Visit Malaysia plays

The government is targeting 47million visitors in 2026.

Key takeaways:

- In an absence of stronger thematics, we think stocks that have leverage to tourism and Visit Malaysia 2026 will be in focus.

- Headline visitor targets are reasonable, but there is substantial nuance in the numbers and forex could be a swing factor.

- We kick off our tourism thematic series with a report on AAX (NR), which benefits on both in and outbound tourism as well as a stronger ringgit.

- We will be releasing the remaining company reports daily over the next week. Create an account to receive updates.

Visit Malaysia 2014 | Ringgit strength | Stock ideas

Source: DOSM, Bloomberg, NewParadigm Research, February 2026

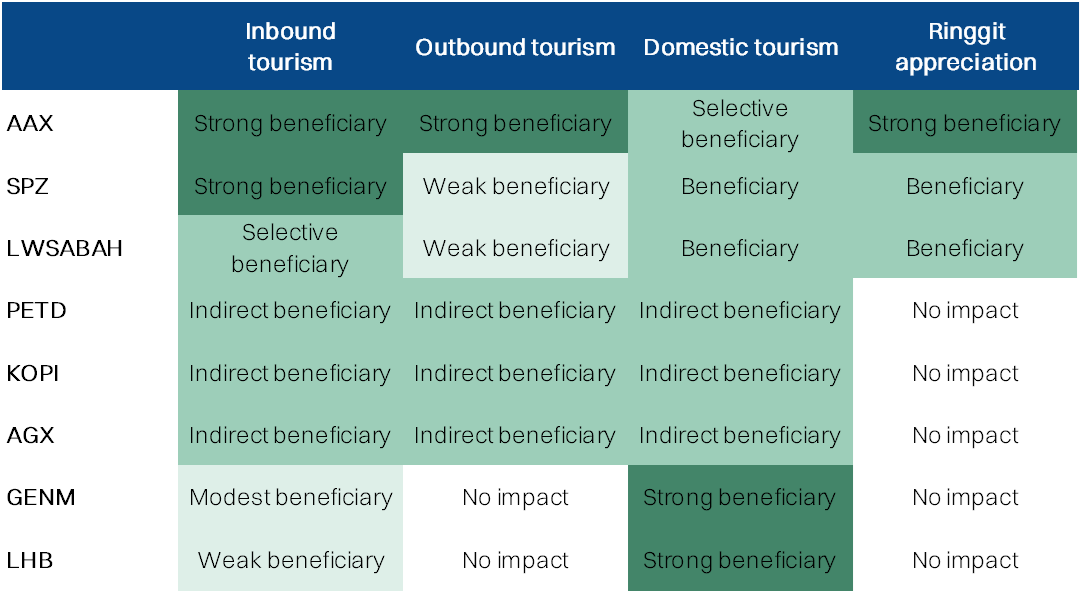

Stocks with a currency “hedge” ideal

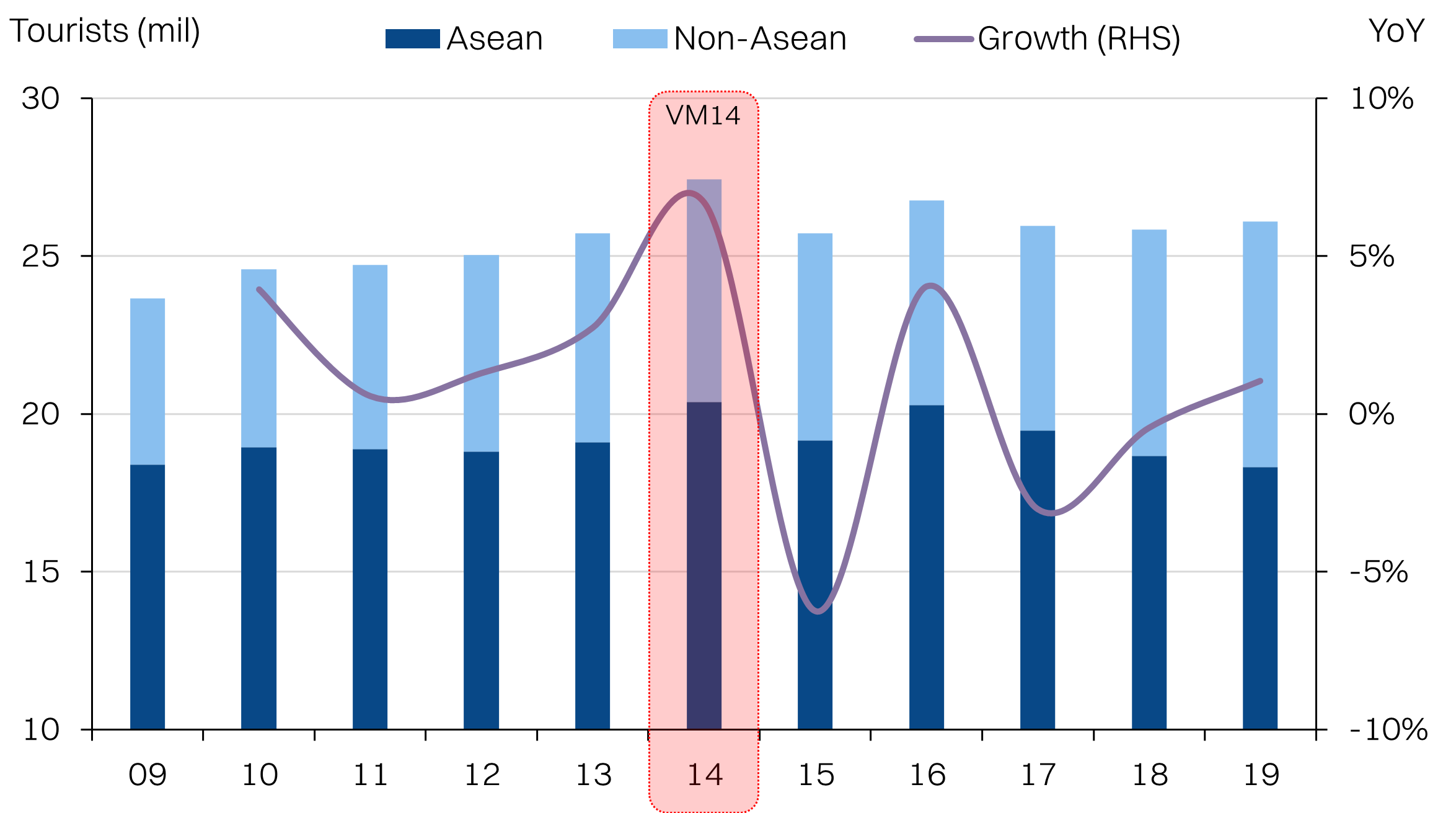

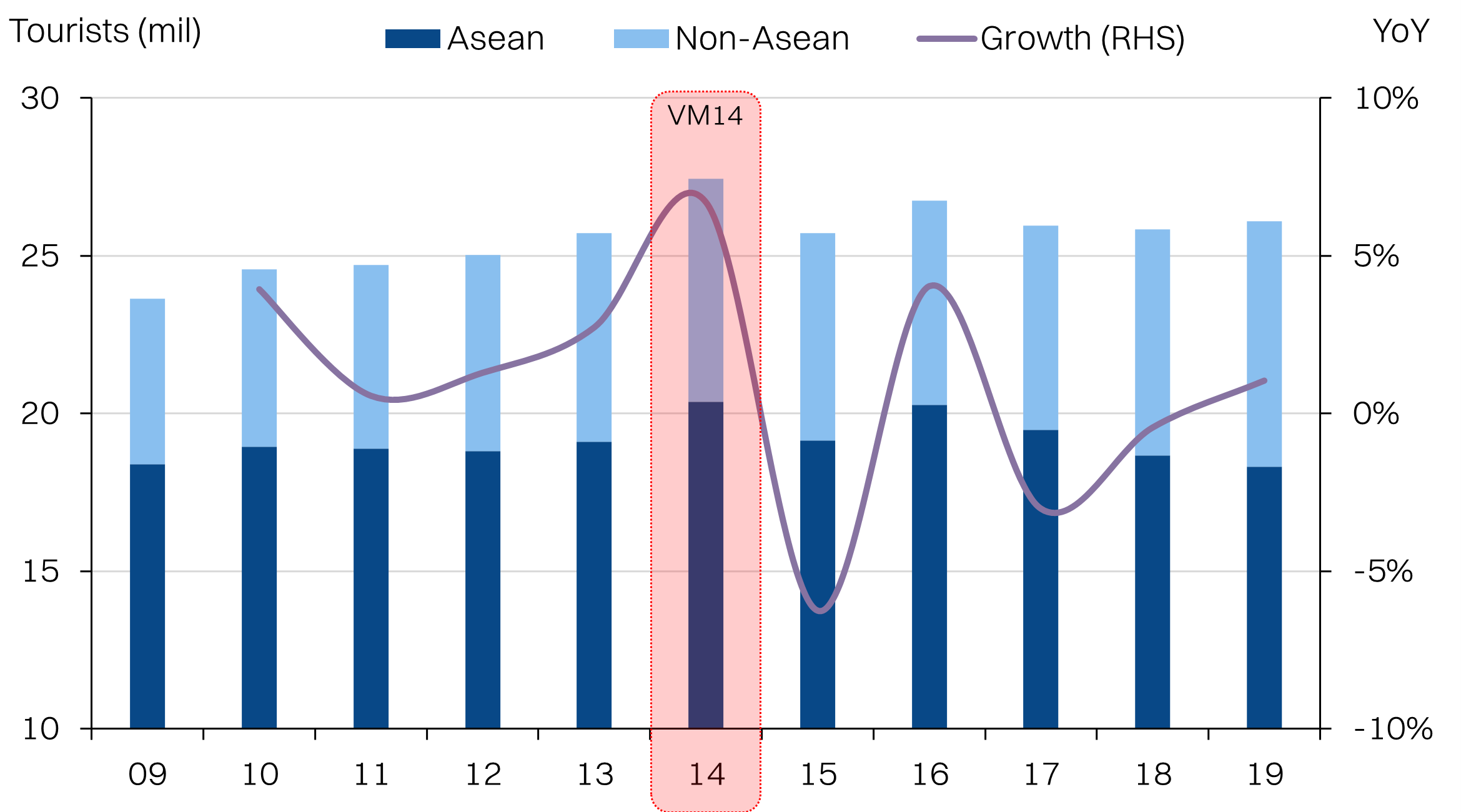

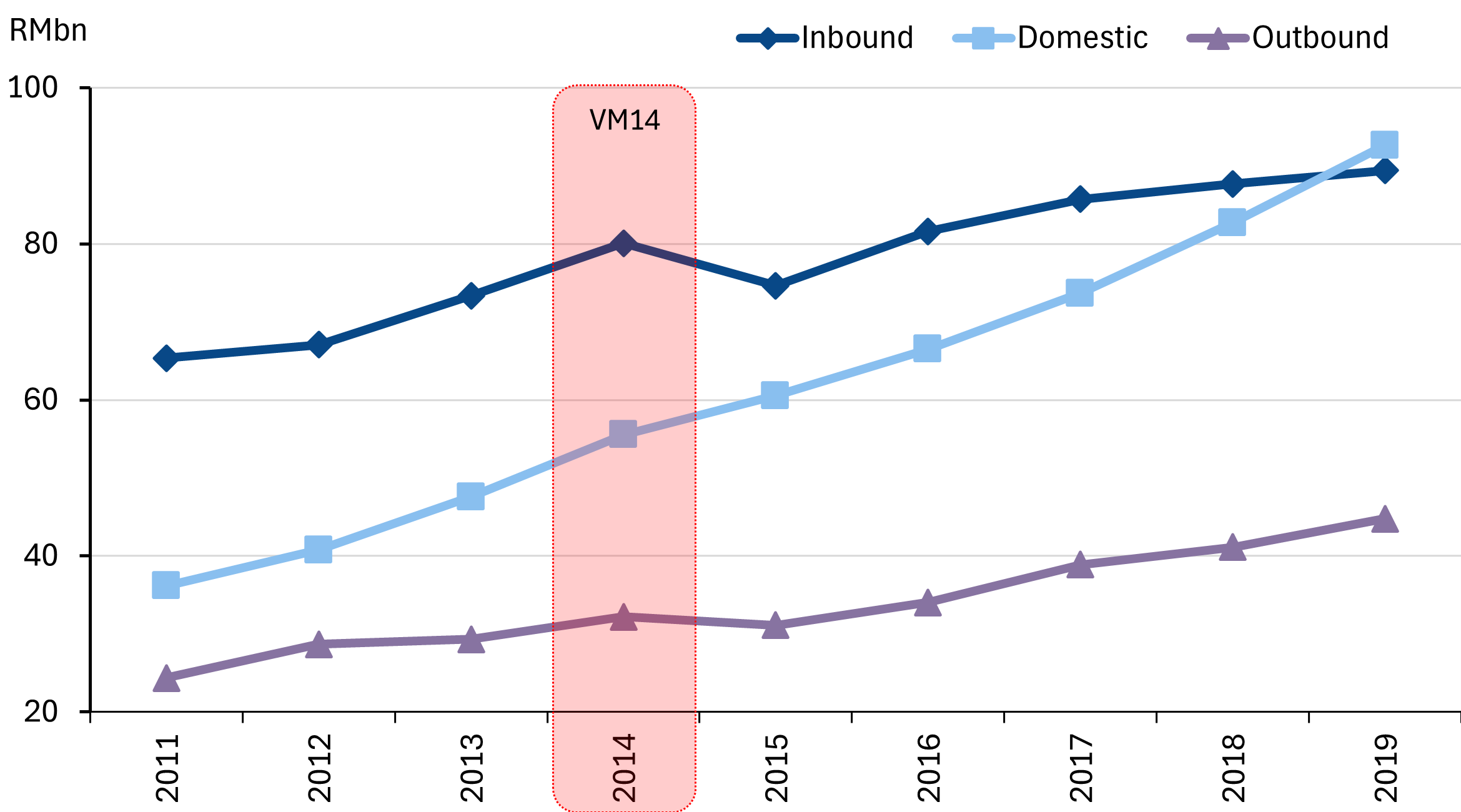

- The last “Visit Malaysia” campaign back in 2014 was relatively successful, with a trend-bucking +6.7% YoY jump in tourist arrivals. The government’s headline target of 47m visitors (+12% YoY) is a little more ambitious, but the broader term “visitors” captures both tourists and excursionists.

- In the absence of other tangible thematics in the market, we anticipate tourism plays will be in focus this year. The main risk stems from the a stronger ringgit that could dissuade foreign tourists as well as drive more outbound tourism at the expense of domestic tourism.

- In turn, our preference within the thematic are for companies that can benefit from both inbound/outbound tourism, domestic tourism as well as a stronger ringgit. The top candidates that meet this criteria are AAX (NR), SPRITZ (NR) and LWSABAH (NR).

- PETD (NR) and KOPI (NR) fall just outside of this category since they do not have much exposure to currency movements and carry some downside risk from softer domestic tourism. Similarly, AGX (NR) is a beneficiary of increased aviation activity via MRO logistics segment.

- Lastly, no tourism report would be complete without covering GENM (NR) - a primarily domestic tourism play with potential upside from VM2026. However, we think EHB (NR) is an interesting alternative given the higher growth ceiling.

The baseline is relatively low

- The post-pandemic recovery in tourism has been slow, only recovering to 2019 levels last year. Thus, growth in 2026 is achievable. However, the complexion of visitors has changed. More Singaporeans are opting for day-trips, which has been a drag on tourist numbers. However, this has been offset by increased tourists from China and India. Chinese tourists could be the most unpredictable in 2026, as Malaysia has benefited from the Chinese eschewing Thailand as a destination over the past two years.

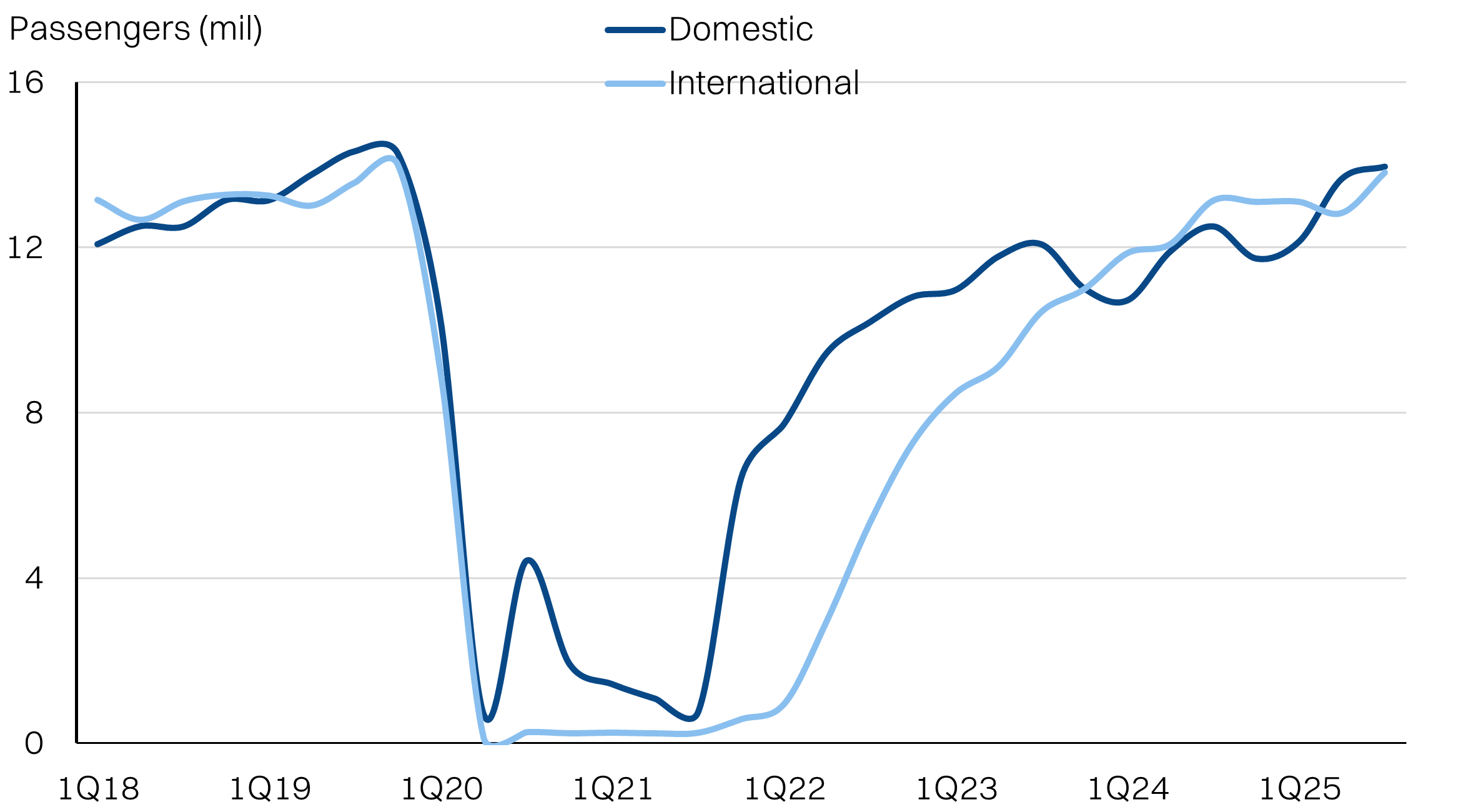

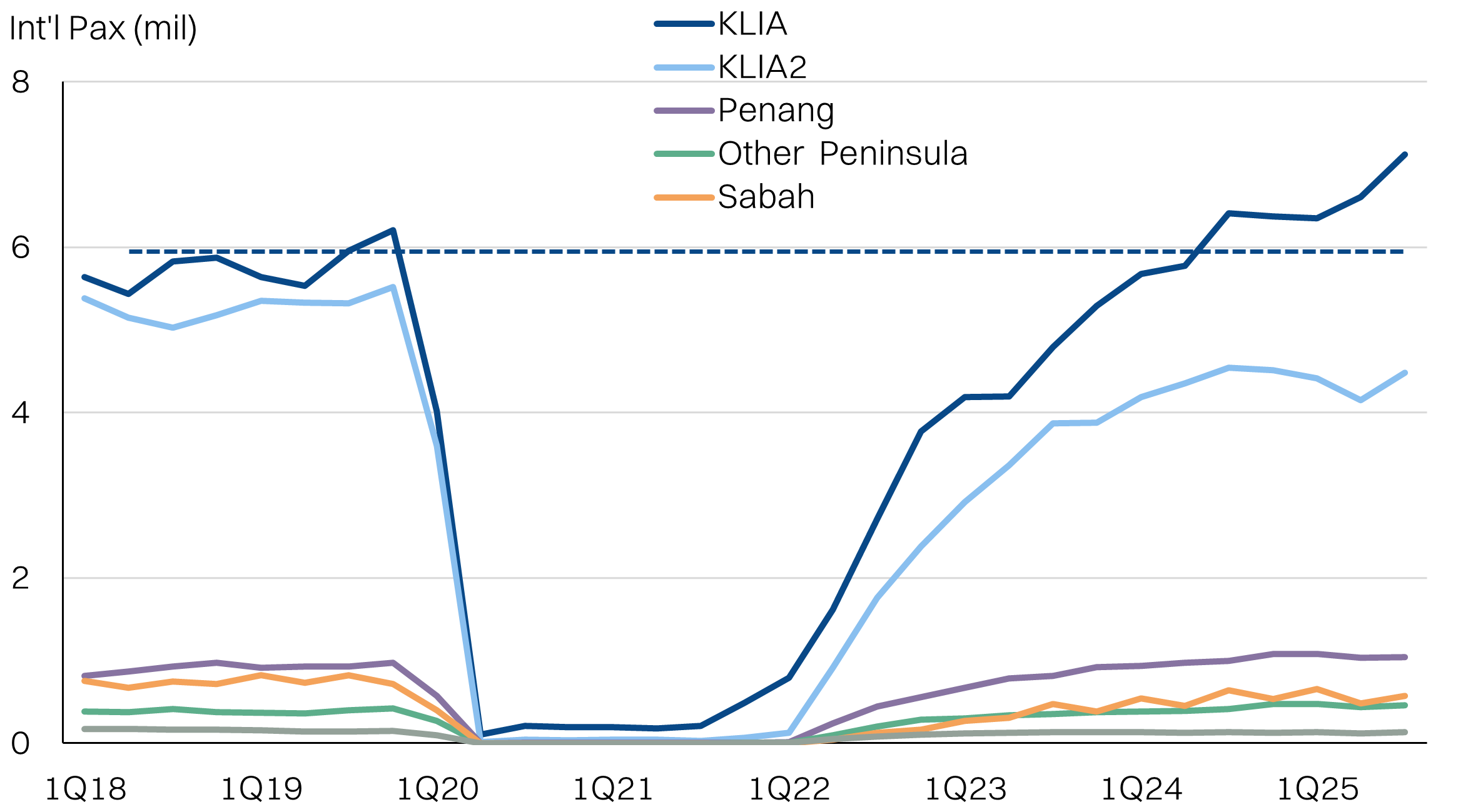

- Additionally, we note that tourism has not been supported by aggressive promotional fares by the low-cost carriers. KLIA2 passenger traffic is actually still below pre-pandemic levels even though KLIA has surpassed it. But this should change as AirAsia completes its fleet reactivation in 2026.

Stock ideas

Comp table

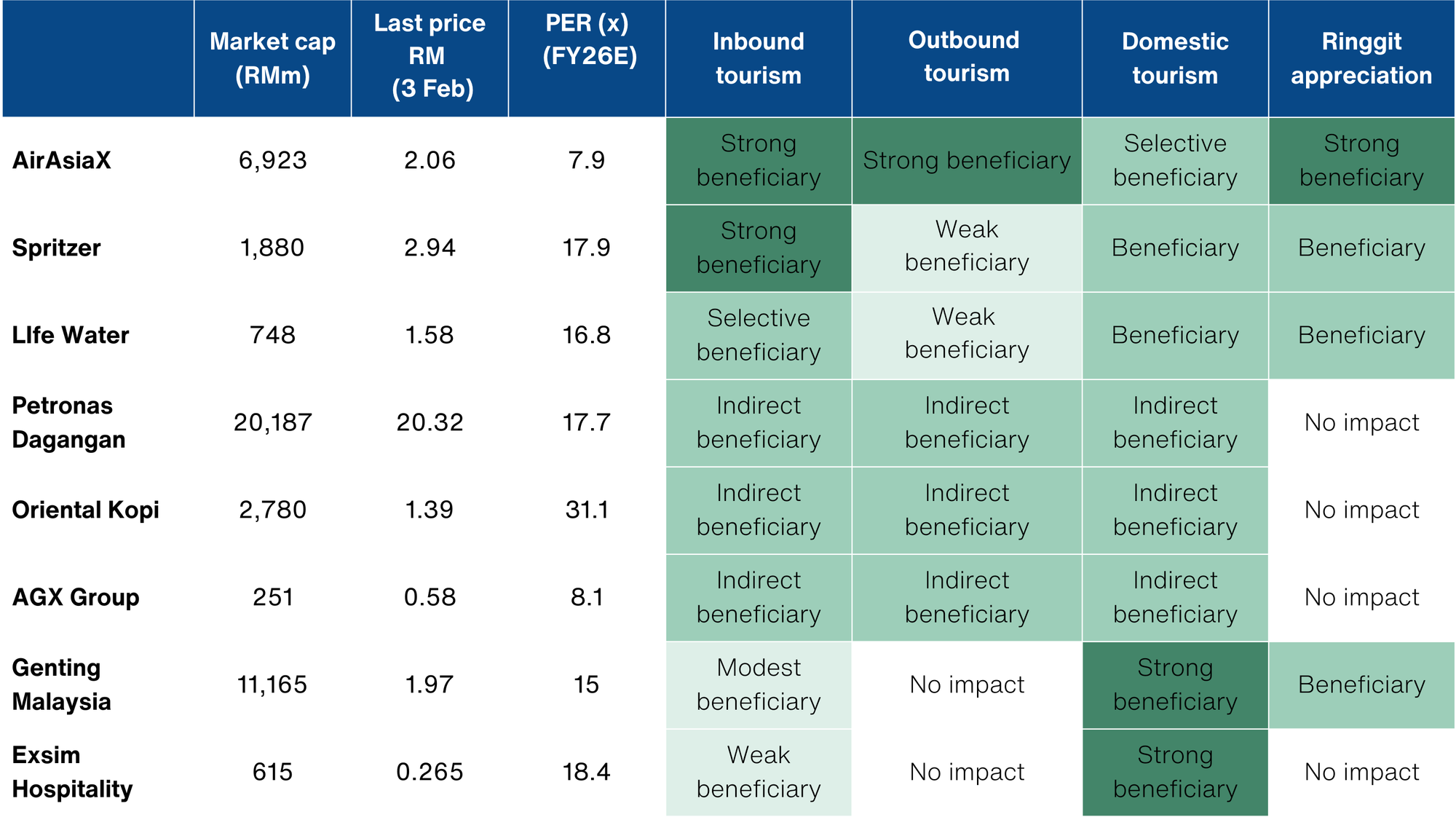

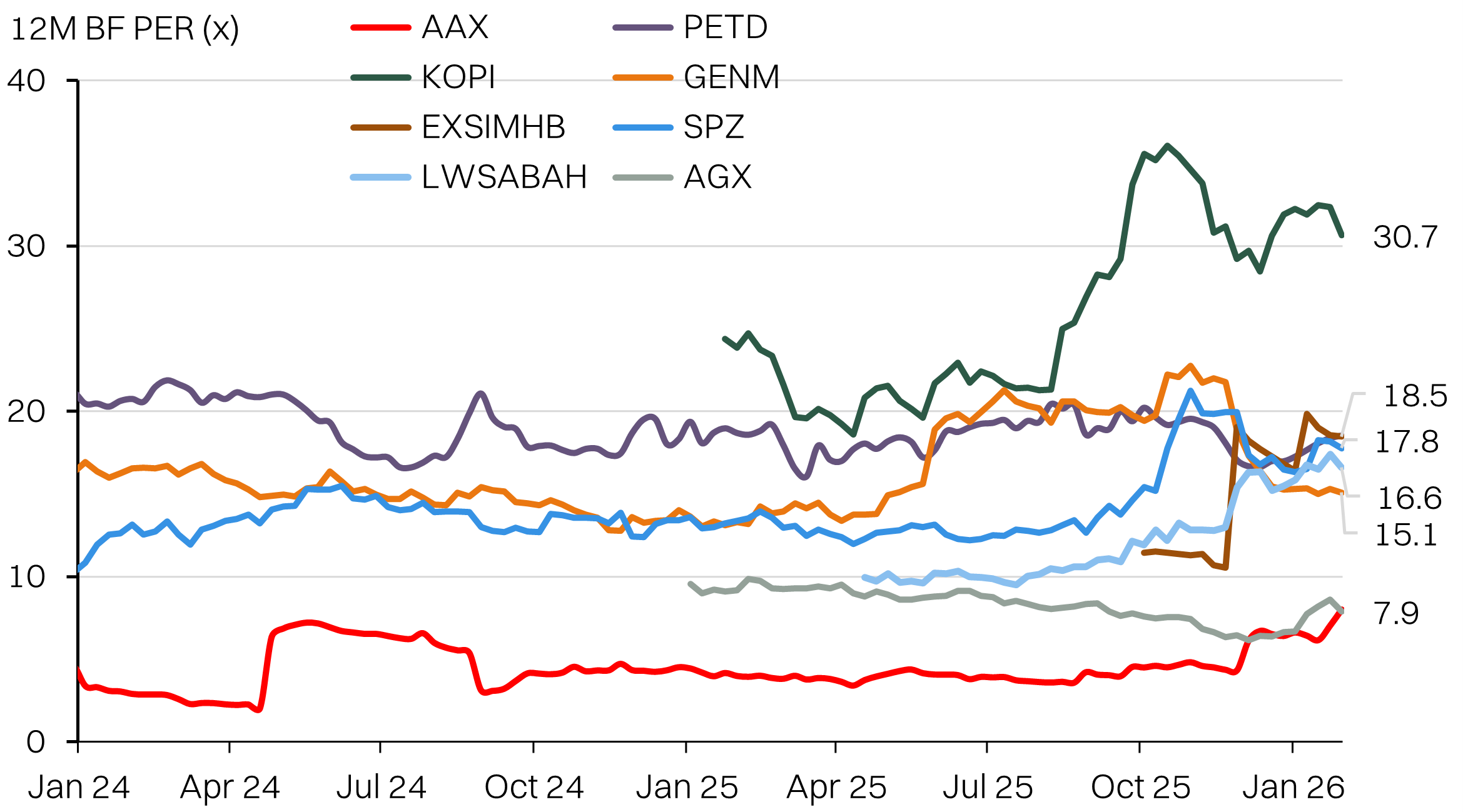

Tourism stocks valuations - Kopi has seen the most re-rating

AirAsiaX (AAX) - highest leverage to tourism, both in and outbound

- Report link

- Restructuring pools all of AirAsia’s aviation operations within a single entity, making AAX by far the most prominent tourism play.

- AirAsia has been operating below potential since the pandemic, lacking the funds to fully reactivate its fleet. Management is guiding for ~14% capacity expansion in 2026 for Malaysia alone.

- However, the bigger tailwind for AAX will be a stronger ringgit and low oil prices that both reduce Dollar-denominated finance costs as well as fuel costs.

- Catalyst: higher passenger load factors; currently only aiming for ~80%.

- Risks: Ringgit weakness and/or stronger oil prices. AAX has zero hedging on fuel.

Spritzer (SPZ) - Margin expansion upside

- Report link

- Sprizter is a natural beneficiary from increased tourism activity, including domestic tourism. It also benefits from both land, air and sea arrivals. We think the 14% consensus topline growth assumption is achievable.

- But we anticipate upside to consensus earnings expectations arising from margin expansion due to - lower imported resin costs, increased operating leverage, improved product mix and removal of SST. Consensus is assuming flattish NP margins.

- 30-35% of COGS comes from imported resin that is priced in US$. Even if tourism misses expectations, currency will drive GP expansion.

- Catalyst: Margin expansion driving earnings upside vs consensus.

- Risks: Sharp increase in resin costs.

Life Water (LWSABAH) - Sabah tourism play

- Life Water is a Sabah-focused comp to Spritzer, with its manufacturing and bulk of sales from the state. LWB is expanding into Sarawak as well. Sabah accounts for 6% of foreign inbound tourism, and overall arrivals are still about 10% below pre-pandemic levels.

- Life Water is increasing production capacity by +30% in FY27 to 804m liters/yr from 626m currently. It is also expanding offerings into other beverage segments.

- Life Water is trading at valuation of 16.6x (BF12M) vs Spritzer’s 17.8x (BF12M). With more headroom for volume growth, albeit in more narrow markets, Life Water could have more room for multiple re-rating.

- Catalyst: High growth than Spritzer could catalyze multiple re-rating to at least match Spritzers.

- Risks: Execution risk in expanding outside of Sabah would impose low ceiling on LT growth. Volatility in raw material costs such as resin and plastic prices.

Petronas Dagangan (PETD) - Low-risk tourism catch-all

- Report link

- Petronas Dagangan is a low-risk proxy to tourism, as it is one of the top aviation fuel suppliers to both MAS and AirAsia. As long as there are more planes flying, PETD will benefit - even if load factors are low.

- PETD is also almost entirely shielded from oil price volatility, barring a 7-day lag impact, which is generally negligible except in the most volatile instances.

- Aviation is about 15-20% of PETD’s revenue and has achieved “high double-digit” growth for 9M25. Room to drive upside surprise vs the conservative low-to-mid single digit earnings growth guidance from management.

- Catalyst: Higher retail fuel sales. PETD also benefits from increased domestic tourism from the increased driving.

- Risks: Accelerated penetration of EV’s could rattle sentiment.

Oriental Kopi (Kopi) - Brand building with foreign tourists

- Unique play as a Malaysian brand offering to foreign tourists. We anticipate Kopi will skew towards a multiple re-rating story given the lack of meaningful comps. Multiples are not cheap but still in the early growth stage.

- New outlet in KLIA just opened in January, adding to the two outlets in KLIA2 (one arrival, one departure). Inbound and outbound tourism will be captured by these high turnover gateway outlets with additional upside from FMCG sales.

- Kopi is also a key proxy to benefit from Singaporean's swing to excursionist visits, with 7 outlets in JB.

- Catalyst: Kopi is most likely a stock that will be driven by multiple expansion on revisions to forward expectations, as the VM26 thematic plays out.

- Risks: Any slowdown in execution of new branch openings will crimp earnings forecasts. Visitors at the new KLIA branch will also be closely watched. Earnings expectations are also high.

AGX Group (AGX) - Aviation activity proxy

- AGX derives ~30% of its sales from aerospace logistics - delivering parts for airlines’ maintenance, repair and overhaul (MRO) requirements. Key customers include MAS and AirAsia. Total aircraft under contract is 489 with plans to grow this to 1,200 by 2035.

- High aircraft utilization should drive up MRO requirements and support segment volumes, especially for unscheduled maintenance (aircraft on ground/AOG) that require parts flown in on short notice and higher margins.

- Management is aiming for a 50:50 revenue mix for aerospace logistics vs the lower margin freight forwarding operations.

- Catalyst: Onboarding of new customer airlines, higher AOG requirements.

- Risks: AirAsia’s fleet reactivation was a major driver of aerospace logistics revenue in FY24/25. But with AirAsia’s fleet fully operational in 2Q26, it could crimp revenues. Partially offset by new MAS contract.

Genting Malaysia (GENM) - Domestic tourism focus, with natural currency hedge

- Roughly 85% of Genting Malaysia's visitors are domestic. In VM2014, domestic tourism numbers rose in tandem with foreign arrivals. With all facilities operational, GENM could hit new record numbers this year.

- GENM's hotel occupancy is already at ~99% in 2025, indicating room for higher average room rates (ARR) in 2026 if demand continues to pick up.

- Additionally, GENM has RM4.6bn in US$ denominated debt. Every 1% appreciation of the ringgit will reduce finance costs by ~RM30m or ~4% upside to FY26E earnings.

- Catalyst: Stronger domestic visitors in tandem with a rise in foreign visitors, driving both occupancy rates as well as ARR.

- Risks: A stronger ringgit could see some domestic visitors opt for overseas holidays and divert foreign tourists away from Malaysia - particularly Singaporean, Chinese and Indian tourists.

Exsim Hospitality (EXSIMHB) - High growth domestic tourism play

- Recurring income growth via launch of key hospitality assets, including flagship hotels in Empire City and Corus Paradise Port Dickson in 2H26.

- Mana-Mana expansion will see rooms under management increase to 2.6k by 3Q26 and >10k in the next 3-5 years. It is also shielded from short-term rental restriction laws because its properties are commercial-titled and purpose-built for hospitality.

- Target audience are the domestic budget travelers and Mana-Mana competes directly with the AirBNB model. Not a direct play on VM26, but likely to re-rate if the thematic heats up.

- Catalyst: Execution of the “room” expansion, hotels and resort completion.

- Risks: Highly dependent on Exsim developments as a funnel for new “room” growth long term.

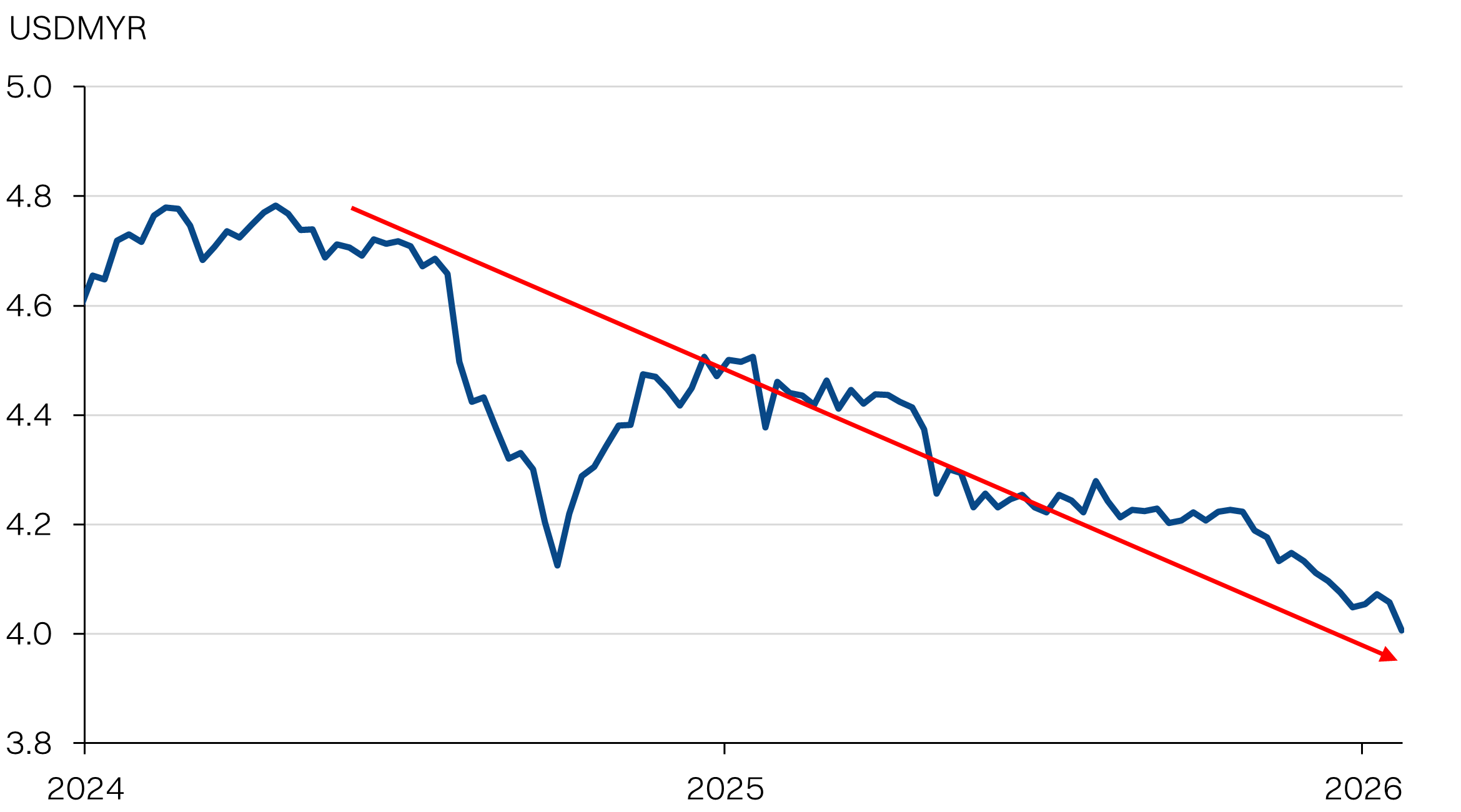

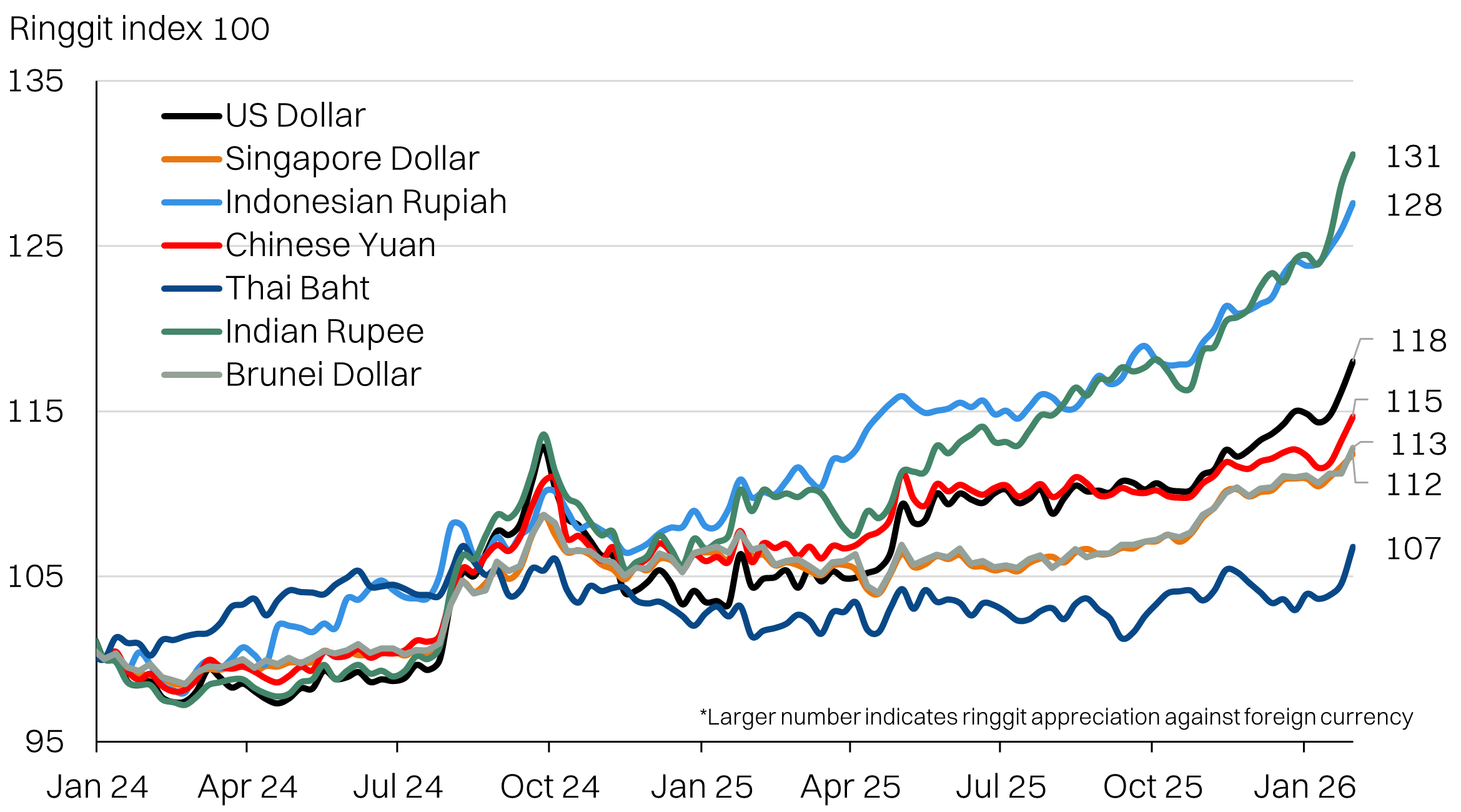

Currency considerations

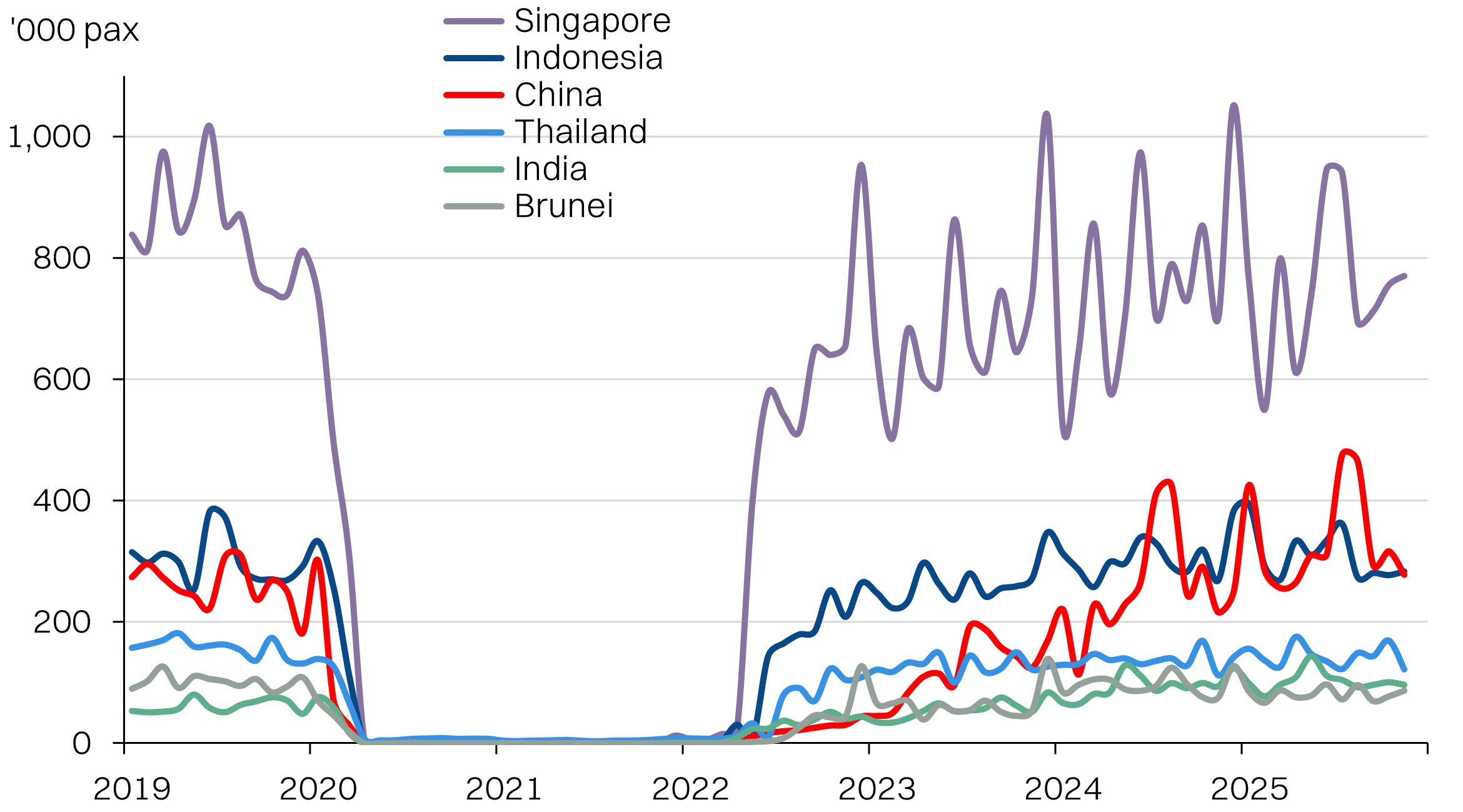

The strength of the ringgit against the dollar (+13% over the past 12 months) may be dominating headlines. But the critical currency movements to track will be how the ringgit performs against the top country of origin of tourists - Singapore, Indonesia, China, Thailand, India and Brunei - which account for 75-80% of all tourist arrivals.

The strength of the ringgit is most pronounced against the Indian Rupee (+20% LTM) as well as the Indonesian Rupiah (+16% LTM). Respectively they account for 5% and 14% of total tourist arrivals.

Fortunately, both the Ringgit strength against the two largest sources of tourist Singapore (35% of tourists) and China (15% of tourists) have been less pronounced +6% and +8% respectively over the last 12 months. However, the recent relative weakness in the Thai Baht against both currencies should be a concern for tourist diversion through 2026, if the trend persists.

In turn, we reiterate our preference for stocks with a natural hedge to the currency risk to tourism - AAX, SPITZ, GENM.

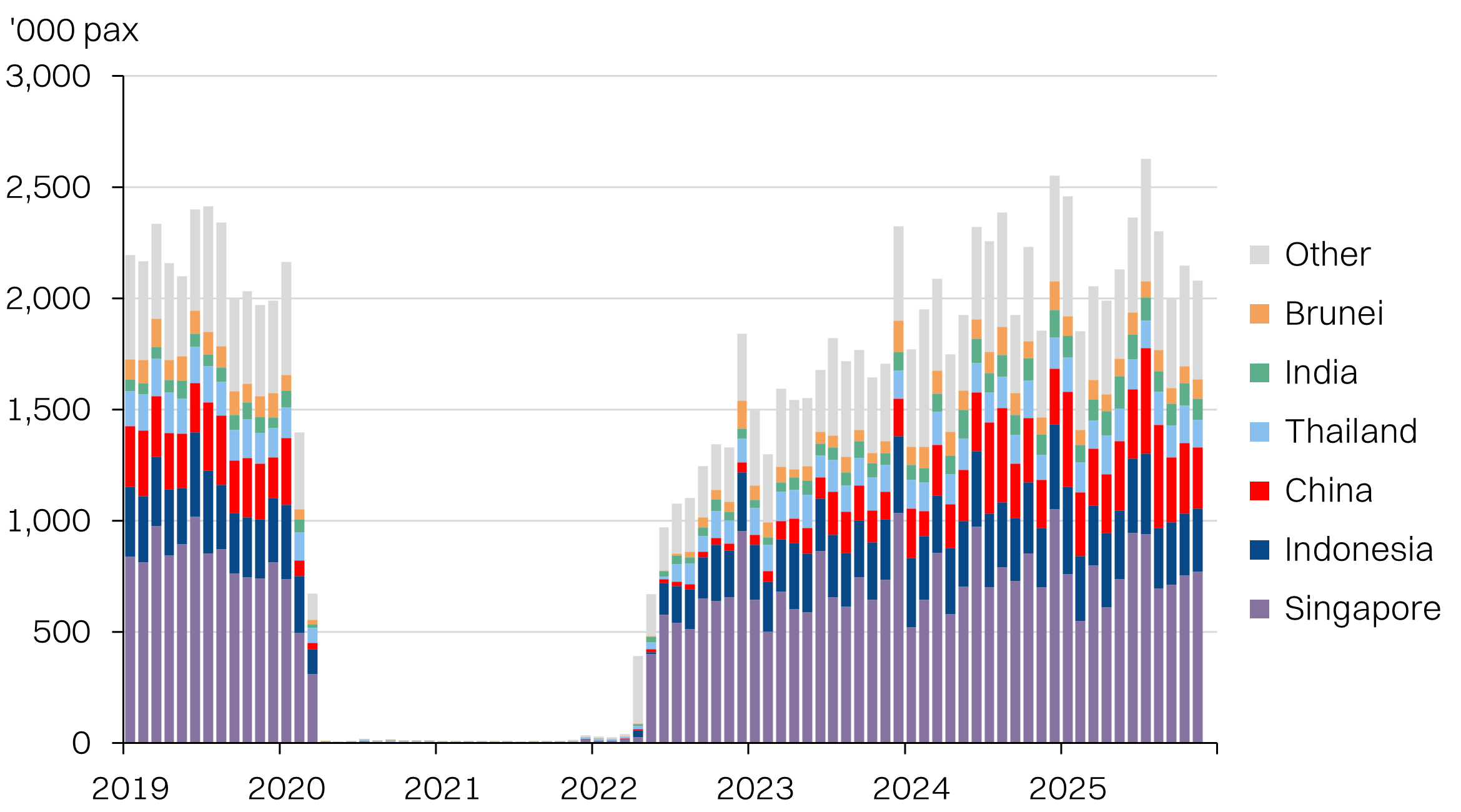

Tourists by country

The Ringgit has appreciated against all major countries of origin for tourists

Visit Malaysia 2024 in charts

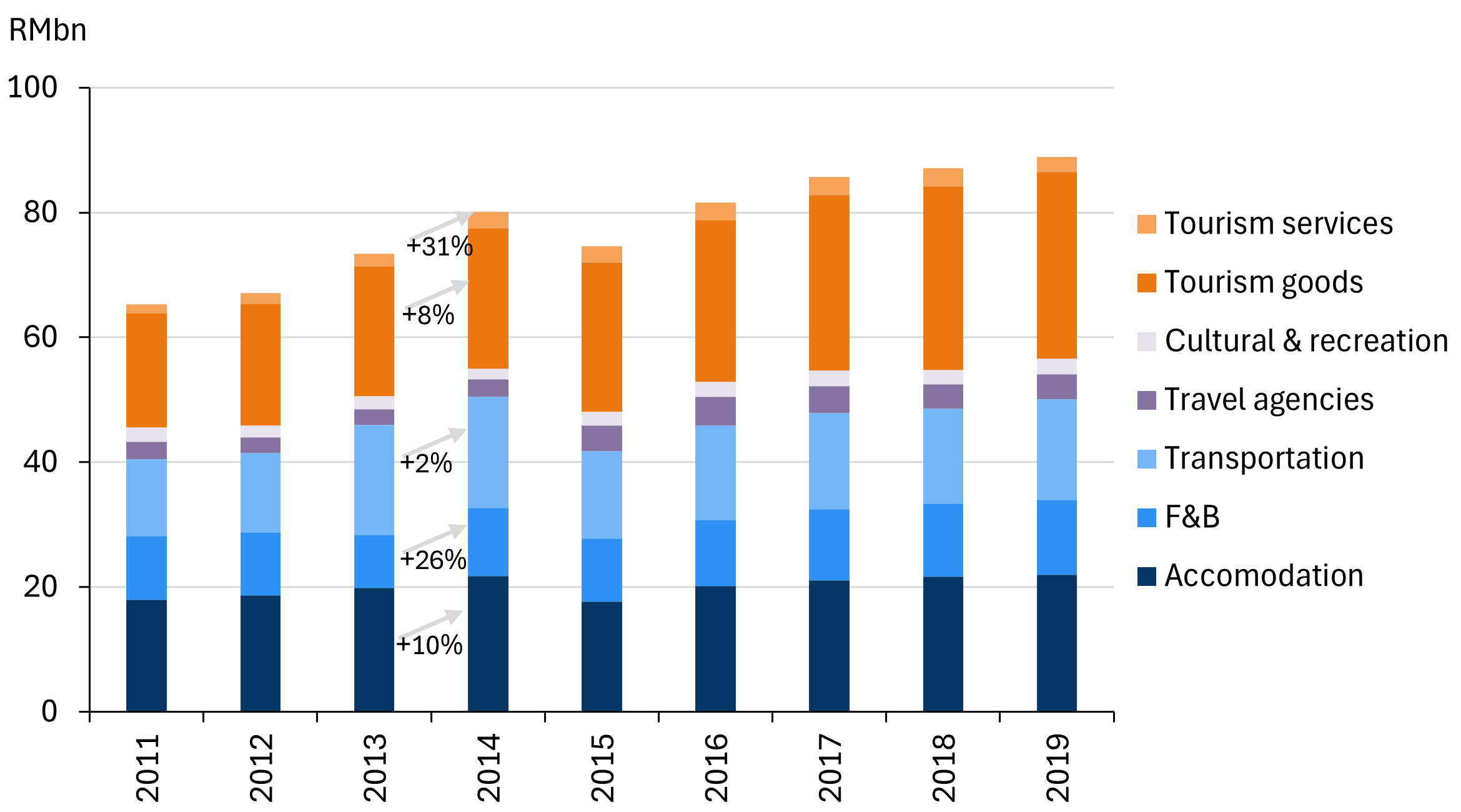

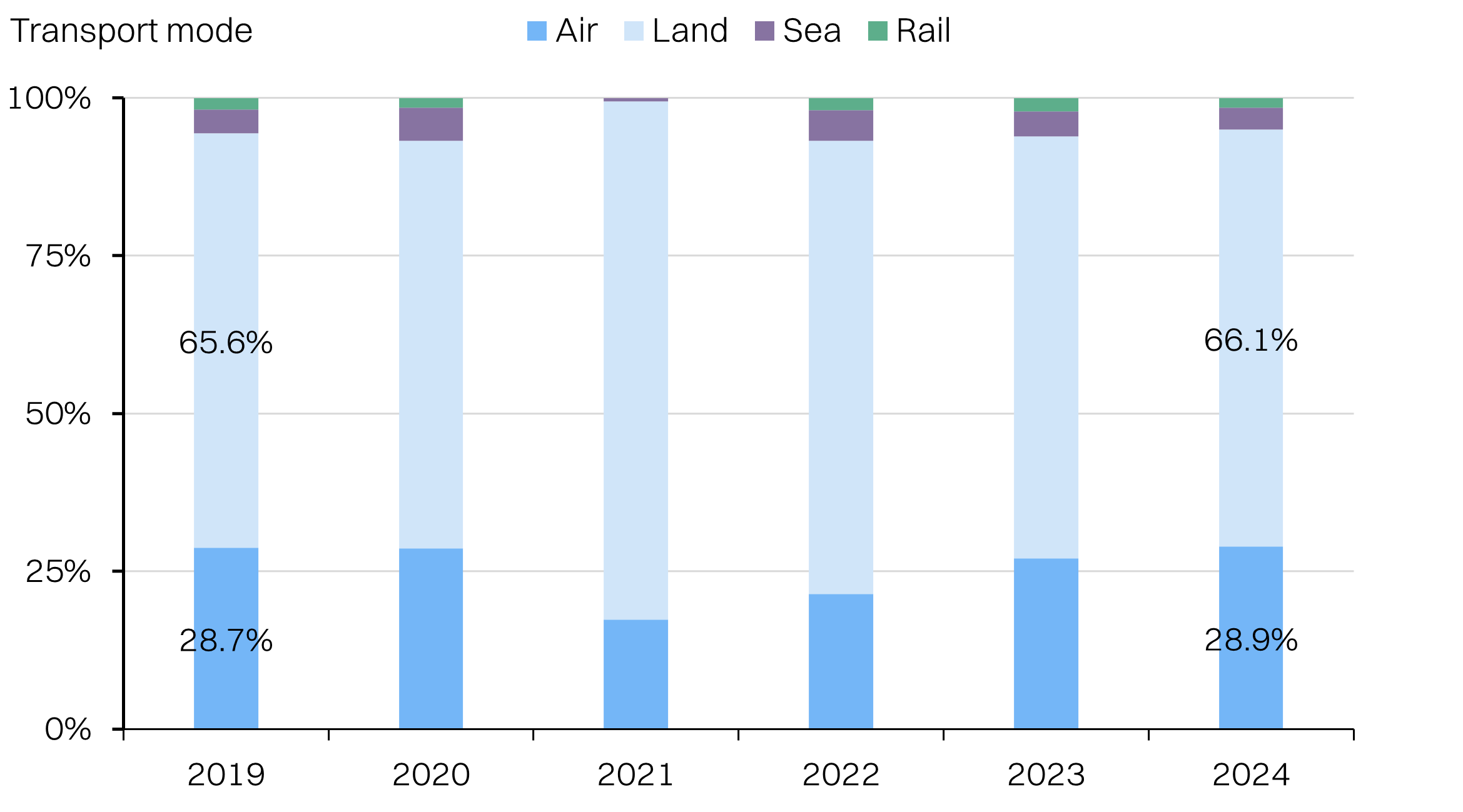

Tourist arrivals | Tourism expenditure | Inbound vs outbound vs domestic

Source: DOSM, NewParadigm Research, February 2026

Visitors - tourists vs excursionists

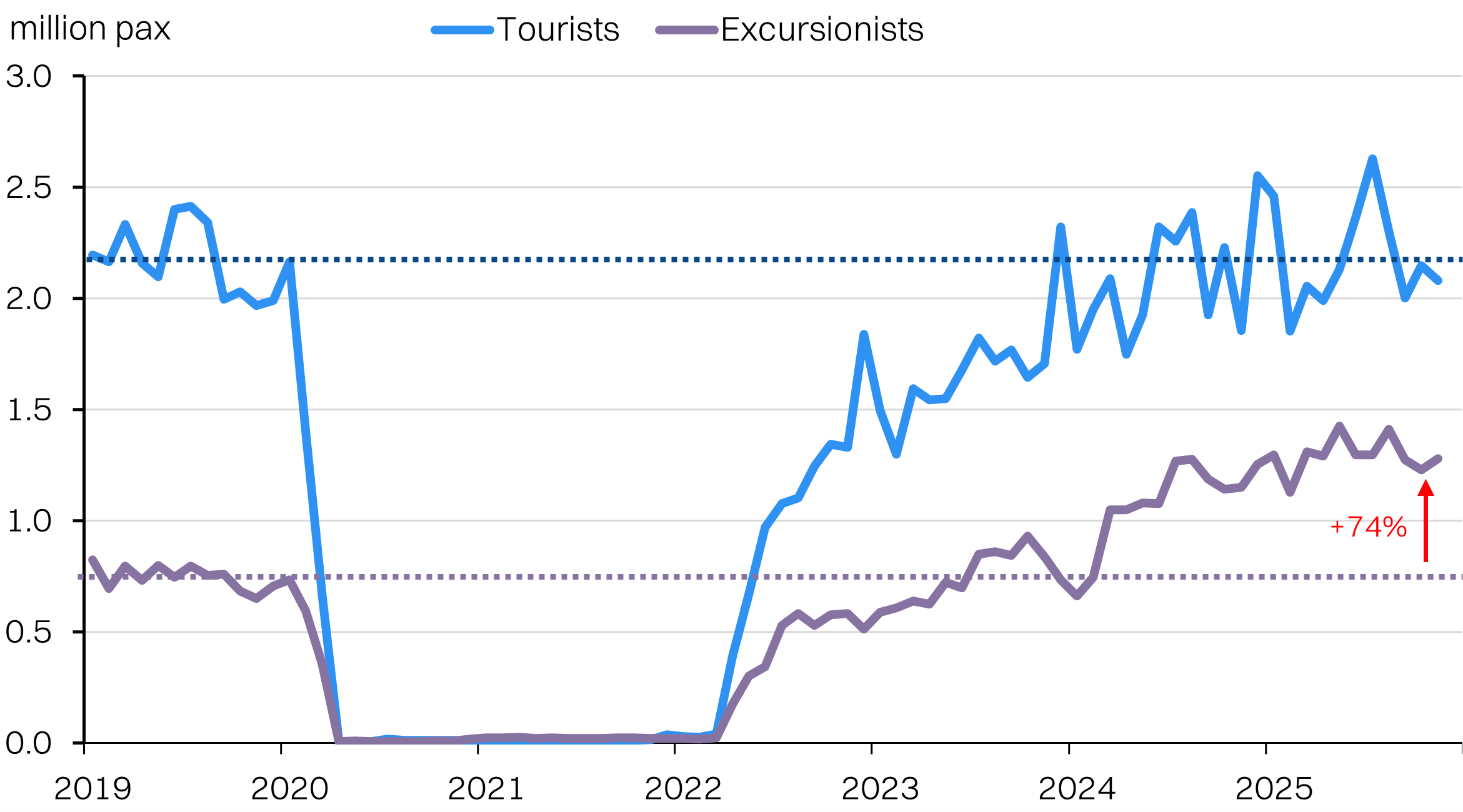

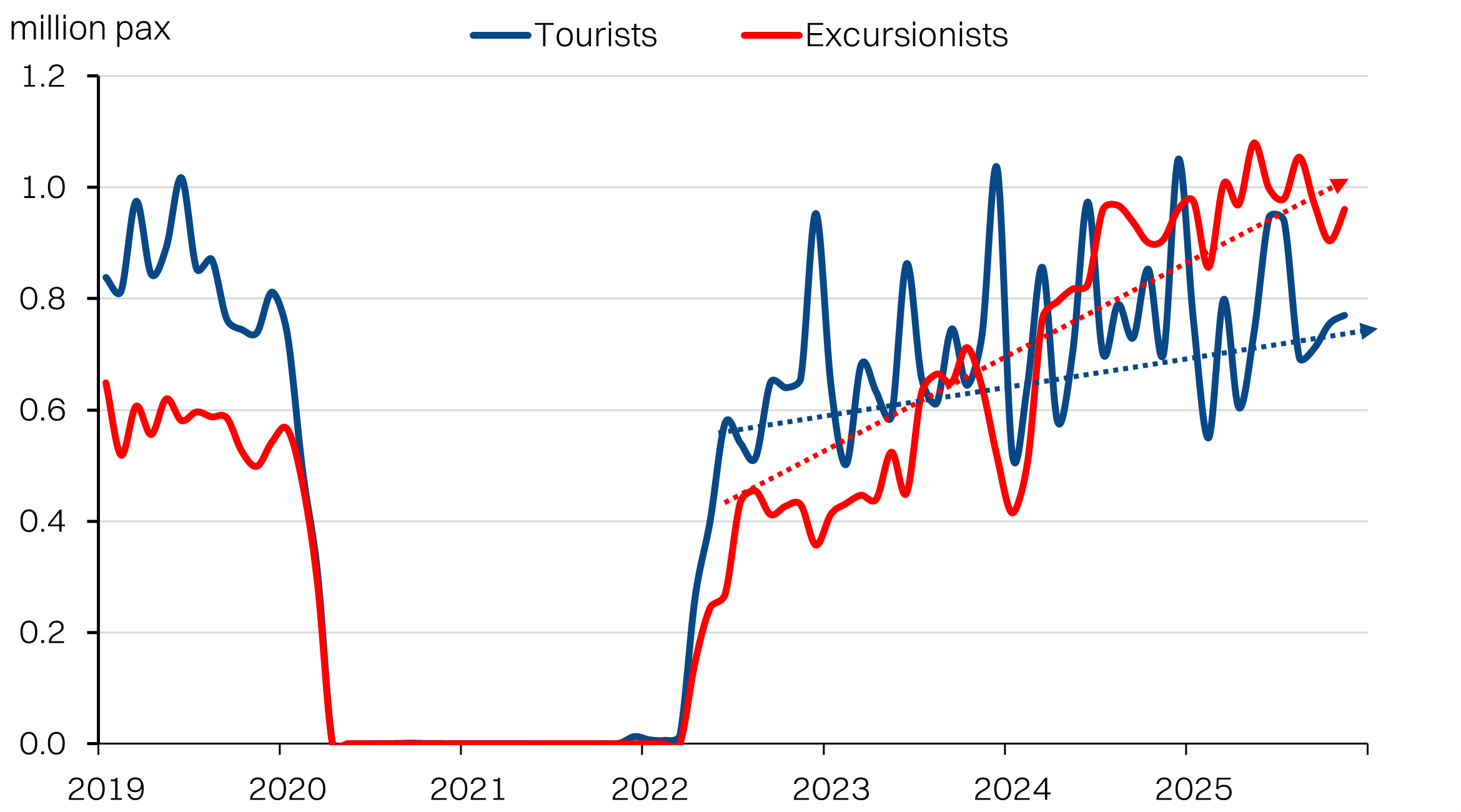

It took longer than expected, but tourist arrivals finally recovered to pre-pandemic levels last year, albeit barely. The recovery has been driven by a surge in both Chinese and Indian tourists, but offset by a decline in Singaporean tourists. December figures are not yet released, but tourist arrivals should top 26million for 2025, based on Malaysia Tourism Statistics.

On a more positive note, overall visitors are +19% above pre-pandemic levels, driven by excursionists (stay <24 hours). This was overwhelmingly driven by Singaporeans. A good rule of thumb however, is that tourism typically outspend excursionists by about 9x-10x. (Note: visitors = tourists + excursionists)

The government is targeting for a headline number of 47million visitors for visit Malaysia 2026, which is roughly 12% YoY growth in arrivals. Visitor arrivals for FY25 was up +12% as well, so the number is not too aggressive. However it is worth noting that 2025's growth was achieved via a 6.8% YoY growth in tourist arrivals compared with a 21.9% jump in excursionists.

Excursionist arrivals have outpaced tourists

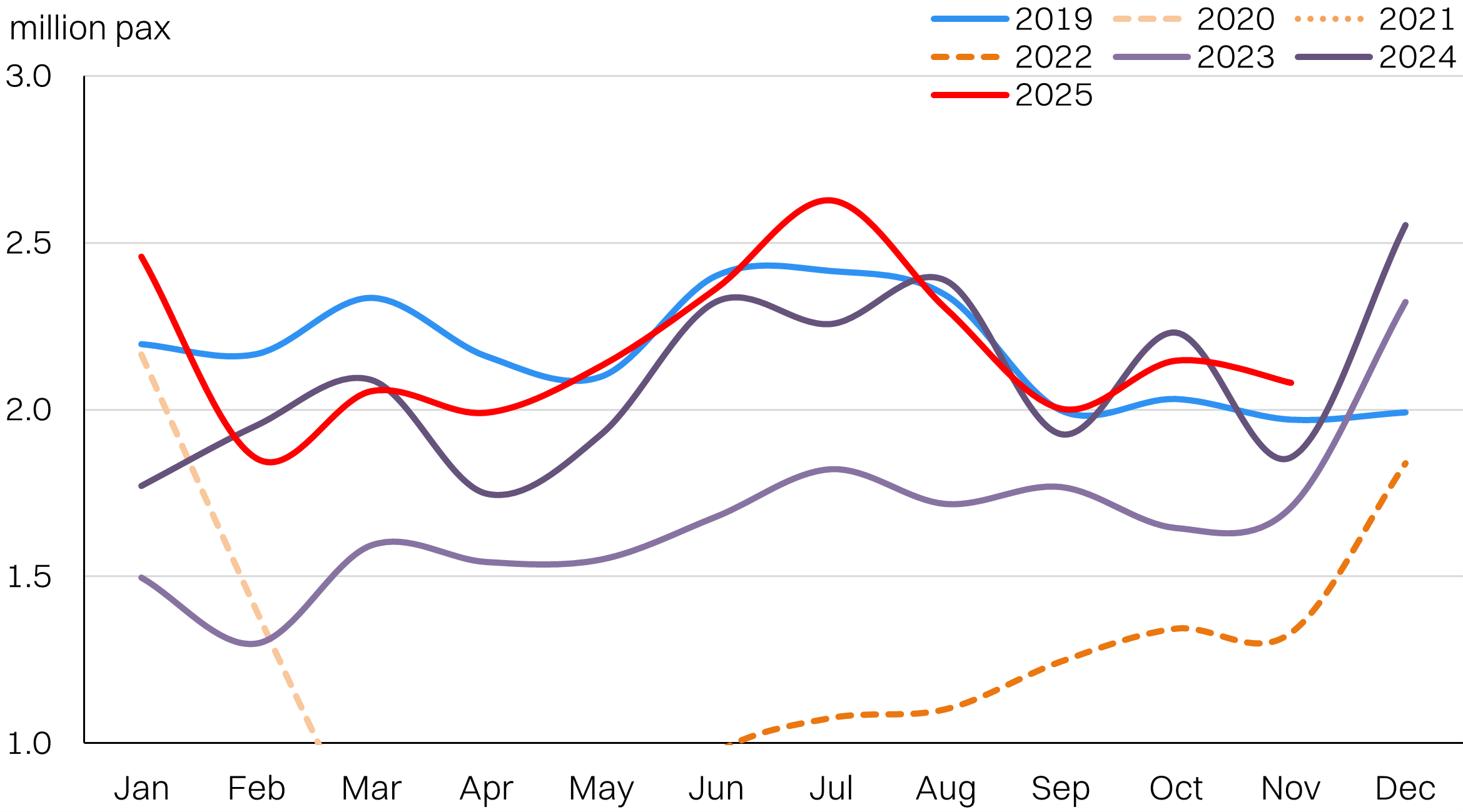

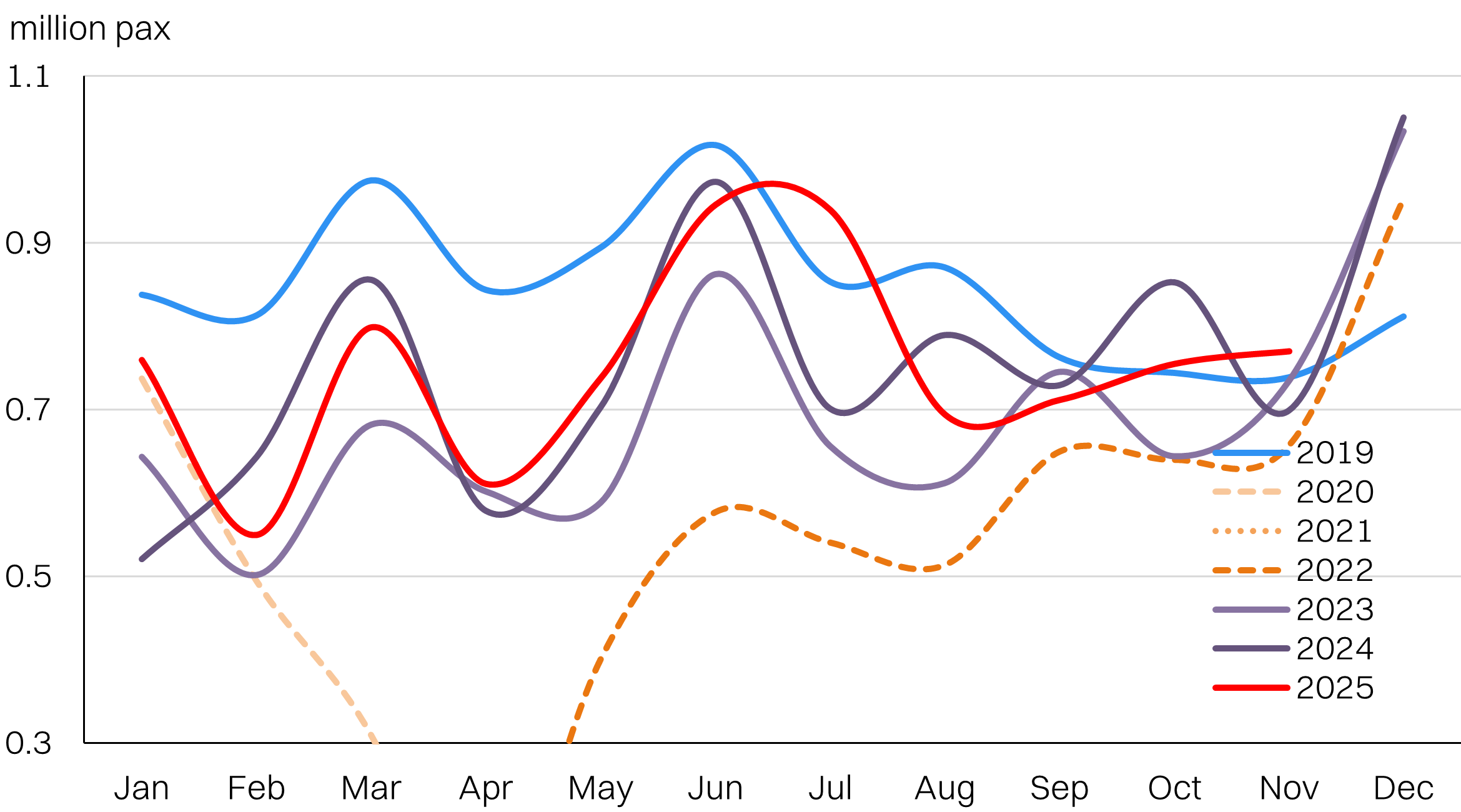

Tourist arrivals - 2025 had a soft start to the year, but caught up later

Tourist breakdown

At the current run rate, tourist arrivals are roughly on par with 2019 levels. It has been a relatively slow and protracted recovery. At the same time, the demographics of tourist arrivals has changed. Asean countries remain the primary source of tourists for Malaysia, but Singapore has seen a stark decline.

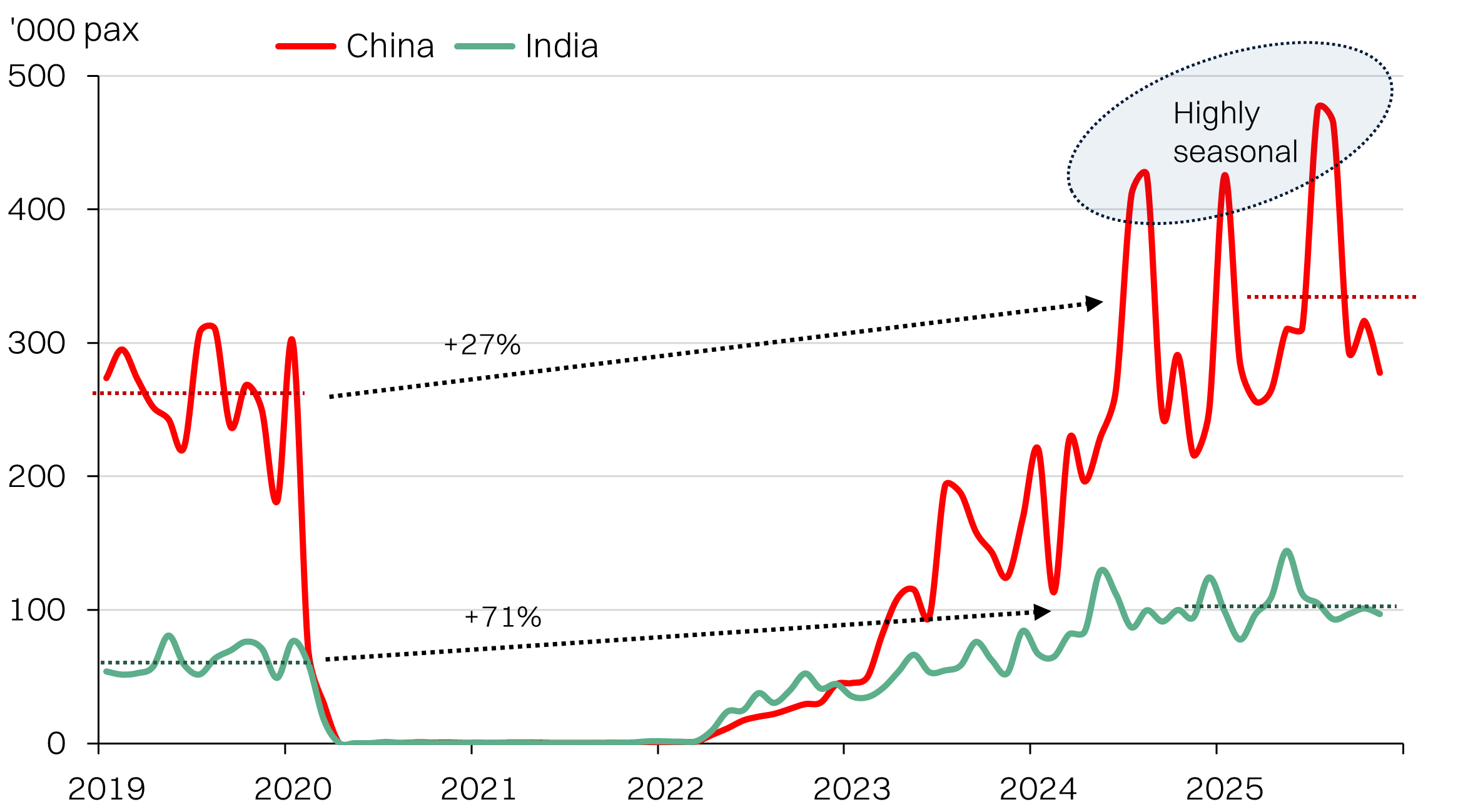

In turn, the recovery has been supported by a +27% (vs 2019) increase in Chinese tourists as well as a +71% (vs 2019) increase in Indian tourists. Singaporeans used to be 39% of tourism arrivals, but has since fallen to 35%. Chinese tourists have gone from 12% to 15% while India has gone from 3% to 5%.

It is also interesting to note that Chinese arrivals are highly concentrated in the January as well as July/August, which coincides with the Lunar New Year as well as their summer holidays. For context, almost 35% of Chinese visitors came in the aforementioned months in 2025.

Tourist arrivals by country - Singapore has fallen, but offset by China and India

Tourist arrivals - China and India have driven the recovery

Singapore - from tourists to excursionists

Our southern neighbor has seen a stark change in visitor behavior, with excursionists now exceeding tourists since mid-2024 - the reverse of pre-pandemic trends. Tourist arrivals from Singapore are down -12% vs pre-pandemic levels while excursionists have risen by +70% in the same period to average almost a million visitors per month.

Many factors could be contributing to the slump in Singaporean tourists - the stronger ringgit, more compelling destinations regionally (China is increasingly popular), as well as a lack of new compelling travel destinations in Malaysia. Youtrip has some interesting stats on Singaporean tourist behavior here.

We suspect the surge in excursionists could be due to rising cost-of-living pressures in Singapore that are pushing more middle- and lower-income Singaporeans to cross the straits for day trips. Anecdotally, Singaporeans are taking the opportunity to purchase basic essentials for cheaper in JB to bring back home. We see this as a potential kicker for consumption in Johor Bahru. However, there are few stocks that have direct exposure to this trend. Kopi is our top pick for its F&B outlet exposure in Johor with 7 outlets located there.

Singaporeans - excursionist arrivals have outpaced tourists

Singaporean tourist arrivals - weaker 1H arrivals

Travel behavior in charts

Mode of transport | Airports mix | Airport recovery (international)

Source: DOSM, MOT, NewParadigm Research, February 2026