Tapping the excursionist trend

Roughly 1m Singaporean day-trippers visit Malaysia each month and Kopi has 7 outlets in JB.

ORIENTAL KOPI HOLDINGS

KOPI | 0338.KL

NOT RATED

Fair Value: RM1.65

Last price: RM1.35

Market cap (RMm): RM2,700m

Shares out: 2,000m

52-week range: RM0.63 / RM1.61

3M ADV: RM5.9m

T12M returns: 51%

Disclaimer: By using this information, you acknowledge that you are solely responsible for evaluating the merits and risks of any investment decision and agree not to hold NewParadigm Research liable for any damages arising from such decisions.

Key takeaways

- In addition to inbound tourism, Kopi offers unique exposure to the surge in Singaporean excursionists (+70% vs 2019), particularly in JB.

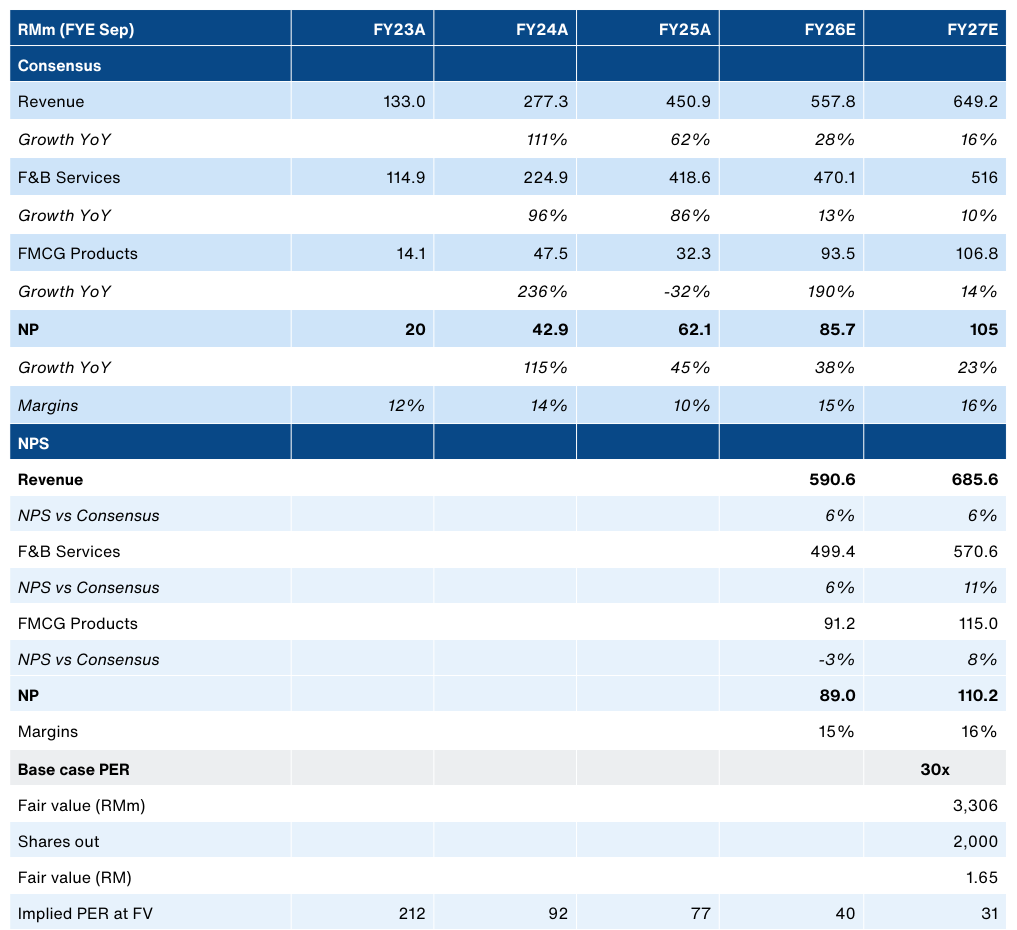

- However, we concede that there is less room for earnings to surprise on the upside; we estimate FY26/27E could have 4-5% upside only vs consensus expectations.

- Regardless, it still translates to ~40% NP CAGR (FY24-27), which will be supportive of valuations. At a FY27E multiple of 30x (+0.8SD), the potential FV would be RM1.65.

- See also: our VM26 thematic report.

Share price performance

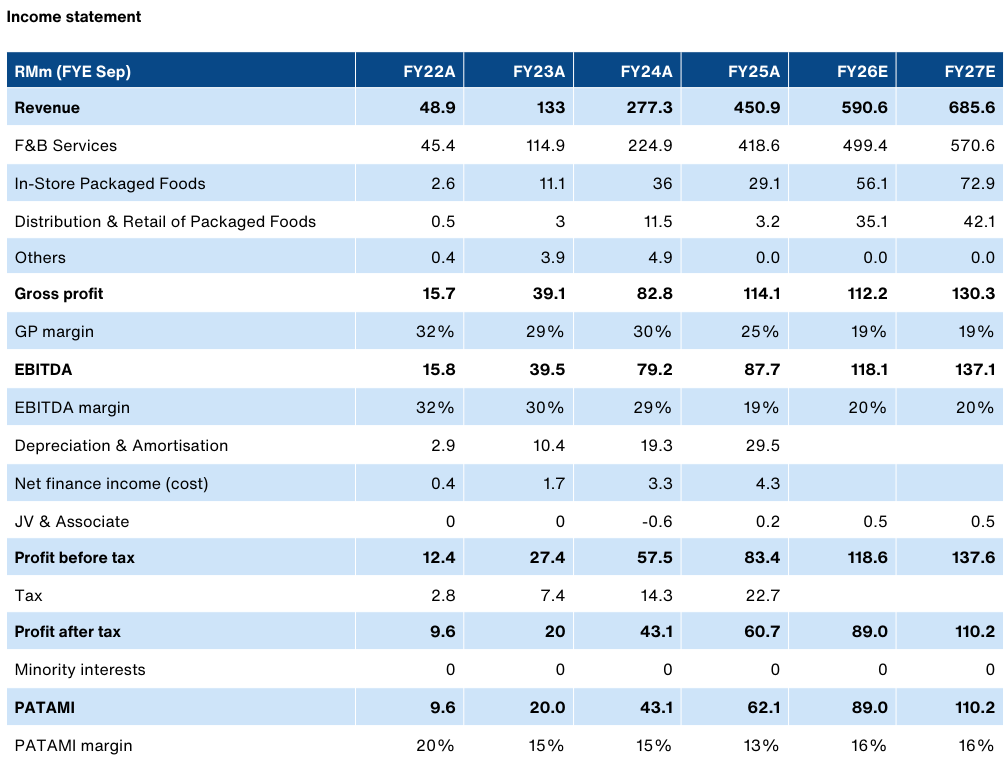

| RMbn (FYE SEP) | FY24A | FY25A | FY26E | FY27E |

|---|---|---|---|---|

| Revenue | 277.3 | 450.9 | 590.6 | 685.6 |

| Growth YoY | 111% | 62% | 36% | 16% |

| Gross Profit | 82.8 | 114.1 | 112.2 | 130.3 |

| Margin | 30% | 25% | 19% | 19% |

| EBITDA | 79.2 | 87.7 | 118.1 | 137.1 |

| Margin | 29% | 19% | 20% | 20% |

| Adj NP | 42.9 | 62.1 | 89.0 | 110.2 |

| Margin | 15% | 14% | 15% | 16% |

Source: Company data, Bloomberg, February 2026

Outlet expansion and gateway dominance

- Kopi offers exposure to a Malaysian brand that can tap into foreign tourist arrivals, supported by expansion into high-traffic tourist hubs. Management is on track for 8–10 new openings, with key confirmed sites including Queensbay Mall, KLIA1 and KLIA2 (Departure).

- The 5 airport outlets (some operating 24/7) enjoy ~40% higher profit margins than standard mall-based outlets.

- Additionally, Kopi has unique exposure to increased Singaporean excursionist arrivals that have surged +70% since 2019. Kopi has 7 outlets in JB.

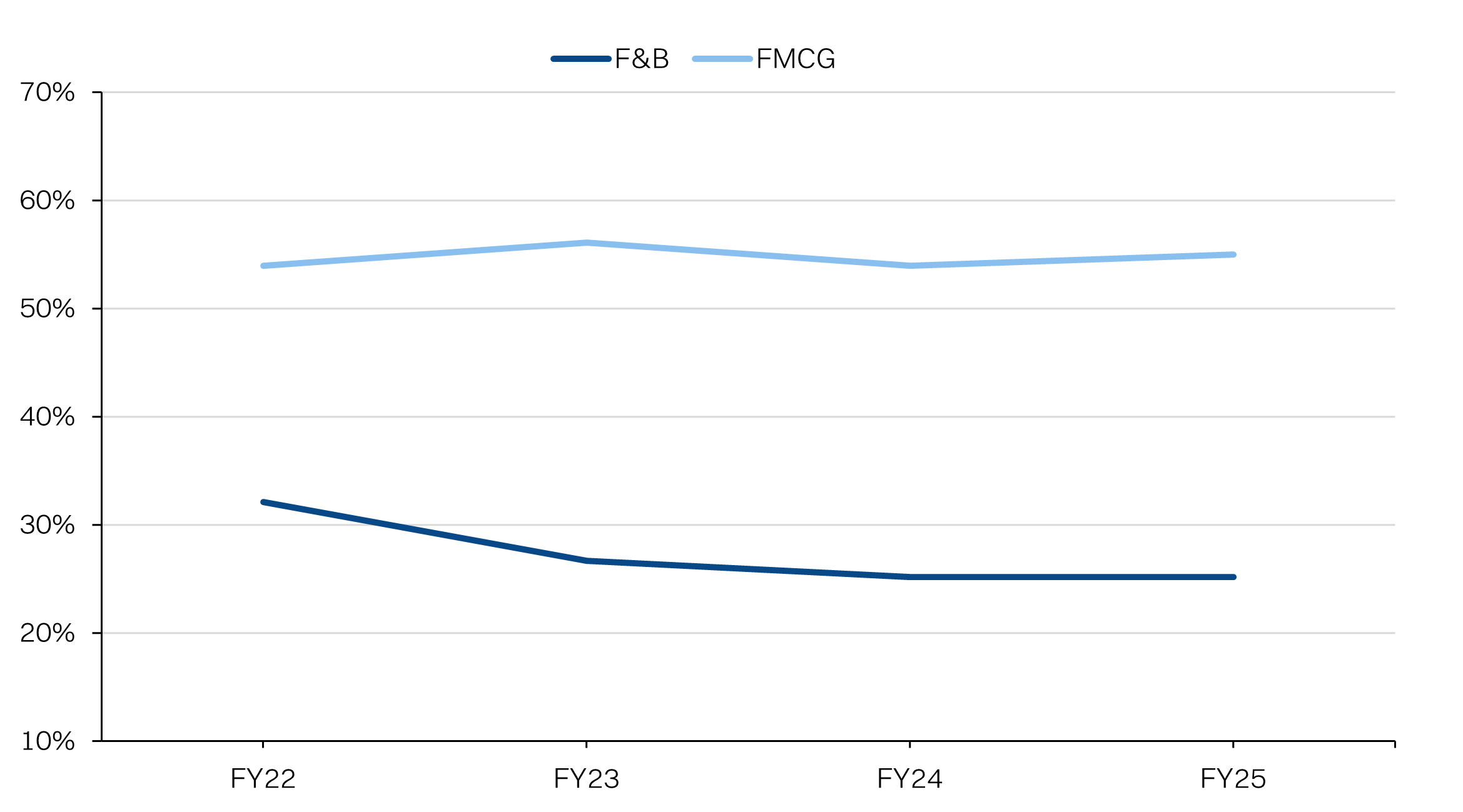

- On the FMCG front, management is also guiding for +20% higher sales from VM26. This is a high margin segment, with a ~50% GP margin compared with F&B’s ~25%.

- One initiative to boost FMCG sales has been the partnership with Tourism Malaysia for the “Rasa Malaysia” campaign. This positions Kopi’s products as a showcase of authentic local Malaysian flavors.

Valuation play

- Admittedly, Kopi’s revenue drivers are well-covered. Between the 10 outlets-per-year expansion plans and push to leverage VM2026, our own revenue estimates are only about 6% above consensus for FY26/27. We have assumed higher yields for the gateway and JB locations. In turn, our earnings upside is only 4-5% compared with consensus.

- That said, Kopi is still on-track to grow at a brisk +40% 3yr CAGR (FY24-27) and has been executing its expansion plans well thus far. We anticipate Kopi will be more about rolling forward current multiples to drive upside for the share price.

- Our RM1.65 fair value for Kopi is based on 30x FY27E, which is +0.85SD vs the historic average. We think this is justified at 0.75x PEG.

- We foresee the catalyst for the re-rating will be improving sentiment around the Visit Malaysia thematic.

About the Company

Oriental Kopi Holdings Berhad (KOPI MK) is a local Malaysian food quick service restaurant (QSR) player with a fast-moving consumer goods (FMCG) segment as well, particularly for its coffee products. Kopi’s offerings are Halal. Kopi has 31 outlets nationwide and plans to add 10 new outlets each year.

Kopi also holds a 30% stake in its Singapore joint venture with Paradise Group, which owns the remaining 70%. The partnership currently operates three outlets, targeting 8 locations nationwide.

About the Stock

Oriental Kopi is a Shariah-compliant stock that listed on the ACE Market in Jan 2025. The stock is led by founder and MD Dato’ Calvin Chan Jian Chern and controlled via his vehicle, United Gomax Sdn Bhd, which holds a 67.85% stake. Bloomberg data shows institutional shareholding stands at approximately 2.8%.

Investment Idea

We estimate Kopi can deliver ~35% revenue growth this year (6% above consensus), supported by:

- rollout of 10 new outlets, including KLIA.

- capturing more Singaporean excursionist spend in JB; 7 outlets.

- stronger FMCG sales from tourist spend.

Against this backdrop, we think the ~40% earnings CAGR could support rolling forward valuations to 30X FY27E.

Key Risks:

- Earnings expectations are highly dependent on timely rollout of new outlets. Falling short of the 10-outlet/yr target will result in earnings downgrades.

- Kopi may struggle to pass on costs if there is a spike in raw material costs, which could affect margins.

- High growth expectations already priced in, any disappointing earnings delivery could have an outsized negative impact on the stock's valuation and lead to a de-rating.

Tourism Malaysia and Oriental Kopi Launch "Rasa Malaysia" Campaign for VM2026

Unique exposure to Singaporean day-trippers

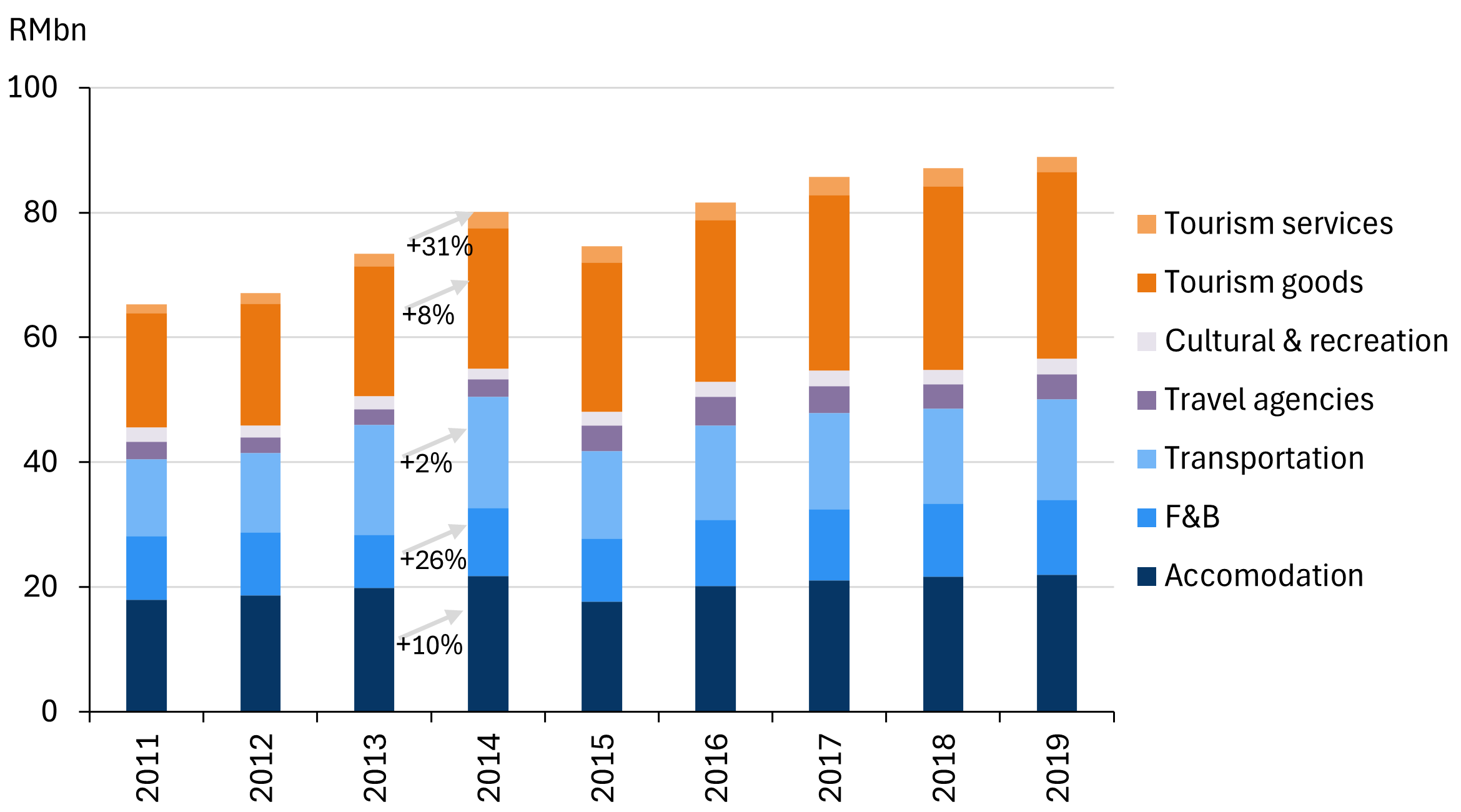

As VM2026 commences, the government is targeting a record 47m visitors, a growth rate of roughly +12% YoY. Based on VM14, the F&B sector enjoyed the highest growth in foreign tourist expenditure. We expect a similar trend this year and Kopi is positioned as a beneficiary. Kopi’s footprint is also well-positioned to capture inbound tourism spend, with outlets across key gateway airports (KLIA, KLIA2) and key tourist locations.

Management guides that a small ~10% rise in passengers leads to a significant increase in F&B sales because travelers have limited dining options. Airport locations also have higher yields with two outlets operating 24 hours a day. This allows them to operate more than twice as long as standard mall stores and generate ~40% profit margins.

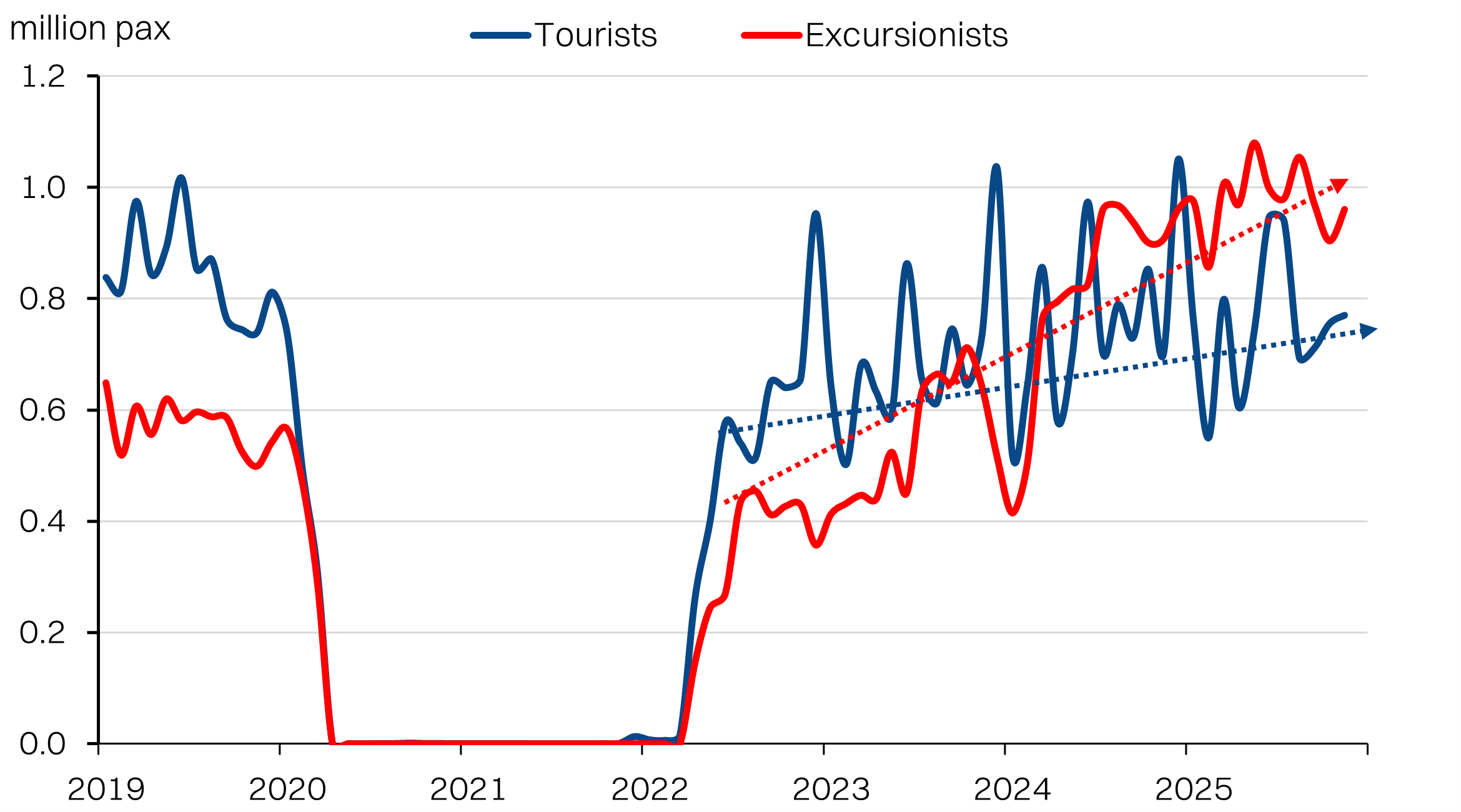

The Singaporean "excursionist" segment has structurally re-rated, tracking 70% above 2019. Kopi captures this via 7 outlets in JB. Management notes that Singaporean customers spend an average of RM60–RM65 per person which is 1.5x to 2.0x higher than local customers. Beyond dining, this premium is catalyzed by the purchase of FMCG products.

Inbound tourism expenditure by product - F&B enjoyed the most upside during VM14

Singaporeans - excursionist arrivals have outpaced tourists

FMCG as the Profitability Anchor

By leveraging the "Rasa Malaysia" partnership (launched on 2026), management is positioning its products as the official gift for the Visit Malaysia 2026 campaign. Kopi is also expanding its offerings, going from 26 to 36 SKUs, is a direct response to "pull" demand from Tier-1 retailers like 7-Eleven, MyNews, and Jaya Grocer.

Management is guiding for 20% FMCG sales this year, riding on tourist demand. Critically, FMCG is a high margin segment - 50% gross margins compared with 25% for F&B.

FMCG GP margins vs F&B GP margins

Beyond tourism

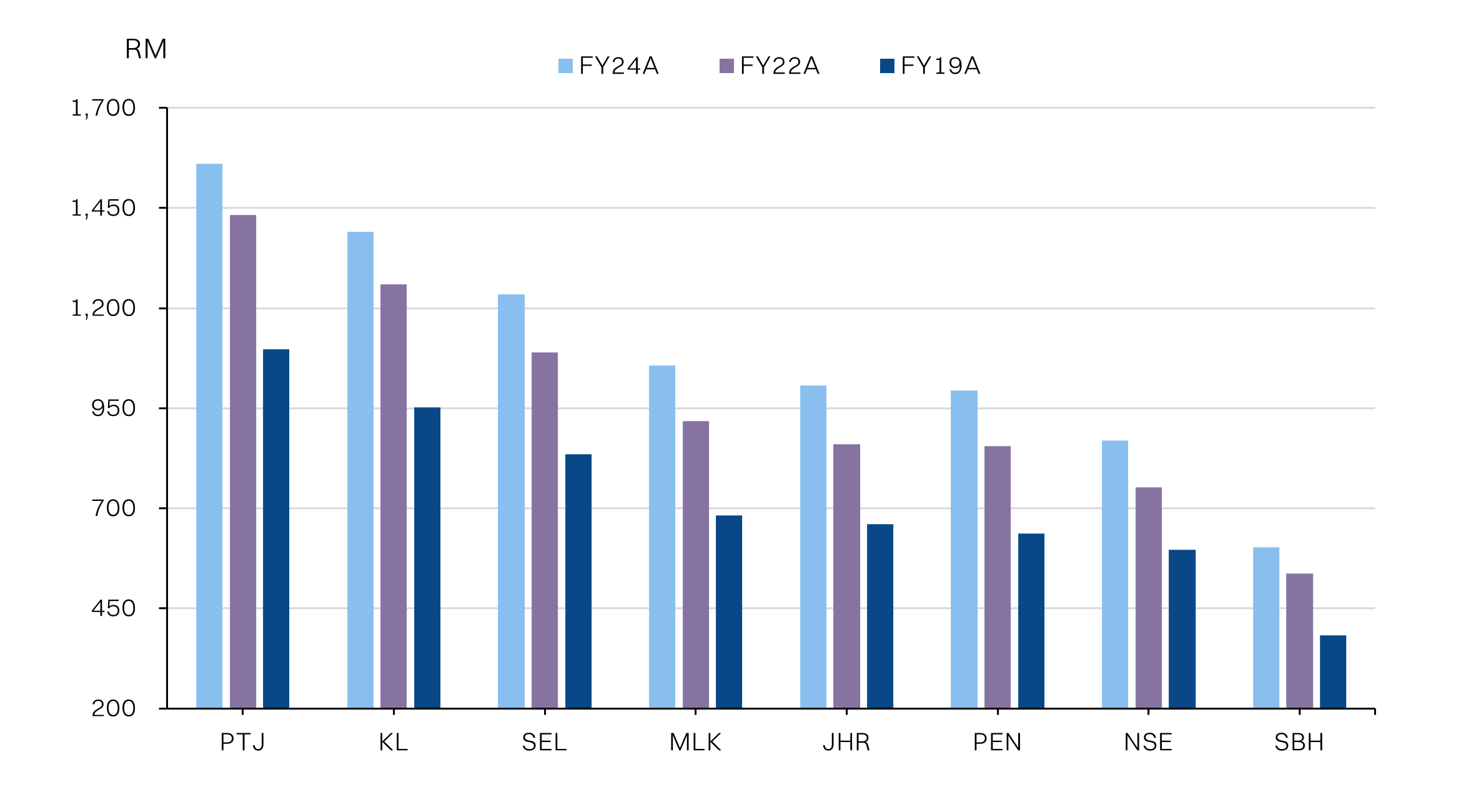

Kopi’s long-term expansion will also give it growth beyond the cyclical VM26 thematic. The shift in household spending to out-of-home dining (+7% CAGR, FY19-24) is a tailwind that supports this expansion. Kopi is also relatively underpenetrated. In contrast, Old Town White Coffee has roughly 180 outlets. Kopi only expanded into Sarawak in 2024 and with plans to open its first outlet in Sabah on March 2026 and additional 2 more in 1Q27.

Average monthly household consumption expenditure on restaurants and cafes.

Marginal earnings upside but higher multiple.

We assumed the outlets located at tourist hotspots (6 locations) will have average revenues +10% stronger than 2025, while the airport locations will be able to average >RM2m/month compared with the RM1.5m/month average for other locations. Coupled with the 20% growth in the FMCG segment, our revenue assumptions came in ~6% above consensus.

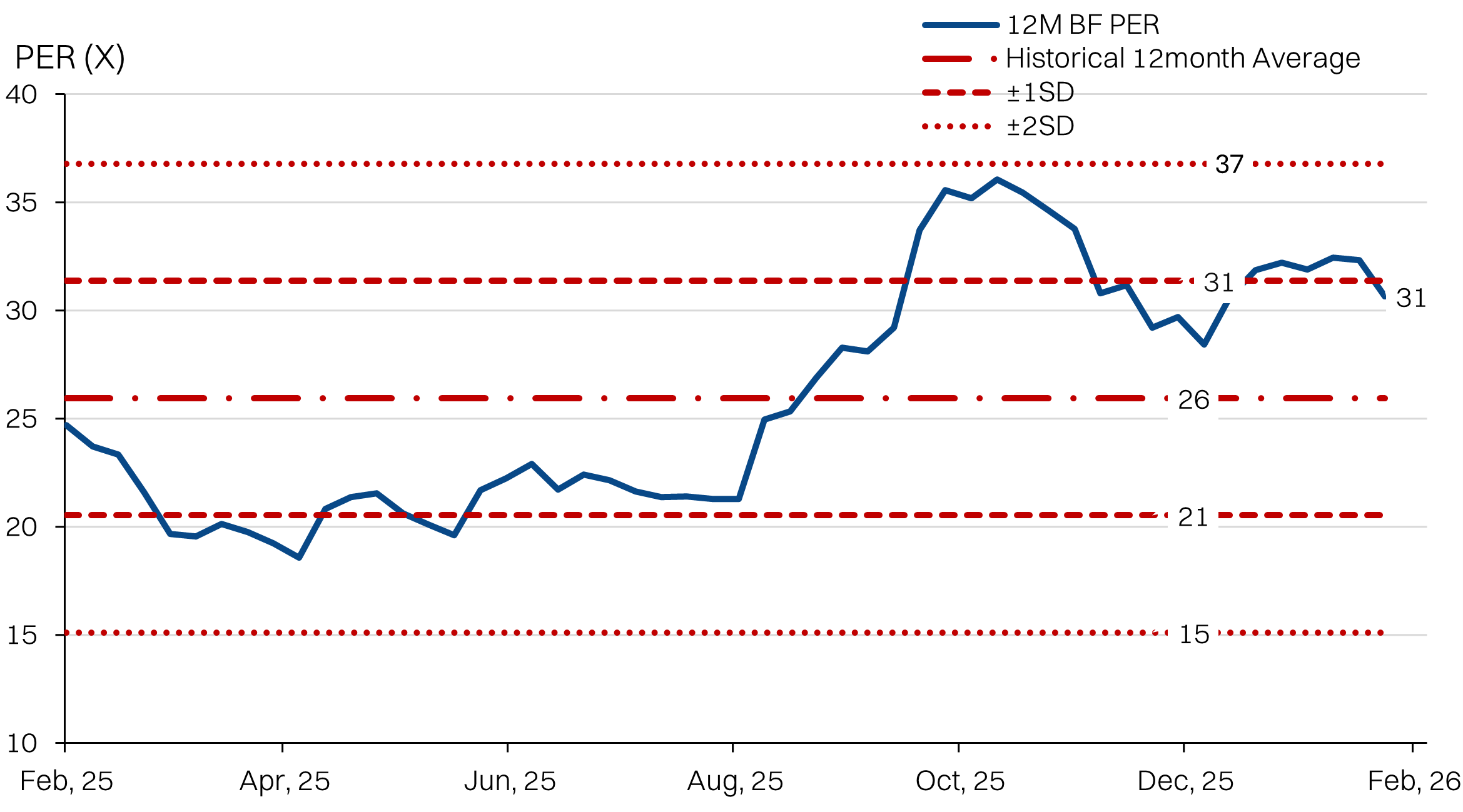

While earnings upside surprise is limited, we anticipate the upside for Kopi will stem from multiple re-rating. Our FV multiple of 30x FY27E implies a FV of RM1.65 or 40x FY26E.

Fair value: RM1.65

Kopi traded at 26x PER on average.

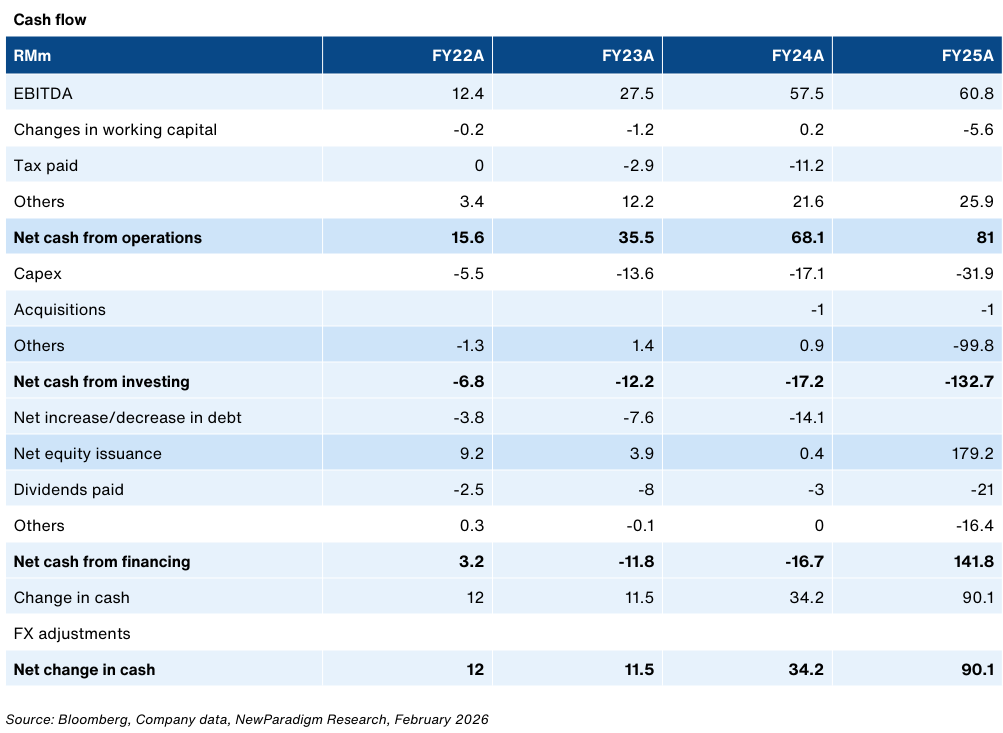

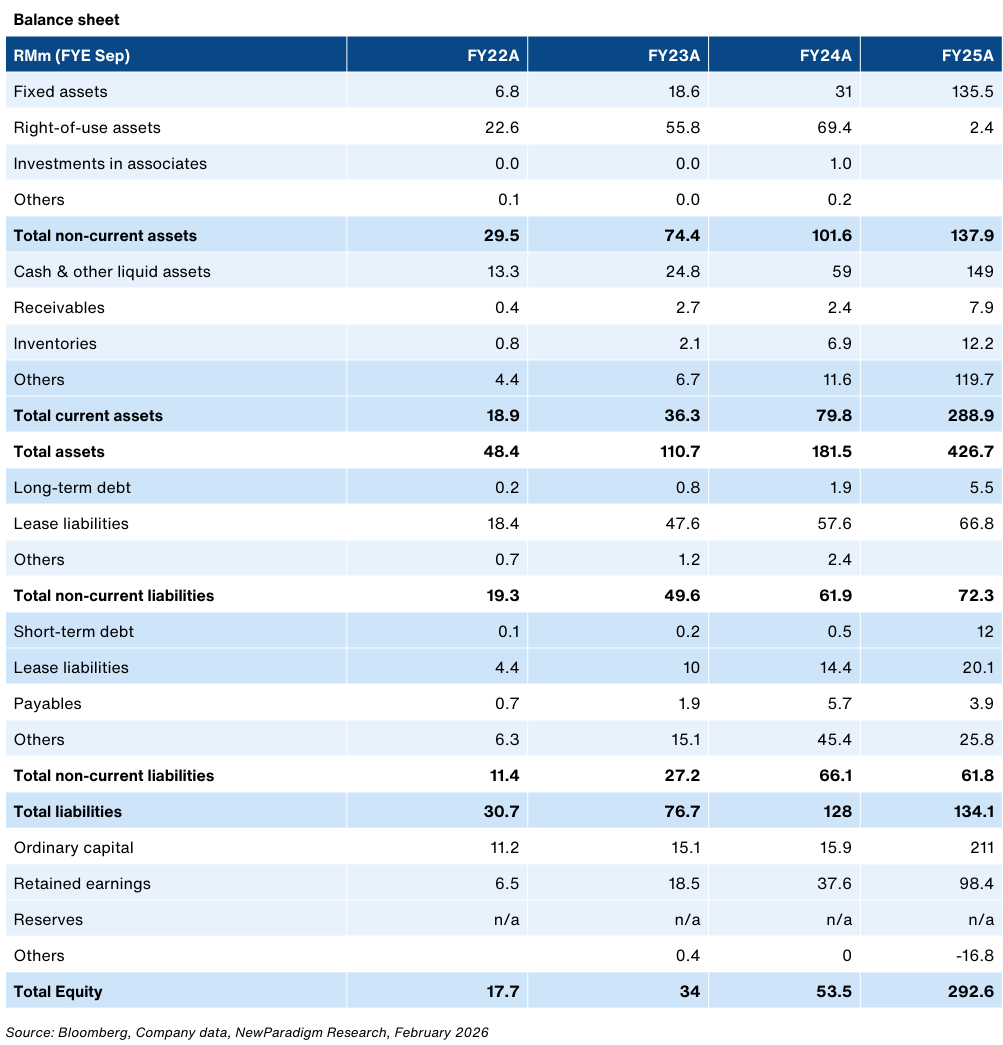

Selected Financials

Source: Bloomberg, Company data, NewParadigm Research, February 2026