Margin & FX upside on VM26 tailwinds

Spritzer should enjoy lower resin costs from the stronger ringgit and SST exemption.

SPRITZER BHD

SPZ | 7103.KL

NOT RATED

Fair Value: RM3.45

Last Price: RM2.85

Market cap: RM1,822m

Shares Out: 639m

52-week range: RM1.38/3.12

3M ADV: RM2.9m

T12M: 97%

Disclaimer: By using this information, you acknowledge that you are solely responsible for evaluating the merits and risks of any investment decision and agree not to hold NewParadigm Research liable for any damages arising from such decisions.

Key takeaways:

- Bottled water sales appear to track tourist arrivals post-pandemic and will support the consensus topline growth of +14% in FY26E.

- But we foresee earnings upside surprise from margin expansion - lower resin costs from forex and SST removal, better product mix, and stronger operating leverage. Consensus assumes flat margins only.

- We anticipate ~8% upside to consensus FY26E NP assumptions or +20% YoY growth. Against a PER of 20x, the potential FV would be RM3.45.

- See also: our VM26 thematic report.

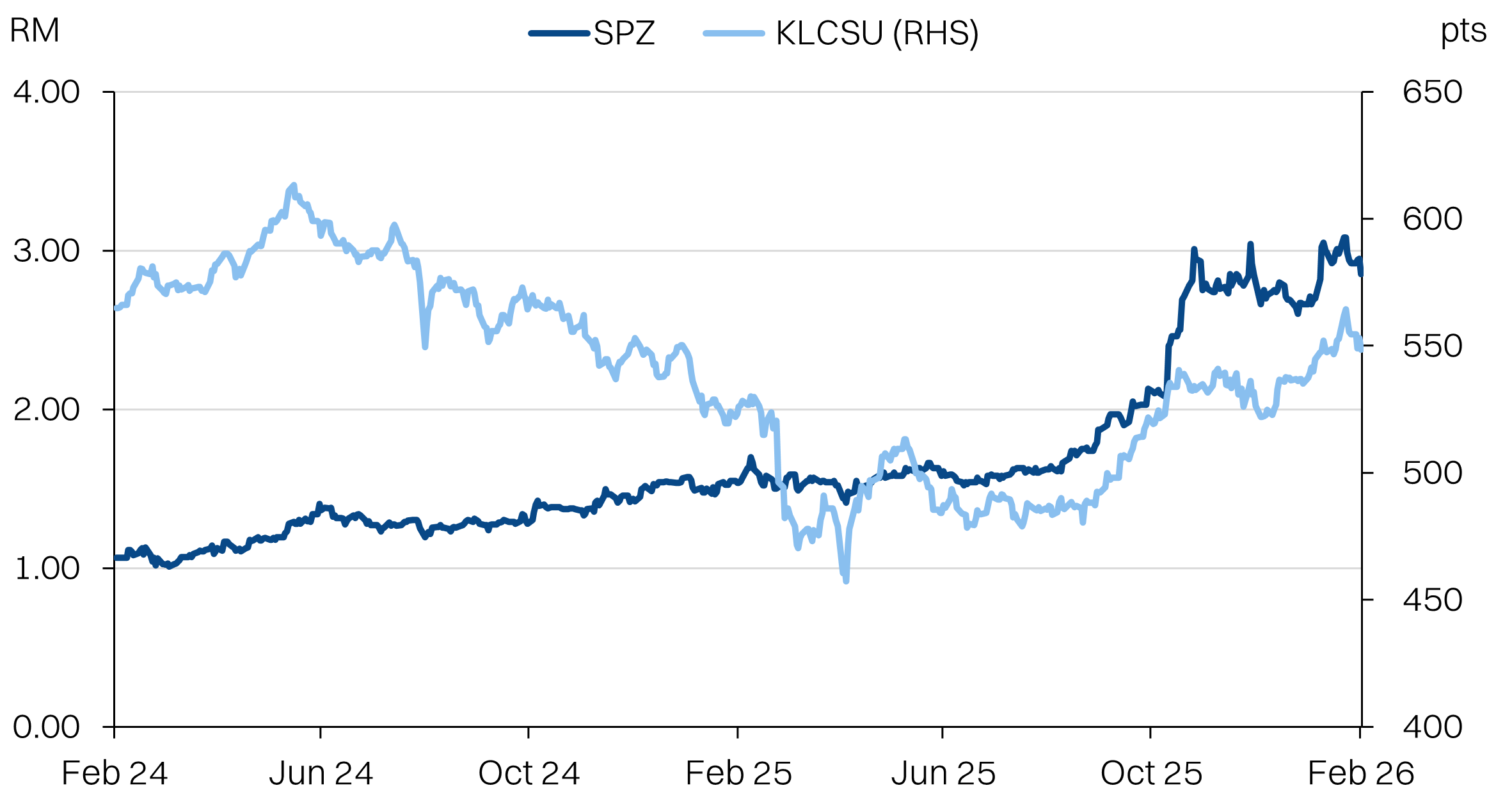

Share Price Performance

Investment fundamentals

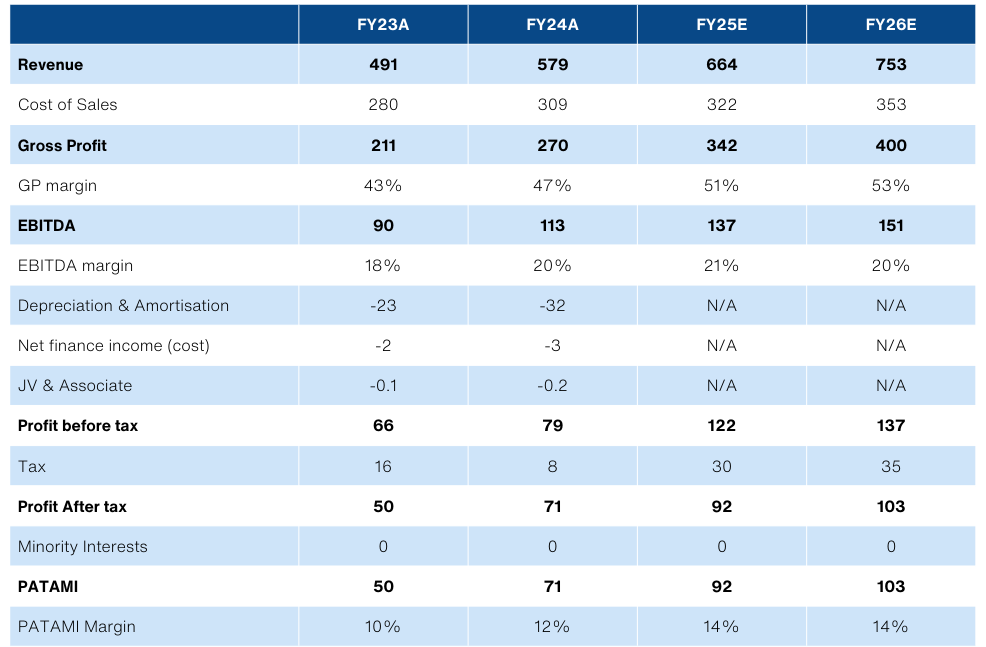

| RMm | FY23A | FY24A | FY25E | FY26E |

|---|---|---|---|---|

| Revenue | 491 | 579 | 664 | 753 |

| Growth YoY | 13.0% | 18.0% | 15.0% | 14.0% |

| EBITDA | 90 | 113 | 137 | 151 |

| EBITDA margin | 18% | 20% | 21% | 20% |

| Adj NP | 50 | 71 | 92 | 103 |

| NP Margin | 10% | 12% | 14% | 14% |

| Net debt | 4.5 | 5.1 | N/A | N/A |

| ROA | 7% | 10% | N/A | N/A |

| PER (X) | 11.8 | 13.8 | 23.9 | N/A |

Source: Company data, Bloomberg, February 2026

Tourism plays with a currency hedge

- Spritzer’s bottled water sales have closely tracked visitor volumes post-pandemic, supporting the assumption that foreign visitors consume more bottled water. A combination of food safety concerns regarding the local tap water as well as convenience on-the-go drives the trend.

- In our view, Spritzer is the best tourism play within the consumer sector for this reason. It also helps that Spritzer is the dominant bottled water player in Malaysia with 40-45% market share, making it highly visible on shelves.

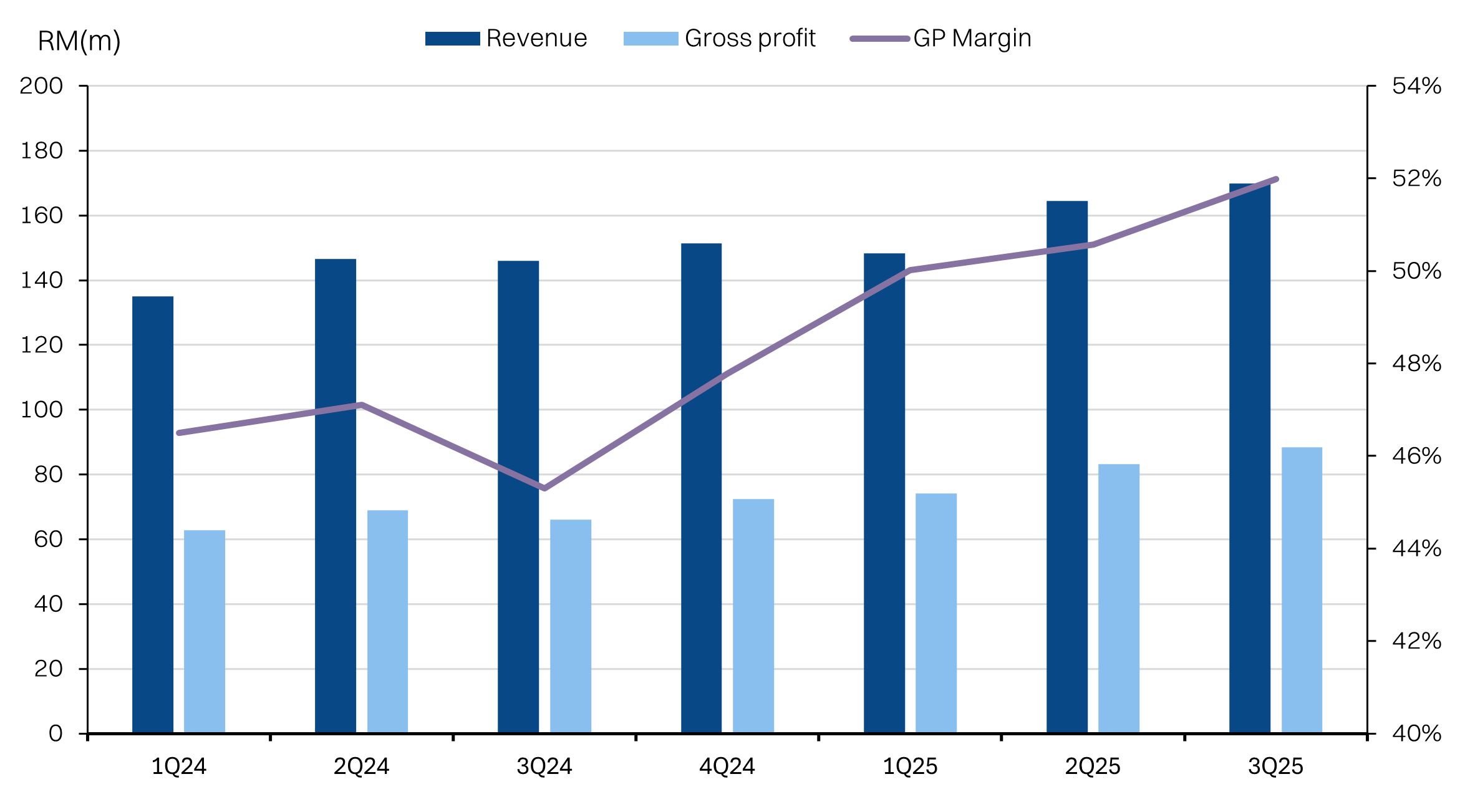

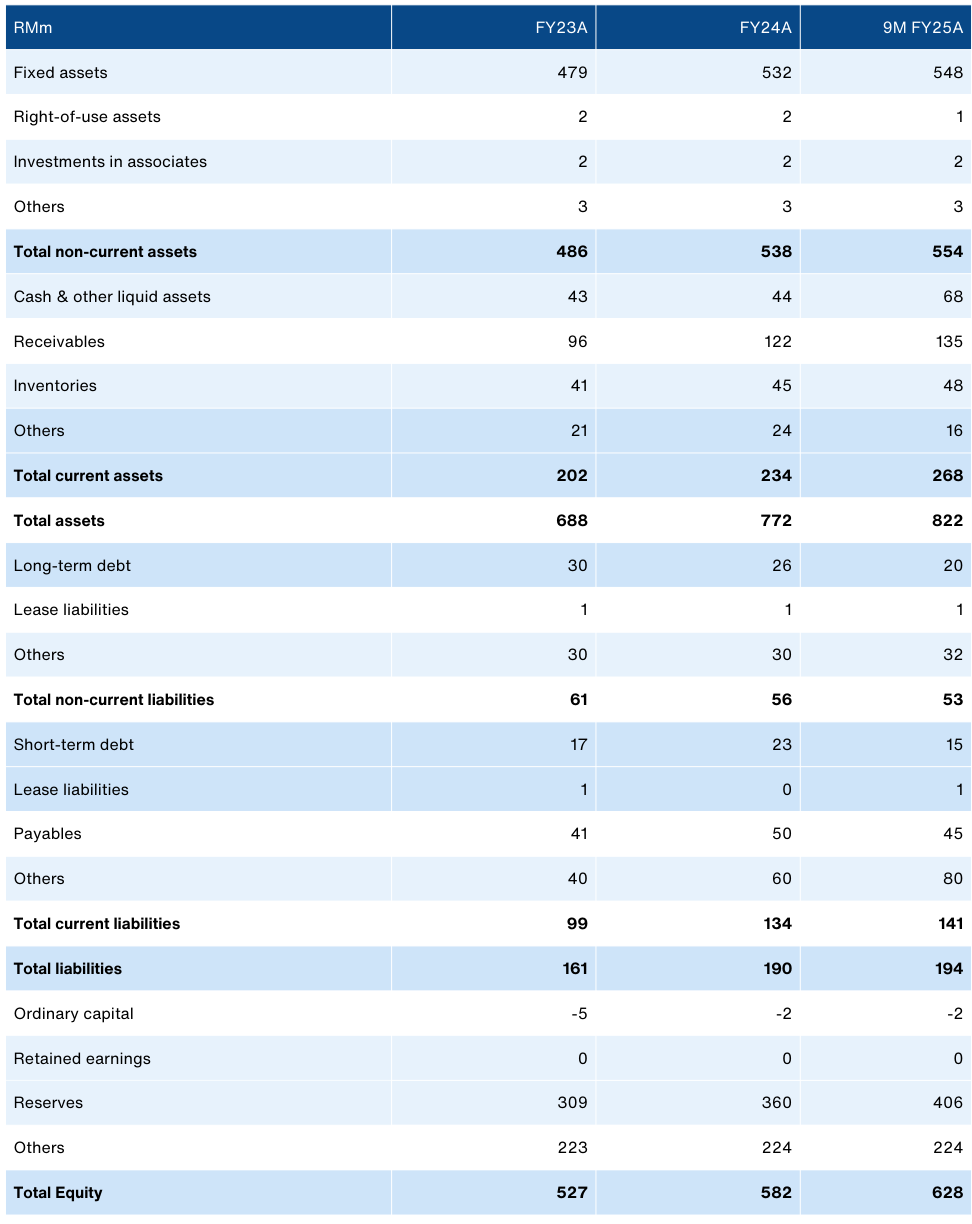

- While the sales upside appears to be well reflected in consensus expectations of +14% revenue growth for FY26, we think there is upside for margins. For context, GP margins have been improving from 47% in FY24 to 51% in 3Q25.

- Firstly, roughly 30-35% of raw material comes from resin, which is imported and priced in US$. The ringgit has strengthened by +13% against the dollar in the past 12 months. Given the group’s policy of hedging its foreign currency exposure, we anticipate a ~6month lag before the savings materialize. We estimate that every 10% strengthening of the ringgit translates to about 8% increase in NP, lag effect aside.

- Forex aside, we expect Spritzer’s underlying operating leverage to continue improving on higher production volumes. Historically, Spritzer’s GP margins expand in tandem with sales. This is somewhat offset by higher marketing costs.

FV potential - RM3.45

- Spritzer is on track to double earnings (FY26 vs 23), as we anticipate earnings can surprise +8% vs consensus estimates to deliver another 20% growth in FY26E.

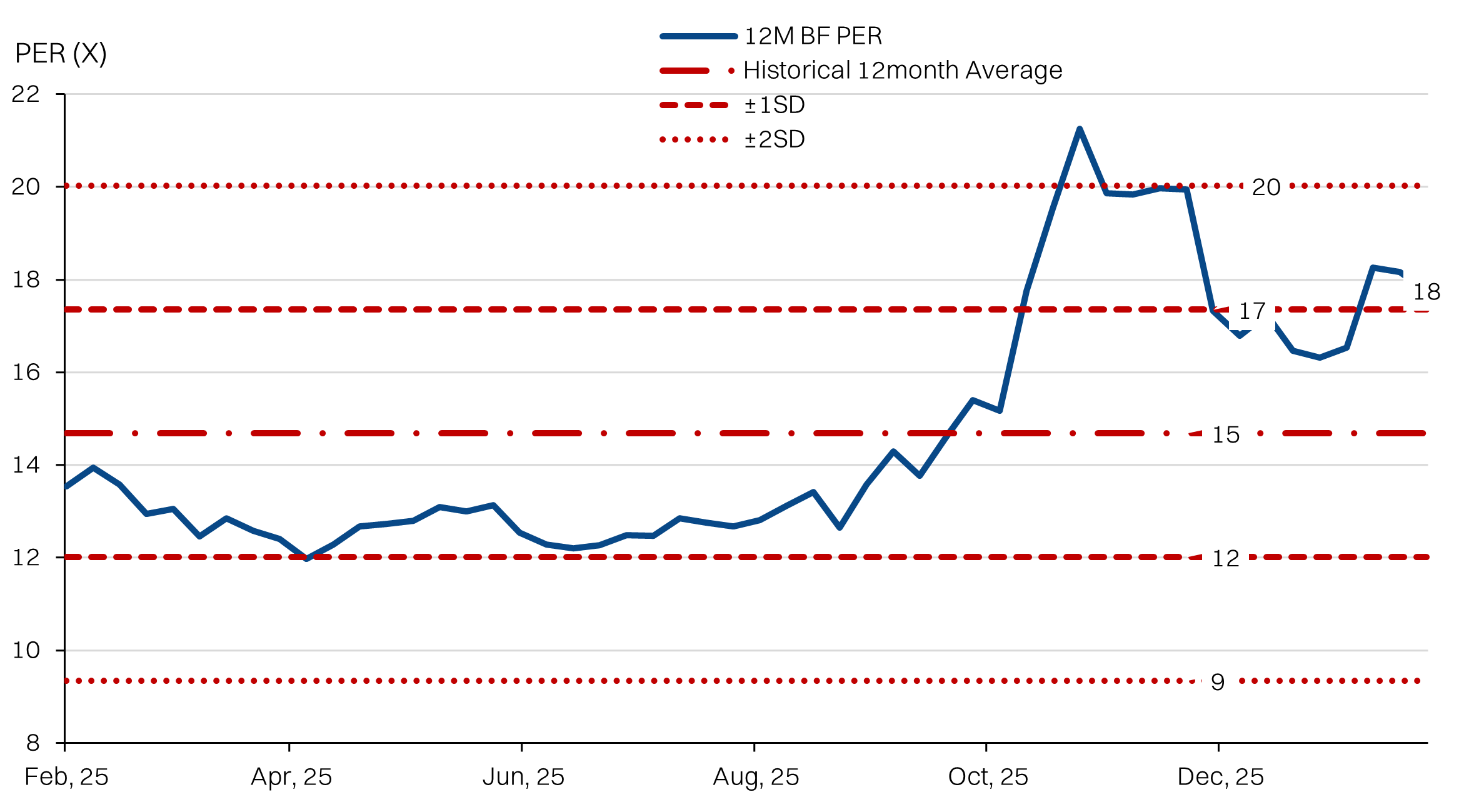

- We think a multiple of 20x (+2SD vs 1yr average) is a reasonable benchmark at 1xPEG, considering Spritzer’s growth track record, leading market share and the timeliness of the thematic. Spritzer has also traded at a premium to the KL Consumer index but has been now at a discount after the recent rally a more conservative multiple of 18.5x would restore said premium to the index and have a FV of RM3.10.

About the Company

Spritzer is the dominant bottled water manufacturer in Malaysia with a 40-45% market share. The group’s flagship offering is the natural mineral water that is produced from its water-catchment landbank in Taiping, Perak. Spritzer also produces the Cactus brand mineral water.

A key competitive advantage lies in its access to natural mineral water sources drawn from protected rainforest areas. This positions Spritzer as one of the few bottled water producers in Malaysia with proprietary mineral water reserves. They also sell distilled water, reverse osmosis and flavored drinking water under various brands including Summer, Desa and Pop.

Spritzer leverages a diverse distribution network nationwide and is now putting more emphasis for expansion into the HoReCa segment. Spritzer also has limited overseas exposure through distributorships in markets such as Singapore and China, although earnings remain predominantly domestic.

About the Stock

Spritzer Berhad was founded in 1989 with the objective of supplying natural mineral water to the Malaysian market. The company subsequently listed its shares on the Main Market of Bursa Malaysia in the year 2000.

Spritzer Berhad remains a family-owned company, with founding shareholder Lim Kok Cheong retaining significant influence over the group. The founder and his family remain the largest shareholders via Yee Lee Corporation Berhad, which holds an approximately 32.3% stake in Spritzer.

Spritzer is classified as a Shariah-compliant stock listed on the main market and is also a member of the FTSE4Good index.

Investment Idea

The tourism push in 2026 will support topline growth for Spritzer. But the real upside will come from margin expansion, which we think is being overlooked in consensus expectations. We anticipate FY26E net margins could expand to 14.6% compared with 13.8% for FY25E (and 13.5% consensus expectations), driven by falling resin costs - a combination of a stronger ringgit (costed in US$) as well as the lifting of SST charges on the resin.

Additionally, the improving operating leverage riding on the aforementioned topline growth, should also continue to support overall margin expansion. We estimate +20% YoY growth is achievable in FY26E, which we think should drive further re-rating in the stock, which has traded at a premium to the KL Consumer Index in recent years.

Key Risks:

- FX volatility and PET resin price risk. A sharp rebound in resin cost for Spritzer could compress margins quickly. Resin is USD-priced, so adverse currency moves can reverse currency tailwinds.

- Tourism underperformance. Lower-than-expected inbound tourist arrivals in FY26 could dampen demand growth and limit operating leverage benefits, resulting in weaker-than-anticipated margin expansion.

- Raw materials account for a significant portion of cost of sales and remain exposed to regulatory risks, including potential tariffs, import duties or policy changes on resin and packaging materials.

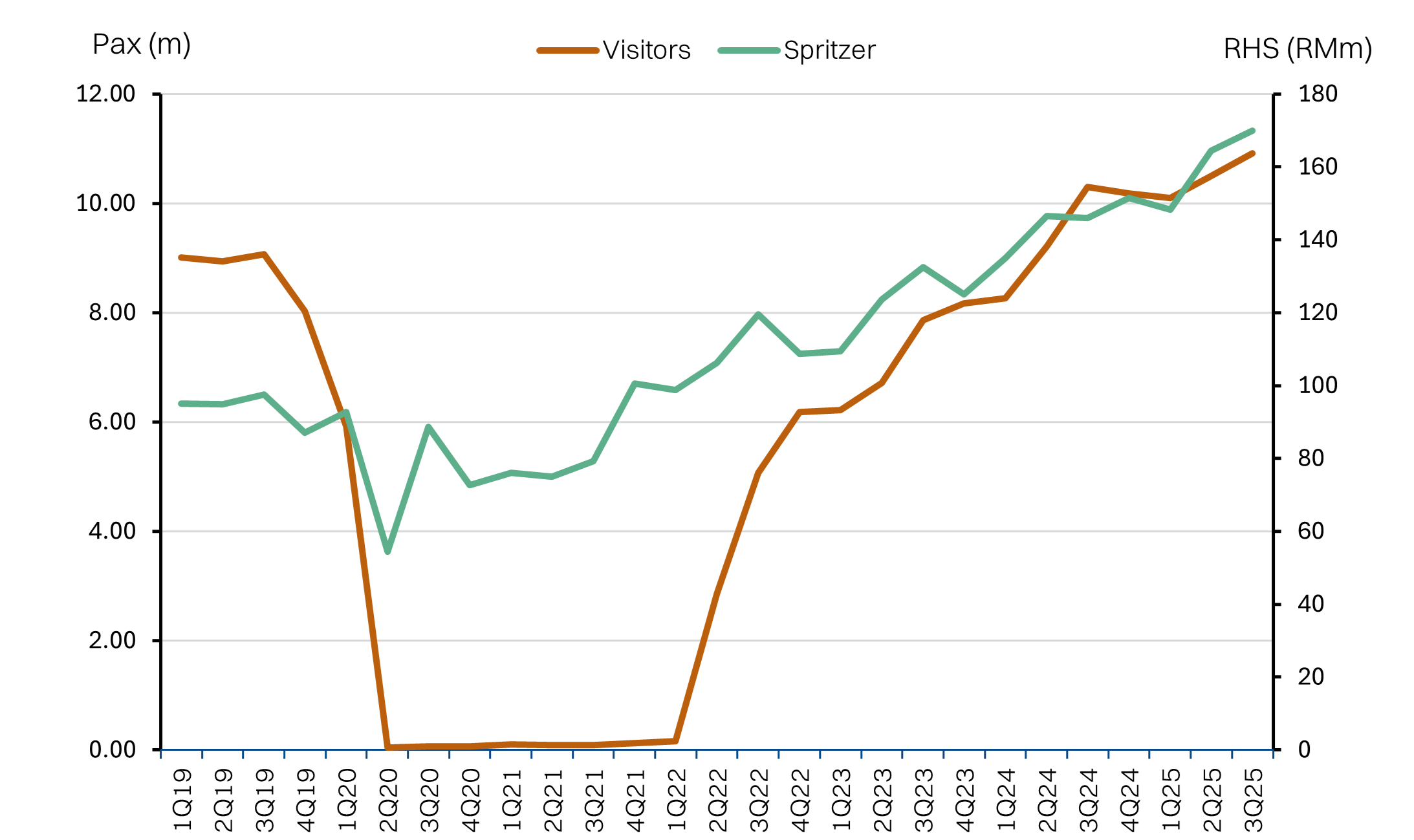

Tourism Upside

Spritzer is a beneficiary of higher visitor/tourist arrivals. Visit Malaysia’s target for 47m visitors should be supportive of the group’s 14% revenue growth expectation (consensus). Tourists tend to consume more bottled water due to food safety concerns with local tap water as well as the convenience factor. Spritzer’s dominant market position and broad distribution base ensures it, and the recent historic data seems to support it as well.

Spritzer’s revenue post-FY21 appears to rise in tandem with visitors to Malaysia. As visitors traffic recovered from pandemic lows, Spritzer’s topline rebounded. This reinforces the view that bottled water demand scales with travel intensity rather than discretionary spending. Air travels typically lead to broader tourism recovery, including land crossings, domestic travel and sea arrivals. This suggests that rising visitors in FY26 should translate into broader tourist footfall. Increased footfall benefits bottled water consumption across hotels, F&B outlets, convenience retail and transport hubs.

Spritzer is also placing an emphasis on HoReCa expansion, with active efforts to increase brand placements across high-traffic locations. The Group is also engaging smaller SMEs that are well-positioned to benefit from tourist arrivals, broadening on-premises penetration and brand visibility. The group is also increasing its investment in marketing and branding to strengthen its positioning around health-conscious and culturally relevant consumption.

Management indicated that the Group has shifted its focus towards the younger demographic, which constitutes most of its consumer base. Spritzer is also proactively supporting VM26 by leveraging partnerships and experiential events to improve brand visibility. Management noted that the group has already secured roles as the main beverage sponsor for multiple Visit Malaysia–linked events in FY26.

Post-pandemic, Spritzer’s sales have tracked visitor arrivals

Margin Expansion Upside

We anticipate upside to consensus earnings expectations driven by margin expansion, whereas consensus is currently assuming largely flattish net profit margins into FY26. A key driver is lower imported resin costs. Raw materials account for approximately 60% of Spritzer’s sales, of which an estimated 30–35% comprises imported PET resin priced in US dollars.

Historically, the group incurred a 5% SST on resin purchases, which directly inflated input costs and capped gross margin expansion. The removal of the 5% SST on resin purchases in 3QFY25 marks a meaningful step change in the group’s cost structure rather than a cyclical benefit. Following the removal, gross profit margin expanded by 1.4 percentage points in 3QFY25, demonstrating the immediate and tangible cost benefit.

Foreign exchange provides an additional margin kicker given resin is priced in US dollars. The MYR has strengthened by approximately 13% against the USD over the past 12 months. While the Group employs hedging strategies to manage near-term volatility, sustained MYR strength is still expected to flow through to the cost base over time. The management states that lower resin costs for Spritzer translates typically within a 2-3 month lag. Based on our estimates, every 10% appreciation in MYR against USD translates into roughly an 8% uplift in net profit on a lagged basis.

In addition, operating leverage remains a key contributor to margin expansion. Spritzer has demonstrated a clear track record of gross profit margin improvement alongside volume increase, reflecting better absorption of fixed production costs as utilization increases. Management has guided that the Group’s utilisation rate is expected to rise from the current level of around 70% to approximately 80–85%anticipation of stronger demand arising from Visit Malaysia 2026. Correspondingly, gross margins have expanded from approximately 43% in FY23 to around 51% by 3QFY25, during a period when revenue recorded YoY growth of 18% and 15% respectively. This underscores the strong operating leverage embedded in the business model.

GP Trend

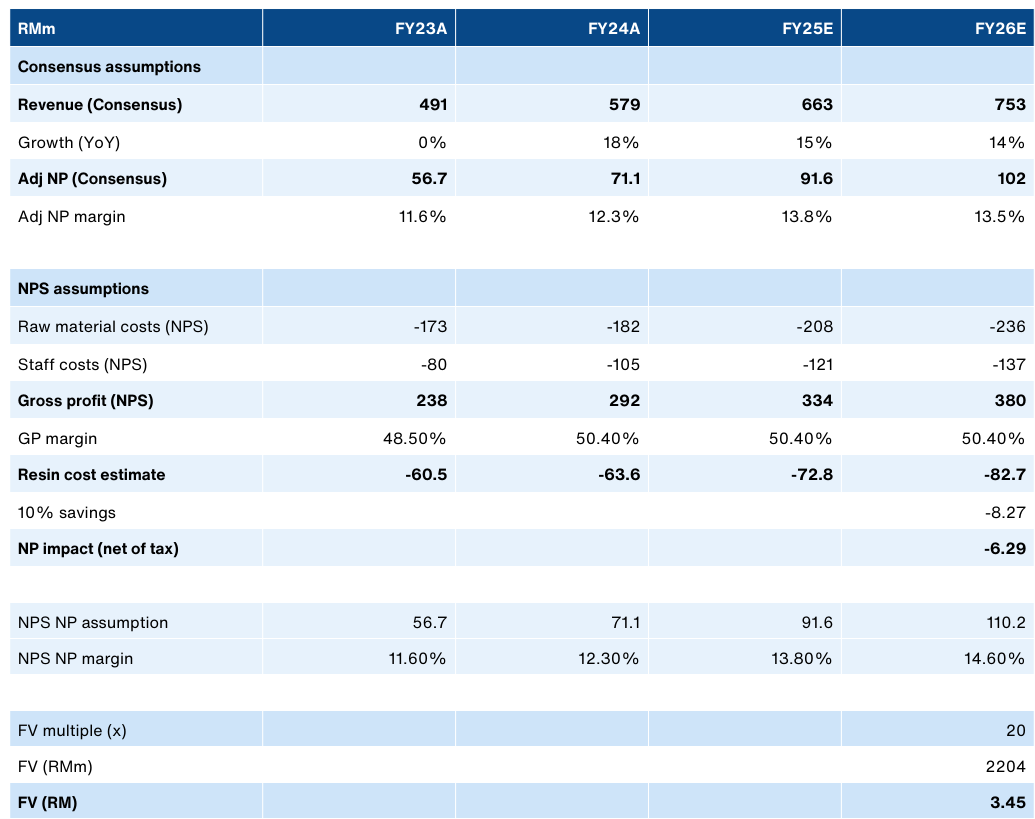

Fair value: RM3.45

We think Spritzer should enjoy further margin expansion in FY26, supported by the aforementioned reduction in resin costs as well as improved operating leverage. We anticipate there is ~8% upside to consensus expectations, with 6ppts coming from a 10% reduction in resin costs alone. Our NP estimate of RM110m implies a margin of 14.6% compared with consensus’ flat 13.5%. We think this is too conservative given 9M25 average NP margin is already 13.7% and with the removal of the SST on resin, it rose to 13.9% in 3Q25.

Against a potential NP of RM110m (+20% YoY), we anticipate multiple expansion to 20x or +2SD (vs the 1yr PER average of 14.7x) would be fair. Spritzer has been a high growth earnings compounder and is on track to double earnings since FY23. Furthermore, it has dominant market share in Malaysia which should attract a premium as well. In turn, this translates to a fair value of RM3.45/share.

Earnings upside and fair value

Spritzer’s valuations have re-rated

Selected Financials

Source: Bloomberg, Company data, NewParadigm Research, February 2026