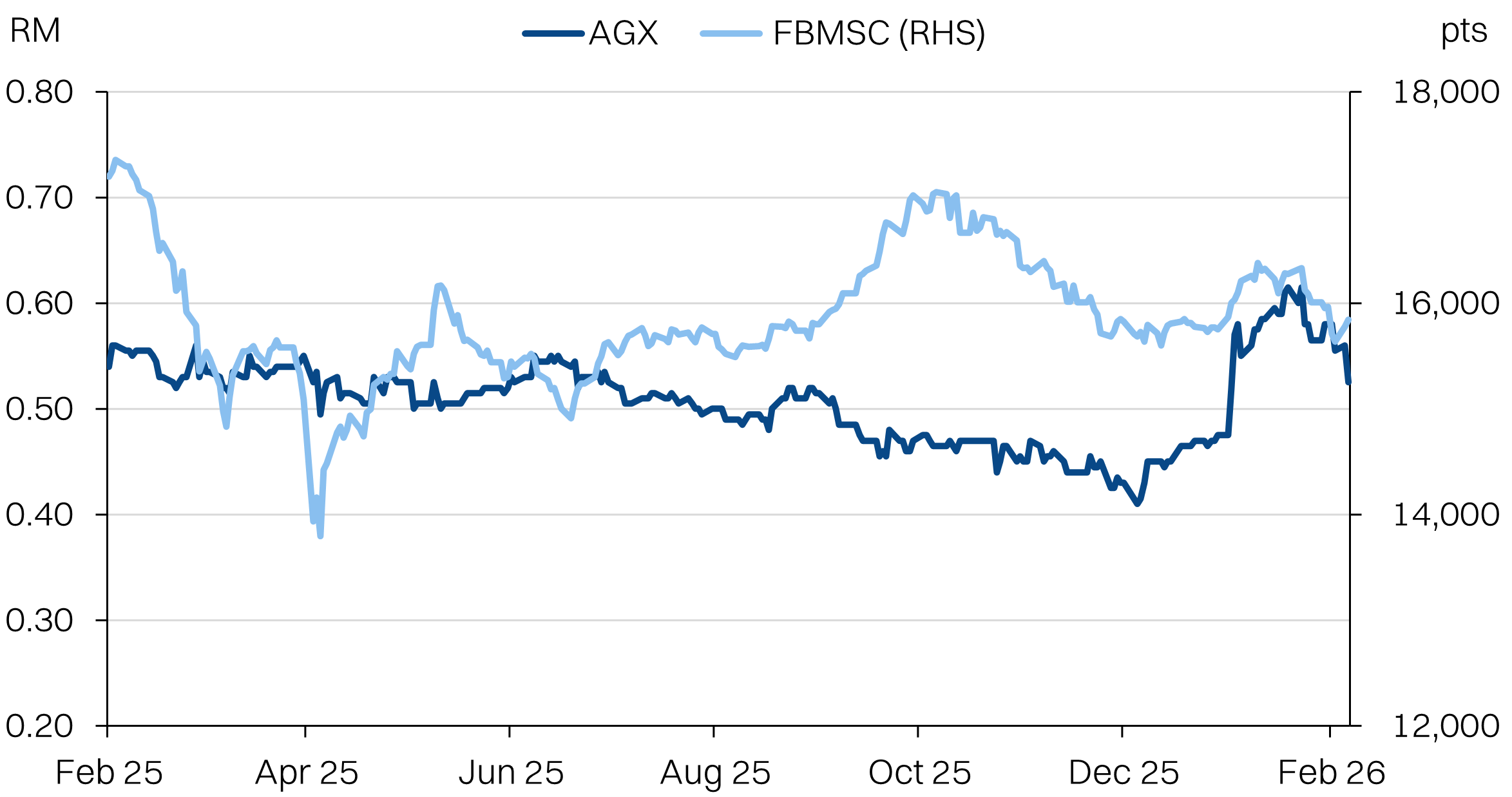

Aviation activity proxy

AGX runs logistics for MRO parts, support major carriers like Malaysia Airlines, AirAsia and VietJet

AGX GROUP BHD

AGX | 0299.KL

NOT RATED

Fair value: RM0.66

Last price: RM0.52

Market cap (RMm): RM227m

Shares out: 433m

52-week range: RM0.41 / RM0.63

3M ADV: RM0.1m

T12M returns: 0%

Disclaimer: By using this information, you acknowledge that you are solely responsible for evaluating the merits and risks of any investment decision and agree not to hold NewParadigm Research liable for any damages arising from such decisions.

Key takeaways

- AGX is an indirect tourism play via its aerospace logistics segment (~25% of revenue) that benefits from higher aviation activity.

- Additions of MAS, VietJet, and Sun PhuQuoc contracts underpin a +23% topline growth for the segment, offsetting anticipated falling AirAsia MRO requirements post-reactivation.

- Against our estimated earnings of RM23.2m, on the historic average multiple of 12.4x, the fair value for AGX should be 66sen/share.

- See also: our VM26 thematic report.

Share price performance

Investment fundamentals

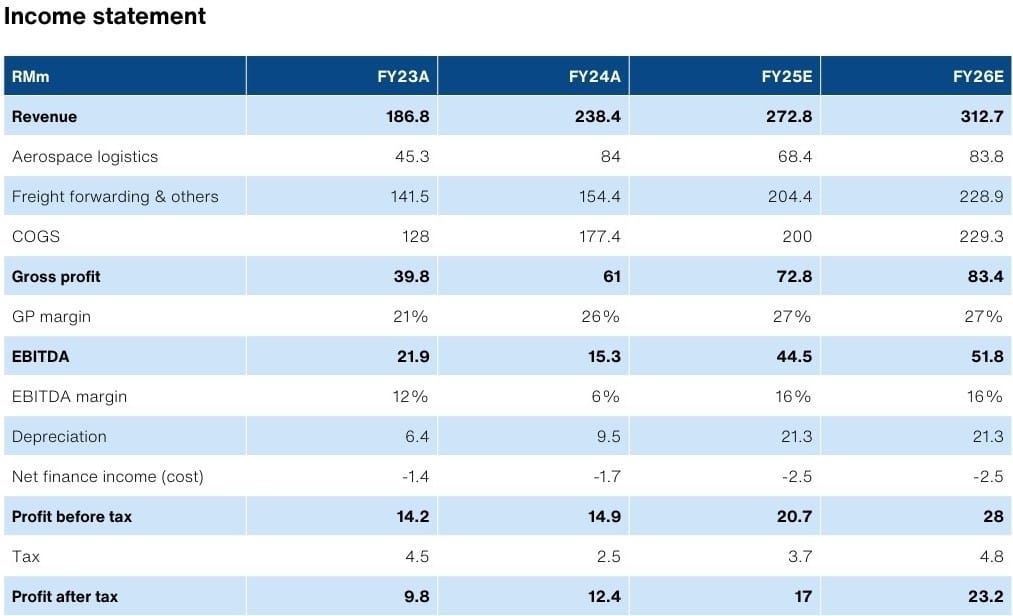

| RMm (FYE DEC) | FY24A | FY25E | FY26E |

|---|---|---|---|

| Revenue | 238.4 | 272.8 | 312.7 |

| Growth YoY | 28% | 14% | 15% |

| EBITDA | 26.1 | 44.5 | 51.8 |

| EBITDA margin | 11% | 16% | 17% |

| Adj NP | 12.4 | 17.0 | 23.2 |

| NP Margin | 5% | 6% | 7% |

| Net debt | 13.9 | 51.3 | 73.8 |

| ROA | 8% | 12% | 13% |

| PER (X) | 19.36 | 14.09 | 10.35 |

Source: Company data, NewParadigm Research, February 2026

Unassuming tourism proxy

- Unlike other tourism plays that are levered to a function of visitor arrivals, AGX’s exposure is via its aerospace logistics segment that delivers parts for airlines’ maintenance, repair and overhaul (MRO) needs. Revenue is a function of MRO activity, which is in turn a function of fleet utility and size. The more often more planes fly, the better for AGX. In turn, there is more upside for unscheduled maintenance, that requires time-critical delivery of parts to minimize aircraft grounding.

- Additionally, AGX is also able to expand its exposure via acquisition of more customers. The group in January announced a three-year contract with Malaysia Airlines for said aerospace logistics services. We estimate this contract will contribute ~RM40m annually. This comes after the VietJet and Sun PhuQuoc contracts that were secured last year, which we estimate will contribute about RM22m.

- Critically, this will offset an expected decline in AGX’ current contract with AirAsia that runs till the end of 2025. Said contract is contributing about RM40-50m in FY25E, we estimate, turbocharged by AirAsia’s elevated MRO activity as part of its broader fleet reactivation. AirAsia has indicated that its entire fleet will be reactivated by 2Q26, suggesting a fall-off in MRO spend. See our AAX report here.

- Overall, we estimate the aerospace logistics business will still grow at +23% YoY in FY26E, supported by the new contracts. And beyond the base effect of the AirAsia reactivation dip, we expect the contract to be renewed. It should be sizable, even if it is lower than the reactivation surge, given AirAsia has a relatively old fleet (average 13 years) and a high aircraft utilization rate.

Beyond freight forwarding?

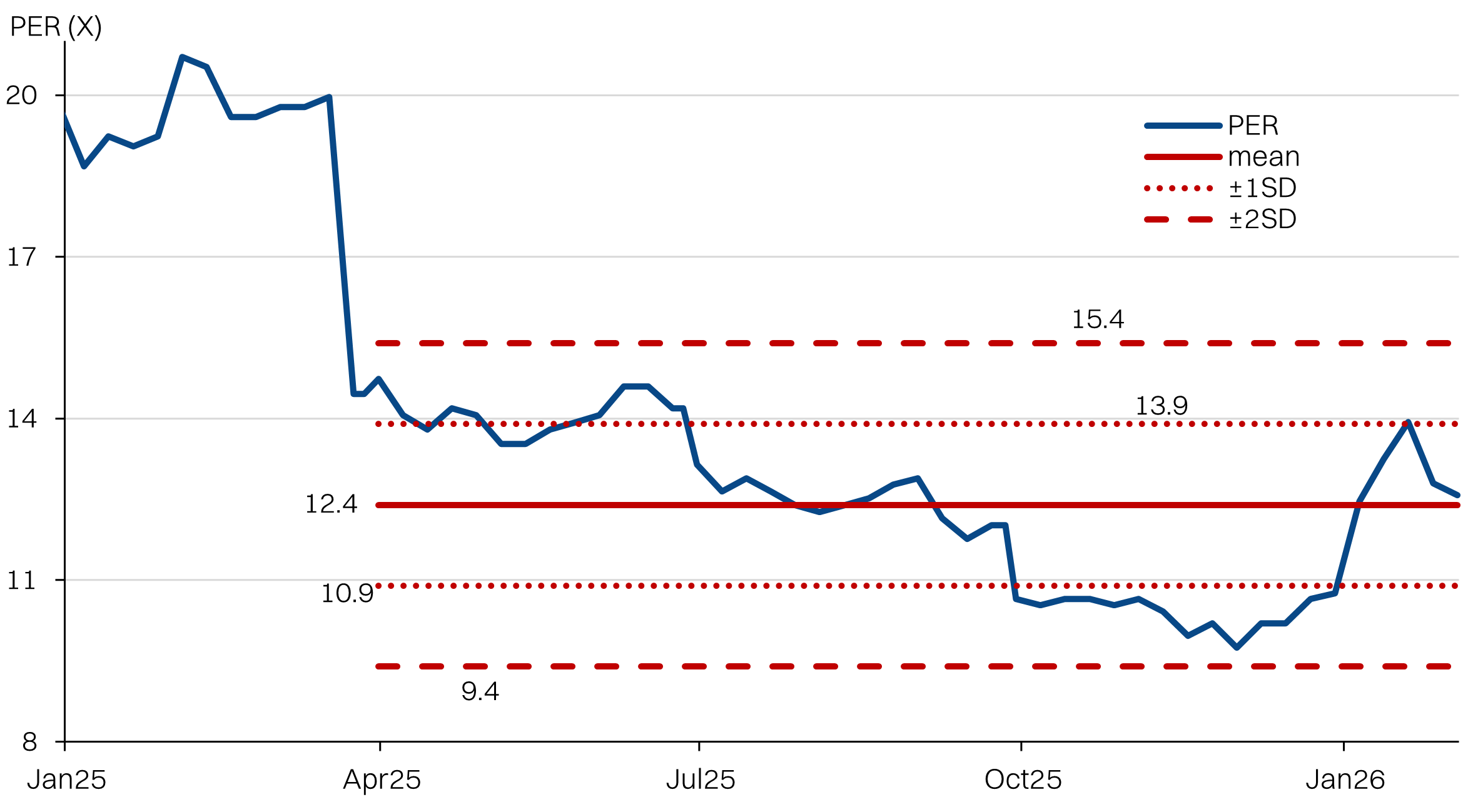

- We estimate FY26E could deliver >30% earnings growth - on margin expansion as well as the strong topline growth. Against a multiple of 12.4x (T12M; average since IPO), our fair value would be 66sen/share.

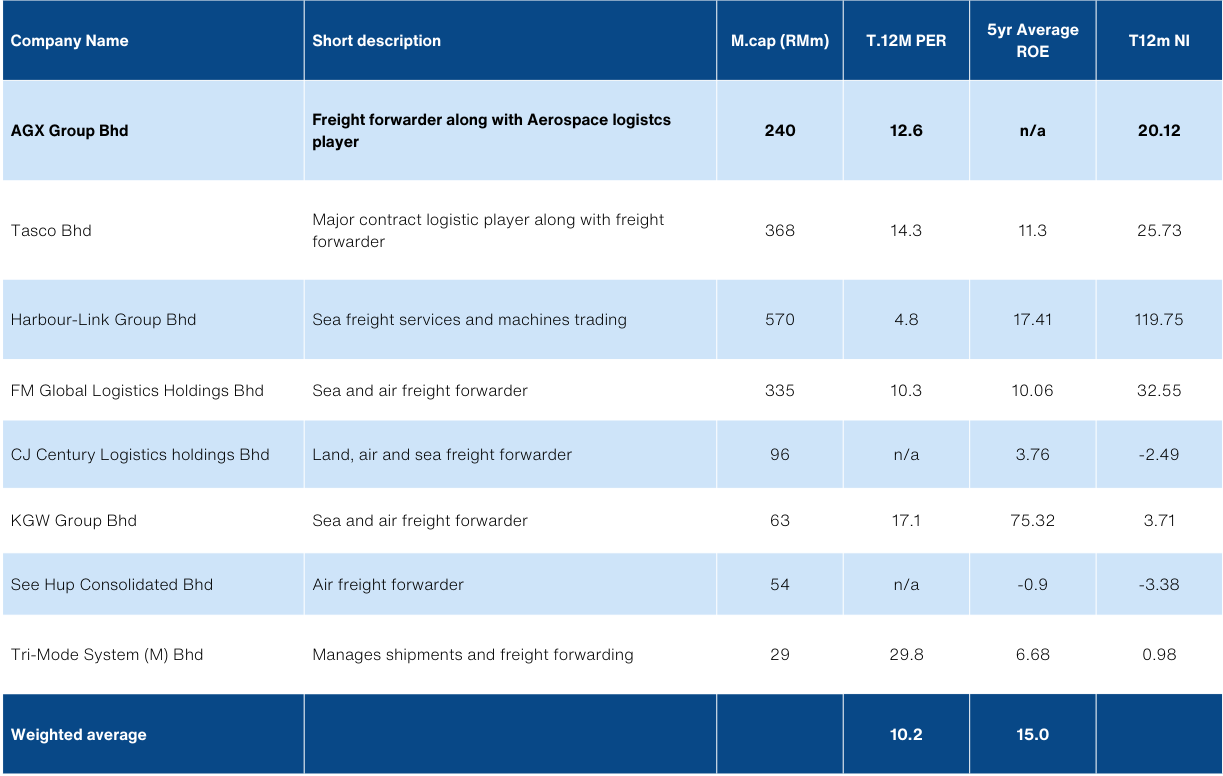

- This is already elevated compared with other freight forwarding peers weighted average PER (T12M) of 10.2x, but as the revenue mix from aerospace logistics grows, we anticipate further upside for re-rating.

About the Company

AGX Group Berhad is a logistic services company with the unique aerospace logistics segment that supports airlines’ maintenance, repair and overhaul requirements. Basically, if MRO operations require parts, AGX will sort out the logistics - often highly time-critical for unscheduled maintenance. This makes up about 25% of revenues.

The balance of revenues comes the freight forwarding and related services, across all major modes of transport. This segment, while lower margin has been growing at 17% CAGR (FY23-FY26).

The Group operates primarily across Malaysia, the Philippines, Singapore, Vietnam, Myanmar, Korea, Cambodia and Thailand, with additional exposure to China.

About the Stock

AGX is a Shariah-compliant stock listed on the ACE market in 2024. The company is owner managed. Group CEO, Datuk Ponnudorai Periasamy holds 11.54% and so does co-founder, executive director and MD, Jayasielan Gopal. Another co-founder and non-executive director, Penu Mark, holds a 19.06% stake.

AGX will be listing a 1:4 company warrant (bonus issuance) on February 27 with a strike price of 70sen, or a potential enlargement of the share base by 25%. These warrants will have a premium of approximately 25% on listing and have a life of 5 years from listing.

Investment Idea

AGX is an indirect tourism play, as it supports both major domestic airlines - MAS and AirAsia - via its aerospace logistics arm. Basically, the more flights, the more wear and tear, the more MRO required, and more volume for AGX. Additionally, AGX has two major clients in Vietnam - Vietjet and Sun PhuQuoc, giving it a total of 489 aircraft under contract.

We see AGX as an interesting spin on the tourism thematic, as it could possibly grow quicker than the underlying trend (VM26 is looking at +12% visitors), by expanding its offering to new customers.

Management is targeting to increase the aerospace logistics share of revenue from 30% to 50%, which we think would justify a re-rating for the stock. Currently the stock is benchmarked to other logistics and freight forwarding peers, which makes sense since it is still ~70% of the group’s topline for now.

Lastly, if AGX can continue growing its customer base and the aerospace logistics segment, it could be a good re-rating candidate.

Key Risks

- AirAsia is approaching the end of its post-pandemic fleet reactivation program come 2Q26. Historically, this has translated to ~RM40-50m revenue for AGX per year. AGX is still on contract with AirAsia, but headline MRO requirements will be lower.

- Failure to secure more airlines as customers would relegate AGX to grow in-line with existing customers long-term, which would be ~10%, optimistically.

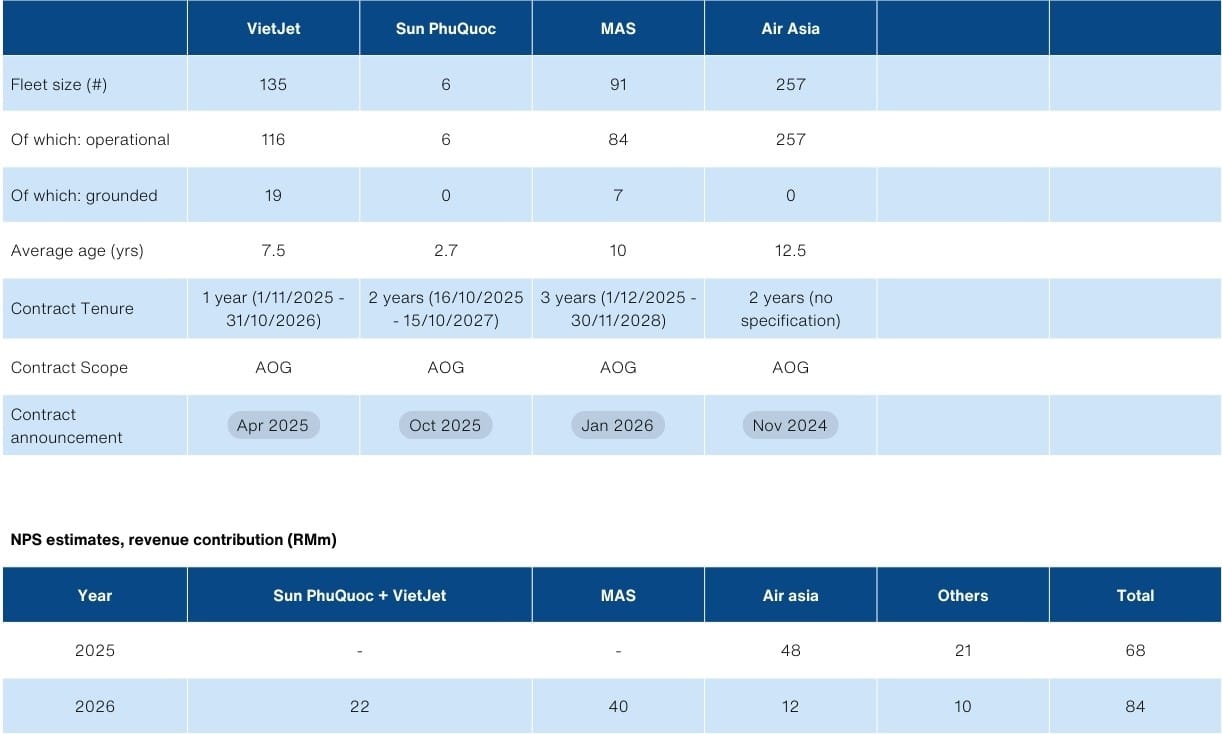

Strategic Client Diversification and the MAS Opportunity

In FY25, AGX’s aerospace earnings were bolstered by an exceptional RM48m contribution from AirAsia, largely driven by logistics support for its grounded fleet. As AirAsia completes its flight reactivation program by 2Q26, we anticipate a reduction of this revenue stream to approximately RM12 million. However, this projected shortfall is expected to be more than offset by a significant long-term contract win with Malaysia Airlines (MAS) for the provision of comprehensive AOG (Aircraft on Ground) services. This transition marks a shift in AGX’s revenue profile, reducing dependence on AirAsia as MAS and the Group’s Vietnamese clients are forecasted to contribute 70% of the segment’s total revenue for 2026.

AGX’s Vietnamese portfolio, comprising VietJet and Sun Phuquoc boasts a fleet size more than double that of MAS. However, we estimate that the MAS contract revenues should be almost double in value (~RM40m vs RM22m) because the Vietnamese airlines have contracted multiple vendors. It is also worth noting that the Malaysian carriers have older fleets as well at 13 years for AirAsia and 10 years for MAS compared with 7.5 years for VietJet and 2.7 years for Sun PhuQuoc, which may also inflate requirements.

AGX’s key aerospace logistics customers

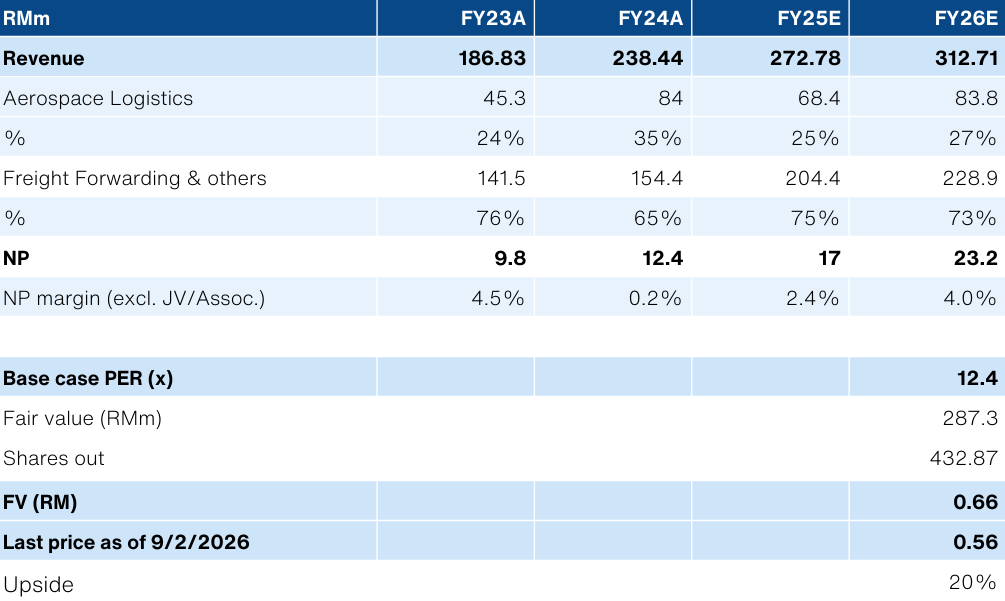

Fair value of RM 0.66

Our key topline assumptions are +23% YoY growth for the aerospace logistics segment and +12% YoY growth for freight forwarding and others. At the same time, we expect to see net margins (excluding JV & associates) expand from 2.4% to 4% on higher margin mix as well as improving operating leverage.

Against FY26E earnings estimate of RM12.4m, we apply a target multiple of 12.4x PER, which is the post-listing average (T12M). We apply T12M because there is a lack of consensus coverage on the stock to work out the forward multiples reliably. This works out to a fair value of 66sen/share.

We foresee room for more multiple re-rating if the group continues to successfully scale up the aerospace logistics operations and shed the valuation benchmark of a freight forwarder.

Fair value: RM0.66

AGX traded at 12.4x T12M PER on average.

Peer comparison

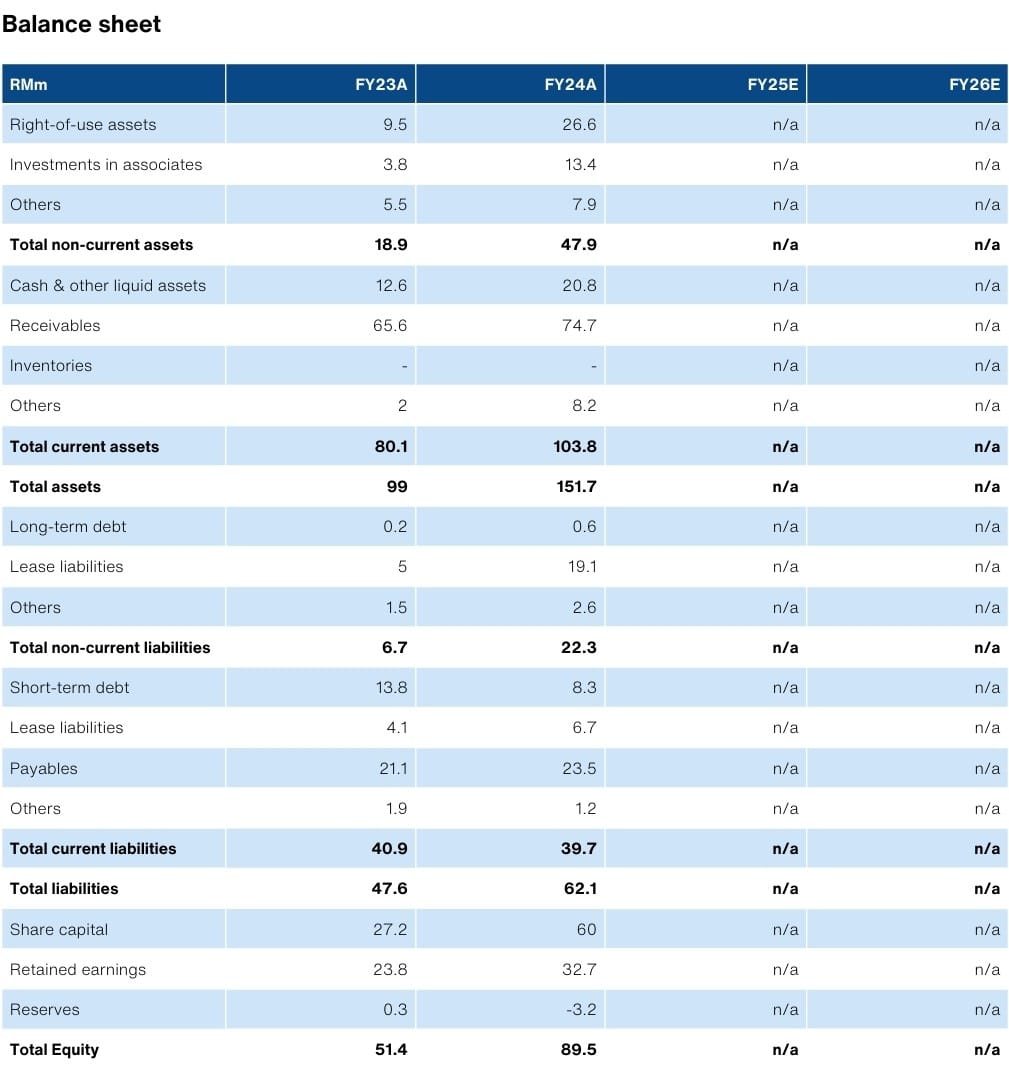

Selected financials

Estimates based on Bloomberg consensus

Source: Bloomberg, Company data, NewParadigm Research, February 2026