition from a contractor towards hospitality services should attract higher valuations. At our target multiple of 18x, EXSIMHB will have a fair value of 33sen/share.

- See also: our VM26 thematic report.

Share price performance

Investment fundamentals

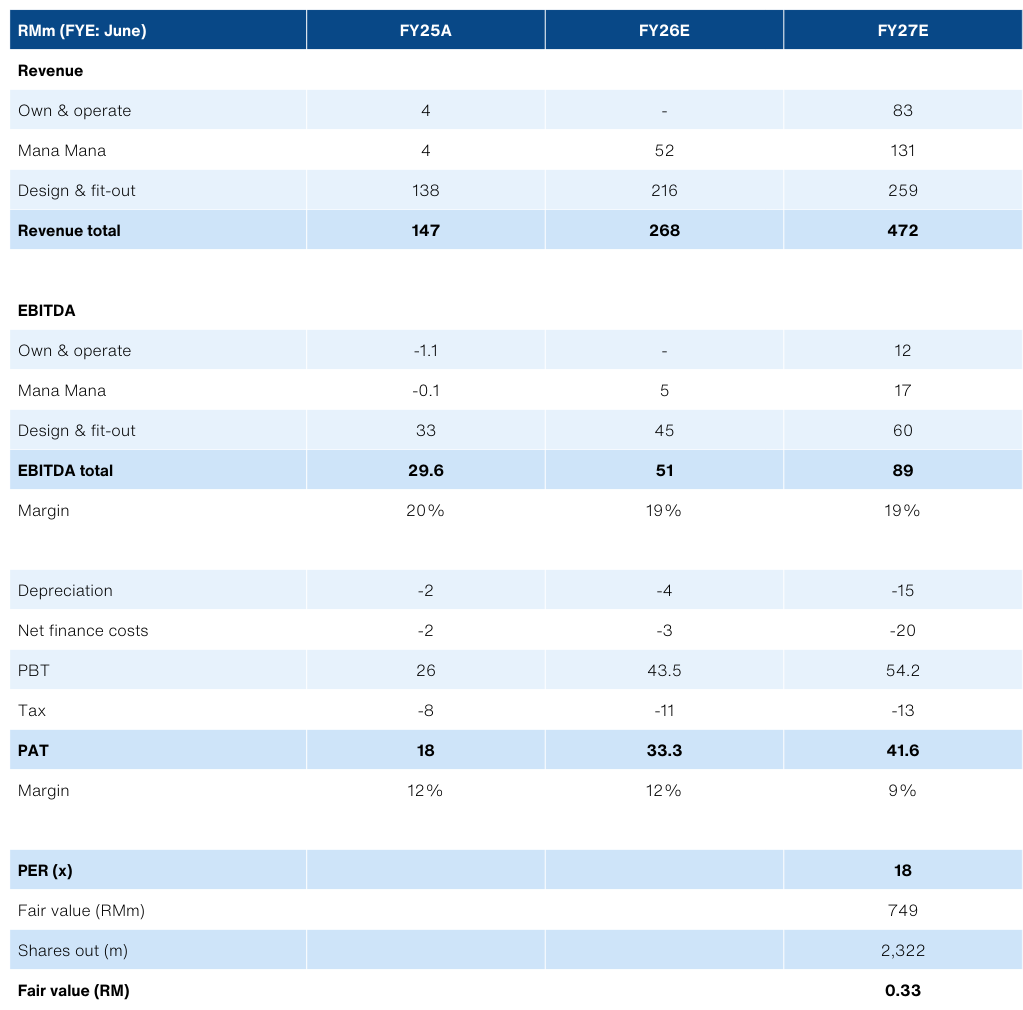

| RMbn (FYE JUNE) | FY25A | FY26E | FY27E |

|---|---|---|---|

| Revenue | 147 | 268 | 472 |

| Growth YoY | 2473% | 83% | 76% |

| EBITDA | 30 | 51 | 89 |

| Margins | 20% | 19% | 19% |

| Adj NP | 18 | 33 | 42 |

| Margins | 12.0% | 12.0% | 9.0% |

| PER | 41.5 | 22.5 | 18.0 |

Source: Company data, NewParadigm Research, February 2026

Room to grow

- EXSIMHB is transitioning rapidly from a primarily contractor-focused business towards hospitality services.

- Historically, the design and fit-out segment was the primary earnings driver for EXSIMHB. It was an orderbook business that was driven by upstream property development volumes, particularly from broader EXSIM group.

- But by end-FY27E EXSIMHB will boast a portfolio of almost 7k rooms across its asset-light Mana Mana business model as well as the more capex intensive own-and operate reports and hotels.

- Rooms under management (Mana Mana) is slated to grow by almost 4x to 6,000 units by end-FY27E. We estimate this asset-light but low-margin arm will contribute about RM17m in EBITDA by FY27E.

- Critically, this segment has good visibility for growth. Based on the pipeline of EXSIM developments (sister company, property developer), management estimates that EXSIMHB can expand its room base to 10,000 in the next 3-5 years.

- This scale-up is highly synergistic for the design and fit-out unit, that offers the renovation services to prospective buy-to-lease investors that fund the underlying rooms for EXSIMHB. This segment will be further boosted by management’s plans to expand into centralized procurement of household appliances and building materials, which we assume will be supported by the broader EXSIM group.

- While the aforementioned operations are relatively asset-light, EXSIMHB is also in the process of refurbishing the 200-bed beachfront Corus Paradise Resort in Port Dickson as well as a yet-unnamed 5-star hotel at Empire City Damansara with ~294 rooms. We estimate that these properties will be able to generate about RM55m in revenue in FY27E, even with both are still ramping up.

20% growth for FY27E

- We estimate EXSIMHB can deliver ~20% NP growth for FY27E, even with conservative margin assumption of 9% (FY25/26E: 12%). Against this trajectory, a target multiple of 18x FY27E would ascribe a fair value of 0.33sen/share.

- EXSIMHB is scheduled to report 2QFY26 results this evening (13 Feb) after market close.

About the Company

EXSIM Hospitality Bhd (EXSIMHB) is a hospitality services provider that is vertically integrated with design and fit-out services.

EXSIMHB started out as the interior design and fit-out arm of the private property developer of its namesake, EXSIM. It has since branched into a predominantly asset-light short-term stay operator under the brand Mana Mana, as well as owning-operating 3 major hotel/resort assets.

The group taps into the designed-for-purpose developments from EXSIM group as a funnel for new properties to manage, as well as driving revenues for its design and fit-out arm. And leaning on growing portfolio of rooms-under-management, EXSIMHB then looks to opportunistically pull in other third party En bloc hotels to operate.

About the Stock

EXSIMHB is the result of reverse takeover of Pan Malaysia Holdings Bhd in 2024 by the EXSIM Lim brothers - Lim Aik Hoe, Lim Aik Kiat, and Lim Aik Fu - that now hold a 72.56% stake in the company. The broader EXSIM group is primary involved with property development.

EXSIMHB was initially injected with the design and fit-out operations of EXSIM, followed by the Mana Mana operations. EXSIMHB has subsequently funded growth via a RM250m rights issuance (completed Dec 2025) with the bulk of the funds utilized for its own-and-operate segments - Corus Paradise Resort in Port Dickson and Empire City Damansara’s hotel.

Investment Idea

EXSIMHB may not be a direct play on Visit Malaysia 2026, given its strong skew to domestic budget travelers. Nonetheless, the group offers unique exposure to the market of short-term stay hospitality, and one that is scaling rapidly in the coming years.

EXSIMHB will be scaling up from ~1.5k rooms currently to almost 7k by end-27E. Meanwhile there are plans to add another 6,400 rooms over the next 3-5 years under the asset-light Mana Mana arm, driven by the funnel of EXSIM group developments.

Another potential catalyst is the state government’s discussion around banning short-term rentals, that will hurt Mana Mana’s competitors. EXSIMHB is largely shielded from this risk due to its operating structure, which is expected to remain unaffected. If such a policy is implemented, individual short-term rental operators may shift toward managed platforms like EXSIMHB, providing upside to room supply and management fees.

Key Risks

- EXSIMHB has a high reliance on new property launches by EXSIM to drive its funnel of Mana Mana properties as well as the design and fit-out business.

- EXSIMHB is bringing a large supply of short-term stay into the market over the next few years. If demand is not able to keep up, it might translate into lower room rates or occupancy rates that will weigh on already-thin margins.

Own & operate segment to add ~500 rooms in FY27

The primary utilization of EXSIMHB’s capital is in the refurbishment of two major properties - The Corus Paradise Resort in Port Dickson as well as the unnamed 5-star hotel in Empire City Damansara. Management is investing ~RM360m into both properties which will have a total of ~500 rooms.

We anticipate a modest first-year revenue contribution of RM55m across both properties, on modest 62%/55% occupancy rates respectively, with room to surprise on the upside. Both assets are currently not contributing.

Corus Paradise is scheduled to reopen in 2H26. This hotel located in Port Dickson, Negeri Sembilan which focus on middle market segment, offering a range of four-star services across corporate events and family holiday-goers. We assume an average daily rate (ADR) of RM280 and occupancy of ~60%, implying ~RM12m in FY27E room revenue.

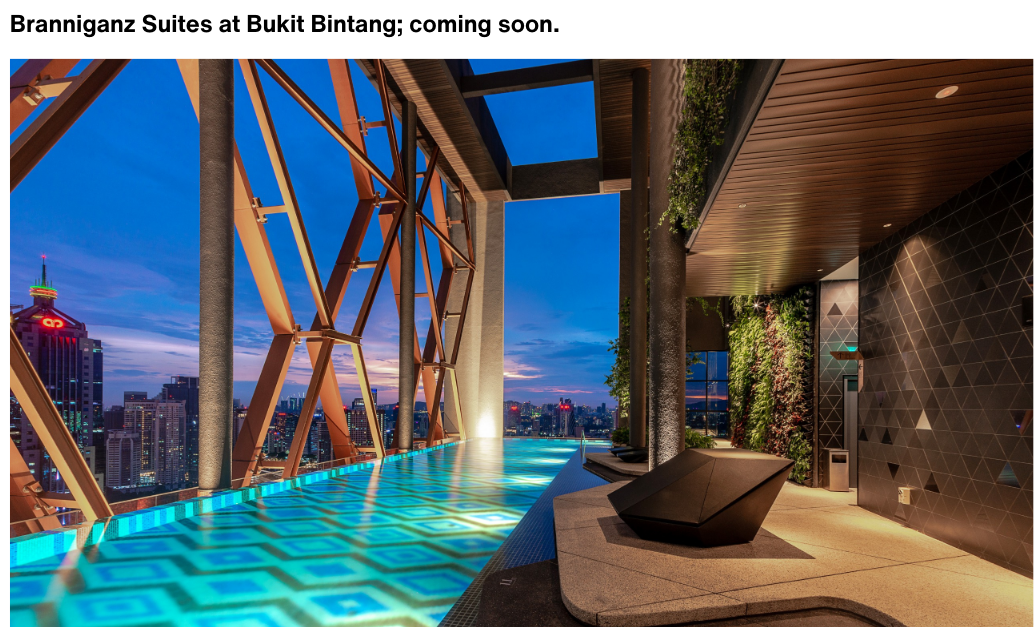

Meanwhile, the acquisition of Tower E (Empire City) expands the group’s hotel portfolio. Given its 5-star positioning and strategic location in Klang Valley. We estimate 55% occupancy in the first year. Beyond room revenue, banquet and event operations are expected to contribute approximately 30% of total hotel revenue, providing incremental upside and a more diversified income base.

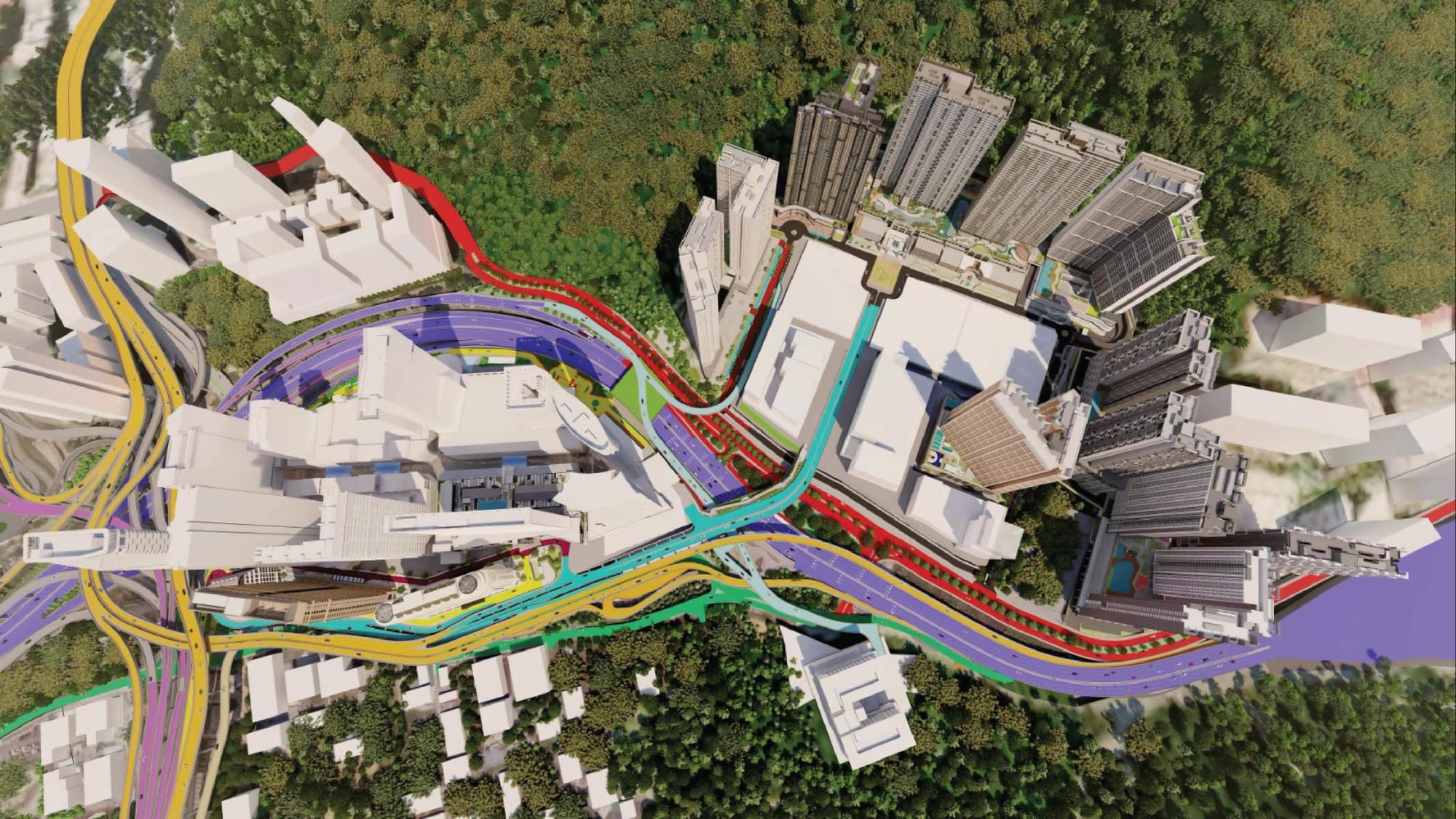

Five-Star Hotel in Empire City Damansara near LDP, DASH and Penchala Link

Asset-Light Growth: Mana-Mana Expansion

EXSIMHB’s most unique segment is the asset-light hospitality services segment that is primarily captured under the Mana Mana brand.

This segment functions as a short-term stay operator for property owners. Mana Mana takes a 20% operators’ fee, after deducting any platform fees (e.g. Agoda/Airbnb) as well as direct costs - utilities, cleaning and maintenance, unit wear and tear, etc. Management guides that the typical room will be able to generate ~RM300/month, net to Mana Mana.

Critically, Mana Mana is solely focused on built-for-purpose developments under commercial titles that are developed by EXSIM group. This means that property investors are presented with the option of the managed short-term stay model even at the point of buying the property. In turn, design and fit-out of the units are made to a consistent standard for visitors, with the capex paid for by the property investor. This allows for significant cost savings due to procurement and renovation due to scale. Additionally, since said buildings are designed with this use in mind, there are purpose-built hospitality front desk, shared amenities and other support facilities included in the development itself.

Importantly, the segment benefits from a defensive regulatory moat. The portfolio is predominantly comprised of commercial-titled, purpose-built hospitality assets, which insulates the group from tightening state-level restrictions on residential short-term rentals (e.g., stay caps or operating bans).

With an average room rate of RM130-150, Mana Mana is heavily skewed towards the domestic mass-market segment, albeit with higher emphasis on quality of experience. While not a direct beneficiary of Visit Malaysia 2026 as a theme, VM14 did show a strong rise in domestic tourism in-tandem with international inbound arrivals. See our thematic report here.

In terms of scale, management is guiding that Mana Mana will grow from the current ~500 rooms in operation to >4,000 by end-FY26. Currently the group is focused on Klang Valley, Perak and Penang. It will be expanding to Terengganu, Pahang, Kelantan, Melaka, Johor, Sabah and Sarawak over the next year or so. Longer term, the funnel of new rooms will be supported by the EXSIM group and management is indicating Mana Mana could scale to >10,000 rooms within the next 5 years.

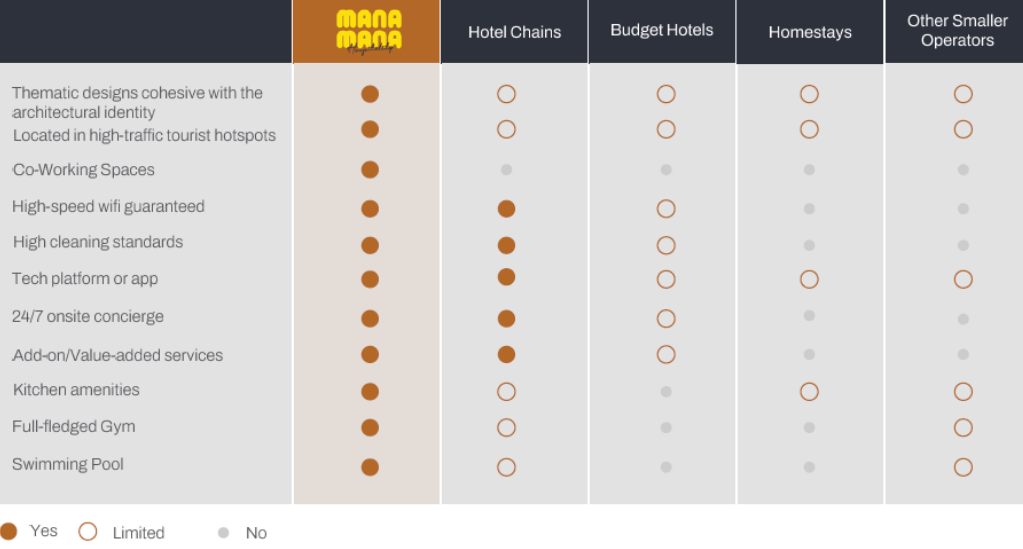

Mana Mana’s value proposition

Mana Mana in pictures

Source: EXSIM Hospitality, February 2026

Concepto as the group’s core earnings driver, for now

EXSIM Concepto is the design and fit-out unit of EXSIMHB. It has been primary earnings engine for the group and will remain so for the next 2-3 years. Supported by jobs almost entirely from the EXSIM group’s property development projects (and related parties), Concepto has amassed an orderbook of RM365m, which is ~1.7x coverage vs our estimate of RM216m revenue for the segment in FY26E.

This unit includes the fit-out of units for Mana Mana projects as well as building temporary showroom units for the EXSIM group. It does have some third-party contracts as well. Recent examples include the fit out of a domestic commercial bank branch. However, relative to the related party projects, these tend to be small.

A growth driver for the segment is the group’s recent proposal to diversify its principal activities into general contracting and centralised procurement. This will include procurement of appliances, for example, as part of the fit out of Mana Mana units. While this should be a relatively low-margin trading business, it should have a decent revenue ceiling. Management has indicated that the potential scale of this new unit could be as much as 25% of total group net profits. We assume this will similarly leverage the sizable procurement of the EXSIM group to drive revenues.

This is the only segment with a meaningful earnings base to use as a reference point, and we have assumed 20% YoY revenue growth, supported by the aforementioned orderbook. We have yet to incorporate the new general contracting and centralised procurement unit in our assumptions.

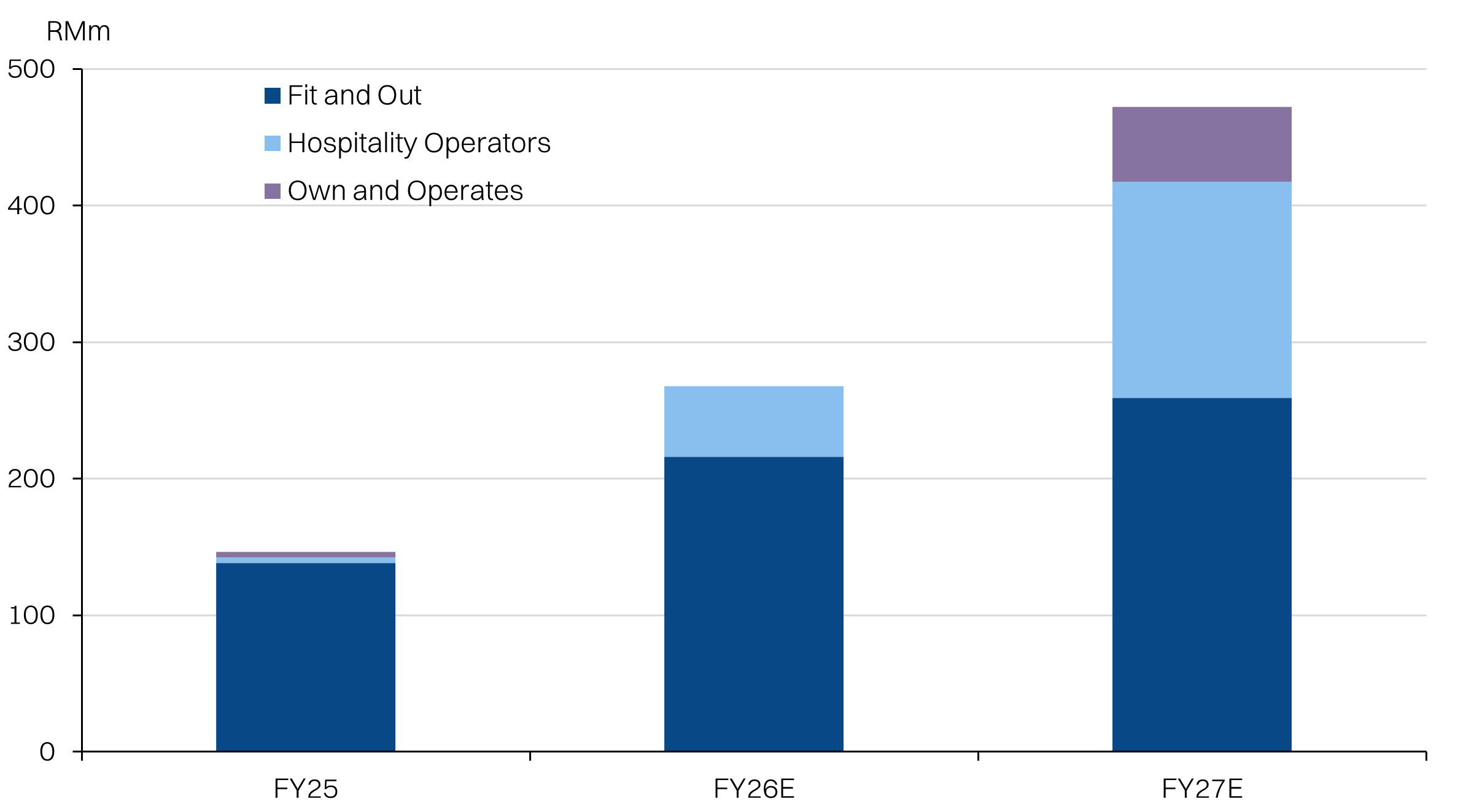

Top-line growth anchored by Concepto

Fair Value : RM0.33

EXSIMHB is a little tricky to value, given its historic valuations are not representative of the evolving business model of the company going forward. Furthermore, with limited consensus coverage (only 1) of the stock, forward expectations are relatively thin. Looking back, EXSIMHB is better classified as a sort of construction stock, given its dependence on the design and fit-out segment. It is a business that is orderbook-based and driven by property development activity upstream.

Looking ahead, the shift to a hospitality services company should attract higher valuations, especially if EXSIMHB is able to execute well and deliver the strong double-digit growth from portfolio expansion. For context, the KL Construction Index has an average PER of 15x. Even as the closest domestic peer, Genting Malaysia (GENM) is probably a poor comparison given the high reliance on gaming as well as its international footprint. Another imperfect comp is Airbnb, given the similar asset-light hospitality model, which has an average PER of 29x.

We estimate that EXSIMHB can deliver about RM42m in NP for FY27, which is about +20% growth. However, note that EBITDA is growth at a brisk +75% YoY. The gap is largely due to the increase finance and depreciation costs with the own & operate hotel/resorts, that will only be in their first year of operations. As these operations mature, we expect the yield on these assets to improve and translate to better net margins as well.

Against this earnings momentum, we think an 18x PER multiple is a reasonable target at 0.8x PEG. In turn, our fair value for EXSIMHB is 33sen.

Fair Value : RM0.33

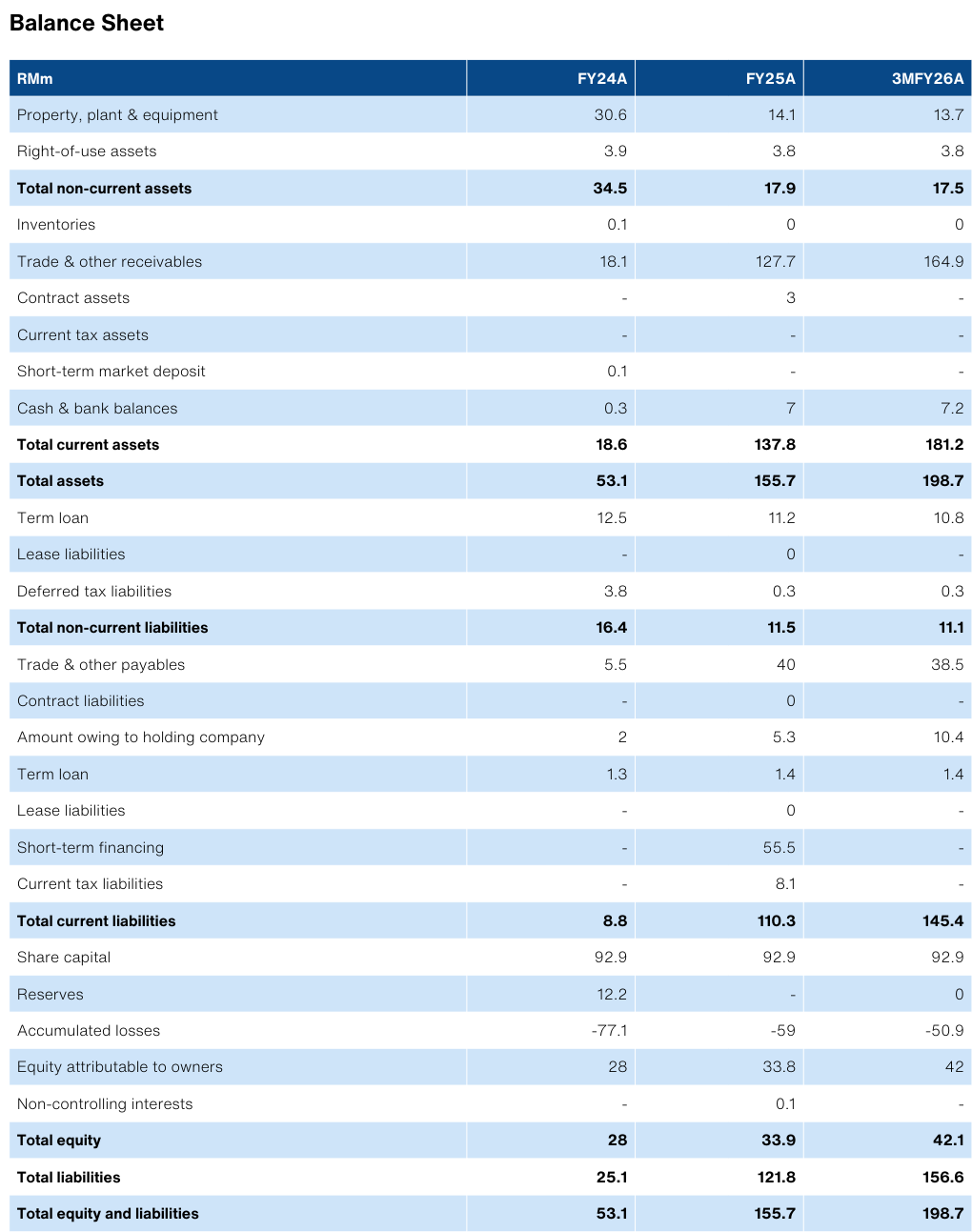

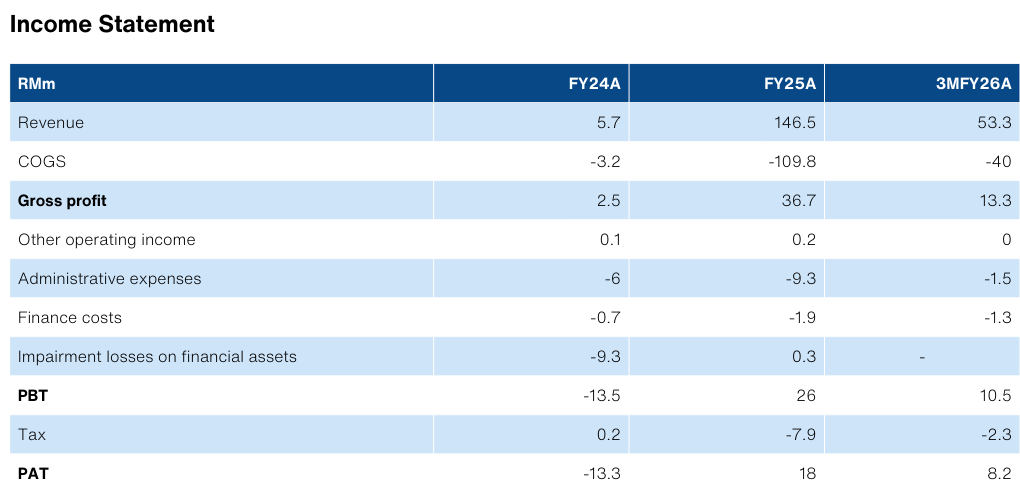

Selected financials

Source: Bloomberg, Company data, NewParadigm Research, February 2026